Fillable Employee Loan Agreement Form

In the modern workplace, financial support can play a crucial role in fostering employee satisfaction and retention. An Employee Loan Agreement form serves as a vital tool for employers and employees alike, outlining the terms under which a loan is provided to an employee. This form typically includes essential elements such as the loan amount, repayment schedule, interest rates, and the consequences of default. It also addresses the purpose of the loan, ensuring that both parties understand the intended use of the funds. By clearly defining the obligations and rights of both the employer and the employee, this agreement aims to prevent misunderstandings and protect the interests of both parties. Additionally, it may include provisions for confidentiality and dispute resolution, further enhancing its effectiveness as a formalized contract. Understanding the nuances of this agreement can empower employees to make informed financial decisions while providing employers with a framework to support their workforce responsibly.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is essential to approach the task with care and attention to detail. Here are some guidelines to help ensure the process goes smoothly.

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and truthful information.

- Do double-check all figures and calculations.

- Do keep a copy of the completed form for your records.

- Do ask questions if any part of the agreement is unclear.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't ignore the terms and conditions outlined in the agreement.

- Don't sign the document until you fully understand your obligations.

By following these guidelines, you can help protect your interests and ensure that the loan agreement is completed correctly.

Employee Loan Agreement Sample

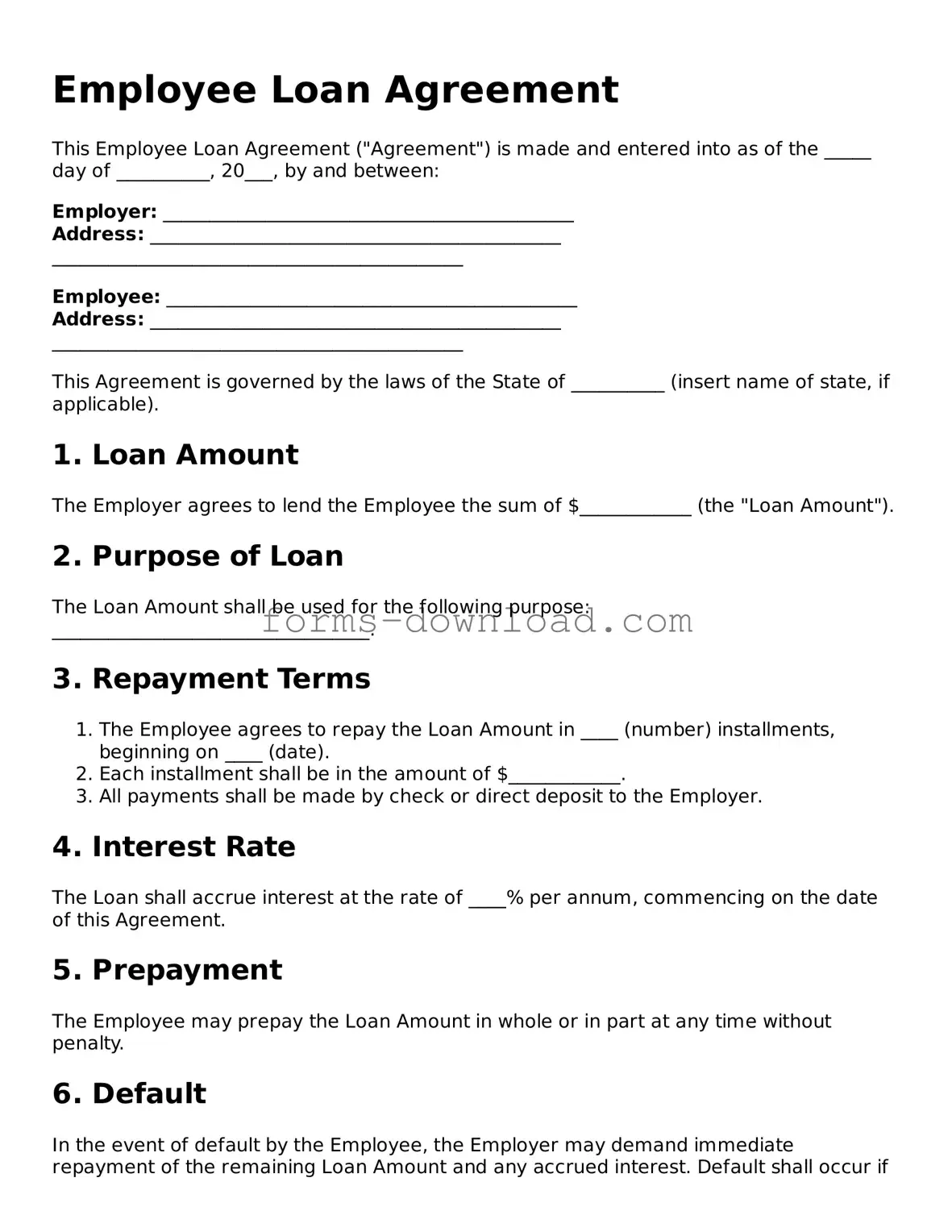

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into as of the _____ day of __________, 20___, by and between:

Employer: ____________________________________________

Address: ____________________________________________

____________________________________________

Employee: ____________________________________________

Address: ____________________________________________

____________________________________________

This Agreement is governed by the laws of the State of __________ (insert name of state, if applicable).

1. Loan Amount

The Employer agrees to lend the Employee the sum of $____________ (the "Loan Amount").

2. Purpose of Loan

The Loan Amount shall be used for the following purpose: __________________________________.

3. Repayment Terms

- The Employee agrees to repay the Loan Amount in ____ (number) installments, beginning on ____ (date).

- Each installment shall be in the amount of $____________.

- All payments shall be made by check or direct deposit to the Employer.

4. Interest Rate

The Loan shall accrue interest at the rate of ____% per annum, commencing on the date of this Agreement.

5. Prepayment

The Employee may prepay the Loan Amount in whole or in part at any time without penalty.

6. Default

In the event of default by the Employee, the Employer may demand immediate repayment of the remaining Loan Amount and any accrued interest. Default shall occur if the Employee:

- Fails to make any scheduled payment within ____ days after its due date;

- Becomes insolvent, or

- Is terminated or resigns from their position.

7. Governing Law

