Attorney-Approved Gift Deed Document for the State of California

The California Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without any exchange of money. This form allows a property owner, known as the grantor, to convey ownership to another individual, referred to as the grantee, as a gift. The process is straightforward, requiring the grantor to provide essential details such as the property description, the names of both parties, and the date of the transfer. Importantly, the Gift Deed must be signed by the grantor and typically requires notarization to ensure its validity. Once executed, the document should be recorded with the county recorder’s office to provide public notice of the transfer. This form not only facilitates the transfer of property but also has implications for tax purposes, as the gift may be subject to federal gift tax regulations. Understanding these elements is vital for anyone considering the use of a Gift Deed in California.

Consider More Gift Deed Templates for Different States

Gift Deed Virginia - It's important to keep copies of the Gift Deed and any related documents in a safe place for future reference.

When purchasing a boat in Louisiana, it is important to have the legal documentation in place to ensure a smooth transfer of ownership; this is where the Bill of Sale for a Boat becomes essential, providing a detailed record of the transaction and protecting both the buyer and seller.

Dos and Don'ts

When filling out the California Gift Deed form, it's essential to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure everything goes smoothly.

- Do make sure you understand the purpose of the Gift Deed. It’s a legal document that transfers property without payment.

- Do clearly identify the property being gifted. Include the full address and legal description.

- Do provide the full names of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Do sign the form in front of a notary public. This step is crucial for the document’s validity.

- Do check local requirements. Some counties may have additional forms or fees.

- Don’t leave any fields blank. Incomplete forms can lead to delays or rejection.

- Don’t use vague language. Be specific about the terms of the gift.

- Don’t forget to keep a copy of the completed form for your records.

- Don’t rush through the process. Take your time to ensure accuracy.

By following these guidelines, you can help ensure that your Gift Deed is completed correctly and legally binding.

