Attorney-Approved Deed in Lieu of Foreclosure Document for the State of Arizona

The Arizona Deed in Lieu of Foreclosure form serves as a valuable tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows a property owner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often costly foreclosure process. By executing this form, the homeowner can settle their mortgage obligations more efficiently, potentially mitigating the impact on their credit score. Key aspects of the form include the identification of the parties involved, a clear description of the property, and an acknowledgment of any existing liens. Additionally, the deed may outline the terms under which the lender agrees to accept the property, which can include the release of the borrower from further liability on the mortgage debt. Understanding the implications of this form is crucial for both homeowners and lenders, as it provides a streamlined alternative to foreclosure while addressing the legal and financial responsibilities of both parties.

Consider More Deed in Lieu of Foreclosure Templates for Different States

Deed in Lieu of Foreclosure Form - A Deed in Lieu can be part of a comprehensive plan to address deeper financial challenges faced by the borrower.

When selling or purchasing a boat in California, it is important to have the appropriate documentation to ensure a legally binding transaction. The California Boat Bill of Sale form is a crucial document that serves as proof of the sale and transfer of ownership for a boat in California. This form provides essential details about the transaction, including the buyer, seller, and vessel information. You can find more information and access the necessary form by visiting the Bill of Sale for a Boat webpage, as understanding how to properly complete this form is vital for a smooth transfer process.

Dos and Don'ts

When filling out the Arizona Deed in Lieu of Foreclosure form, it is important to follow certain guidelines to ensure that the process goes smoothly. Here are six things to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do sign the document in front of a notary public. This step is essential for the validity of the deed.

- Do provide any required supporting documents. This may include a copy of the mortgage or loan agreement.

- Don't rush through the form. Take your time to read each section carefully and understand what is being requested.

- Don't forget to keep copies of the completed form and any related documents for your records.

- Don't leave any sections blank unless instructed to do so. Incomplete forms can lead to delays or rejections.

By following these guidelines, you can help ensure that your submission is processed efficiently and correctly.

