Blank Adp Pay Stub Form

The ADP Pay Stub form serves as a crucial document for employees, providing a detailed breakdown of earnings and deductions for each pay period. This form typically includes essential information such as gross pay, net pay, and various deductions, including taxes and benefits. Employees can easily track their earnings over time, making it a valuable tool for personal financial management. Additionally, the pay stub may feature year-to-date totals, allowing individuals to assess their overall income and tax contributions. Understanding the components of the ADP Pay Stub form can empower employees to make informed decisions about their finances and ensure they are accurately compensated for their work. With clarity and transparency, this document plays a vital role in the employer-employee relationship, fostering trust and accountability in the workplace.

More PDF Forms

4 Point Inspection Florida Cost - Roofing materials and their age are important for determining the remaining useful life of the roof.

For those looking to finalize their transactions, the informative guide on the essential bill of sale is a crucial resource. This document not only serves its primary function but also clarifies the responsibilities and rights of both parties involved. You can explore more by visiting the reliable source for a bill of sale template.

Instructions for Form 4562 - Can aid in planning for future business expansions or investments based on reported income.

Dos and Don'ts

When filling out the ADP Pay Stub form, there are important guidelines to follow. Here’s a list of things you should and shouldn't do:

- Do double-check your personal information for accuracy.

- Do ensure that your hours worked are correctly reported.

- Do review your deductions and contributions carefully.

- Do keep a copy of your completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't use incorrect codes for deductions or benefits.

- Don't forget to sign and date the form if required.

- Don't submit the form without reviewing it for errors.

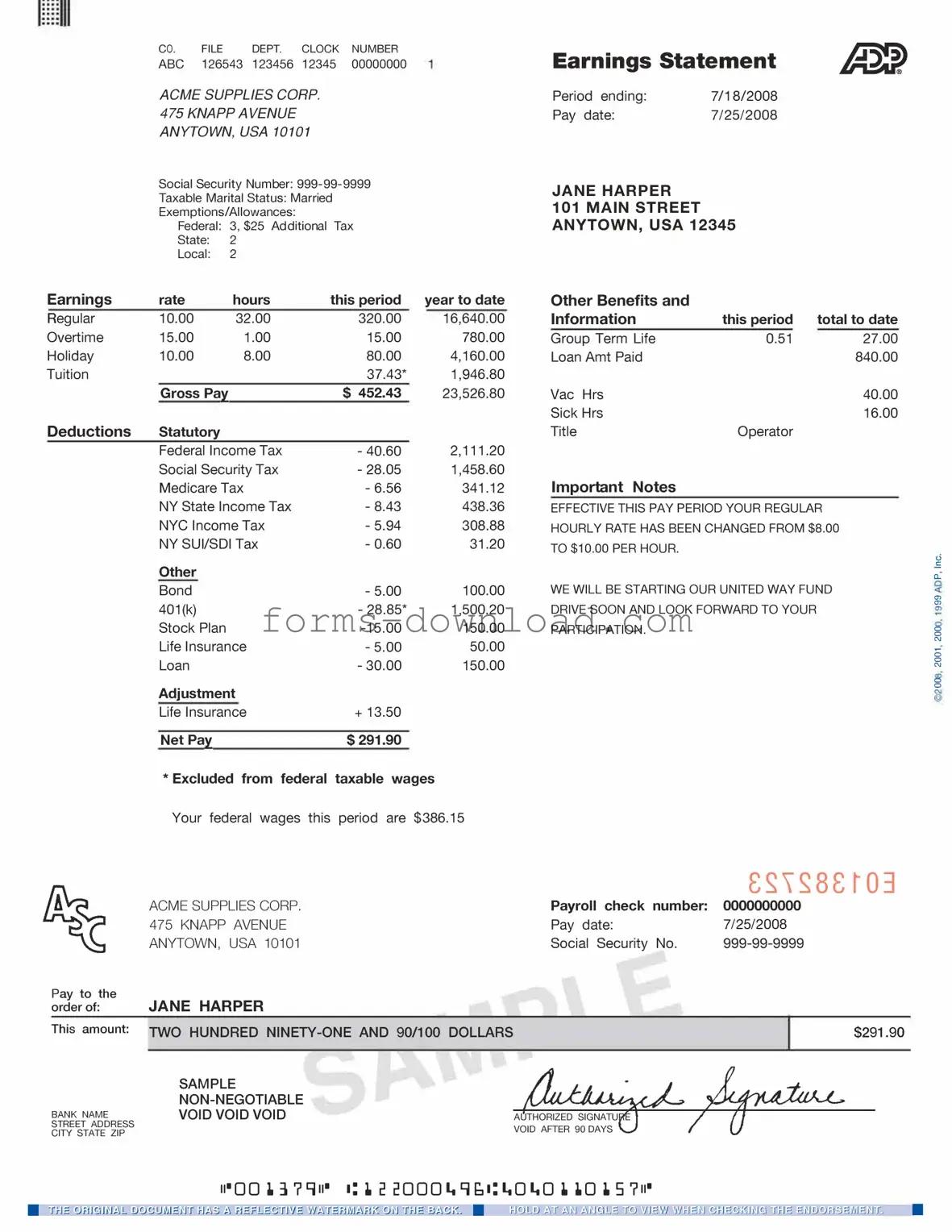

Adp Pay Stub Sample

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Listed Questions and Answers

-

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It includes details such as gross pay, deductions, and net pay. Employees can use this document to verify their income and track their earnings over time.

-

How can I access my ADP Pay Stub?

Employees can access their ADP Pay Stubs online through the ADP portal. You will need to log in using your credentials. If you are a first-time user, you may need to create an account using your employee ID and other identifying information. Once logged in, you can view, download, or print your pay stubs.

-

What information is included in the ADP Pay Stub?

The ADP Pay Stub typically includes the following information:

- Employee name and identification number

- Pay period dates

- Gross pay (total earnings before deductions)

- Deductions (taxes, benefits, retirement contributions)

- Net pay (amount received after deductions)

- Year-to-date totals for earnings and deductions

This information helps employees understand their compensation and tax obligations.

-

What should I do if I notice an error on my ADP Pay Stub?

If you find an error on your ADP Pay Stub, it is important to address it promptly. First, review the details to confirm the mistake. Then, contact your employer's payroll department or HR representative. They can assist you in correcting the error and ensuring that your records are accurate.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. |

| Components | The form typically includes sections for gross pay, taxes withheld, benefits deductions, and any other withholdings. |

| Accessibility | Employees can usually access their pay stubs online through the ADP portal or receive them via email or physical mail, depending on employer preferences. |

| State-Specific Regulations | In some states, employers must provide pay stubs that comply with local labor laws. For example, California requires detailed itemization of deductions as per California Labor Code Section 226. |

| Record Keeping | Employees should retain pay stubs for personal records, as they serve as proof of income and are useful for tax filing and loan applications. |