Attorney-Approved Transfer-on-Death Deed Document for the State of Arizona

The Arizona Transfer-on-Death Deed (TODD) offers a straightforward method for property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This form allows individuals to retain full control over their property during their lifetime, as they can sell, mortgage, or revoke the deed at any time. The TODD becomes effective only after the property owner passes away, simplifying the transfer process and reducing the administrative burden on heirs. To be valid, the deed must be properly executed, recorded with the county recorder, and comply with Arizona law. Beneficiaries named in the deed receive the property outright, which can help avoid potential disputes among family members. Understanding the nuances of this form is crucial for anyone considering estate planning in Arizona, as it can significantly impact how one's assets are handled after death.

Consider More Transfer-on-Death Deed Templates for Different States

Lady Bird Deed Virginia - A simple way to manage your assets and ensure they go to the right people.

How to File a Transfer on Death Deed - Potential property tax implications should be discussed with a tax professional before execution.

The Texas Motor Vehicle Power of Attorney form allows one person to authorizes another to act on their behalf specifically regarding motor vehicle transactions. This document is essential for those who need assistance with tasks such as buying, selling, or transferring ownership of a vehicle. Individuals can obtain the necessary documentation, including the Motor Vehicle Power of Attorney form, to ensure that their interests are managed properly without requiring their direct involvement.

Transfer on Death Deed Tennessee Form - Helps to formalize the owner's intentions regarding their property's future.

Transfer on Death Deed Form Florida - The beneficiaries named in the deed are not responsible for any debts associated with the property until ownership is transferred.

Dos and Don'ts

When filling out the Arizona Transfer-on-Death Deed form, it’s important to be careful and thorough. Here are some guidelines to follow:

- Do ensure that all property details are accurate. Double-check the legal description of the property.

- Do clearly identify the beneficiaries. Make sure their names are spelled correctly and their relationships to you are clear.

- Do sign the form in the presence of a notary public. This step is crucial for the deed to be valid.

- Do file the completed deed with the county recorder's office. This makes the transfer official and legally binding.

- Don't leave any sections blank. Incomplete forms can lead to confusion or legal issues.

- Don't forget to consider tax implications. Understand how this deed may affect your estate taxes.

- Don't use outdated forms. Always check that you have the most current version of the Transfer-on-Death Deed.

- Don't assume that verbal agreements are enough. Everything must be documented properly to avoid disputes later.

