Attorney-Approved Transfer-on-Death Deed Document for the State of California

The California Transfer-on-Death Deed form serves as a valuable tool for property owners looking to simplify the transfer of real estate upon their passing. This form allows individuals to designate beneficiaries who will inherit their property without the need for probate, streamlining the process and reducing potential legal complications for loved ones. By filling out and recording this deed, property owners can maintain control during their lifetime while ensuring a smooth transition of ownership after death. Key aspects of the form include the requirement for the property owner to be of sound mind and to clearly identify the beneficiaries. Additionally, the deed must be properly executed and recorded with the county recorder's office to be legally binding. Understanding how this form works and its implications can empower property owners to make informed decisions about their estate planning. With the right knowledge, individuals can effectively use the Transfer-on-Death Deed to benefit their heirs and preserve their legacy.

Consider More Transfer-on-Death Deed Templates for Different States

Problems With Transfer on Death Deeds - This deed type ensures that the property avoids probate, streamlining the transfer process.

In order to facilitate the transfer of ownership, it is crucial for buyers and sellers to utilize the proper documentation, such as the Bill of Sale for a Boat, which outlines the terms of the sale and provides legal protection to both parties involved.

Transfer on Death Deed Washington State Form - Transfer-on-Death Deeds generally do not incur tax implications for the beneficiaries at the time of transfer.

Transfer on Death Deed Form Florida - It allows owners to name alternate beneficiaries in the event the primary beneficiaries cannot inherit.

Transfer on Death Deed Tennessee Form - Can prevent delays in property transfer after the owner's passing.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it's essential to follow certain guidelines to ensure the document is valid and effective. Here are some key dos and don’ts:

- Do provide accurate property information, including the full legal description.

- Do include the names of all intended beneficiaries clearly.

- Do sign the deed in front of a notary public to ensure its legality.

- Do keep a copy of the completed deed for your records.

- Don't forget to record the deed with the county recorder's office after signing.

- Don't leave any blank spaces on the form, as this may lead to confusion or disputes.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is completed correctly and serves its intended purpose. Always consider seeking professional advice if you have questions or concerns about the process.

