Fillable Business Purchase and Sale Agreement Form

The Business Purchase and Sale Agreement is a crucial document for anyone involved in the buying or selling of a business. This agreement outlines the terms and conditions under which the transaction will occur, ensuring that both parties have a clear understanding of their rights and obligations. Key components typically include the purchase price, payment terms, and a detailed description of the assets being transferred. Additionally, the agreement often addresses contingencies, such as financing and due diligence requirements, which protect both the buyer and seller during the transaction process. Warranties and representations made by both parties are also included to clarify expectations and reduce the risk of disputes. By laying out these essential elements, the Business Purchase and Sale Agreement serves as a roadmap for a successful transaction, helping to facilitate a smooth transfer of ownership while safeguarding the interests of all involved.

Popular Forms:

Quick Bill of Sale - Designed for clarity, minimizing confusion during transactions.

When engaging in a boat transaction, having the right documentation is essential, and the Bill of Sale for a Boat ensures that all necessary information is recorded to facilitate a smooth transfer of ownership.

Employee Application - What you provide could be used to assess your fit for the role you seek.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of things to do and avoid:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about the business.

- Do consult with a legal professional if you have any questions.

- Do keep copies of all documents for your records.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific in your descriptions.

- Don't forget to review the agreement with all parties involved before signing.

By following these guidelines, you can help ensure that your Business Purchase and Sale Agreement is filled out correctly and effectively.

Business Purchase and Sale Agreement Sample

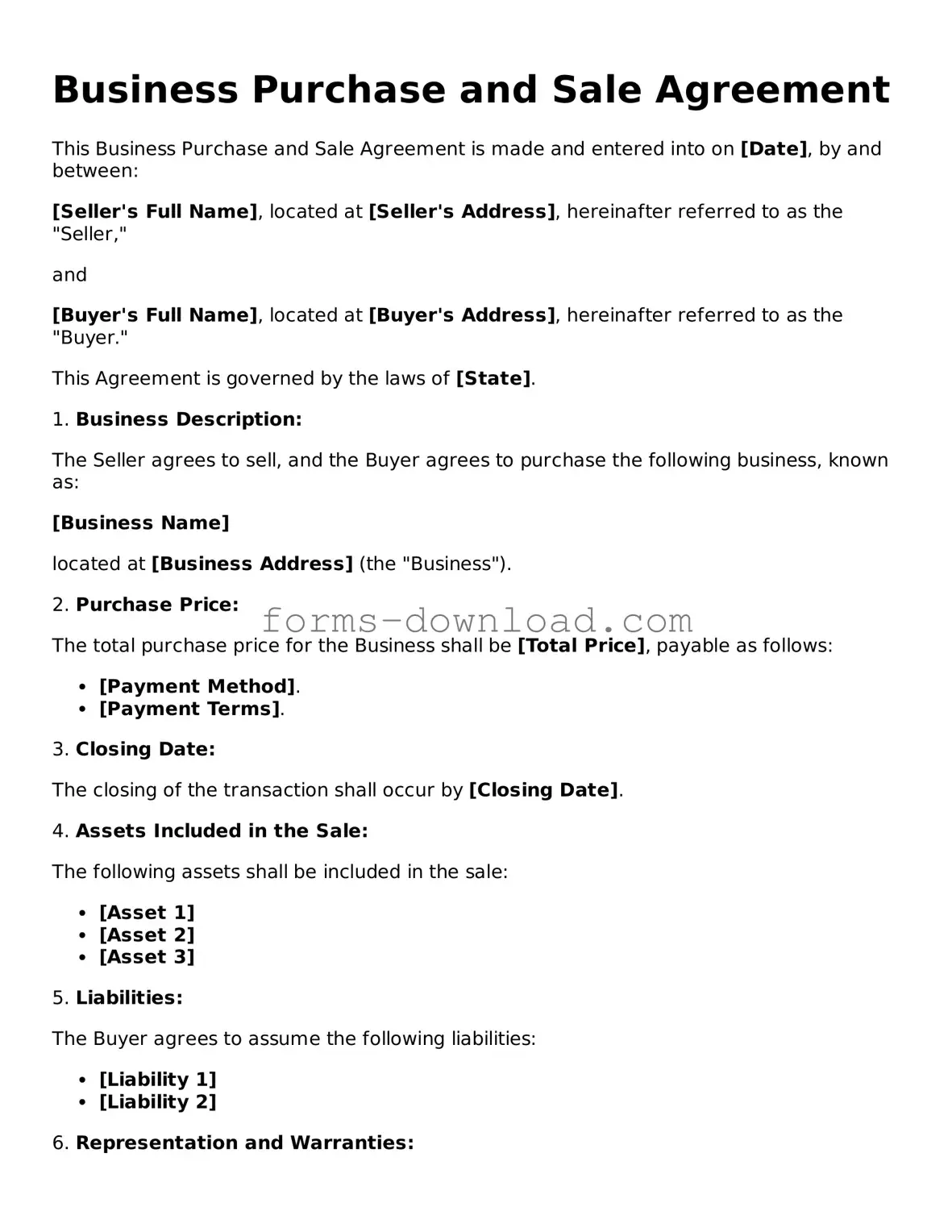

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement is made and entered into on [Date], by and between:

[Seller's Full Name], located at [Seller's Address], hereinafter referred to as the "Seller,"

and

[Buyer's Full Name], located at [Buyer's Address], hereinafter referred to as the "Buyer."