Arizona Transfer-on-Death Deed Sample

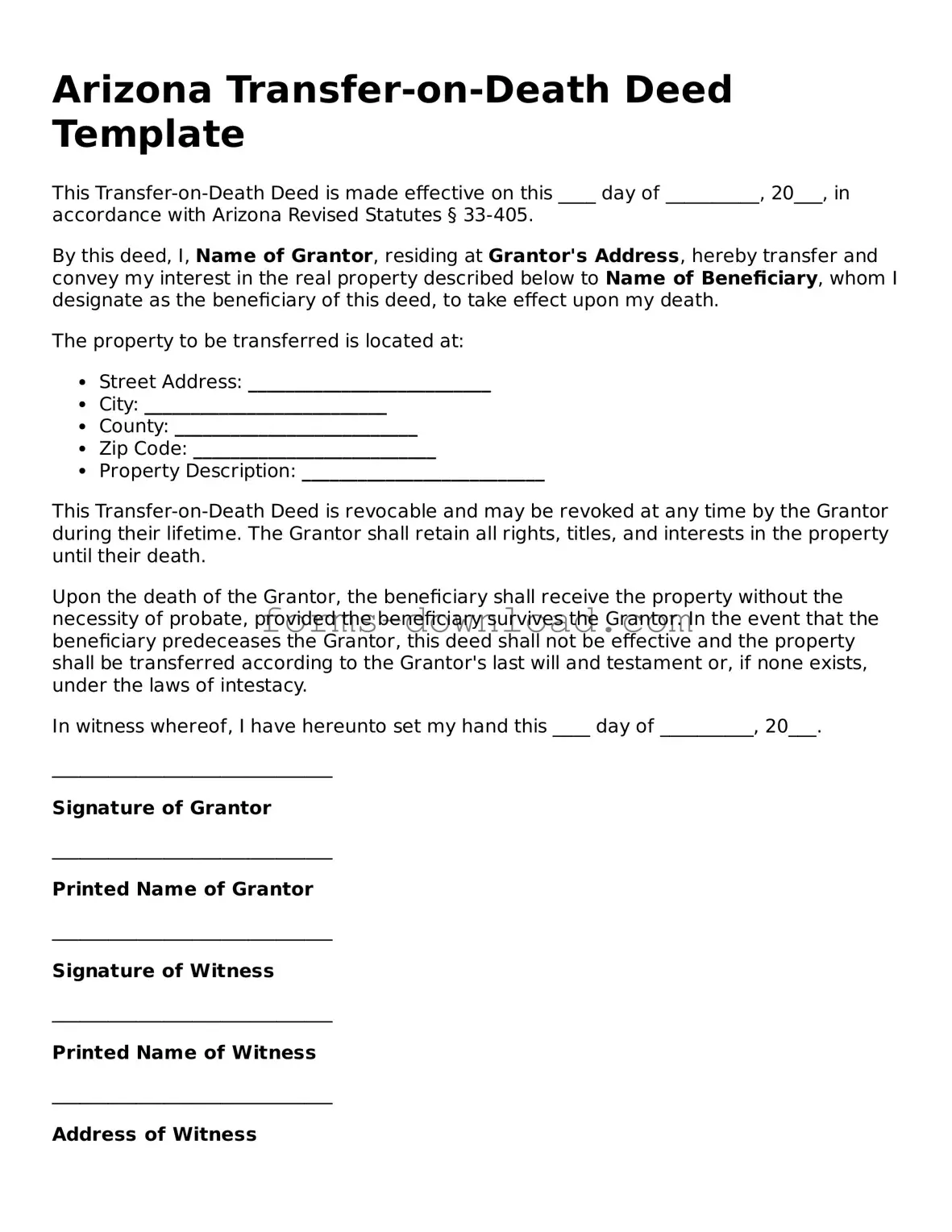

Arizona Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made effective on this ____ day of __________, 20___, in accordance with Arizona Revised Statutes § 33-405.

By this deed, I, Name of Grantor, residing at Grantor's Address, hereby transfer and convey my interest in the real property described below to Name of Beneficiary, whom I designate as the beneficiary of this deed, to take effect upon my death.

The property to be transferred is located at:

- Street Address: __________________________

- City: __________________________

- County: __________________________

- Zip Code: __________________________

- Property Description: __________________________

This Transfer-on-Death Deed is revocable and may be revoked at any time by the Grantor during their lifetime. The Grantor shall retain all rights, titles, and interests in the property until their death.

Upon the death of the Grantor, the beneficiary shall receive the property without the necessity of probate, provided the beneficiary survives the Grantor. In the event that the beneficiary predeceases the Grantor, this deed shall not be effective and the property shall be transferred according to the Grantor's last will and testament or, if none exists, under the laws of intestacy.

In witness whereof, I have hereunto set my hand this ____ day of __________, 20___.

______________________________

Signature of Grantor

______________________________

Printed Name of Grantor

______________________________

Signature of Witness

______________________________

Printed Name of Witness

______________________________

Address of Witness

Listed Questions and Answers

-

What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Arizona to transfer their real estate to a designated beneficiary upon their death. This deed enables the owner to retain full control over the property during their lifetime, while ensuring a smooth transfer of ownership without the need for probate after their passing.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must complete the form with accurate details about the property and the designated beneficiary. This includes the legal description of the property and the names of the beneficiaries. Once completed, the deed must be signed in the presence of a notary public and recorded with the county recorder's office where the property is located. It is crucial to follow these steps carefully to ensure the deed is valid.

-

Can I change the beneficiary on a Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time while you are alive. To do this, you will need to execute a new TOD Deed that specifies the new beneficiary or revoke the existing deed altogether. It is important to record the new deed with the county recorder to ensure that your wishes are legally recognized.

-

What happens if I do not name a beneficiary?

If no beneficiary is named on the Transfer-on-Death Deed, the property will not automatically transfer upon your death. Instead, it will become part of your estate and may be subject to the probate process. This could lead to delays and additional costs for your heirs, so it is advisable to ensure that a beneficiary is designated.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. The property retains its tax basis, and beneficiaries may receive a step-up in basis upon your death, potentially reducing capital gains tax if they sell the property. However, it is wise to consult a tax professional for specific advice related to your situation.

-

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a beneficial estate planning tool for many individuals, particularly those who wish to avoid probate. However, it may not be suitable for everyone. Factors such as the complexity of your estate, family dynamics, and specific financial goals should be considered. Consulting with an estate planning attorney can provide tailored guidance based on your unique circumstances.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | The Arizona Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Arizona Revised Statutes, Title 33, Chapter 4, Article 6. |

| Eligibility | Any individual who owns real property in Arizona can execute a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Revocation | The deed can be revoked at any time before the property owner's death by executing a new deed or a written revocation. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded with the county recorder's office to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes or income taxes at the time of transfer. |

| Survivorship Rights | Designating multiple beneficiaries can create joint ownership, but it is essential to specify rights clearly. |

| Effect on Creditors | Property transferred via a Transfer-on-Death Deed may still be subject to claims by creditors of the deceased owner. |

| Legal Assistance | While not required, consulting with an attorney is advisable to ensure that the deed is executed properly and meets the owner's intentions. |