Blank Childcare Receipt Form

The Childcare Receipt form is an essential document for parents and guardians who utilize childcare services. This form provides a clear record of payments made for childcare, ensuring that both the provider and the parent have a mutual understanding of the services rendered. Each receipt includes crucial details such as the date of service, the total amount paid, and the names of the children receiving care. Additionally, it specifies the duration of the childcare services, which helps in tracking attendance and service periods. The signature of the provider adds an extra layer of authenticity, confirming that the transaction has been completed. By keeping these receipts organized, parents can easily manage their childcare expenses and may even use them for tax purposes. Understanding the components of the Childcare Receipt form can aid in maintaining accurate financial records and ensure compliance with any applicable regulations.

More PDF Forms

Da - A quantity field allows the user to record how many items are being accounted for.

The Minnesota Trailer Bill of Sale form is essential for anyone involved in the sale of a trailer in Minnesota, serving as a legal document that officially confirms the transaction between the buyer and seller. This form not only protects the parties involved but also provides a clear record of ownership transfer. To help you complete the process, more information can be found at https://vehiclebillofsaleform.com/trailer-bill-of-sale-template/minnesota-trailer-bill-of-sale-template/.

How to Create a Column Graph in Excel - Column Four: The fourth data set or category for comprehensive evaluation.

Dos and Don'ts

When filling out the Childcare Receipt form, attention to detail is crucial. Here’s a list of things to keep in mind:

- Do write clearly and legibly to avoid confusion.

- Do include the correct date of service to ensure accurate record-keeping.

- Do specify the amount received in full dollars and cents.

- Do ensure that the name of the child or children is complete and spelled correctly.

- Don't leave any fields blank; all sections must be filled out.

- Don't forget to sign the form as the provider; this confirms the receipt of payment.

- Don't use abbreviations or shorthand that may lead to misunderstandings.

- Don't alter the form once it has been filled out; any changes should be clearly noted.

