Fillable Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure can be a valuable option for homeowners facing financial difficulties and the threat of foreclosure. This legal document allows a homeowner to voluntarily transfer the title of their property to the lender, effectively settling the mortgage debt without the lengthy and often stressful foreclosure process. By signing this deed, the homeowner can avoid the negative impact of foreclosure on their credit score, while the lender can expedite the recovery of the property. The process typically involves negotiations between the homeowner and the lender, ensuring that both parties agree on the terms of the transfer. Additionally, it's essential to understand the potential implications, such as tax consequences and the impact on future borrowing. Overall, a Deed in Lieu of Foreclosure can serve as a practical solution for those looking to navigate challenging financial circumstances while minimizing the long-term repercussions on their financial health.

Deed in Lieu of ForeclosureTemplates for Particular US States

More Deed in Lieu of Foreclosure Forms:

New Jersey Quitclaim Deed Form - These deeds are often used in real estate transactions involving no money.

For those looking to streamline their rental agreements, our informative guide on the Lease Agreement process can be invaluable. By understanding the required terms and conditions, both landlords and tenants can navigate their responsibilities effectively. To access the template, visit the Lease Agreement template now.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it's important to be careful and thorough. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do ensure all information is accurate and up-to-date.

- Do consult with a legal or financial advisor if you have questions.

- Do sign and date the document where indicated.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

By following these guidelines, you can help ensure that your Deed in Lieu of Foreclosure form is completed correctly and efficiently.

