Attorney-Approved Deed in Lieu of Foreclosure Document for the State of Florida

In Florida, homeowners facing financial difficulties and the possibility of foreclosure may find a Deed in Lieu of Foreclosure to be a viable option. This legal document allows a borrower to voluntarily transfer ownership of their property back to the lender, effectively eliminating the need for a lengthy foreclosure process. By executing this form, the homeowner can potentially avoid the negative consequences associated with foreclosure, such as damage to their credit score and the stress of court proceedings. The Deed in Lieu of Foreclosure form typically requires the homeowner to provide key information, including the property address, loan details, and a statement of the homeowner's financial situation. Importantly, this agreement may also include clauses regarding the lender's release of any further claims against the homeowner, which can provide peace of mind during a challenging financial period. Understanding the implications and requirements of this form is essential for homeowners seeking a smoother transition away from their mortgage obligations.

Consider More Deed in Lieu of Foreclosure Templates for Different States

Deed in Lieu of Mortgage - Lenders often prefer this option to minimize losses associated with foreclosure proceedings.

When purchasing a boat in California, it is mandatory to use the California Boat Bill of Sale form, as this document is vital in establishing the legality of the transfer. Without this form, both parties might face difficulties in proving ownership in the future. For more information on how to efficiently manage this process, including details on completing the necessary documents, you can refer to the Bill of Sale for a Boat.

California Pre-foreclosure Property Transfer - Clear communication with the lender throughout the process is crucial for a successful Deed in Lieu.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Below is a list of things to do and avoid to ensure that the form is completed correctly and effectively.

- Do: Ensure that all property information is accurate, including the legal description and address.

- Do: Sign the document in the presence of a notary public to validate the deed.

- Do: Provide any required supporting documentation, such as a copy of the mortgage or loan agreement.

- Do: Consult with a legal professional if you have questions or concerns about the process.

- Don't: Leave any sections of the form blank; this can lead to delays or rejection of the deed.

- Don't: Submit the form without reviewing it for errors or omissions.

- Don't: Forget to check the deadlines for submitting the deed to ensure compliance with local regulations.

- Don't: Sign the form without fully understanding the implications of transferring ownership of the property.