This Agreement shall be governed and construed in accordance with the laws of the State of __________ (insert name of state, if applicable).

8. Amendments

This Agreement may not be amended or modified except in writing and signed by both parties.

9. Entire Agreement

This Agreement constitutes the entire understanding between the Employer and the Employee concerning the Loan and supersedes all prior agreements, whether written or oral.

IN WITNESS WHEREOF, the parties have executed this Employee Loan Agreement on the date first above written.

Employer Signature: _________________________________

Title: ____________________________________________

Date: ____________________________________________

Employee Signature: _________________________________

Date: ____________________________________________

Listed Questions and Answers

-

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any other relevant terms. It serves to protect both the employer and the employee by clearly defining the expectations and obligations of each party.

-

Who can apply for an Employee Loan?

Generally, all employees who meet specific criteria set by the employer may apply for an Employee Loan. Eligibility may depend on factors such as the employee's length of service, job performance, and financial need. It is important for employees to check with their HR department for the specific requirements and policies regarding loan applications.

-

What information is required to complete the form?

To complete the Employee Loan Agreement form, employees typically need to provide personal information, including their name, employee ID, and contact details. Additionally, they must specify the loan amount requested, the purpose of the loan, and agree to the repayment terms. It may also require the employee's signature and date to validate the agreement.

-

What happens if I cannot repay the loan on time?

If an employee is unable to repay the loan as agreed, it is crucial to communicate with the employer as soon as possible. Employers may offer options such as a revised repayment plan or deferment. However, failing to repay the loan could lead to consequences, including deductions from the employee's paycheck or potential legal action. Open communication is key to finding a solution.

-

Is the interest on the loan taxable?

The tax implications of an Employee Loan can vary based on several factors, including the interest rate and the terms of the loan. In some cases, if the interest rate is below the market rate, the IRS may consider the difference as taxable income. Employees should consult with a tax professional to understand how the loan may affect their tax situation.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | An Employee Loan Agreement is a formal document outlining the terms under which an employer lends money to an employee. |

| Purpose | This agreement helps to clarify repayment terms, interest rates, and the consequences of default. |

| Governing Law | In the state of California, for example, the agreement is governed by California Civil Code Section 1916-1922. |

| Repayment Terms | The agreement typically specifies the repayment schedule, which can be deducted directly from the employee's paycheck. |

| Interest Rates | Interest rates, if applicable, should be clearly stated and must comply with state usury laws. |

| Default Consequences | Failure to repay may result in wage garnishment or legal action, as outlined in the agreement. |