California Gift Deed Sample

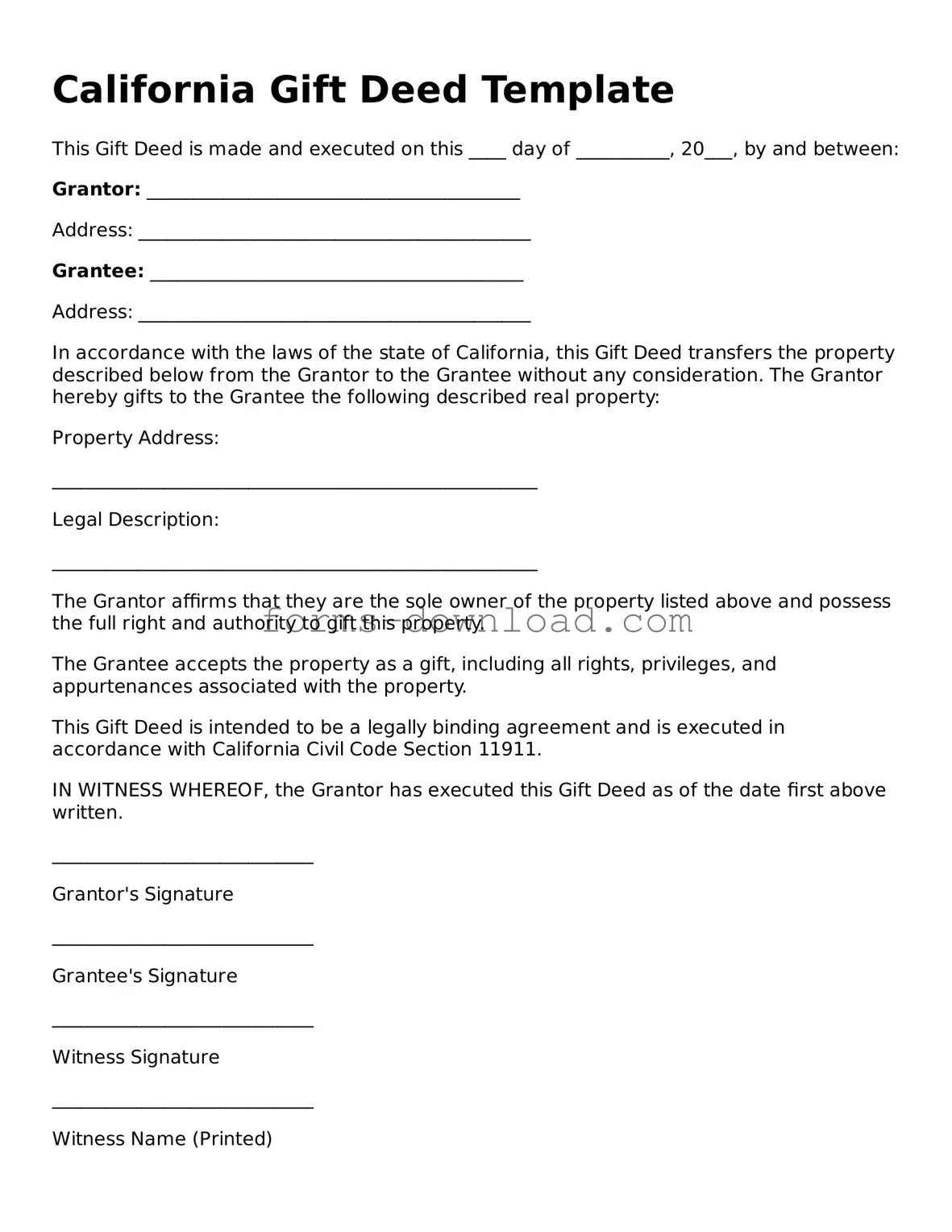

California Gift Deed Template

This Gift Deed is made and executed on this ____ day of __________, 20___, by and between:

Grantor: ________________________________________

Address: __________________________________________

Grantee: ________________________________________

Address: __________________________________________

In accordance with the laws of the state of California, this Gift Deed transfers the property described below from the Grantor to the Grantee without any consideration. The Grantor hereby gifts to the Grantee the following described real property:

Property Address:

____________________________________________________

Legal Description:

____________________________________________________

The Grantor affirms that they are the sole owner of the property listed above and possess the full right and authority to gift this property.

The Grantee accepts the property as a gift, including all rights, privileges, and appurtenances associated with the property.

This Gift Deed is intended to be a legally binding agreement and is executed in accordance with California Civil Code Section 11911.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed as of the date first above written.

____________________________

Grantor's Signature

____________________________

Grantee's Signature

____________________________

Witness Signature

____________________________

Witness Name (Printed)

Notary Public:

State of California

County of ____________________

On this ____ day of __________, 20___, before me, _________________________, a Notary Public, personally appeared _________________________________________, known to me to be the person whose name is subscribed to this document, and acknowledged that they executed the same.

Given under my hand and seal.

_________________________________

Notary Public Signature

My Commission Expires: _____________

Listed Questions and Answers

-

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is commonly used when a property owner wishes to give their property as a gift to a family member or friend. The deed must be signed by the donor (the person giving the gift) and typically requires notarization to be valid.

-

What information is needed to complete a Gift Deed?

To complete a Gift Deed in California, you will need the following information:

- The full names and addresses of both the donor and the recipient.

- A legal description of the property being gifted, which can usually be found on the property’s title or tax records.

- The date of the gift.

- Signatures of the donor and a notary public.

-

Are there any tax implications for gifting property?

Yes, gifting property may have tax implications. The donor may need to file a gift tax return if the value of the property exceeds the annual exclusion limit set by the IRS. However, the recipient typically does not owe taxes at the time of receiving the gift. It is advisable to consult a tax professional to understand the specific consequences and any potential exemptions.

-

Do I need to record the Gift Deed?

Yes, it is important to record the Gift Deed with the county recorder’s office where the property is located. Recording the deed provides public notice of the transfer and helps protect the recipient's ownership rights. Without recording, there may be complications if disputes arise in the future regarding the property.

-

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it is generally considered final and cannot be revoked. However, if the donor retains some control over the property or if specific conditions were attached to the gift, there may be grounds for revocation. It’s essential to understand the implications before executing a Gift Deed.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Civil Code, specifically Section 11911, governs the use and requirements of Gift Deeds in California. |

| No Consideration Required | Unlike traditional property transfers, a Gift Deed does not require consideration (payment) to be valid. |

| Recording Requirement | To ensure the transfer is legally recognized, the Gift Deed must be recorded with the county recorder's office where the property is located. |

| Tax Implications | Gift Deeds may have tax implications, including potential gift taxes, so consulting a tax professional is advisable. |

| Revocation | A Gift Deed can be revoked before it is recorded, but once recorded, it is generally irrevocable. |