Attorney-Approved Bill of Sale Document for the State of California

The California Bill of Sale form serves as a crucial document for individuals engaging in the sale or transfer of personal property within the state. This form outlines essential details, including the names and addresses of both the seller and buyer, a description of the item being sold, and the sale price. It provides legal protection for both parties by documenting the transaction, thereby reducing the risk of disputes in the future. Additionally, the form may include information about warranties, if any, and specifies whether the sale is conducted "as-is." This document is not only important for vehicles but also for various types of personal property, such as boats, trailers, and even certain types of equipment. Understanding how to properly fill out and execute this form is vital for ensuring a smooth transfer of ownership and safeguarding the interests of both the buyer and seller.

Consider More Bill of Sale Templates for Different States

Nj Dmv Transfer Title - A legal agreement confirming the sale of personal property.

The California Articles of Incorporation form not only establishes a corporation's existence in California but also requires accurate and detailed information for a successful filing. For those looking to simplify this process, utilizing Fillable Forms can be incredibly beneficial, ensuring that all necessary sections are properly completed.

Vehicle Registration Memphis Tn - Acts as a formal acknowledgment of the buyer's new ownership rights.

Dos and Don'ts

When filling out the California Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do provide accurate and complete information about the buyer and seller.

- Do include a detailed description of the item being sold, including make, model, and VIN if applicable.

- Don't leave any sections of the form blank; every part must be filled out to avoid issues.

- Don't forget to sign and date the form; both parties must acknowledge the transaction.

