Blank Employee Advance Form

The Employee Advance form is a vital tool designed to assist employees in managing their financial needs while ensuring that the company maintains clear and organized records. This form allows employees to request an advance on their salary for various reasons, such as covering unexpected expenses or supporting personal emergencies. By filling out the form, employees can specify the amount they need and provide a brief explanation of their request, which helps the management understand the context. Additionally, the form includes sections for approval signatures, ensuring that all requests are reviewed and authorized by the appropriate personnel. This process not only promotes transparency but also fosters a supportive work environment where employees feel valued and understood. Understanding how to properly complete and submit the Employee Advance form is essential for employees seeking financial assistance, as it streamlines the process and helps avoid any potential delays in receiving the funds they need.

More PDF Forms

Printable Puppy Health Record - Verify your dog's vaccination history with this official document.

To finalize the purchase of your new vessel, it's important to have a proper documentation process in place, and the Bill of Sale for a Boat is an essential step in ensuring a smooth transfer of ownership in Indiana.

I-983 - Filling out the I-983 carefully can enhance a student’s chances of a successful career transition.

Hurt Feelings Report - Helps individuals confront and articulate their feelings.

Dos and Don'ts

When filling out the Employee Advance form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid:

Things You Should Do:

- Provide accurate personal information, including your full name and employee ID.

- Clearly specify the amount of the advance requested.

- Include a detailed description of the purpose for the advance.

- Attach any necessary documentation to support your request.

- Review the form for completeness before submission.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid submitting the form without proper signatures.

- Do not provide vague or unclear descriptions of the advance purpose.

- Refrain from requesting an amount that exceeds company policy limits.

- Do not forget to keep a copy of the submitted form for your records.

