Attorney-Approved Deed in Lieu of Foreclosure Document for the State of California

In California, homeowners facing financial distress may consider a deed in lieu of foreclosure as a viable alternative to the lengthy and often painful foreclosure process. This legal instrument allows a homeowner to voluntarily transfer the title of their property to the lender in exchange for the cancellation of their mortgage debt. By executing this form, the homeowner can avoid the negative consequences associated with foreclosure, such as a significant drop in credit score and the emotional toll of losing their home through court proceedings. The deed in lieu of foreclosure form also typically requires the homeowner to confirm that they are unable to keep up with mortgage payments and that the property is free of other liens, ensuring a smoother transaction for both parties involved. Importantly, this option may also provide the homeowner with a more dignified exit from their financial obligations, allowing for a fresh start. However, it is essential to understand the implications and requirements of this process, as well as potential tax consequences, before proceeding with a deed in lieu of foreclosure.

Consider More Deed in Lieu of Foreclosure Templates for Different States

Deed in Lieu of Foreclosure Form - A successful Deed in Lieu of Foreclosure can restore a sense of control over financial circumstances for the homeowner.

For families looking to start their homeschooling journey, understanding the significance of the process is crucial. The necessary forms, including the Homeschool Letter of Intent template, play an integral role in ensuring compliance with state regulations and outlining the educational plan.

Deed in Lieu of Mortgage - By signing this form, the homeowner typically relinquishes all rights to the property.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is important to follow certain guidelines. Here are six things you should and shouldn't do:

- Do ensure that all information is accurate and complete.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Do consult with a legal professional if you have any questions.

- Don't sign the document until you fully understand its implications.

- Do keep a copy of the completed form for your records.

- Don't rush the process; take your time to review everything carefully.

