Attorney-Approved Promissory Note Document for the State of California

When navigating the world of personal and business finance in California, understanding the California Promissory Note form is essential for anyone involved in lending or borrowing money. This important document serves as a written promise from a borrower to repay a specified amount of money to a lender, under agreed-upon terms. Typically, it outlines key details such as the principal amount, interest rate, repayment schedule, and any penalties for late payments. By clearly defining these terms, the Promissory Note not only protects the interests of the lender but also provides the borrower with a clear understanding of their obligations. Moreover, it can be tailored to suit various lending scenarios, whether for personal loans between friends or formal agreements between businesses. Familiarizing oneself with this form is crucial, as it lays the groundwork for a transparent and trustworthy financial relationship.

Consider More Promissory Note Templates for Different States

Tennessee Promissory Note - This note is often used in real estate transactions to secure financing.

The Texas Motor Vehicle Power of Attorney form allows one person to authorize another to act on their behalf specifically regarding motor vehicle transactions. This document is essential for those who need assistance with tasks such as buying, selling, or transferring ownership of a vehicle. By using this form, individuals can ensure that their interests are managed properly without requiring their direct involvement. For more information, you can find the Motor Vehicle Power of Attorney form online.

Arizona Promissory Note - It is advisable to keep copies of the Promissory Note for personal records.

Promissory Note Template Florida Pdf - This form is essential for personal loans, business loans, and other borrowing scenarios.

Dos and Don'ts

When filling out the California Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information regarding the borrower and lender, including full names and addresses.

- Do clearly state the loan amount and the interest rate, if applicable.

- Do include a repayment schedule that outlines the payment terms.

- Don't leave any sections blank; all relevant fields must be completed.

- Don't use ambiguous language; be clear and precise in your wording.

- Don't forget to sign and date the document in the appropriate sections.

By adhering to these guidelines, individuals can help ensure that the Promissory Note is properly executed and serves its intended purpose.

