Fillable Durable Power of Attorney Form

When it comes to planning for the future, understanding the Durable Power of Attorney (DPOA) form is essential. This legal document allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. The authority granted can encompass a wide range of matters, including financial transactions, healthcare decisions, and property management. One of the key features of a DPOA is its durability; it remains effective even if the principal becomes incapacitated, ensuring that someone trusted can step in when needed. This form can be tailored to fit specific needs, whether it be for a limited time or for broader, ongoing authority. Understanding how to properly execute and utilize a Durable Power of Attorney can provide peace of mind, knowing that your wishes will be honored and your affairs will be managed according to your preferences, even when you are unable to communicate them yourself.

Durable Power of AttorneyTemplates for Particular US States

More Durable Power of Attorney Forms:

Poa Document - This form is beneficial for elderly individuals who may need assistance with their property managing tasks.

When engaging in a boat transaction, it's crucial to utilize the appropriate documentation; the California Boat Bill of Sale is an indispensable form that not only confirms the sale but also facilitates a seamless transfer of ownership. To enhance your understanding of the necessary paperwork, you can refer to the Vessel Bill of Sale, which provides valuable insights and guidance on this important matter.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it is essential to approach the process with care. Here are four important do's and don'ts to consider:

- Do clearly identify the principal and the agent. Ensure that both parties' names and contact information are accurate.

- Do specify the powers granted to the agent. Be explicit about what decisions the agent can make on your behalf.

- Don't leave any sections blank. Incomplete forms can lead to confusion or disputes later.

- Don't forget to sign and date the form. Without your signature, the document will not be legally binding.

