Fillable Business Bill of Sale Form

The Business Bill of Sale form serves as a crucial document in the transfer of ownership of a business or its assets. This form outlines essential details such as the names of the buyer and seller, the date of the transaction, and a comprehensive description of the items being sold. It also includes the purchase price, ensuring both parties agree on the financial terms of the sale. By documenting the transfer, this form protects the interests of both the seller and the buyer, providing a clear record of the transaction. Additionally, it may contain warranties or disclaimers regarding the condition of the assets, which can be vital in avoiding future disputes. Overall, the Business Bill of Sale is an important tool that formalizes the sale process and establishes legal ownership, contributing to a smooth transition for all involved parties.

More Business Bill of Sale Forms:

Printable Atv Bill of Sale Pdf - An official document to transfer ownership of an ATV.

Bill of Sale for Dirt Bike - Encourages transparency in buying and selling dirt bikes.

For anyone looking to navigate the complexities of property transfers, having a reliable resource can be invaluable. Consider exploring this comprehensive guide on the General Bill of Sale form to understand its significance in documenting ownership changes.

Cattle Bill of Sale Template - This document ensures accountability in commercial livestock sales.

Dos and Don'ts

When filling out the Business Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn't do:

- Do provide accurate information about the business being sold.

- Do include the full names and addresses of both the buyer and seller.

- Do clearly describe the assets being sold, including any equipment or inventory.

- Do specify the sale price and payment terms.

- Don't leave any fields blank; fill in all required information.

- Don't use vague language; be specific to avoid misunderstandings.

Following these guidelines will help ensure a smooth transaction and protect both parties involved.

