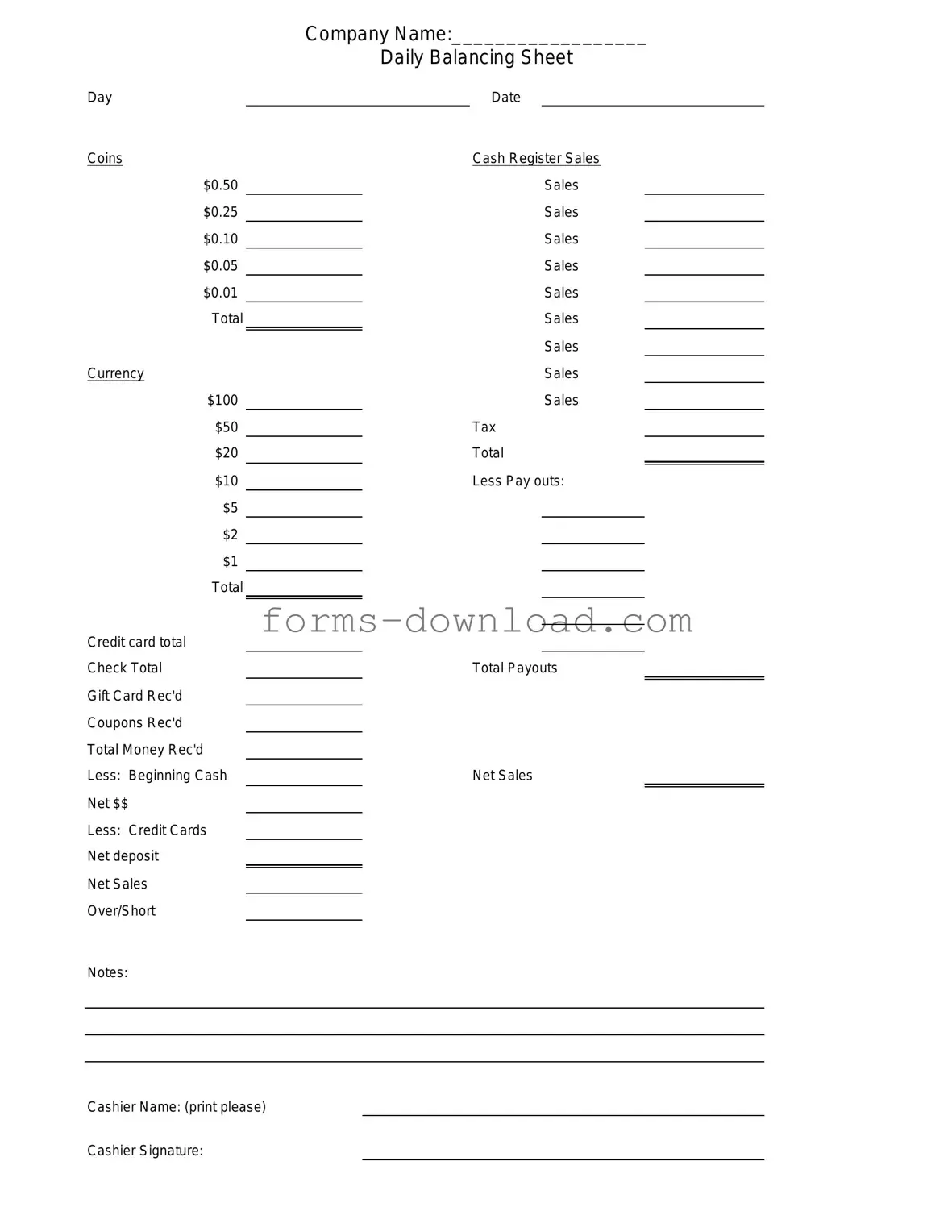

Blank Cash Drawer Count Sheet Form

The Cash Drawer Count Sheet is an essential tool for businesses that handle cash transactions, providing a structured way to track and verify cash on hand. This form serves multiple purposes, from ensuring accuracy during cash handling to assisting in financial audits. It typically includes sections for recording the opening cash balance, daily sales, and any cash received or spent throughout the day. By documenting these transactions, the form helps prevent discrepancies and promotes accountability among staff members. Furthermore, it can be utilized for end-of-day reconciliations, making it easier to identify any cash shortages or overages. Ultimately, the Cash Drawer Count Sheet not only aids in maintaining financial integrity but also fosters trust between employees and management by promoting transparency in cash handling practices.

More PDF Forms

Physical Exam Form for Healthcare Workers - Documenting any activity limitations ensures careful planning for your daily routine.

2b Mindset Tracker Pdf - Each completed entry nurtures a sense of accomplishment.

This vital Motor Vehicle Bill of Sale template simplifies the process of documenting your vehicle transaction, ensuring that all critical details are accurately recorded for both parties involved.

Section 8 100 Gold Street - Be prepared for potential follow-up from the authority after submission.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, accuracy and attention to detail are crucial. Here are four important dos and don'ts to keep in mind:

- Do double-check all amounts entered to ensure they match the physical cash on hand.

- Do use clear and legible handwriting to avoid any misinterpretations.

- Don't leave any fields blank; every section should be filled out completely.

- Don't rush through the process; take your time to minimize errors.

Cash Drawer Count Sheet Sample

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Listed Questions and Answers

-

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to record the amount of cash in the cash drawer at the end of a shift or business day. This form helps ensure that the cash on hand matches the sales recorded during that period.

-

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for maintaining accurate financial records. It helps prevent discrepancies between cash sales and cash on hand, which can indicate errors or potential theft. Regularly counting cash and documenting it promotes accountability and transparency in cash handling.

-

How often should I complete a Cash Drawer Count Sheet?

