Attorney-Approved Promissory Note Document for the State of Arizona

In Arizona, a Promissory Note serves as a crucial financial instrument that outlines the terms of a loan between a borrower and a lender. This legally binding document details the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties have a clear understanding of their obligations. It typically includes essential information such as the borrower's and lender's names, the date of the agreement, and the consequences of default. The form can also specify whether the note is secured or unsecured, adding another layer of protection for the lender. Understanding these elements is vital for anyone involved in lending or borrowing money in Arizona, as it helps prevent disputes and fosters transparency in financial transactions. Whether you are a first-time borrower or a seasoned lender, knowing how to properly utilize the Arizona Promissory Note form can significantly impact the success of your financial dealings.

Consider More Promissory Note Templates for Different States

Promissory Note Virginia - Clarifying the payment method is important to ensure smooth transactions between parties.

In addition to completing the form for your boat transaction, it is important to ensure that all parties involved are aware of the legal requirements in California, which can be facilitated by utilizing the Bill of Sale for a Boat to formalize the agreement and ensure a transparent process.

Loan Promissory Note - The note includes crucial details like the loan amount, interest rate, and payment schedule.

California Promissory Note Template - A legal document where one party promises to pay a specific amount to another.

Dos and Don'ts

When filling out the Arizona Promissory Note form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do ensure that all parties' names are spelled correctly and match their identification documents.

- Do clearly specify the loan amount, including both the principal and any interest.

- Do include the payment schedule, detailing when payments are due and how much each payment will be.

- Do sign and date the document in the appropriate sections.

- Don't leave any blank spaces on the form; fill in all required information to avoid confusion later.

- Don't use ambiguous language; be clear and concise in your terms to prevent misunderstandings.

- Don't forget to keep a copy of the signed Promissory Note for your records.

By following these guidelines, you can help ensure that your Promissory Note is completed accurately and effectively, protecting both parties involved.

