Attorney-Approved Loan Agreement Document for the State of California

When entering into a loan agreement in California, it's essential to understand the key components that make up this important document. A California Loan Agreement form outlines the terms and conditions between the lender and the borrower, ensuring that both parties are clear on their rights and responsibilities. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it may specify the consequences of defaulting on the loan, which can protect the lender's interests. Both parties must also acknowledge any fees or charges that may apply throughout the loan term. By clearly laying out these terms, the Loan Agreement helps to prevent misunderstandings and provides a solid foundation for the financial relationship. Whether you're borrowing money for a personal project or lending funds to a friend, having a well-structured loan agreement is crucial for a smooth transaction.

Consider More Loan Agreement Templates for Different States

Promissory Note Florida Pdf - It can include provisions for late payment interest or fees.

It's crucial to understand your rights regarding healthcare decisions. The important Medical Power of Attorney guidelines can help you prepare for unforeseen situations where medical decisions may be necessary. Being informed empowers you to appoint a trusted individual to advocate for your medical wishes.

Dos and Don'ts

When filling out the California Loan Agreement form, it's important to be thorough and accurate. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your full name and address.

- Do double-check the loan amount and interest rate you are requesting.

- Do ensure all signatures are completed where required.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank unless instructed to do so.

- Don't rush through the process; take your time to avoid mistakes.

- Don't provide false information; it can lead to serious consequences.

- Don't forget to review the terms and conditions of the loan.