It's best practice to complete a Cash Drawer Count Sheet at the end of each shift or business day. This ensures that any discrepancies are caught early and allows for timely reconciliation of cash sales with the cash in the drawer.

-

What information should be included on the Cash Drawer Count Sheet?

The Cash Drawer Count Sheet should include:

- The date and time of the count

- The name of the employee conducting the count

- The total amount of cash counted

- A breakdown of cash denominations (e.g., bills and coins)

- Any discrepancies noted between expected and actual cash

-

What should I do if there is a discrepancy in the cash count?

If a discrepancy is found, it is essential to investigate promptly. Review sales records and any transactions that occurred during the shift. If the discrepancy cannot be explained, report it to a manager or supervisor for further action. Keeping a clear record of discrepancies can help identify patterns over time.

-

Who is responsible for completing the Cash Drawer Count Sheet?

The responsibility typically falls on the employee who is closing out the cash drawer at the end of their shift. However, management may also implement policies that require a second person to verify the count for added accuracy and security.

-

Can I use a digital version of the Cash Drawer Count Sheet?

Yes, many businesses opt for digital versions of the Cash Drawer Count Sheet. Digital forms can streamline the counting process, reduce paperwork, and allow for easier tracking and reporting. Ensure that any digital system you use complies with your business's record-keeping policies.

-

How should I store completed Cash Drawer Count Sheets?

Completed Cash Drawer Count Sheets should be stored securely, either in a physical file system or digitally in a secure database. Retaining these records for a specified period is important for auditing and financial review purposes. Check your local regulations for any specific requirements regarding record retention.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the cash on hand in a cash drawer at the end of a shift or business day. |

| Importance | This form helps in ensuring accurate financial reporting and accountability, reducing discrepancies in cash handling. |

| Usage Frequency | Typically, businesses use this sheet daily or at the end of each shift to track cash flow and balance the drawer. |

| Governing Laws | While there are no specific laws governing the Cash Drawer Count Sheet, businesses must comply with general accounting principles and tax regulations in their respective states. |