Durable Power of Attorney Sample

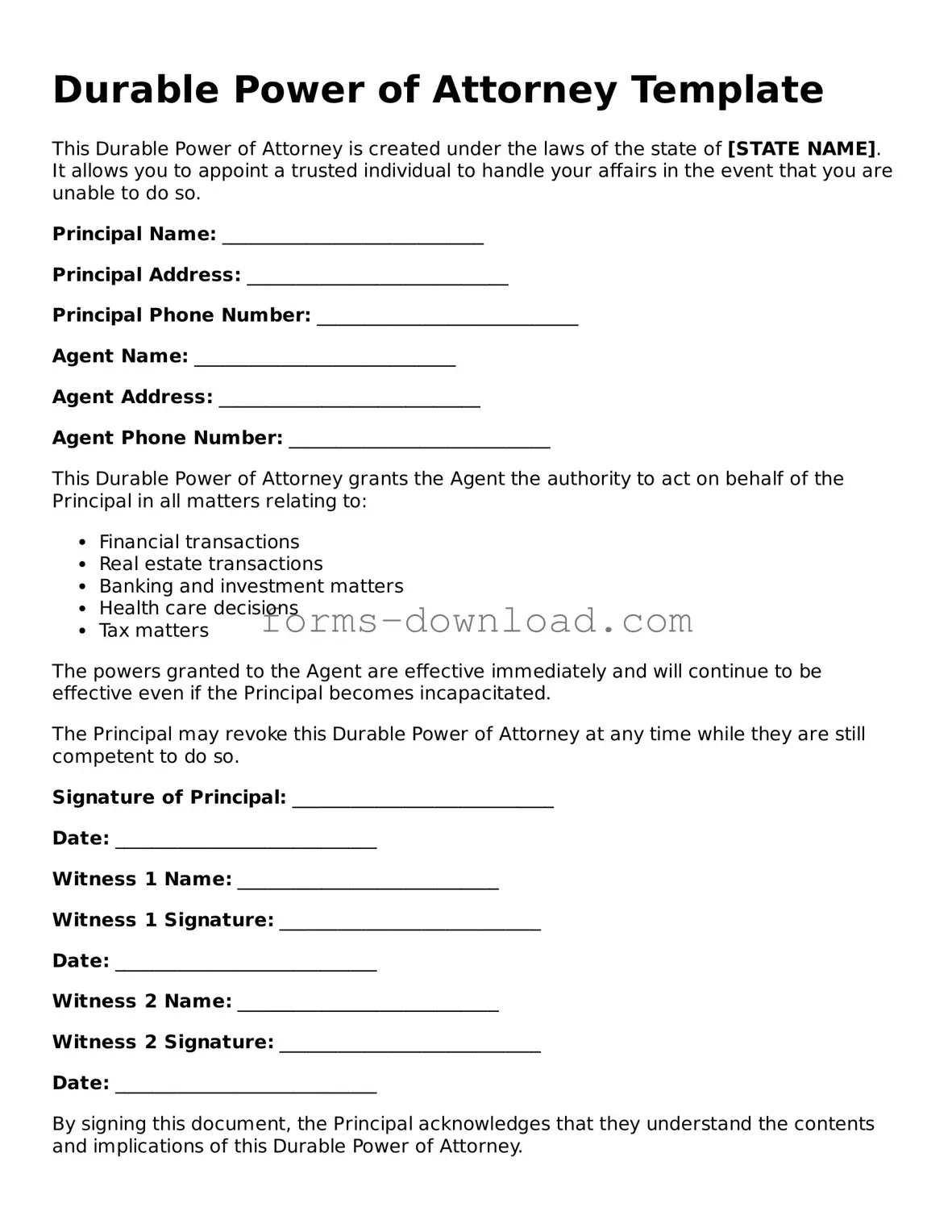

Durable Power of Attorney Template

This Durable Power of Attorney is created under the laws of the state of [STATE NAME]. It allows you to appoint a trusted individual to handle your affairs in the event that you are unable to do so.

Principal Name: ____________________________

Principal Address: ____________________________

Principal Phone Number: ____________________________

Agent Name: ____________________________

Agent Address: ____________________________

Agent Phone Number: ____________________________

This Durable Power of Attorney grants the Agent the authority to act on behalf of the Principal in all matters relating to:

- Financial transactions

- Real estate transactions

- Banking and investment matters

- Health care decisions

- Tax matters

The powers granted to the Agent are effective immediately and will continue to be effective even if the Principal becomes incapacitated.

The Principal may revoke this Durable Power of Attorney at any time while they are still competent to do so.

Signature of Principal: ____________________________

Date: ____________________________

Witness 1 Name: ____________________________

Witness 1 Signature: ____________________________

Date: ____________________________

Witness 2 Name: ____________________________

Witness 2 Signature: ____________________________

Date: ____________________________

By signing this document, the Principal acknowledges that they understand the contents and implications of this Durable Power of Attorney.

Listed Questions and Answers

-

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to manage your financial or medical affairs if you become unable to do so yourself. Unlike a regular power of attorney, a DPOA remains effective even if you become incapacitated.

-

Who can be appointed as an agent?

You can choose anyone you trust to be your agent, including a family member, friend, or a professional. However, it is important to select someone who is responsible and capable of making decisions on your behalf.

-

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including the ability to handle banking transactions, pay bills, manage investments, and make healthcare decisions. You can specify which powers your agent has and any limitations you want to impose.

-

How do I create a Durable Power of Attorney?

To create a DPOA, you need to fill out a specific form that complies with your state’s laws. It usually requires your signature and may need to be notarized or witnessed. It is advisable to consult with a legal professional to ensure it is done correctly.

-

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To revoke it, you should create a written notice stating your intention to revoke and notify your agent and any institutions that may have a copy of the original document.

-

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may appoint a guardian or conservator to manage your affairs. This process can be time-consuming and may not align with your wishes.

-

Is a Durable Power of Attorney the same as a Living Will?

No, a DPOA and a Living Will serve different purposes. A DPOA allows someone to make decisions on your behalf, while a Living Will outlines your wishes regarding medical treatment in the event you cannot communicate them yourself.

-

Can I have more than one Durable Power of Attorney?

While you can have multiple DPOAs, it is generally advisable to have only one active DPOA for each area of responsibility (financial and healthcare) to avoid confusion. If you wish to appoint different agents for different matters, clearly specify their roles in the documents.

-

Do I need an attorney to create a Durable Power of Attorney?

While it is not legally required to have an attorney, consulting one is recommended. An attorney can help ensure that the document meets all legal requirements and accurately reflects your wishes.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate someone to make financial or medical decisions on their behalf, even if they become incapacitated. |

| State-Specific Laws | The requirements for creating a Durable Power of Attorney vary by state. For example, in California, it is governed by the California Probate Code Section 4400. |

| Durability | This form remains effective even if the principal becomes unable to make decisions due to illness or injury, which is what distinguishes it from a regular Power of Attorney. |

| Revocation | The principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent to do so. This revocation must be communicated clearly to the agent and any relevant institutions. |