This Agreement is governed by the laws of [State].

1. Business Description:

The Seller agrees to sell, and the Buyer agrees to purchase the following business, known as:

[Business Name]

located at [Business Address] (the "Business").

2. Purchase Price:

The total purchase price for the Business shall be [Total Price], payable as follows:

- [Payment Method].

- [Payment Terms].

3. Closing Date:

The closing of the transaction shall occur by [Closing Date].

4. Assets Included in the Sale:

The following assets shall be included in the sale:

- [Asset 1]

- [Asset 2]

- [Asset 3]

5. Liabilities:

The Buyer agrees to assume the following liabilities:

- [Liability 1]

- [Liability 2]

6. Representation and Warranties:

The Seller represents and warrants that:

- The Seller has full authority to enter into this Agreement.

- The Business is sold free of any encumbrances.

7. Governing Law:

This Agreement shall be governed by the laws of [State].

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the date first above written.

_____________________________

Seller's Signature:

Date: [Date]

_____________________________

Buyer's Signature:

Date: [Date]

Listed Questions and Answers

-

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. It serves as a blueprint for the transaction, detailing the responsibilities of both the buyer and the seller. This agreement ensures that both parties are on the same page regarding the sale and helps prevent misunderstandings.

-

What key elements are included in this agreement?

Typically, a Business Purchase and Sale Agreement includes:

- The names and contact information of both the buyer and seller.

- A detailed description of the business being sold, including assets and liabilities.

- The purchase price and payment terms.

- Any contingencies that must be met before the sale is finalized.

- Representations and warranties from both parties.

- Confidentiality clauses to protect sensitive information.

-

Why is it important to have a Business Purchase and Sale Agreement?

This agreement is crucial because it protects both parties involved in the transaction. It lays out the expectations and obligations of each party, reducing the risk of disputes after the sale. By having everything in writing, both the buyer and seller can refer back to the agreement if any issues arise.

-

Can I create my own Business Purchase and Sale Agreement?

While it is possible to draft your own agreement, it is highly recommended to seek legal advice. A professional can help ensure that the document complies with state laws and adequately protects your interests. A well-drafted agreement can save you from potential headaches down the road.

-

What happens if one party breaches the agreement?

If one party fails to adhere to the terms of the agreement, it is considered a breach. The non-breaching party may have the right to seek legal remedies, which could include monetary damages or specific performance, where the breaching party is required to fulfill their obligations as outlined in the agreement.

-

How long does it take to finalize a Business Purchase and Sale Agreement?

The timeline can vary significantly based on the complexity of the sale and the readiness of both parties. Generally, it can take anywhere from a few days to several weeks to negotiate and finalize the agreement. Factors like financing arrangements, due diligence, and regulatory approvals can all affect the timeline.

-

Is a Business Purchase and Sale Agreement legally binding?

Yes, once both parties have signed the agreement, it becomes legally binding. This means that both the buyer and seller are obligated to follow the terms outlined in the document. If either party fails to comply, they may face legal consequences.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document outlining the terms of a transaction where one party buys a business from another. |

| Purpose | This agreement serves to protect both the buyer and seller by clearly defining the rights and responsibilities of each party. |

| Key Components | It typically includes details about the purchase price, payment terms, and any contingencies that must be met before the sale is finalized. |

| Governing Law | The agreement is subject to the laws of the state in which the business operates, ensuring compliance with local regulations. |

| Confidentiality | Many agreements include clauses that protect sensitive business information shared during the negotiation process. |

| Due Diligence | Buyers are encouraged to conduct due diligence to verify the financial health and legal standing of the business before finalizing the purchase. |

| Asset vs. Stock Sale | The agreement can specify whether the sale involves the purchase of assets or the sale of stock, which can have different tax implications. |

| Closing Process | Once all terms are agreed upon, a closing process takes place where the final documents are signed and ownership is transferred. |

| Legal Representation | It is highly advisable for both parties to seek legal counsel to ensure their interests are adequately represented and protected. |

| State-Specific Forms | Many states have specific forms or requirements for Business Purchase and Sale Agreements, so it's important to consult local laws. |