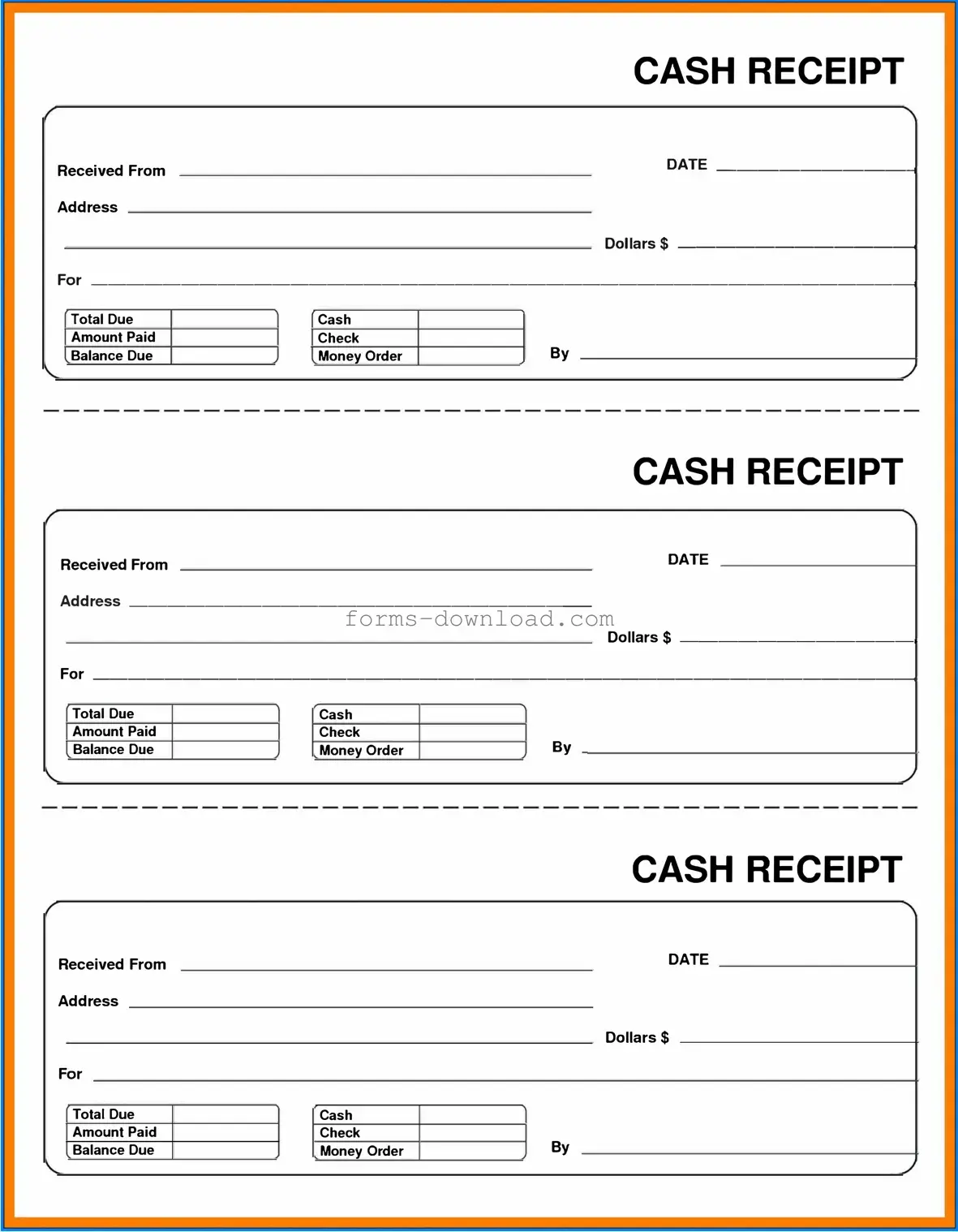

Blank Cash Receipt Form

In the world of finance and accounting, keeping track of transactions is essential for maintaining accurate records. One of the key tools used in this process is the Cash Receipt form. This form serves as a vital document that records the details of cash transactions, providing a clear and concise way to document incoming funds. Typically, it includes important information such as the date of the transaction, the amount received, the source of the payment, and the purpose of the payment. By capturing these details, the Cash Receipt form not only aids businesses in tracking their cash flow but also ensures that both the payer and the receiver have a reliable record for their financial documentation. Additionally, using this form can help in reconciling accounts and preparing for audits, making it an indispensable part of effective financial management. Understanding how to properly complete and utilize a Cash Receipt form can significantly enhance your financial practices, whether you are managing a small business or overseeing a large organization.

More PDF Forms

Light Bill Template - This document can help outline billing cycles and payment due dates.

Profits or Loss From Business - The IRS Schedule C form is used by sole proprietors to report their income and expenses from a business.

The Texas RV Bill of Sale is a crucial document used when buying or selling a recreational vehicle in the state of Texas. This form provides essential information about the transaction, including details about the RV, the involved parties, and the purchase price. Additionally, utilizing an RV Bill of Sale form can facilitate a smooth transfer of ownership and protect both buyers and sellers.

Section 8 100 Gold Street - The lease for your new unit must start within seven days after the extension ends.

Dos and Don'ts

When filling out the Cash Receipt form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn’t do:

- Do double-check the amount received to avoid errors.

- Do write clearly to ensure all information is legible.

- Do include the date of the transaction for proper record-keeping.

- Don't leave any required fields blank; this can lead to delays.

- Don't use correction fluid; it can cause confusion and may not be accepted.

Cash Receipt Sample

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Listed Questions and Answers

-

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof that a transaction has occurred and helps keep track of financial exchanges. This form is essential for maintaining accurate financial records.

-

When should I use a Cash Receipt form?

You should use a Cash Receipt form anytime cash is received for goods or services. This includes payments from customers, deposits, or any other cash transactions. Using the form ensures that all cash transactions are documented properly.

-

What information is required on the Cash Receipt form?

The Cash Receipt form typically requires the following information:

- Date of the transaction

- Name of the payer

- Amount received

- Purpose of the payment

- Signature of the person receiving the cash

Including all this information helps maintain clear and accurate records.

-

How should I store Cash Receipt forms?

Cash Receipt forms should be stored securely to protect sensitive information. You can keep physical copies in a locked filing cabinet or scan them for digital storage. Ensure that access is limited to authorized personnel only.

-

Can I modify the Cash Receipt form?

Yes, you can modify the Cash Receipt form to fit your specific needs. However, make sure that all essential information is still included. Customizing the form can help streamline your processes while ensuring compliance with your organization’s policies.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments. It serves as proof of transaction for both the payer and the recipient. |

| Components | This form typically includes details such as the date of payment, amount received, payer's information, and the purpose of the payment. |

| Record Keeping | Organizations must retain Cash Receipt forms for accounting and auditing purposes. This helps ensure transparency and accountability in financial transactions. |

| State-Specific Requirements | Some states may have specific regulations regarding the use of Cash Receipt forms. For example, California requires adherence to the California Civil Code Section 1720 for cash transactions. |

| Format | The form can be in paper or electronic format. Digital versions often include features that facilitate easy tracking and storage. |

| Signature Requirement | A signature from the recipient of the cash is often required to validate the transaction. This adds an extra layer of verification. |