Deed in Lieu of Foreclosure Sample

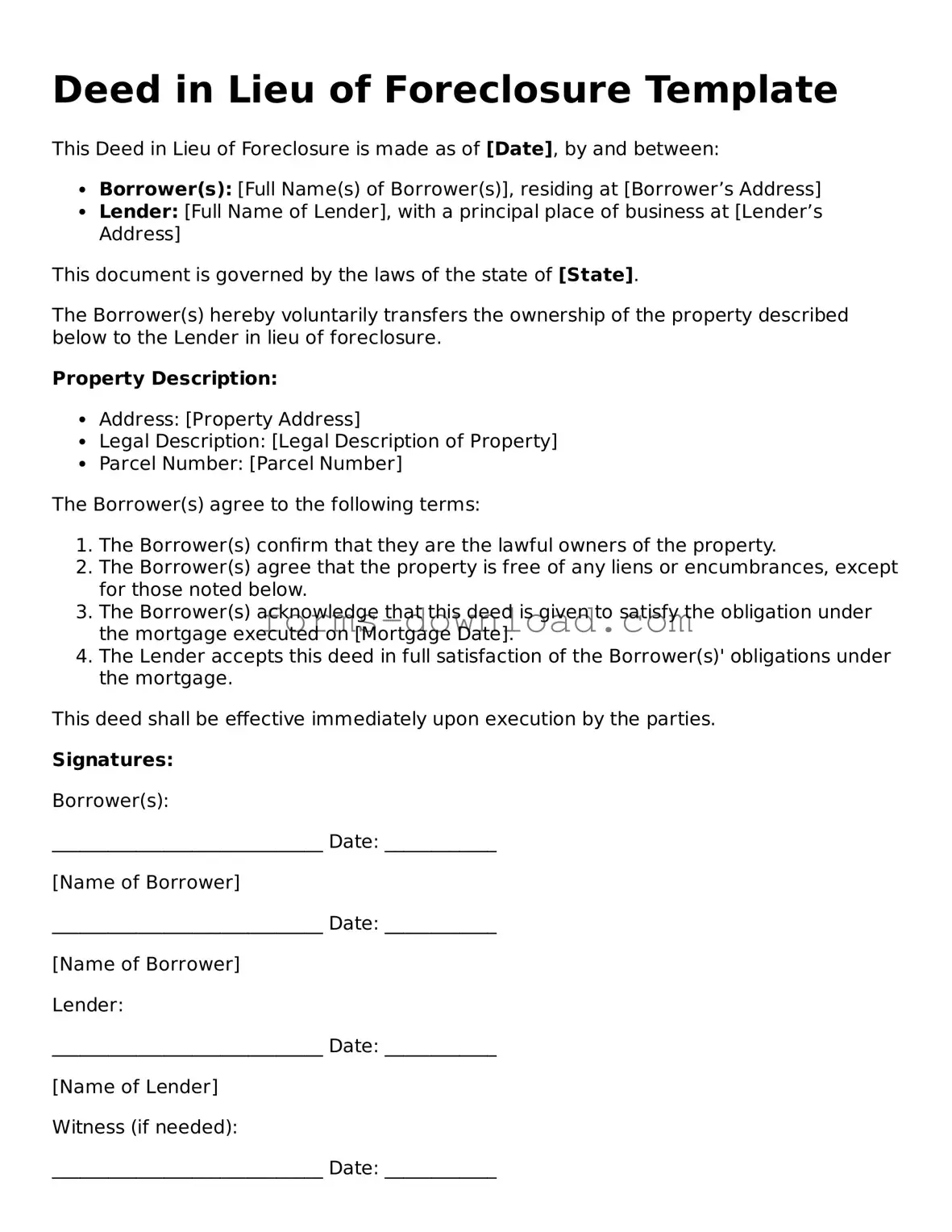

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made as of [Date], by and between:

- Borrower(s): [Full Name(s) of Borrower(s)], residing at [Borrower’s Address]

- Lender: [Full Name of Lender], with a principal place of business at [Lender’s Address]

This document is governed by the laws of the state of [State].

The Borrower(s) hereby voluntarily transfers the ownership of the property described below to the Lender in lieu of foreclosure.

Property Description:

- Address: [Property Address]

- Legal Description: [Legal Description of Property]

- Parcel Number: [Parcel Number]

The Borrower(s) agree to the following terms:

- The Borrower(s) confirm that they are the lawful owners of the property.

- The Borrower(s) agree that the property is free of any liens or encumbrances, except for those noted below.

- The Borrower(s) acknowledge that this deed is given to satisfy the obligation under the mortgage executed on [Mortgage Date].

- The Lender accepts this deed in full satisfaction of the Borrower(s)' obligations under the mortgage.

This deed shall be effective immediately upon execution by the parties.

Signatures:

Borrower(s):

_____________________________ Date: ____________

[Name of Borrower]

_____________________________ Date: ____________

[Name of Borrower]

Lender:

_____________________________ Date: ____________

[Name of Lender]

Witness (if needed):

_____________________________ Date: ____________

[Name of Witness]

Listed Questions and Answers

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish ownership while potentially mitigating the negative impact on their credit score. It can be a more amicable solution compared to the lengthy and often stressful foreclosure process.

-

How does the process work?

The process typically begins when a homeowner realizes they cannot keep up with mortgage payments. The homeowner must contact their lender to express interest in a Deed in Lieu of Foreclosure. If the lender agrees, they will review the homeowner's financial situation. After an assessment, if both parties reach an agreement, the homeowner signs the deed, transferring ownership to the lender. The lender then forgives the remaining mortgage debt, although this may vary based on the agreement.

-

What are the benefits of choosing this option?

There are several benefits to a Deed in Lieu of Foreclosure:

- It can help preserve the homeowner's credit score more than a foreclosure would.

- The process is generally quicker and less complicated than foreclosure proceedings.

- Homeowners may avoid owing any remaining mortgage balance, depending on the lender's policies.

- It allows for a smoother transition to finding new housing.

-

Are there any drawbacks?

While a Deed in Lieu of Foreclosure has its advantages, there are also potential drawbacks. Homeowners may still face tax implications if the lender forgives a significant amount of debt. This forgiveness could be considered taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, and homeowners may need to meet specific criteria set by their lender. It's essential to consult with a financial advisor or attorney before proceeding.

-

What should homeowners do before pursuing this option?

Homeowners should first evaluate their financial situation and consider all alternatives, such as loan modification or short sale. It’s crucial to communicate openly with the lender about financial difficulties. Gathering necessary documentation, such as income statements and details about the property, can help streamline the process. Consulting with a legal expert or housing counselor can provide additional guidance tailored to individual circumstances.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers the property title to the lender to avoid foreclosure. |

| Benefits | This process can help borrowers avoid the lengthy foreclosure process and minimize damage to their credit score. |

| State-Specific Forms | Each state may have its own specific requirements for the Deed in Lieu of Foreclosure, so it’s important to consult local laws. |

| Governing Laws | In the U.S., the Uniform Commercial Code (UCC) and state-specific property laws govern the process of Deed in Lieu of Foreclosure. |

| Eligibility | Typically, borrowers must demonstrate financial hardship and be unable to continue mortgage payments to qualify for this option. |

| Impact on Credit | While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it may still negatively affect the borrower’s credit score. |