Attorney-Approved Motor Vehicle Bill of Sale Document for the State of California

When buying or selling a vehicle in California, one essential document comes into play: the Motor Vehicle Bill of Sale form. This form serves as a crucial record of the transaction, providing proof of ownership transfer between the seller and the buyer. It includes important details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), ensuring that both parties have a clear understanding of what is being sold. Additionally, the form captures the sale price and the date of the transaction, which can be vital for tax purposes. Both the seller and buyer must sign the document, making it a binding agreement that protects the interests of both parties. Having a properly completed Bill of Sale can also simplify the registration process with the California Department of Motor Vehicles (DMV), making it a key step in the vehicle transfer process.

Consider More Motor Vehicle Bill of Sale Templates for Different States

Transfer Title in Tn - Keep the bill of sale in a safe place as it will be important for future ownership verification.

Bill of Sale for Car Arizona - Both parties should initial or sign any changes made to the document to ensure transparency.

Understanding the importance of the California Articles of Incorporation form is vital for anyone looking to establish a corporation in California, and for detailed information and resources, you can refer to Templates and Guide, which can assist you in the process of preparing this essential documentation.

Washington State Bill of Sale Pdf - The form typically includes information about any liens on the vehicle, if applicable.

Dmv Forms Va - A key component in ensuring compliance with state and local vehicle registration laws.

Dos and Don'ts

When filling out the California Motor Vehicle Bill of Sale form, there are important practices to follow. Here are five things you should and shouldn't do:

- Do ensure all information is accurate, including the vehicle identification number (VIN).

- Do sign and date the form to validate the transaction.

- Do provide complete contact information for both the buyer and the seller.

- Don't leave any required fields blank, as this may cause delays in processing.

- Don't alter the form after it has been signed, as this can lead to legal issues.