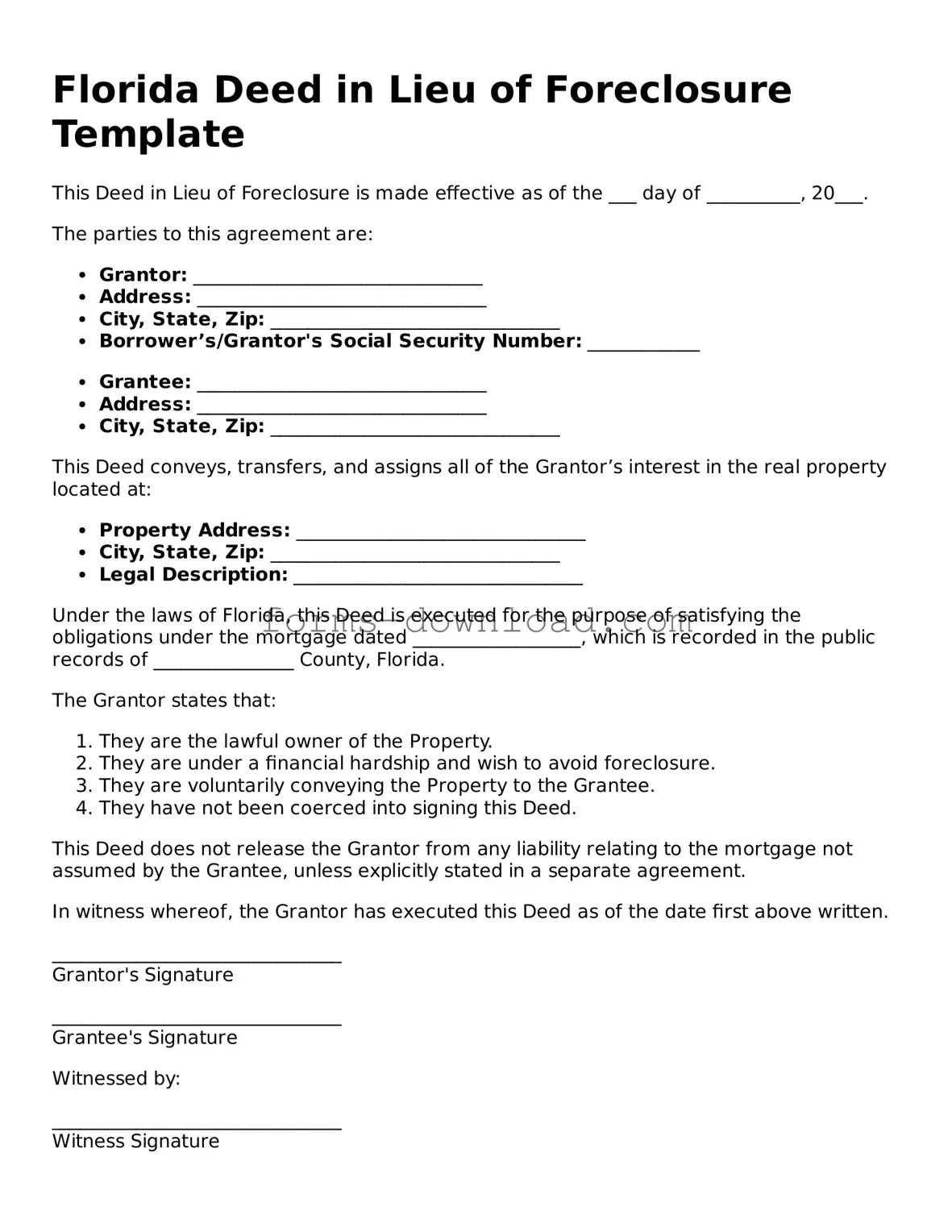

Florida Deed in Lieu of Foreclosure Sample

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made effective as of the ___ day of __________, 20___.

The parties to this agreement are:

- Grantor: _______________________________

- Address: _______________________________

- City, State, Zip: _______________________________

- Borrower’s/Grantor's Social Security Number: ____________

- Grantee: _______________________________

- Address: _______________________________

- City, State, Zip: _______________________________

This Deed conveys, transfers, and assigns all of the Grantor’s interest in the real property located at:

- Property Address: _______________________________

- City, State, Zip: _______________________________

- Legal Description: _______________________________

Under the laws of Florida, this Deed is executed for the purpose of satisfying the obligations under the mortgage dated __________________, which is recorded in the public records of _______________ County, Florida.

The Grantor states that:

- They are the lawful owner of the Property.

- They are under a financial hardship and wish to avoid foreclosure.

- They are voluntarily conveying the Property to the Grantee.

- They have not been coerced into signing this Deed.

This Deed does not release the Grantor from any liability relating to the mortgage not assumed by the Grantee, unless explicitly stated in a separate agreement.

In witness whereof, the Grantor has executed this Deed as of the date first above written.

_______________________________

Grantor's Signature

_______________________________

Grantee's Signature

Witnessed by:

_______________________________

Witness Signature

_______________________________

Witness Signature

State of Florida

County of ____________________

On this ___ day of __________, 20___, before me, a Notary Public, personally appeared ______________________________, who is known to me to be the same person whose name is subscribed to this instrument.

_______________________________

Notary Public Signature

My Commission Expires: _______________

Listed Questions and Answers

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender to avoid foreclosure. This process can help the homeowner mitigate the negative impact of foreclosure on their credit report.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Homeowners facing financial hardship and at risk of foreclosure may be eligible. However, lenders typically require that the homeowner has attempted other alternatives, such as loan modification or short sale, before considering a Deed in Lieu of Foreclosure.

-

What are the benefits of a Deed in Lieu of Foreclosure?

One of the primary benefits is that it can be less damaging to a homeowner's credit score compared to a foreclosure. Additionally, the process can be quicker and less expensive than a foreclosure proceeding. Homeowners may also be relieved of any remaining mortgage debt, depending on the terms agreed upon with the lender.

-

What are the potential drawbacks?

While a Deed in Lieu of Foreclosure can be beneficial, there are potential drawbacks. Homeowners may still face tax implications if the lender forgives any remaining debt. Additionally, the lender may require the homeowner to vacate the property promptly, which can be a difficult transition.

-

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and may require documentation. If approved, both parties will sign the deed, transferring ownership of the property to the lender.

-

Can a homeowner negotiate terms?

Yes, homeowners can negotiate certain terms, such as the timeline for vacating the property or any potential forgiveness of remaining debt. It is advisable to have legal representation during this process to ensure that the homeowner's interests are protected.

-

What happens to the homeowner after the deed is signed?

Once the deed is signed and recorded, the homeowner will typically need to vacate the property within a specified timeframe. The lender will then take possession of the property and may proceed to sell it to recover their losses.

-

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure will impact your credit score, but generally less severely than a foreclosure. The exact effect will depend on various factors, including your overall credit history and the lender's reporting practices.

-

Is legal assistance recommended?

It is highly recommended to seek legal assistance when considering a Deed in Lieu of Foreclosure. An attorney can provide valuable guidance, help negotiate terms, and ensure that all legal requirements are met.

-

What should I do if my lender denies my request?

If a lender denies a request for a Deed in Lieu of Foreclosure, homeowners should explore other options. These may include pursuing a loan modification, short sale, or seeking assistance from a housing counselor to evaluate alternative solutions.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | The relevant laws governing deeds in lieu of foreclosure in Florida include Florida Statutes Chapter 697 and Chapter 702. |

| Process | The process typically involves the homeowner and lender negotiating the terms, followed by the execution of the deed and transfer of property. |

| Benefits | This option can help homeowners avoid the negative impact of foreclosure on their credit score and may expedite the transition out of a financial burden. |

| Considerations | Homeowners should consider potential tax implications and ensure they understand the terms before proceeding with a deed in lieu of foreclosure. |