Business Bill of Sale Sample

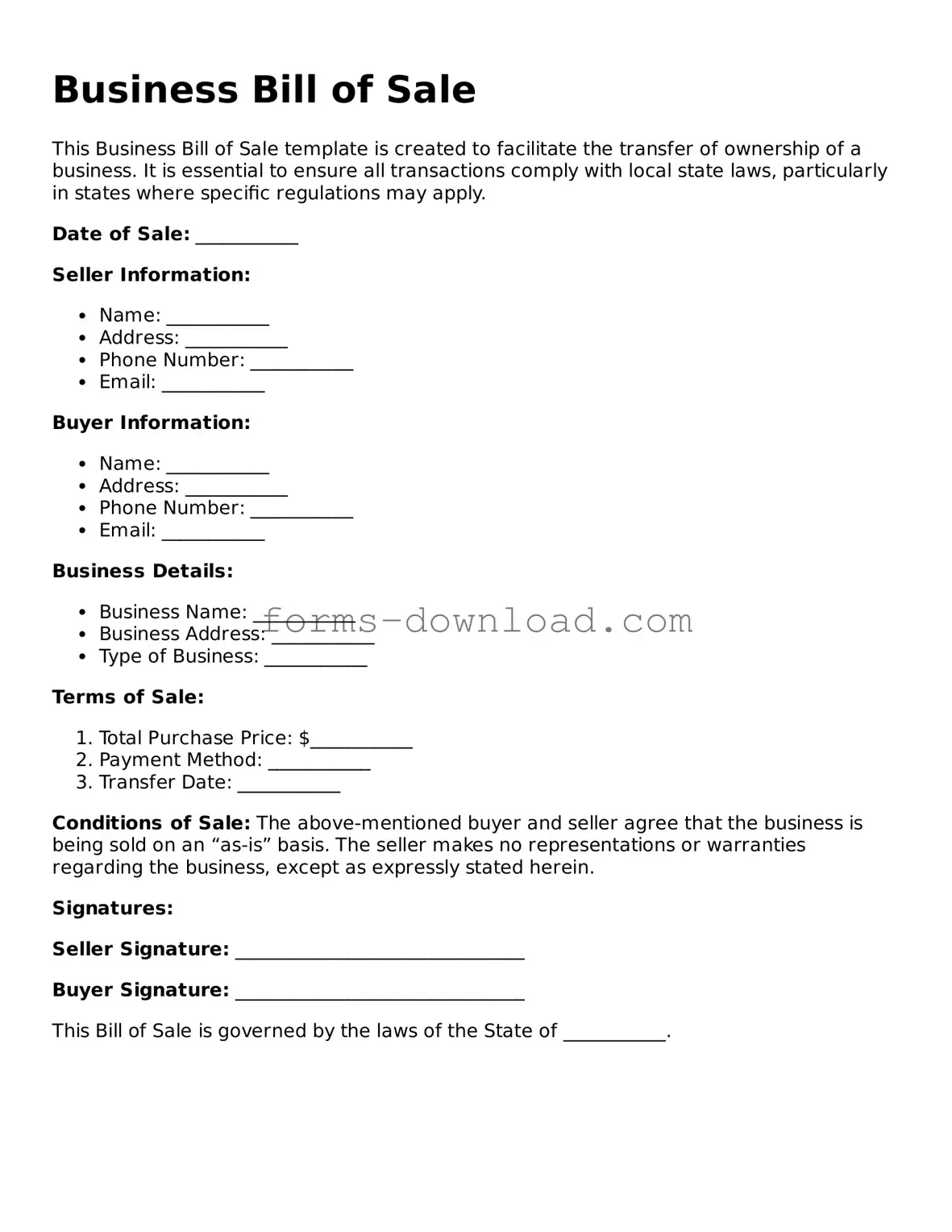

Business Bill of Sale

This Business Bill of Sale template is created to facilitate the transfer of ownership of a business. It is essential to ensure all transactions comply with local state laws, particularly in states where specific regulations may apply.

Date of Sale: ___________

Seller Information:

- Name: ___________

- Address: ___________

- Phone Number: ___________

- Email: ___________

Buyer Information:

- Name: ___________

- Address: ___________

- Phone Number: ___________

- Email: ___________

Business Details:

- Business Name: ___________

- Business Address: ___________

- Type of Business: ___________

Terms of Sale:

- Total Purchase Price: $___________

- Payment Method: ___________

- Transfer Date: ___________

Conditions of Sale: The above-mentioned buyer and seller agree that the business is being sold on an “as-is” basis. The seller makes no representations or warranties regarding the business, except as expressly stated herein.

Signatures:

Seller Signature: _______________________________

Buyer Signature: _______________________________

This Bill of Sale is governed by the laws of the State of ___________.

Listed Questions and Answers

-

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business from one party to another. This form outlines the details of the sale, including the purchase price, the assets being transferred, and any liabilities that may be involved. It serves as proof of the transaction and protects both the buyer and seller by clearly defining the terms of the sale.

-

Why do I need a Business Bill of Sale?

This document is crucial for several reasons. First, it provides legal protection by documenting the sale and the terms agreed upon by both parties. Second, it helps in the transfer of business assets, ensuring that the buyer has clear ownership. Lastly, it can be useful for tax purposes and in case of any disputes that may arise in the future.

-

What information is typically included in a Business Bill of Sale?

A typical Business Bill of Sale includes:

- The names and addresses of the buyer and seller

- A detailed description of the business being sold, including assets and liabilities

- The purchase price

- The date of the transaction

- Any warranties or guarantees provided by the seller

-

Is a Business Bill of Sale required by law?

While it is not always legally required to have a Business Bill of Sale, it is highly recommended. Many states do not mandate this document for business sales, but having it can prevent misunderstandings and provide a clear record of the transaction.

-

Can I create my own Business Bill of Sale?

Yes, you can create your own Business Bill of Sale. However, it is essential to ensure that the document includes all necessary information and complies with state laws. Many templates are available online, but consulting with a legal professional can help tailor the document to your specific situation.

-

What happens if I don’t use a Business Bill of Sale?

Not using a Business Bill of Sale can lead to complications. Without this document, there may be no official record of the sale, which could result in disputes over ownership, assets, or liabilities. In the absence of a clear agreement, both parties may find themselves in a difficult situation if disagreements arise later.

-

How do I fill out a Business Bill of Sale?

To fill out a Business Bill of Sale, start by entering the names and addresses of both the buyer and seller. Next, provide a detailed description of the business, including any assets being sold. Clearly state the purchase price and include the date of the transaction. Finally, both parties should sign and date the document to make it official.

-

Do I need witnesses or notarization for a Business Bill of Sale?

While not always required, having witnesses or notarization can add an extra layer of protection to the Business Bill of Sale. Some states may have specific requirements regarding signatures or notarization, so it is advisable to check local laws to ensure compliance.

-

What should I do after completing the Business Bill of Sale?

After completing the Business Bill of Sale, both the buyer and seller should keep a copy for their records. It may also be necessary to file the document with local authorities, depending on state regulations. Additionally, updating any business licenses or registrations to reflect the new ownership is crucial.

-

Can a Business Bill of Sale be modified after it is signed?

Once signed, a Business Bill of Sale is generally considered a binding agreement. However, if both parties agree to changes, they can create an amendment or a new document that outlines the modifications. It is important to document any changes in writing and have both parties sign the new agreement to ensure clarity and enforceability.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business from one party to another. |

| Purpose | This form serves to provide proof of the transaction and details the terms agreed upon by the buyer and seller. |

| Governing Law | The laws governing the Business Bill of Sale vary by state. For example, in California, it is governed by the California Commercial Code. |

| Required Information | The form typically includes the names of the buyer and seller, a description of the business, and the sale price. |

| Signatures | Both parties must sign the document for it to be legally binding. Witness signatures may also be required in some states. |

| Record Keeping | It is important to keep a copy of the Bill of Sale for future reference and potential legal needs. |