Blank Auto Insurance Card Form

When navigating the complexities of auto insurance, the Auto Insurance Card serves as a crucial document for both policyholders and law enforcement. This card encapsulates essential information, including the insurance company’s name and contact details, the policy number, and the dates of coverage—both effective and expiration. Additionally, it provides critical details about the insured vehicle, such as its make, model, and Vehicle Identification Number (VIN). The card is not merely a formality; it must be kept in the insured vehicle at all times and presented upon request in the event of an accident. This requirement underscores the importance of being prepared for unexpected incidents on the road. Moreover, the card includes an important notice on the reverse side, advising policyholders to report any accidents to their insurance agent promptly and to gather pertinent information from all parties involved. The front of the card features an artificial watermark, which serves as a security measure, ensuring its authenticity. Understanding these components is vital for any driver, as they facilitate a smoother claims process and contribute to overall road safety.

More PDF Forms

Texas Temporary Tag - You may need to show proof of insurance when submitting the form.

The Arkansas Boat Bill of Sale not only facilitates the transfer of ownership for a boat but is also crucial for ensuring all relevant details are documented, including buyer and seller information, boat specifications, and the sale price. To further assist in the process, you can refer to the Vessel Bill of Sale for guidance on the necessary steps and legal requirements involved in this transaction.

Where to Find 1040 Form - Some taxpayers may need to file additional forms beyond the 1040 to meet their reporting obligations.

Dos and Don'ts

Filling out your Auto Insurance Card form correctly is essential. It ensures that you have all the necessary information in case of an accident. Here’s a helpful list of things to do and avoid when completing the form.

- Do provide accurate information for each section, including your vehicle’s make and model.

- Do double-check the policy number and effective dates to ensure they are correct.

- Do keep the card in your vehicle at all times, as required by law.

- Do report any accidents to your insurance agent as soon as they occur.

- Do include the correct vehicle identification number (VIN) for your car.

- Don't leave any sections blank; incomplete forms can lead to complications.

- Don't use nicknames or abbreviations for names; full legal names are necessary.

- Don't forget to check the expiration date; an expired card can lead to fines.

- Don't ignore the importance of the watermark; it helps validate the document.

- Don't assume that verbal information is enough; always write it down on the form.

By following these guidelines, you can ensure that your Auto Insurance Card is filled out correctly and is ready for use whenever needed.