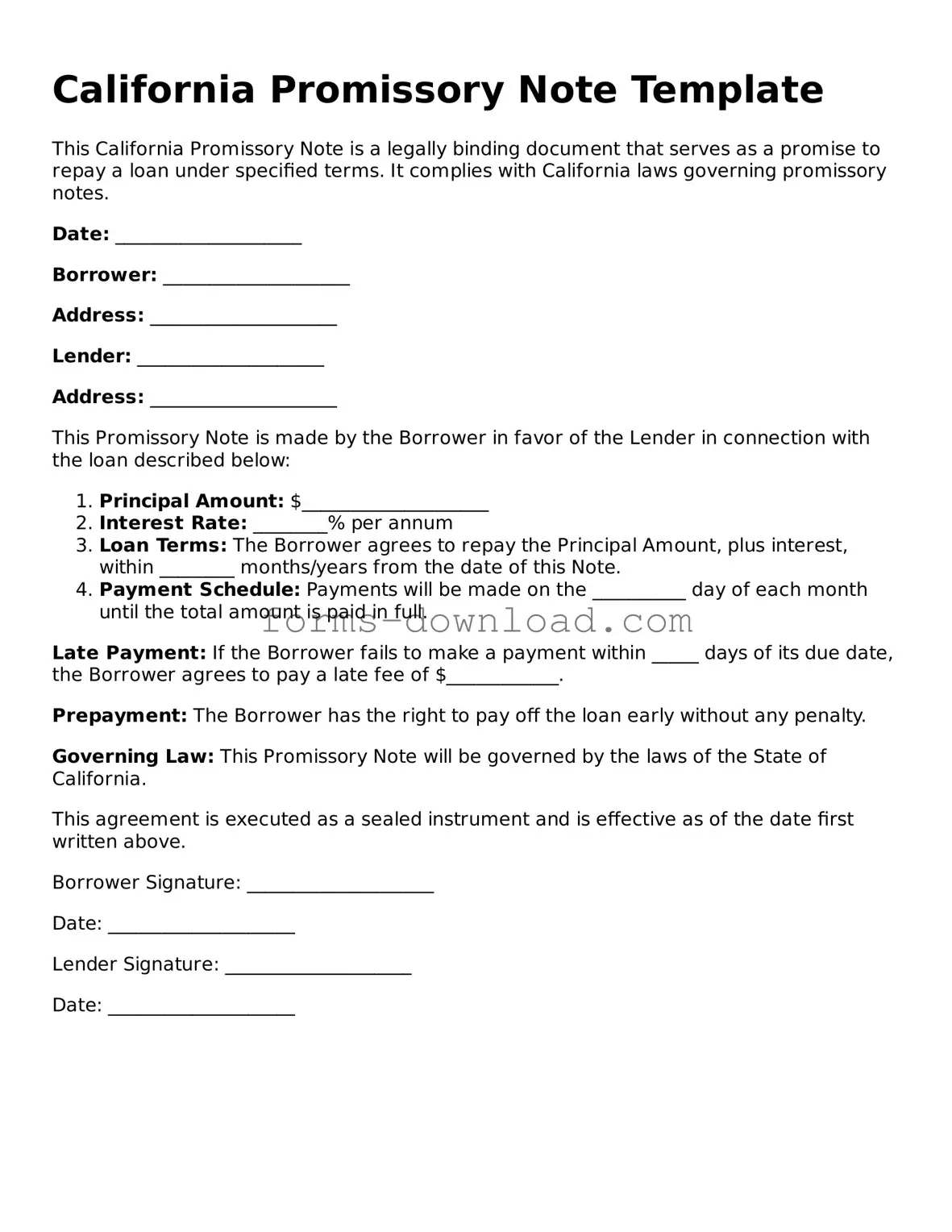

California Promissory Note Sample

California Promissory Note Template

This California Promissory Note is a legally binding document that serves as a promise to repay a loan under specified terms. It complies with California laws governing promissory notes.

Date: ____________________

Borrower: ____________________

Address: ____________________

Lender: ____________________

Address: ____________________

This Promissory Note is made by the Borrower in favor of the Lender in connection with the loan described below:

- Principal Amount: $____________________

- Interest Rate: ________% per annum

- Loan Terms: The Borrower agrees to repay the Principal Amount, plus interest, within ________ months/years from the date of this Note.

- Payment Schedule: Payments will be made on the __________ day of each month until the total amount is paid in full.

Late Payment: If the Borrower fails to make a payment within _____ days of its due date, the Borrower agrees to pay a late fee of $____________.

Prepayment: The Borrower has the right to pay off the loan early without any penalty.

Governing Law: This Promissory Note will be governed by the laws of the State of California.

This agreement is executed as a sealed instrument and is effective as of the date first written above.

Borrower Signature: ____________________

Date: ____________________

Lender Signature: ____________________

Date: ____________________

Listed Questions and Answers

-

What is a California Promissory Note?

A California Promissory Note is a written agreement in which one party, known as the borrower, promises to pay a specific amount of money to another party, known as the lender, under agreed-upon terms. This document outlines the amount borrowed, the interest rate, repayment schedule, and other conditions related to the loan.

-

Why is a Promissory Note important?

This document serves as a legal record of the loan transaction. It provides clarity on the terms of the loan and can be used as evidence in case of disputes. By having a signed promissory note, both parties are protected and have a clear understanding of their obligations.

-

What are the key components of a California Promissory Note?

A typical promissory note includes:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and legal standing.

-

Is a Promissory Note legally binding?

Yes, once signed by both parties, a promissory note is legally binding. This means that the borrower is obligated to repay the loan according to the terms outlined in the note, and the lender has the right to seek legal recourse if the borrower fails to meet those terms.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, meaning they fail to make payments as agreed, the lender can take several actions. These may include contacting the borrower to discuss the situation, imposing late fees, or pursuing legal action to recover the owed amount. The specific actions depend on the terms outlined in the promissory note.

-

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a promissory note, consulting one can be beneficial. A lawyer can help ensure that the document complies with California law and adequately protects the interests of both parties.

-

Can a Promissory Note be secured or unsecured?

A promissory note can be either secured or unsecured. A secured note is backed by collateral, such as property or assets, which the lender can claim if the borrower defaults. An unsecured note does not have collateral backing it, making it riskier for the lender.

-

What is the difference between a Promissory Note and a Loan Agreement?

While both documents serve to outline the terms of a loan, a promissory note is typically simpler and focuses primarily on the borrower's promise to repay the loan. A loan agreement, on the other hand, is more comprehensive and may include additional terms and conditions, such as covenants and warranties.

-

How should a Promissory Note be executed?

To properly execute a promissory note, both parties should sign and date the document. It is also advisable to have the signatures witnessed or notarized, especially for larger amounts, to add an extra layer of authenticity and legal protection.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | The California Civil Code, particularly Sections 3300-3350, governs promissory notes in the state. |

| Types | There are various types of promissory notes, including secured and unsecured notes, as well as demand notes and installment notes. |

| Interest Rates | California law allows parties to agree on interest rates, but they must comply with state usury laws, which set maximum limits. |

| Enforceability | A promissory note is enforceable as long as it is signed by the borrower and contains clear terms regarding repayment. |

| Default Consequences | If a borrower defaults, the lender may pursue legal action to recover the owed amount, including potential foreclosure on secured loans. |

| Transferability | Promissory notes can often be transferred or assigned to another party, subject to the terms outlined in the note. |