Attorney-Approved Durable Power of Attorney Document for the State of Florida

The Florida Durable Power of Attorney form is a crucial legal document that empowers individuals to designate a trusted person to make financial and legal decisions on their behalf when they are unable to do so. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption. Key aspects include the ability to grant broad or limited powers, the requirement for the principal to be of sound mind when signing, and the necessity for witnesses and notarization to validate the document. Additionally, the form can be customized to reflect specific wishes, allowing for tailored authority that aligns with the principal’s needs. Understanding the implications of this form is vital, as it can significantly impact financial management and healthcare decisions in times of crisis.

Consider More Durable Power of Attorney Templates for Different States

Power of Attorney California Form - It is recommended to review your Durable Power of Attorney periodically to ensure it reflects your current wishes.

To ensure the security of your sensitive information, it's crucial to utilize a reliable Non-disclosure Agreement template that clearly outlines your obligations and protects your interests in any professional dealings. For a comprehensive guide, explore our effective Non-disclosure Agreement solution by visiting our resource here.

Types of Power of Attorney Nj - The Durable Power of Attorney empowers your agent to act without court intervention.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it is essential to approach the task carefully. Here are nine important guidelines to follow:

- Do: Clearly identify the principal and the agent to avoid any confusion.

- Do: Specify the powers granted to the agent in detail.

- Do: Sign the document in the presence of a notary public.

- Do: Keep a copy of the signed form for your records.

- Do: Discuss your wishes and intentions with the agent before completing the form.

- Don't: Leave any sections blank, as this may lead to misunderstandings.

- Don't: Use vague language that could be misinterpreted.

- Don't: Forget to date the document when you sign it.

- Don't: Assume that the form is valid without proper notarization.

Following these guidelines will help ensure that your Durable Power of Attorney form accurately reflects your intentions and provides the necessary authority to your agent.