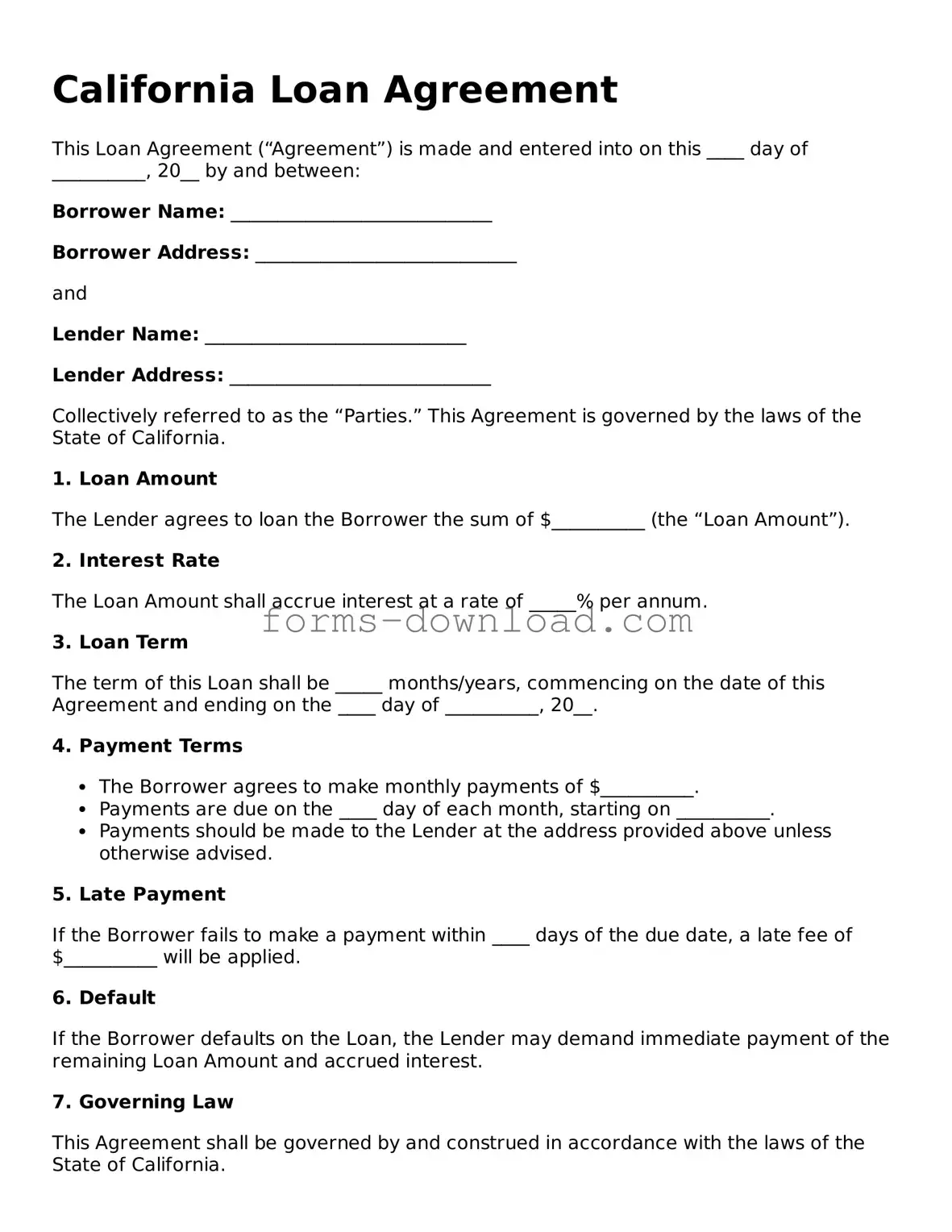

California Loan Agreement Sample

California Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into on this ____ day of __________, 20__ by and between:

Borrower Name: ____________________________

Borrower Address: ____________________________

and

Lender Name: ____________________________

Lender Address: ____________________________

Collectively referred to as the “Parties.” This Agreement is governed by the laws of the State of California.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of $__________ (the “Loan Amount”).

2. Interest Rate

The Loan Amount shall accrue interest at a rate of _____% per annum.

3. Loan Term

The term of this Loan shall be _____ months/years, commencing on the date of this Agreement and ending on the ____ day of __________, 20__.

4. Payment Terms

- The Borrower agrees to make monthly payments of $__________.

- Payments are due on the ____ day of each month, starting on __________.

- Payments should be made to the Lender at the address provided above unless otherwise advised.

5. Late Payment

If the Borrower fails to make a payment within ____ days of the due date, a late fee of $__________ will be applied.

6. Default

If the Borrower defaults on the Loan, the Lender may demand immediate payment of the remaining Loan Amount and accrued interest.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

8. Entire Agreement

This document constitutes the entire agreement between the Parties and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the Parties have executed this Loan Agreement as of the date first written above.

_____________________________

Borrower Signature

_____________________________

Lender Signature

Listed Questions and Answers

-

What is a California Loan Agreement?

A California Loan Agreement is a legal document outlining the terms and conditions of a loan between a lender and a borrower in the state of California. This agreement specifies the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations.

-

Who needs a Loan Agreement?

Any individual or entity lending money or borrowing funds in California should consider using a Loan Agreement. This includes personal loans between friends or family, business loans, and formal loans from financial institutions. Having a written agreement helps prevent misunderstandings and disputes.

-

What key elements should be included in a Loan Agreement?

A comprehensive Loan Agreement should include:

- Names and addresses of the lender and borrower

- The principal amount of the loan

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Any collateral or security for the loan

- Consequences for late payments or default

-

Is it necessary to have a lawyer review the Loan Agreement?

While it is not legally required to have a lawyer review the Loan Agreement, it is highly advisable. A legal professional can ensure that the document complies with California laws and adequately protects your interests. This is particularly important for larger loans or more complex agreements.

-

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the updated agreement. This helps maintain clarity and legal enforceability.

-

What happens if the borrower defaults on the Loan Agreement?

If the borrower defaults, the lender may take specific actions as outlined in the Loan Agreement. This could include demanding immediate repayment of the remaining balance, charging late fees, or pursuing legal action. The exact consequences depend on the terms set forth in the agreement.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form outlines the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California. |

| Parties Involved | The form includes sections for both the lender and the borrower to provide their information. |

| Loan Amount | The specific amount of money being loaned must be clearly stated in the agreement. |

| Repayment Terms | Details about how and when the borrower will repay the loan are included in the form. |

| Signatures | Both parties must sign the agreement to make it legally binding. |