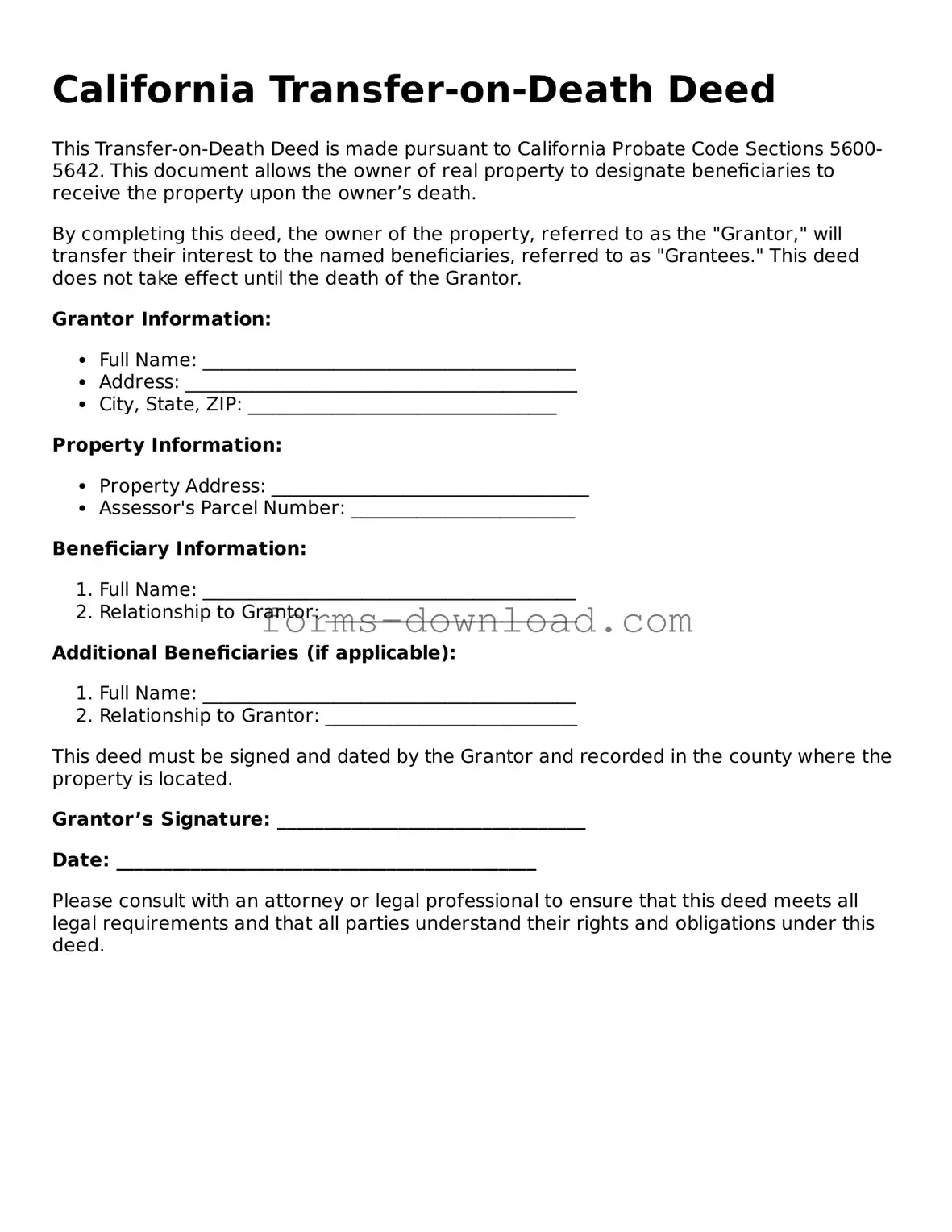

California Transfer-on-Death Deed Sample

California Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to California Probate Code Sections 5600-5642. This document allows the owner of real property to designate beneficiaries to receive the property upon the owner’s death.

By completing this deed, the owner of the property, referred to as the "Grantor," will transfer their interest to the named beneficiaries, referred to as "Grantees." This deed does not take effect until the death of the Grantor.

Grantor Information:

- Full Name: ________________________________________

- Address: __________________________________________

- City, State, ZIP: _________________________________

Property Information:

- Property Address: __________________________________

- Assessor's Parcel Number: ________________________

Beneficiary Information:

- Full Name: ________________________________________

- Relationship to Grantor: ___________________________

Additional Beneficiaries (if applicable):

- Full Name: ________________________________________

- Relationship to Grantor: ___________________________

This deed must be signed and dated by the Grantor and recorded in the county where the property is located.

Grantor’s Signature: _________________________________

Date: _____________________________________________

Please consult with an attorney or legal professional to ensure that this deed meets all legal requirements and that all parties understand their rights and obligations under this deed.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real property upon their death. This deed enables the property to transfer directly to the designated beneficiaries without going through probate, simplifying the process and potentially reducing costs.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed in California, the property owner must complete the appropriate form, which includes details such as the property description and the names of the beneficiaries. The deed must then be signed and notarized. After completing these steps, it must be recorded with the county recorder's office where the property is located. It is essential to ensure that the deed is properly executed to avoid any issues later on.

-

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The property owner can revoke the deed by executing a new deed that explicitly states the revocation or by recording a revocation form with the county recorder’s office. It is important to follow the proper legal procedures to ensure that the revocation is valid and recognized.

-

Are there any limitations to using a Transfer-on-Death Deed?

While a TOD Deed offers several benefits, there are limitations to consider. For instance, it cannot be used to transfer property that is part of a trust or to transfer an interest in property that is subject to a mortgage without the lender’s consent. Additionally, the property owner must retain the right to sell or encumber the property during their lifetime. Understanding these limitations is crucial for effective estate planning.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5690. |

| Eligibility | Any individual who owns real property in California can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the deed can specify how the property is to be divided among them. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner through a written document. |

| Filing Requirements | The deed must be recorded with the county recorder's office where the property is located to be effective. |

| Effect on Creditors | Property transferred via a Transfer-on-Death Deed may still be subject to the deceased owner's debts and creditors. |

| Tax Implications | Transfer-on-Death Deeds generally do not trigger immediate tax consequences, but beneficiaries should consult a tax professional for guidance. |