Arizona Promissory Note Sample

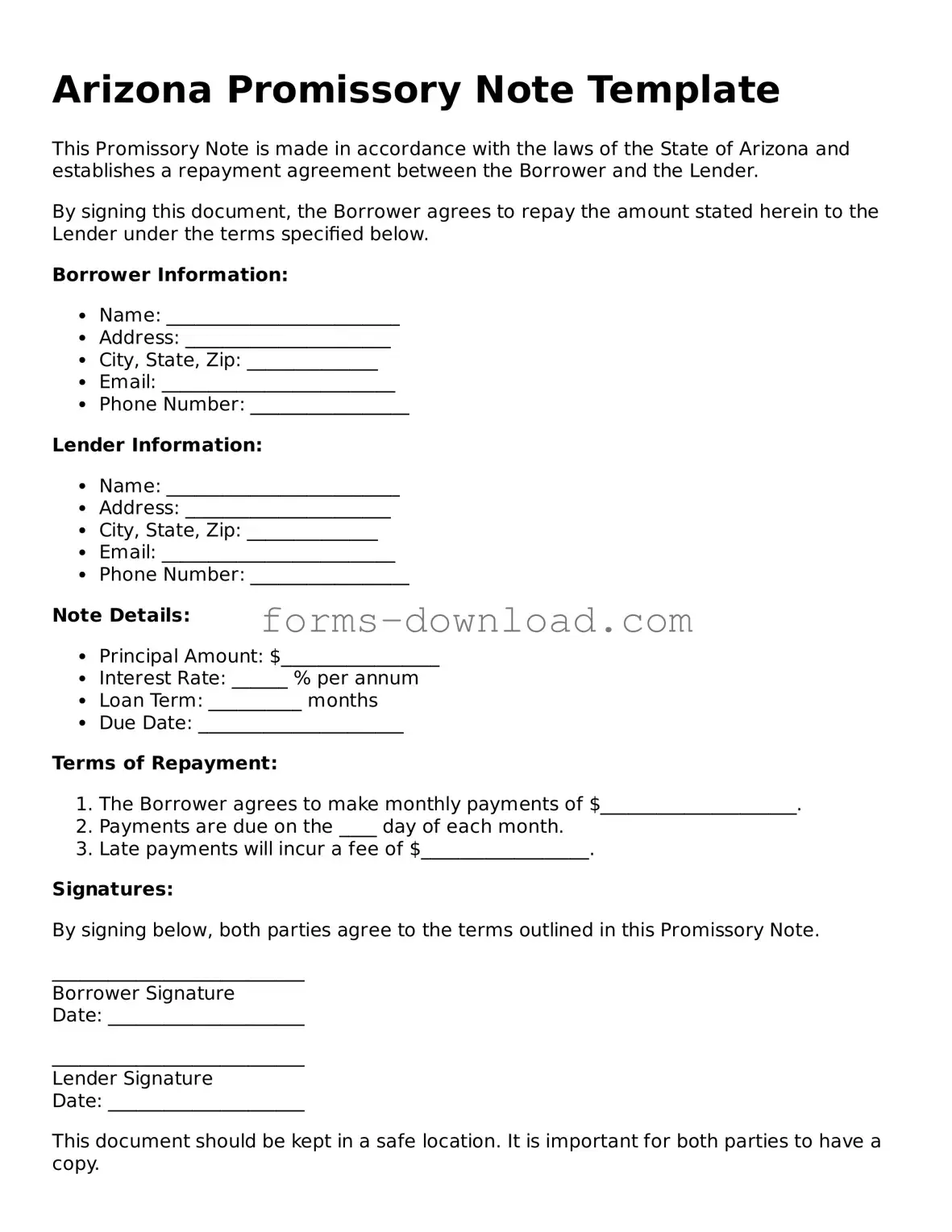

Arizona Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Arizona and establishes a repayment agreement between the Borrower and the Lender.

By signing this document, the Borrower agrees to repay the amount stated herein to the Lender under the terms specified below.

Borrower Information:

- Name: _________________________

- Address: ______________________

- City, State, Zip: ______________

- Email: _________________________

- Phone Number: _________________

Lender Information:

- Name: _________________________

- Address: ______________________

- City, State, Zip: ______________

- Email: _________________________

- Phone Number: _________________

Note Details:

- Principal Amount: $_________________

- Interest Rate: ______ % per annum

- Loan Term: __________ months

- Due Date: ______________________

Terms of Repayment:

- The Borrower agrees to make monthly payments of $_____________________.

- Payments are due on the ____ day of each month.

- Late payments will incur a fee of $__________________.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

___________________________

Borrower Signature

Date: _____________________

___________________________

Lender Signature

Date: _____________________

This document should be kept in a safe location. It is important for both parties to have a copy.

Listed Questions and Answers

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document outlining the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

-

Who uses a Promissory Note in Arizona?

Individuals and businesses in Arizona use promissory notes for various purposes. Common users include lenders, borrowers, and investors. They are often utilized in personal loans, business loans, and real estate transactions.

-

What information is required in an Arizona Promissory Note?

Essential information includes:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate, if applicable

- The repayment terms, including the due date

- Any penalties for late payment

-

Is a Promissory Note legally binding in Arizona?

Yes, a properly executed promissory note is legally binding in Arizona. Both parties must agree to the terms, and the note should be signed and dated to ensure its enforceability.

-

Do I need a witness or notarization for a Promissory Note in Arizona?

While not required, having a witness or notarizing the document can add an extra layer of protection. It helps verify the identities of the parties involved and can be useful in case of disputes.

-

Can I modify the terms of a Promissory Note after it has been signed?

Yes, the terms can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, the lender can take legal action to recover the owed amount. This may include filing a lawsuit or pursuing other collection methods.

-

How can I ensure my Promissory Note is enforceable?

To ensure enforceability, include clear terms, have both parties sign the document, and consider notarization. Keeping a copy of the signed note and any correspondence related to the loan can also be beneficial.

-

Are there any specific laws governing Promissory Notes in Arizona?

Yes, Arizona has specific laws regarding promissory notes, primarily found in the Arizona Revised Statutes. It is important to be aware of these laws to ensure compliance and protect your rights.

-

Where can I find a template for an Arizona Promissory Note?

Templates for Arizona promissory notes can be found online through legal document preparation services, law firms, or official state websites. Ensure that any template used complies with Arizona laws and is tailored to your specific needs.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | An Arizona Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | The Arizona Promissory Note is governed by the Arizona Revised Statutes, specifically Title 47, which covers the Uniform Commercial Code. |

| Form Requirements | While no specific form is mandated, the note should clearly state the amount, interest rate, payment schedule, and signatures of the parties involved. |

| Enforceability | To be enforceable, the note must be signed by the borrower and should include all essential terms. A properly executed note can be legally binding in Arizona. |