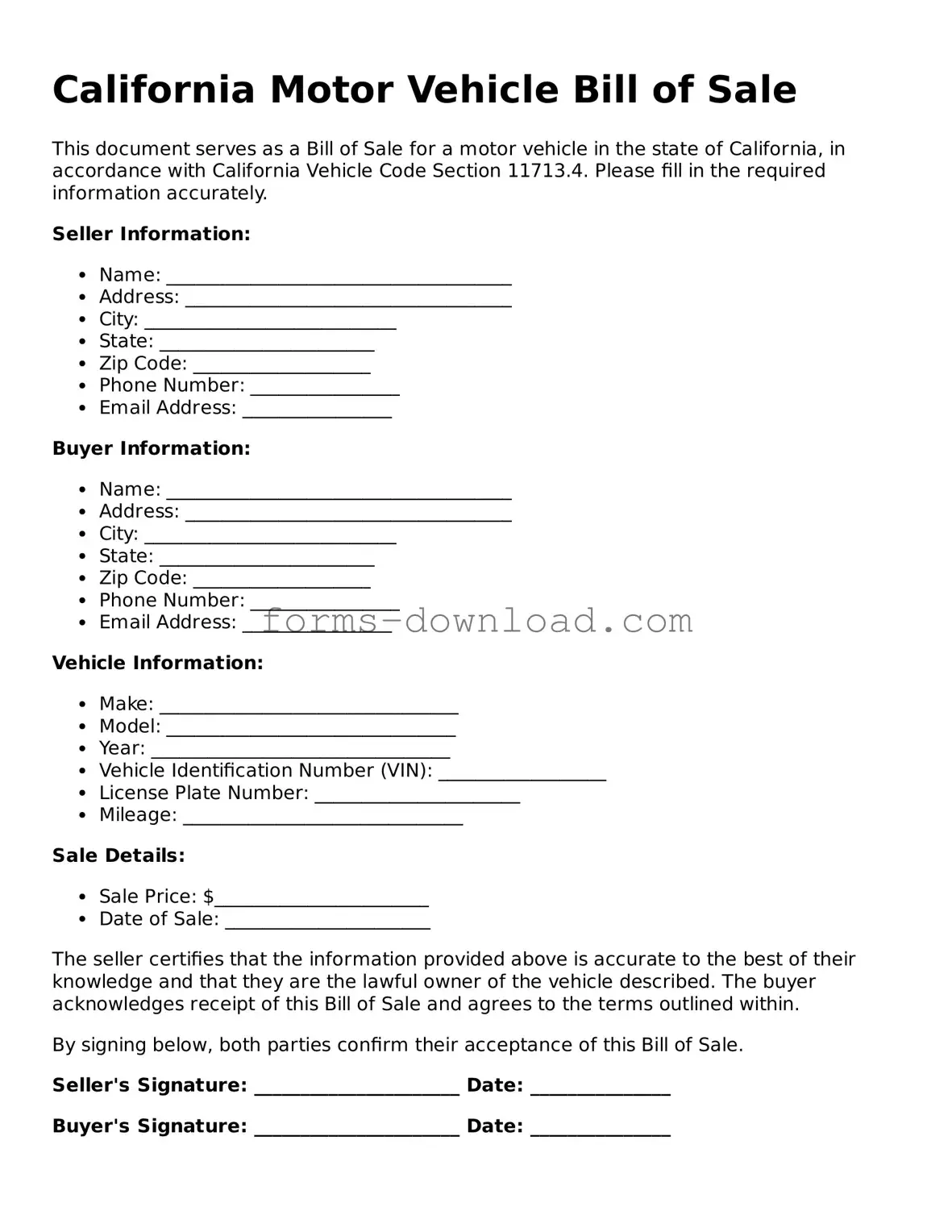

California Motor Vehicle Bill of Sale Sample

California Motor Vehicle Bill of Sale

This document serves as a Bill of Sale for a motor vehicle in the state of California, in accordance with California Vehicle Code Section 11713.4. Please fill in the required information accurately.

Seller Information:

- Name: _____________________________________

- Address: ___________________________________

- City: ___________________________

- State: _______________________

- Zip Code: ___________________

- Phone Number: ________________

- Email Address: ________________

Buyer Information:

- Name: _____________________________________

- Address: ___________________________________

- City: ___________________________

- State: _______________________

- Zip Code: ___________________

- Phone Number: ________________

- Email Address: ________________

Vehicle Information:

- Make: ________________________________

- Model: _______________________________

- Year: ________________________________

- Vehicle Identification Number (VIN): __________________

- License Plate Number: ______________________

- Mileage: ______________________________

Sale Details:

- Sale Price: $_______________________

- Date of Sale: ______________________

The seller certifies that the information provided above is accurate to the best of their knowledge and that they are the lawful owner of the vehicle described. The buyer acknowledges receipt of this Bill of Sale and agrees to the terms outlined within.

By signing below, both parties confirm their acceptance of this Bill of Sale.

Seller's Signature: ______________________ Date: _______________

Buyer's Signature: ______________________ Date: _______________

Listed Questions and Answers

-

What is a California Motor Vehicle Bill of Sale?

A California Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle between a buyer and a seller. This form includes essential details such as the vehicle's identification number (VIN), make, model, year, and the sale price. It serves as proof of the transaction and is important for both parties to keep for their records.

-

Why is a Bill of Sale necessary in California?

A Bill of Sale is necessary in California for several reasons. It provides a clear record of the sale, which can help prevent disputes regarding ownership. Additionally, it is often required when registering the vehicle with the Department of Motor Vehicles (DMV). Without this document, the buyer may face challenges in obtaining a title or registering the vehicle.

-

What information is required on the Bill of Sale?

The Bill of Sale must include specific information to be valid. This includes:

- The names and addresses of both the buyer and seller.

- The vehicle's make, model, year, and VIN.

- The sale price of the vehicle.

- The date of the sale.

- Signatures of both the buyer and seller.

Providing accurate and complete information helps ensure the document's effectiveness.

-

Where can I obtain a California Motor Vehicle Bill of Sale form?

A California Motor Vehicle Bill of Sale form can be obtained from various sources. The form is available online through the California DMV website. Additionally, some local auto dealerships and legal stationery stores may provide copies. It is important to use the most current version of the form to ensure compliance with state regulations.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The California Motor Vehicle Bill of Sale form serves as a legal document to record the sale of a vehicle between a buyer and a seller. |

| Governing Law | The form is governed by California Vehicle Code Section 5902, which outlines the requirements for vehicle sales. |

| Information Required | The form requires details such as the vehicle identification number (VIN), make, model, year, and odometer reading at the time of sale. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction and acknowledge the terms of the sale. |

| Notarization | Notarization is not required for the Bill of Sale in California, but it may provide additional legal protection. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Transfer of Ownership | The form facilitates the transfer of ownership, which must also be reported to the California Department of Motor Vehicles (DMV). |

| Tax Implications | Sales tax may apply to the transaction, and the buyer is responsible for reporting the purchase to the DMV for tax purposes. |