California Deed in Lieu of Foreclosure Sample

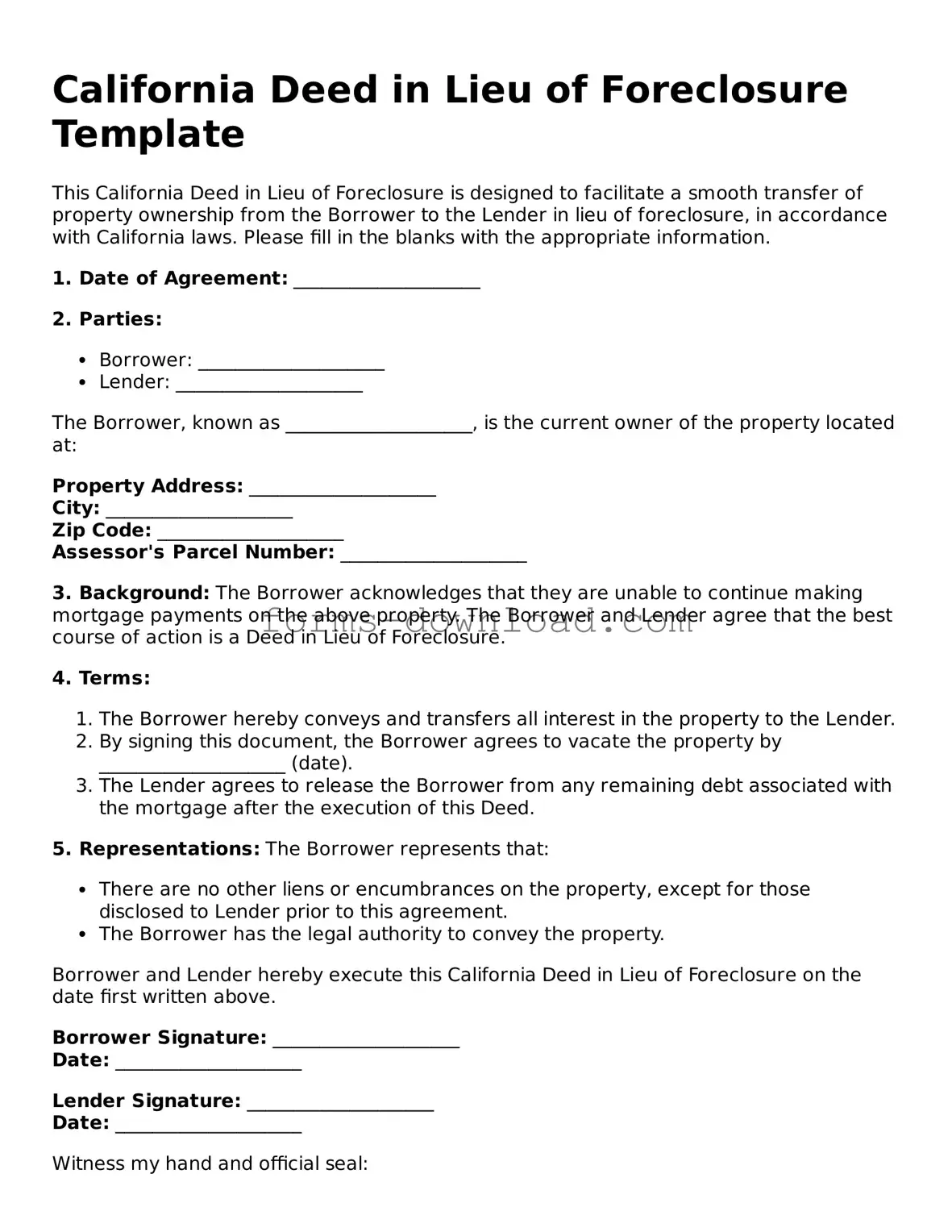

California Deed in Lieu of Foreclosure Template

This California Deed in Lieu of Foreclosure is designed to facilitate a smooth transfer of property ownership from the Borrower to the Lender in lieu of foreclosure, in accordance with California laws. Please fill in the blanks with the appropriate information.

1. Date of Agreement: ____________________

2. Parties:

- Borrower: ____________________

- Lender: ____________________

The Borrower, known as ____________________, is the current owner of the property located at:

Property Address: ____________________

City: ____________________

Zip Code: ____________________

Assessor's Parcel Number: ____________________

3. Background: The Borrower acknowledges that they are unable to continue making mortgage payments on the above property. The Borrower and Lender agree that the best course of action is a Deed in Lieu of Foreclosure.

4. Terms:

- The Borrower hereby conveys and transfers all interest in the property to the Lender.

- By signing this document, the Borrower agrees to vacate the property by ____________________ (date).

- The Lender agrees to release the Borrower from any remaining debt associated with the mortgage after the execution of this Deed.

5. Representations: The Borrower represents that:

- There are no other liens or encumbrances on the property, except for those disclosed to Lender prior to this agreement.

- The Borrower has the legal authority to convey the property.

Borrower and Lender hereby execute this California Deed in Lieu of Foreclosure on the date first written above.

Borrower Signature: ____________________

Date: ____________________

Lender Signature: ____________________

Date: ____________________

Witness my hand and official seal:

Notary Public Signature: ____________________

Date: ____________________

This document has been prepared for informational purposes only and does not constitute legal advice. Consult an attorney for specific legal guidance.

Listed Questions and Answers

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the ownership of their property back to the lender to avoid the foreclosure process. This option can provide a more amicable resolution for both parties, as it helps the homeowner avoid the negative impacts of foreclosure on their credit score and allows the lender to recover their investment more quickly.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- Credit Impact: A Deed in Lieu typically has a less severe effect on your credit score compared to a foreclosure.

- Cost Savings: It can save both the homeowner and the lender money by avoiding the lengthy and costly foreclosure process.

- Time Efficiency: The process is generally quicker than going through foreclosure, allowing for a faster resolution.

- Potential for Relocation Assistance: Some lenders may offer relocation assistance to help homeowners transition to new housing.

-

What are the requirements to qualify for a Deed in Lieu of Foreclosure?

To qualify, homeowners typically need to meet certain criteria set by their lender. These may include:

- The homeowner must be facing financial hardship, such as job loss or medical expenses.

- The property must be free of other liens or encumbrances, or the lender must agree to accept the property with existing liens.

- The homeowner must be willing to vacate the property upon completion of the transfer.

Each lender may have specific guidelines, so it’s essential to communicate directly with them to understand the requirements.

-

What steps should I take if I want to pursue a Deed in Lieu of Foreclosure?

If you are considering this option, follow these steps:

- Contact Your Lender: Initiate a conversation with your lender to discuss your financial situation and express your interest in a Deed in Lieu of Foreclosure.

- Gather Documentation: Prepare necessary documents, such as proof of income, financial statements, and any other information your lender may require.

- Submit a Formal Request: Complete any required forms and submit your request to the lender for their review.

- Review the Agreement: If approved, carefully review the terms of the Deed in Lieu agreement before signing. Consider seeking legal advice to ensure you understand your rights and obligations.

Taking these steps can help ensure a smoother process as you navigate this difficult situation.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by California Civil Code Section 2943. |

| Eligibility | Homeowners facing financial difficulties may qualify for this option, provided they have a valid reason for their inability to pay. |

| Advantages | It can help borrowers avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Process | The borrower must submit a request to the lender, who will review the situation before accepting the deed. |

| Impact on Credit | A Deed in Lieu of Foreclosure typically has a less severe impact on credit compared to a foreclosure. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to forgiven debt. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before proceeding with a Deed in Lieu of Foreclosure. |