Blank Business Credit Application Form

When seeking to establish a line of credit for a business, the Business Credit Application form plays a pivotal role in the process. This essential document serves as a bridge between businesses and potential creditors, providing the necessary information to evaluate creditworthiness. Typically, the form requires details about the business, including its legal structure, ownership, and financial history. Key components often include the business's name, address, and tax identification number, as well as the personal information of the owners or guarantors. Additionally, applicants may need to disclose financial statements, banking relationships, and trade references to give creditors a comprehensive view of their financial health. Completing this form accurately and thoroughly can significantly enhance a business's chances of obtaining favorable credit terms, making it a critical step in financial planning and management.

More PDF Forms

Judgement of Divorce Form Michigan - It highlights any previous custody proceedings that may relate to the current case.

How to File a Mechanics Lien - Can be filed by anyone working on property-related projects in California.

The importance of having a properly executed California Boat Bill of Sale cannot be overstated, as it not only provides key details about the transaction but also serves as a safeguard for both the buyer and the seller. By utilizing this legal document, all parties involved can confirm the terms of the sale, ensuring that every aspect of the ownership transfer is documented thoroughly. For those looking to understand the procedural requirements better, resources such as the Vessel Bill of Sale can offer valuable insights and templates to follow.

Printable Puppy Health Record - This form simplifies communication with your veterinarian about vaccinations.

Dos and Don'ts

When filling out a Business Credit Application form, it is important to be thorough and accurate. Here are some guidelines to follow:

- Do: Provide accurate and complete information. Double-check all entries for correctness.

- Do: Use clear and concise language. Avoid ambiguity to ensure your application is easily understood.

- Do: Include all necessary documentation. Supporting documents can strengthen your application.

- Do: Review the form before submission. Ensure everything is filled out correctly and all required fields are completed.

- Don't: Leave any fields blank. Incomplete applications may be rejected or delayed.

- Don't: Provide misleading information. Honesty is crucial; inaccuracies can harm your credibility.

- Don't: Rush through the application. Take your time to ensure quality and accuracy.

- Don't: Ignore the instructions. Follow the guidelines provided to avoid errors that could affect your application.