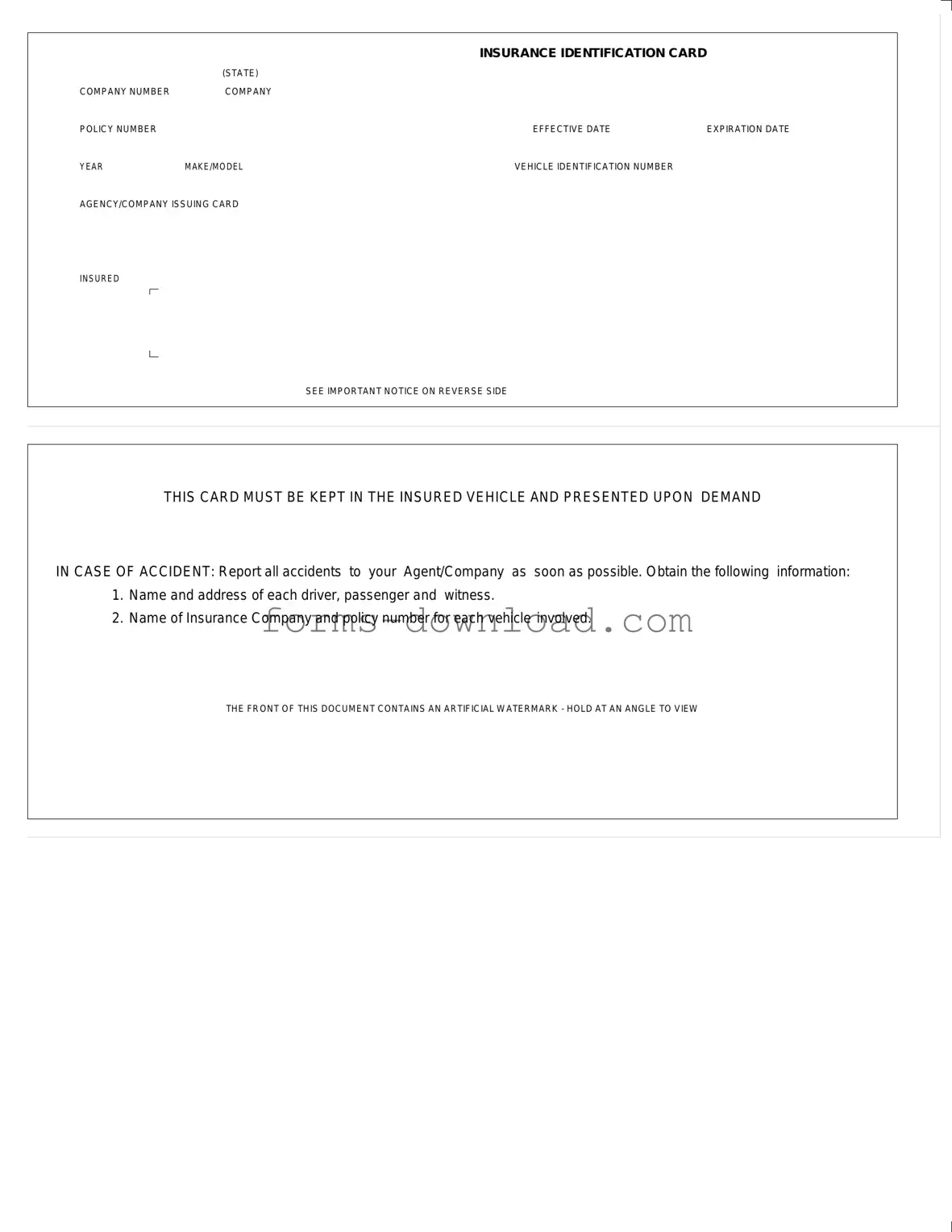

Auto Insurance Card Sample

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Listed Questions and Answers

-

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have valid auto insurance coverage. It contains essential information such as your insurance company details, policy number, and vehicle information. This card must be kept in your vehicle at all times.

-

What information is included on the Auto Insurance Card?

The card typically includes the following details:

- Company number

- Company policy number

- Effective date of the policy

- Expiration date of the policy

- Year, make, and model of the insured vehicle

- Vehicle Identification Number (VIN)

- Agency or company issuing the card

-

Why is it important to keep the Auto Insurance Card in the vehicle?

The Auto Insurance Card must be kept in the insured vehicle to ensure that you can present it upon demand in case of an accident or traffic stop. It serves as proof of insurance and is often required by law.

-

What should I do if I get into an accident?

In the event of an accident, report it to your insurance agent or company as soon as possible. Collect essential information from all parties involved, including:

- Name and address of each driver, passenger, and witness

- Name of the insurance company and policy number for each vehicle involved

-

What is the significance of the artificial watermark on the card?

The front of the Auto Insurance Card contains an artificial watermark. This feature is designed to prevent forgery and can be viewed clearly when held at an angle. It serves as a security measure to ensure the authenticity of the document.

-

What happens if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance company or agent immediately to request a replacement. They will provide you with a new card, which you should keep in your vehicle once received.

-

Can I use a digital version of the Auto Insurance Card?

Many states allow the use of digital insurance cards, which can be stored on your smartphone. Check with your state’s regulations and your insurance provider to determine if a digital version is acceptable.

-

How often should I check my Auto Insurance Card for updates?

It is advisable to review your Auto Insurance Card regularly, especially before long trips or after renewing your policy. Ensure that all information is current, including the effective and expiration dates.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle listed on the card. |

| Legal Requirement | In most states, including California and New York, drivers must carry this card in their vehicle as mandated by state law. |

| Key Information | The card includes essential details such as the insurance company name, policy number, effective date, and expiration date. |

| Accident Protocol | In case of an accident, the cardholder is required to present the card and report the incident to their insurance agent as soon as possible. |

| Watermark Feature | The front of the card features an artificial watermark that can be viewed by holding the card at an angle. |