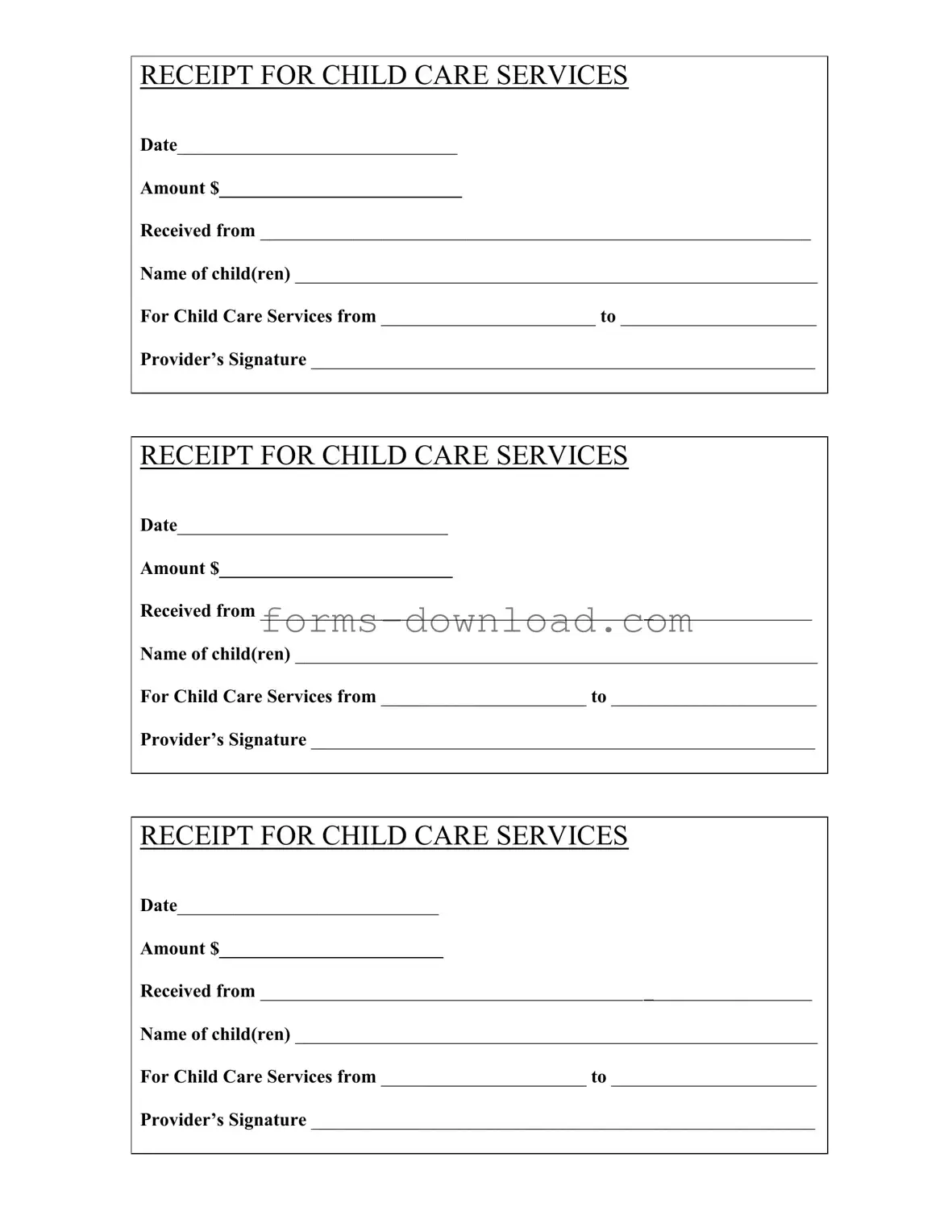

Childcare Receipt Sample

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Listed Questions and Answers

-

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a formal record of payment for childcare services. It is essential for parents or guardians to keep this receipt for their records, especially when filing taxes or applying for financial assistance. The receipt provides proof of the amount paid, the dates of service, and the provider’s information.

-

What information is included on the Childcare Receipt form?

The form includes several key pieces of information:

- Date of payment

- Amount paid

- Name of the person making the payment

- Name(s) of the child(ren) receiving care

- Dates of the childcare services provided

- Provider’s signature

This information is crucial for both the provider and the parent for record-keeping and tax purposes.

-

How should I fill out the Childcare Receipt form?

To fill out the Childcare Receipt form, you should start by entering the date of payment at the top. Next, write the amount paid for the childcare services. Following that, include your name as the person making the payment. Then, list the names of the child(ren) who received care. Specify the start and end dates of the childcare services. Finally, the childcare provider must sign the form to validate the receipt.

-

Is the Childcare Receipt form required for tax purposes?

Yes, the Childcare Receipt form is often required for tax purposes. Parents may need to provide proof of childcare expenses when filing their taxes, especially if they are claiming tax credits or deductions related to childcare. Keeping these receipts organized can make tax season less stressful.

-

What should I do if I lose my Childcare Receipt form?

If you lose your Childcare Receipt form, it is advisable to contact your childcare provider as soon as possible. They may be able to issue a duplicate receipt or provide you with a new one. Keeping digital copies of important documents can help prevent loss in the future.

-

Can I use the Childcare Receipt form for multiple children?

Yes, the Childcare Receipt form can be used for multiple children. Simply list each child’s name on the form. However, it is important to ensure that the amount paid and the dates of service accurately reflect the care provided for all listed children. This clarity helps avoid any confusion regarding the services rendered.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Childcare Receipt form serves as a proof of payment for childcare services rendered. |

| Required Information | The form must include the date, amount paid, name of the payer, names of the children, service period, and provider's signature. |

| Legal Importance | This receipt can be used for tax purposes, allowing parents to claim childcare expenses on their tax returns. |

| State-Specific Requirements | Different states may have specific laws governing childcare services and receipts. Always check local regulations. |

| Record Keeping | Parents should keep these receipts for at least three years in case of an audit by the IRS. |

| Provider's Responsibility | Childcare providers must accurately fill out the receipt to ensure compliance with tax and legal standards. |

| Multiple Receipts | For ongoing childcare services, multiple receipts may be issued, each covering different service periods. |

| Signature Requirement | The provider’s signature is crucial as it authenticates the receipt and confirms that services were rendered. |

| Digital vs. Paper | Both digital and paper formats of the receipt are acceptable, but ensure they are properly documented and stored. |