California Bill of Sale Sample

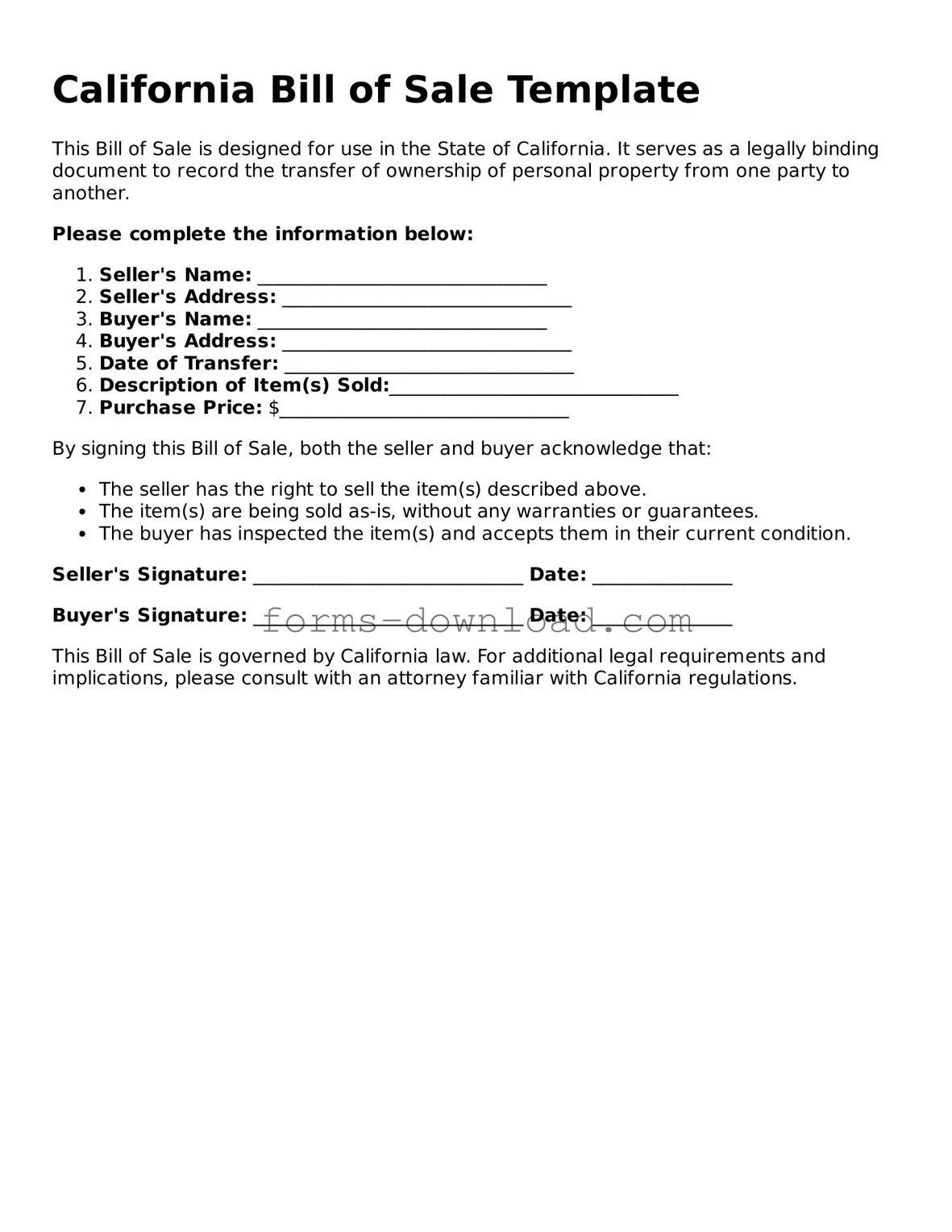

California Bill of Sale Template

This Bill of Sale is designed for use in the State of California. It serves as a legally binding document to record the transfer of ownership of personal property from one party to another.

Please complete the information below:

- Seller's Name: _______________________________

- Seller's Address: _______________________________

- Buyer's Name: _______________________________

- Buyer's Address: _______________________________

- Date of Transfer: _______________________________

- Description of Item(s) Sold:_______________________________

- Purchase Price: $_______________________________

By signing this Bill of Sale, both the seller and buyer acknowledge that:

- The seller has the right to sell the item(s) described above.

- The item(s) are being sold as-is, without any warranties or guarantees.

- The buyer has inspected the item(s) and accepts them in their current condition.

Seller's Signature: _____________________________ Date: _______________

Buyer's Signature: _____________________________ Date: _______________

This Bill of Sale is governed by California law. For additional legal requirements and implications, please consult with an attorney familiar with California regulations.

Listed Questions and Answers

-

What is a California Bill of Sale?

A California Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. It typically includes details about the item being sold, the buyer, and the seller. This document is especially important for transactions involving vehicles, boats, or valuable items, as it provides a record of the sale and can protect both parties in case of disputes.

-

When do I need a Bill of Sale in California?

In California, a Bill of Sale is not always required, but it is highly recommended for certain transactions. For instance, if you are selling a vehicle, a Bill of Sale is necessary to complete the registration process with the Department of Motor Vehicles (DMV). Additionally, it is useful for other personal property sales, such as trailers, boats, or high-value items, to establish clear ownership and prevent future claims.

-

What information should be included in a Bill of Sale?

A comprehensive Bill of Sale should include the following information:

- The names and addresses of both the buyer and the seller

- A detailed description of the item being sold, including make, model, year, and any identifying numbers (like VIN for vehicles)

- The sale price

- The date of the transaction

- Any warranties or guarantees provided by the seller

- Signatures of both parties

-

Is a Bill of Sale legally binding?

Yes, a Bill of Sale is a legally binding document as long as it is properly completed and signed by both parties. It acts as a receipt for the transaction and can be used in court if any disputes arise. However, it is essential to ensure that all information is accurate and that both parties understand the terms of the sale before signing.

-

Do I need to have the Bill of Sale notarized?

In California, notarization of a Bill of Sale is not typically required. However, having it notarized can add an extra layer of authenticity and may be beneficial in certain situations, especially for high-value items. Notarization can help verify the identities of the parties involved and provide additional proof of the transaction.

-

Where can I obtain a Bill of Sale form?

Bill of Sale forms can be obtained from various sources. Many legal websites offer downloadable templates that comply with California laws. Additionally, you can find forms at office supply stores or through local legal aid organizations. It is crucial to ensure that the form you choose meets all necessary legal requirements for your specific transaction.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The California Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one party to another. |

| Governing Law | This form is governed by the California Civil Code, specifically sections related to the sale of goods and personal property. |

| Types of Property | The form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required for all transactions, it is recommended to enhance the document's authenticity and provide additional legal protection. |

| Signatures Required | Both the seller and buyer must sign the Bill of Sale to validate the transaction and acknowledge the transfer of ownership. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it may be needed for future reference or legal purposes. |

| Tax Implications | Sales tax may apply depending on the type of property sold and its value, so both parties should be aware of potential tax obligations. |

| Additional Information | The form may include details such as the purchase price, condition of the property, and any warranties or guarantees provided by the seller. |