Attorney-Approved Operating Agreement Document for the State of Arizona

When starting a business in Arizona, having a clear and comprehensive Operating Agreement is essential for any limited liability company (LLC). This document outlines the internal workings of the LLC, detailing the management structure, ownership percentages, and the responsibilities of each member. It serves as a roadmap for decision-making processes, helping to prevent disputes among members by establishing rules for meetings, voting rights, and profit distribution. Additionally, the Operating Agreement can address what happens in the event of a member's departure or the addition of new members, ensuring a smooth transition and continuity for the business. By creating this agreement, members can protect their personal assets and clarify their roles within the company, making it a critical step in the formation of an LLC in Arizona. Understanding these major aspects is vital for any entrepreneur looking to navigate the complexities of business ownership effectively.

Consider More Operating Agreement Templates for Different States

How to File Operating Agreement Llc - Members can use the document to outline their purpose and goals.

Creating an Operating Agreement - An Operating Agreement outlines the internal structure and operational procedures of a Limited Liability Company (LLC).

Completing a Minnesota Trailer Bill of Sale form is crucial for anyone involved in the sale or transfer of a trailer in Minnesota, as it provides a clear record of ownership transfer and safeguards the interests of both parties. To obtain the necessary documentation, you can visit vehiclebillofsaleform.com/trailer-bill-of-sale-template/minnesota-trailer-bill-of-sale-template/ for the template and further guidance on how to proceed.

Florida Operating Agreement Template - This agreement can define the capital contributions required from each member.

Dos and Don'ts

When filling out the Arizona Operating Agreement form, it's essential to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do ensure that all member names and addresses are accurately listed.

- Do include the purpose of the LLC clearly and concisely.

- Do specify the management structure, whether member-managed or manager-managed.

- Do outline the distribution of profits and losses among members.

- Don't leave any sections blank; provide information for all required fields.

- Don't use vague language; clarity is crucial for the agreement's effectiveness.

By following these guidelines, you can ensure a smoother process in establishing your LLC in Arizona. Taking the time to fill out the form correctly will save you from potential issues down the road.

Arizona Operating Agreement Sample

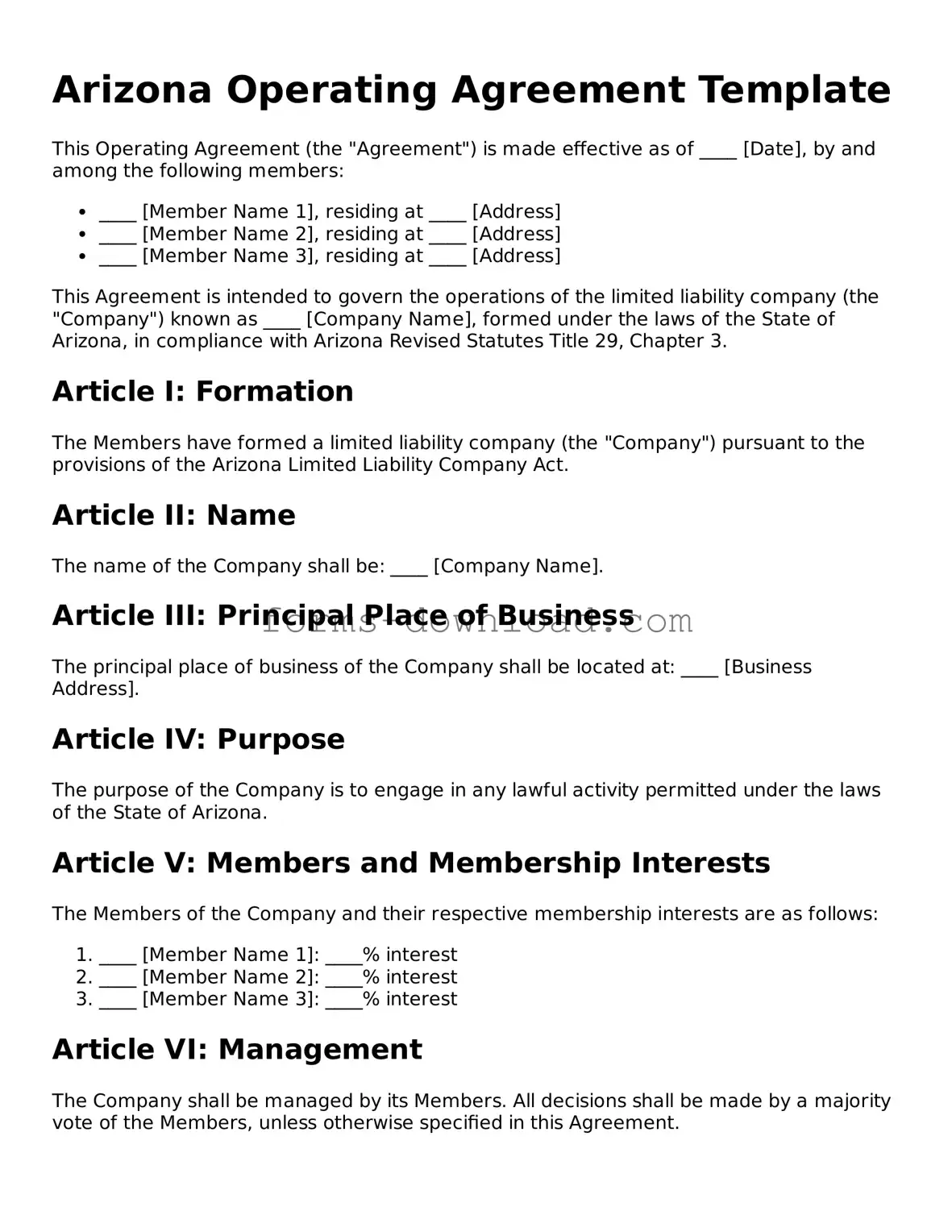

Arizona Operating Agreement Template

This Operating Agreement (the "Agreement") is made effective as of ____ [Date], by and among the following members:

- ____ [Member Name 1], residing at ____ [Address]

- ____ [Member Name 2], residing at ____ [Address]

- ____ [Member Name 3], residing at ____ [Address]

This Agreement is intended to govern the operations of the limited liability company (the "Company") known as ____ [Company Name], formed under the laws of the State of Arizona, in compliance with Arizona Revised Statutes Title 29, Chapter 3.

Article I: Formation

The Members have formed a limited liability company (the "Company") pursuant to the provisions of the Arizona Limited Liability Company Act.

Article II: Name

The name of the Company shall be: ____ [Company Name].

Article III: Principal Place of Business

The principal place of business of the Company shall be located at: ____ [Business Address].

Article IV: Purpose

The purpose of the Company is to engage in any lawful activity permitted under the laws of the State of Arizona.

Article V: Members and Membership Interests

The Members of the Company and their respective membership interests are as follows:

- ____ [Member Name 1]: ____% interest

- ____ [Member Name 2]: ____% interest

- ____ [Member Name 3]: ____% interest

Article VI: Management

The Company shall be managed by its Members. All decisions shall be made by a majority vote of the Members, unless otherwise specified in this Agreement.

Article VII: Capital Contributions

Members shall contribute to the capital of the Company as follows:

- ____ [Member Name 1]: $____

- ____ [Member Name 2]: $____

- ____ [Member Name 3]: $____

Article VIII: Distributions

Cash distributions shall be made to the Members in proportion to their respective membership interests unless otherwise agreed upon.

Article IX: Indemnification

The Company shall indemnify any Member or manager against expenses and liabilities incurred in connection with the Company, except for matters arising from gross negligence or willful misconduct.

Article X: Amendments

This Agreement may only be amended or modified by a written agreement signed by all Members.

Article XI: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Arizona.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first above written.

___________________________

Signature of Member 1

___________________________

Signature of Member 2

___________________________

Signature of Member 3

Listed Questions and Answers

-

What is an Arizona Operating Agreement?

An Arizona Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in Arizona. This agreement serves as a foundational document that defines the roles and responsibilities of the members, how profits and losses will be distributed, and how the company will be managed. While not legally required, having an Operating Agreement is highly recommended as it helps prevent misunderstandings among members and provides clarity on operational procedures.

-

Is an Operating Agreement required in Arizona?

No, Arizona does not legally require LLCs to have an Operating Agreement. However, it is strongly advisable to create one. An Operating Agreement can help protect the limited liability status of the members and provide a framework for resolving disputes. Without it, members may face challenges in the event of disagreements or legal issues.

-

Who should draft the Operating Agreement?

While any member of the LLC can draft the Operating Agreement, it is often beneficial to seek legal assistance. A lawyer experienced in business law can ensure that the agreement complies with state laws and meets the specific needs of the LLC. This can help avoid potential pitfalls and ensure that all members are adequately protected.

-

What should be included in the Operating Agreement?

An effective Operating Agreement should cover several key elements:

- Identification of the members and their ownership percentages

- Management structure and decision-making processes

- Procedures for adding or removing members

- Distribution of profits and losses

- Dispute resolution mechanisms

- Amendment procedures for the agreement

Including these elements helps ensure that all members have a clear understanding of their rights and responsibilities.

-

How does the Operating Agreement affect liability protection?

Having a well-drafted Operating Agreement can help reinforce the limited liability protection that an LLC offers its members. It demonstrates that the LLC is being operated as a separate legal entity, which can help protect personal assets from business liabilities. If disputes arise, a clear Operating Agreement can serve as evidence of the intended structure and operations of the business.

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. It is important to include a section in the agreement that outlines the process for making amendments. Typically, amendments require the consent of a certain percentage of members, depending on what is specified in the agreement. Keeping the Operating Agreement up to date ensures that it reflects the current structure and needs of the LLC.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, the company will be governed by Arizona's default LLC laws. These laws may not align with the members' intentions or business practices. This can lead to confusion and disputes, particularly regarding profit distribution, management decisions, and member responsibilities. Having an Operating Agreement helps to avoid these potential issues and provides a clear roadmap for the operation of the business.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Operating Agreement outlines the management structure and operational guidelines for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Arizona Revised Statutes, specifically Title 29, Chapter 4. |

| Member Rights | It specifies the rights and responsibilities of each member involved in the LLC. |

| Profit Distribution | The agreement details how profits and losses will be distributed among members. |

| Amendments | It provides a process for amending the agreement as needed, ensuring flexibility for the LLC. |

| Duration | The document may specify the duration of the LLC, whether it is perpetual or for a set term. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, promoting harmony within the LLC. |