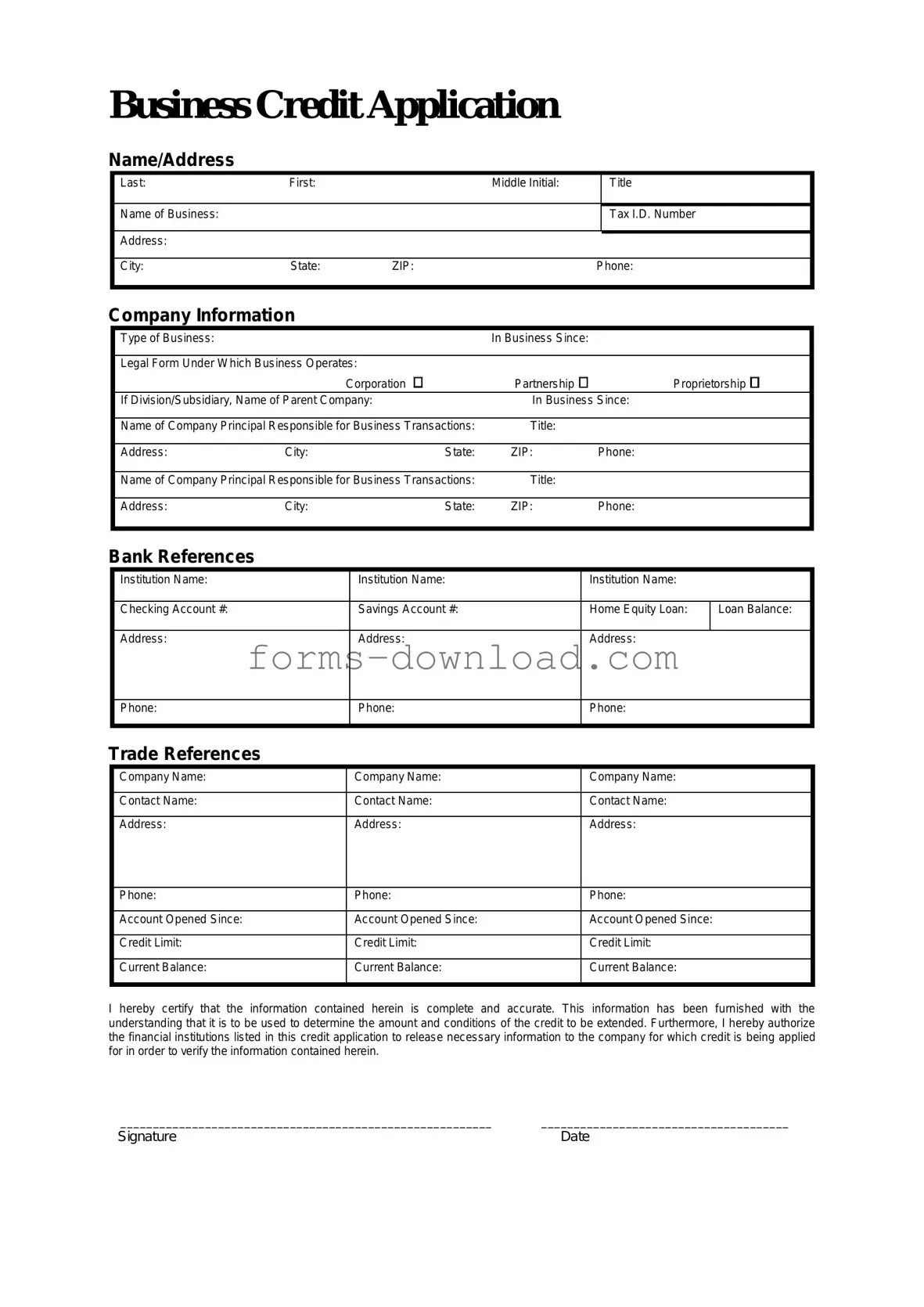

Business Credit Application Sample

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Listed Questions and Answers

-

What is a Business Credit Application form?

A Business Credit Application form is a document that businesses fill out to request credit from suppliers or lenders. It typically includes information about the business, its owners, and its financial status. This form helps creditors assess the creditworthiness of a business before extending credit terms.

-

Who should fill out the Business Credit Application form?

The Business Credit Application form should be completed by the owner or an authorized representative of the business. This person should have a good understanding of the company's financial situation and be able to provide accurate information regarding its credit history and current financial status.

-

What information is typically required on the form?

The form usually requires details such as:

- Business name and address

- Type of business (e.g., corporation, partnership, sole proprietorship)

- Tax identification number

- Owner(s) information

- Bank references

- Trade references

- Financial statements or other relevant financial information

-

How long does it take to process a Business Credit Application?

The processing time can vary depending on the lender or supplier. Generally, it may take anywhere from a few days to a couple of weeks. Factors that influence this timeline include the completeness of the application, the speed of reference checks, and the lender’s workload.

-

What happens after I submit the application?

Once you submit the application, the creditor will review the information provided. They may contact you for additional details or clarification. After assessing your creditworthiness, they will inform you of their decision, which could result in approval, denial, or a request for further information.

-

Can I appeal if my application is denied?

Yes, if your application is denied, you can often request an explanation for the decision. Some creditors may allow you to appeal their decision by providing additional information or addressing any concerns they had. It’s important to understand the reasons for the denial before proceeding with an appeal.

-

Is there a fee associated with submitting a Business Credit Application?

Most creditors do not charge a fee for submitting a Business Credit Application. However, it’s always a good idea to check with the specific lender or supplier to confirm their policies. Be aware of any potential fees that may apply if credit is extended or if you fail to meet payment terms.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used to assess a business's creditworthiness when applying for credit or financing. |

| Information Required | Typically, the form requests details such as business name, address, ownership structure, and financial information. |

| Signatures | Authorized representatives of the business must sign the form to verify the accuracy of the information provided. |

| Confidentiality | Information submitted is usually treated as confidential and is protected under privacy laws. |

| State-Specific Forms | Some states may have specific requirements for the Business Credit Application form. Check local regulations. |

| Governing Laws | In California, for example, the form is governed by the California Commercial Code. |

| Review Process | After submission, lenders typically review the application, which may include a credit check and financial analysis. |

| Approval Timeframe | The time it takes to process the application can vary, often ranging from a few days to several weeks. |

| Impact on Credit Score | Submitting a Business Credit Application may impact the business's credit score, especially if a hard inquiry is performed. |