Employee Advance Sample

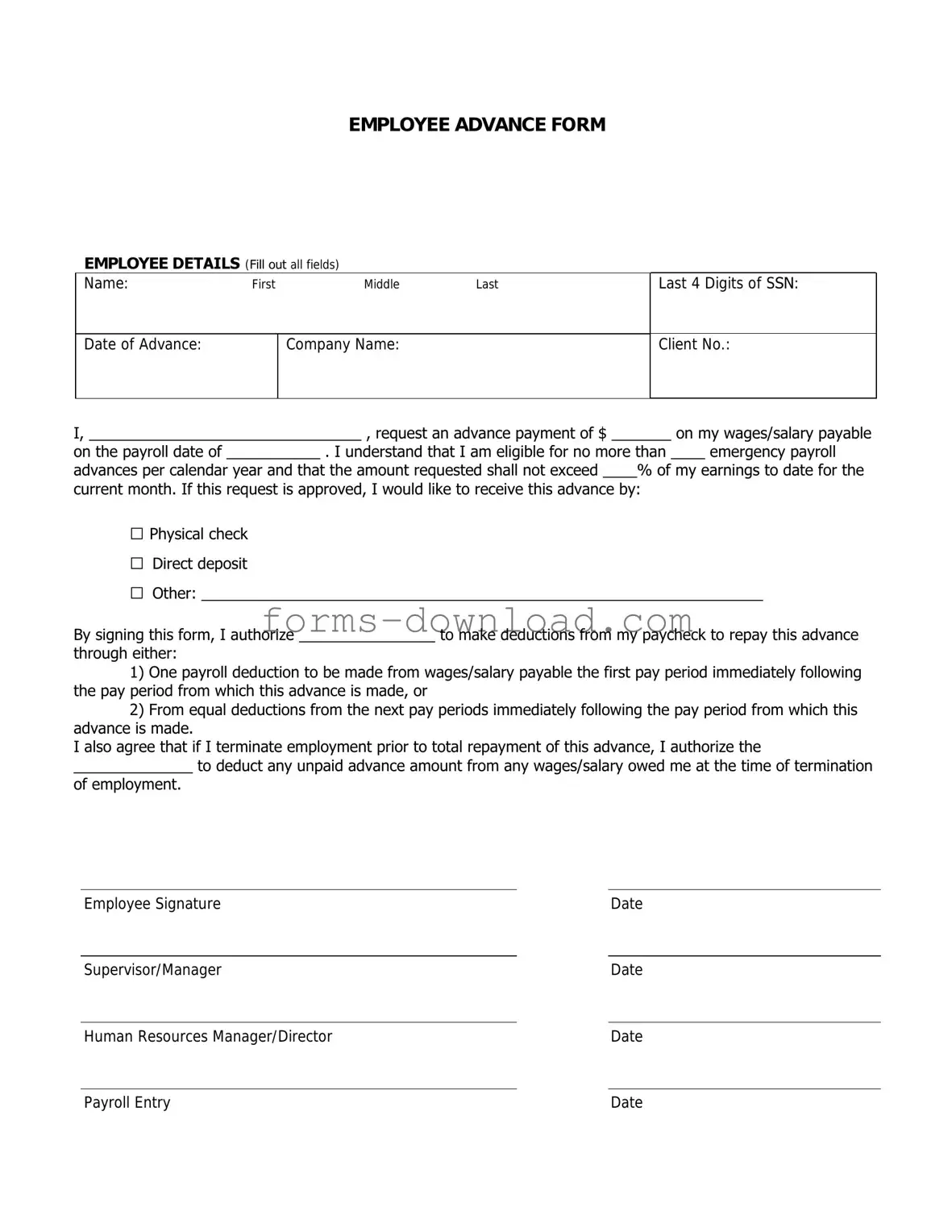

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Listed Questions and Answers

-

What is the Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or other compensation. This form is typically used for urgent financial needs that arise before the regular pay period.

-

Who is eligible to use the Employee Advance form?

Generally, all employees who have completed their probationary period are eligible to request an advance. Specific eligibility criteria may vary by organization, so it is advisable to check with the HR department for details.

-

What information is required to complete the form?

The form typically requires the following information:

- Your name and employee ID

- The amount of the advance requested

- The reason for the request

- Your signature and date

-

How long does it take to process the Employee Advance request?

Processing times can vary depending on the organization’s policies. Generally, requests are reviewed within a few business days. Employees should allow sufficient time for approval before expecting the funds.

-

Will the advance be deducted from my next paycheck?

Yes, typically, the amount of the advance will be deducted from your next paycheck or subsequent paychecks until the total amount is repaid. The specific repayment terms should be outlined in the approval communication.

-

Can I submit the form electronically?

Many organizations now accept electronic submissions of the Employee Advance form. Check with your HR department to see if this option is available and to understand the submission process.

-

What should I do if my request is denied?

If your request is denied, you may contact your supervisor or HR for clarification. Understanding the reasons for denial can help you address any issues or improve future requests.

-

Is there a limit to how many advances I can request?

Most organizations have policies regarding the frequency and total amount of advances an employee can request. It is important to review these policies or consult with HR to avoid any misunderstandings.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on wages or expenses by an employee. |

| Eligibility | Typically, only employees who have been with the company for a certain period can apply for an advance. |

| Repayment Terms | Advances are generally repaid through deductions from future paychecks, often over several pay periods. |

| State-Specific Forms | Some states may require specific forms or disclosures. For instance, California has particular guidelines under Labor Code Section 224. |

| Approval Process | The form must be approved by a supervisor or HR before any funds are disbursed. |

| Documentation Required | Employees may need to provide documentation justifying the need for the advance, such as receipts or invoices. |

| Impact on Taxes | Advances are not considered taxable income at the time of issuance, but they may affect future tax calculations. |

| Employer Policies | Employers often have specific policies regarding the maximum amount that can be advanced and the frequency of requests. |

| Legal Compliance | Employers must comply with federal and state laws regarding wage advances, including ensuring they do not violate minimum wage laws. |