Arizona Deed in Lieu of Foreclosure Sample

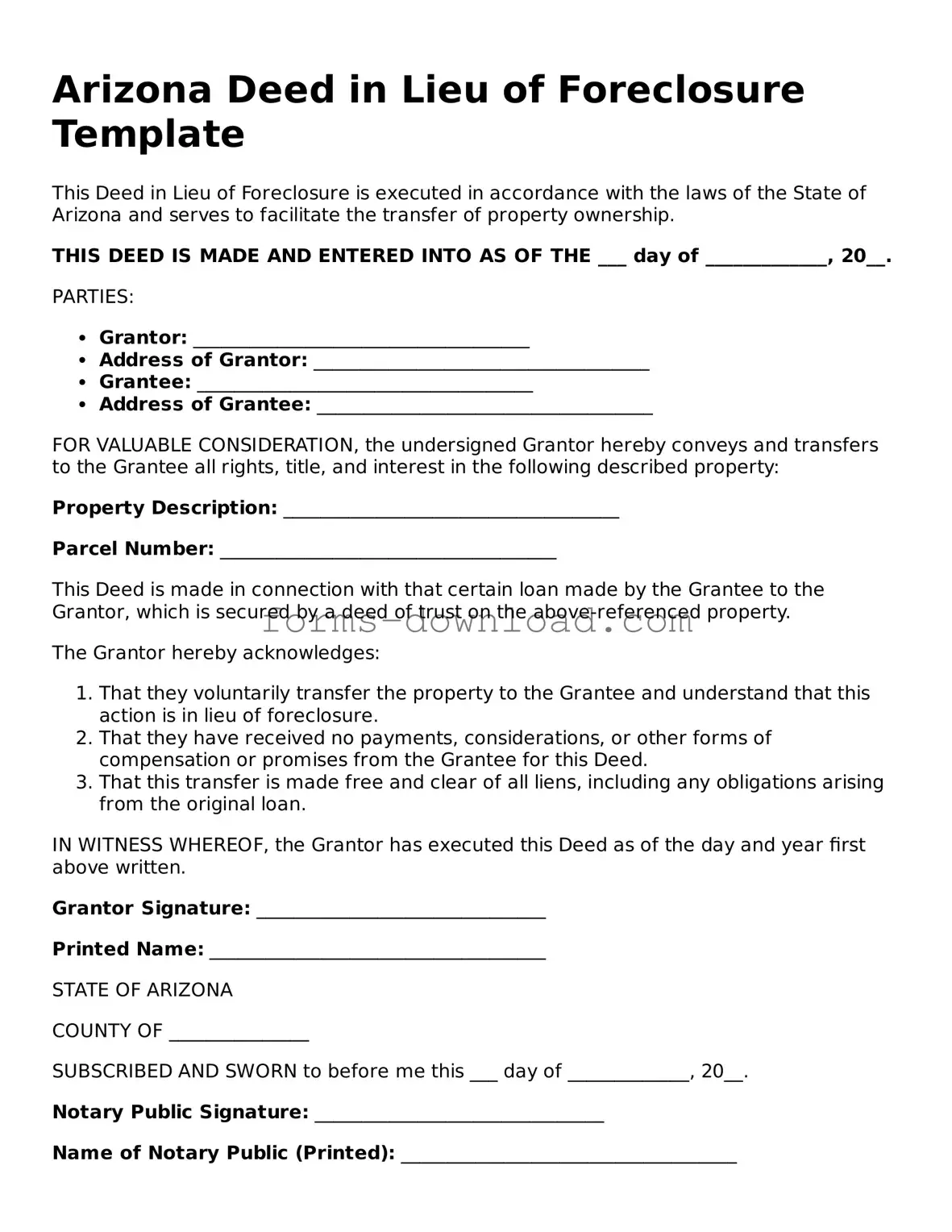

Arizona Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of Arizona and serves to facilitate the transfer of property ownership.

THIS DEED IS MADE AND ENTERED INTO AS OF THE ___ day of _____________, 20__.

PARTIES:

- Grantor: ____________________________________

- Address of Grantor: ____________________________________

- Grantee: ____________________________________

- Address of Grantee: ____________________________________

FOR VALUABLE CONSIDERATION, the undersigned Grantor hereby conveys and transfers to the Grantee all rights, title, and interest in the following described property:

Property Description: ____________________________________

Parcel Number: ____________________________________

This Deed is made in connection with that certain loan made by the Grantee to the Grantor, which is secured by a deed of trust on the above-referenced property.

The Grantor hereby acknowledges:

- That they voluntarily transfer the property to the Grantee and understand that this action is in lieu of foreclosure.

- That they have received no payments, considerations, or other forms of compensation or promises from the Grantee for this Deed.

- That this transfer is made free and clear of all liens, including any obligations arising from the original loan.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the day and year first above written.

Grantor Signature: _______________________________

Printed Name: ____________________________________

STATE OF ARIZONA

COUNTY OF _______________

SUBSCRIBED AND SWORN to before me this ___ day of _____________, 20__.

Notary Public Signature: _______________________________

Name of Notary Public (Printed): ____________________________________

My Commission Expires: _______________________________

Listed Questions and Answers

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender to avoid foreclosure. This option can help homeowners clear their mortgage debt and prevent the negative impacts of foreclosure on their credit score.

-

How does the process work?

The homeowner and lender agree on the terms. The homeowner signs the deed, transferring ownership of the property to the lender. In exchange, the lender typically forgives the remaining mortgage debt. It is advisable to consult with a legal expert to ensure all aspects are understood before proceeding.

-

What are the benefits of a Deed in Lieu of Foreclosure?

- It can be less damaging to your credit score compared to a foreclosure.

- The process is usually faster than going through foreclosure.

- Homeowners may avoid the costs associated with foreclosure proceedings.

-

Are there any drawbacks?

Yes, there can be drawbacks. The lender may require the homeowner to be current on payments or may not accept the deed if there are liens on the property. Additionally, some lenders may still report the deed in lieu as a negative item on the homeowner's credit report.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility varies by lender. Generally, homeowners facing financial hardship who can no longer afford their mortgage payments may qualify. Lenders often look for homeowners who have tried other options, such as loan modifications or short sales, before considering a deed in lieu.

-

What should I do before signing a Deed in Lieu of Foreclosure?

Before signing, homeowners should review their financial situation and explore all available options. Consulting with a real estate attorney or financial advisor can provide valuable insights. It's also important to ensure that the lender is willing to accept the deed and that all terms are clearly understood.

-

Will I be responsible for any remaining debt after the deed is signed?

Typically, if the lender agrees to the deed in lieu, they will forgive the remaining mortgage debt. However, homeowners should confirm this with their lender. In some cases, lenders may pursue a deficiency judgment if the property sells for less than the amount owed.

-

How does a Deed in Lieu of Foreclosure affect my credit score?

A deed in lieu may have a less severe impact on your credit score than a foreclosure. However, it can still be reported negatively. The exact effect on your credit score will depend on your overall credit history and the policies of credit reporting agencies.

-

Can I still buy a home after a Deed in Lieu of Foreclosure?

Yes, it is possible to buy another home after a deed in lieu, but it may take time. Lenders typically require a waiting period before you can qualify for a new mortgage. This period can vary, but it is often around two to four years, depending on the lender's policies.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | Arizona Revised Statutes, Title 33, Chapter 6 governs deeds in lieu of foreclosure in Arizona. |

| Eligibility | Homeowners facing financial difficulties can consider this option if they are unable to keep up with mortgage payments. |

| Process | The borrower must negotiate with the lender and provide the necessary documentation to initiate the deed in lieu process. |

| Benefits | It can help borrowers avoid the lengthy and stressful foreclosure process while potentially minimizing damage to their credit score. |

| Risks | Borrowers may still be liable for any deficiency if the property's value is less than the mortgage balance, depending on state law. |

| Title Transfer | Upon acceptance, the lender receives the title to the property, and the borrower is released from the mortgage obligation. |

| Alternatives | Other options include loan modification, short sale, or bankruptcy, which may be more suitable depending on individual circumstances. |