Florida Durable Power of Attorney Sample

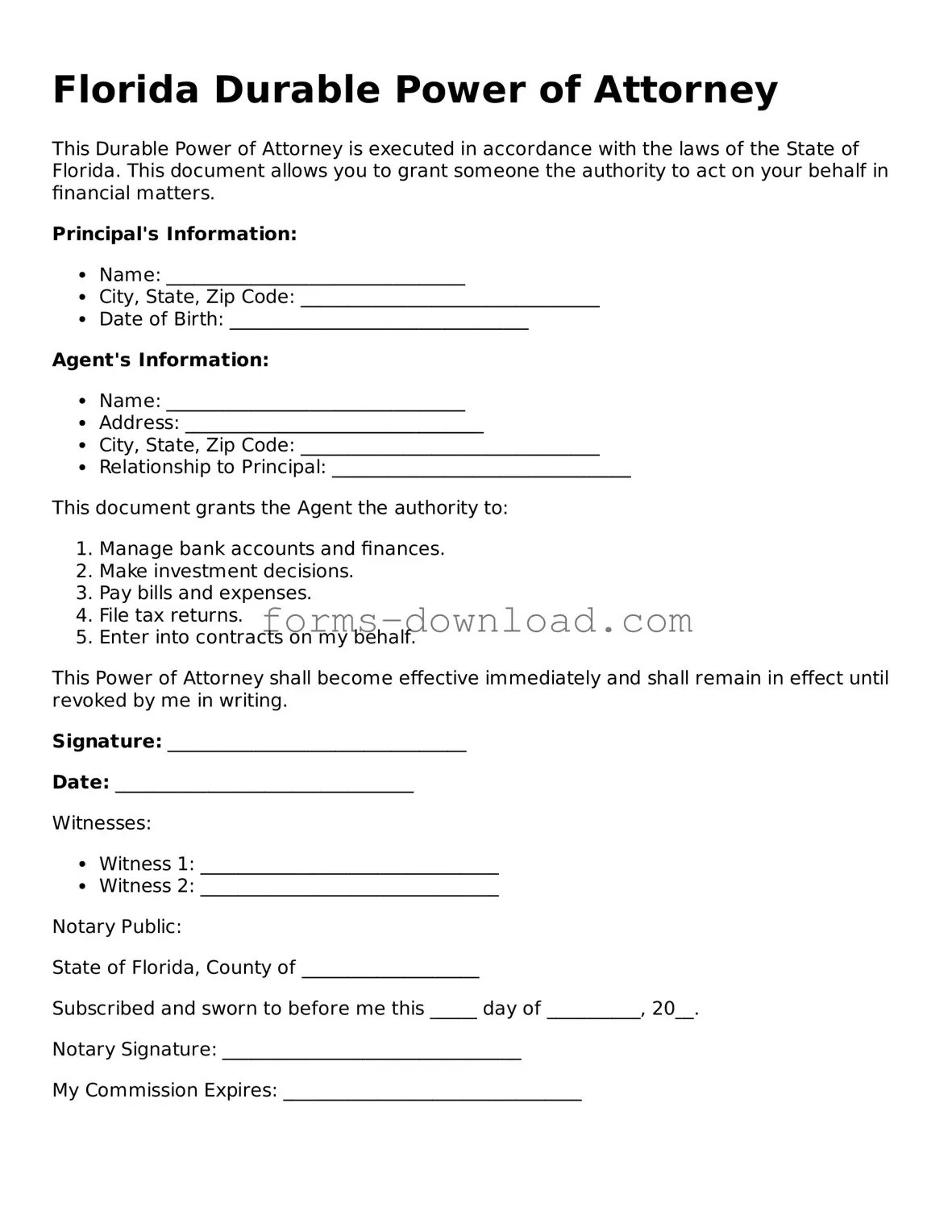

Florida Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the State of Florida. This document allows you to grant someone the authority to act on your behalf in financial matters.

Principal's Information:

- Name: ________________________________

- City, State, Zip Code: ________________________________

- Date of Birth: ________________________________

Agent's Information:

- Name: ________________________________

- Address: ________________________________

- City, State, Zip Code: ________________________________

- Relationship to Principal: ________________________________

This document grants the Agent the authority to:

- Manage bank accounts and finances.

- Make investment decisions.

- Pay bills and expenses.

- File tax returns.

- Enter into contracts on my behalf.

This Power of Attorney shall become effective immediately and shall remain in effect until revoked by me in writing.

Signature: ________________________________

Date: ________________________________

Witnesses:

- Witness 1: ________________________________

- Witness 2: ________________________________

Notary Public:

State of Florida, County of ___________________

Subscribed and sworn to before me this _____ day of __________, 20__.

Notary Signature: ________________________________

My Commission Expires: ________________________________

Listed Questions and Answers

-

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows you to appoint someone you trust to manage your financial and legal affairs on your behalf. This authority remains effective even if you become incapacitated. It ensures that your affairs can be handled without interruption.

-

Who can be appointed as an agent?

You can appoint any competent adult as your agent. This includes family members, friends, or professionals. It is crucial to choose someone who is trustworthy and capable of making decisions in your best interest.

-

What powers can I grant my agent?

You have the flexibility to grant a wide range of powers to your agent. These can include managing bank accounts, paying bills, handling real estate transactions, and making investment decisions. You can specify which powers you want to include or limit the authority as you see fit.

-

Do I need to have my Durable Power of Attorney notarized?

Yes, in Florida, your Durable Power of Attorney must be signed in the presence of a notary public. This helps to ensure the document is valid and can be recognized by financial institutions and other entities. Additionally, it is advisable to have witnesses present during the signing.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you must create a written document stating your intention to revoke it. You should also notify your agent and any institutions that may have a copy of the original document.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Florida Durable Power of Attorney allows an individual (the principal) to appoint someone else (the agent) to manage their financial affairs, even if the principal becomes incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes Chapter 709. |

| Durability | This form remains effective even if the principal becomes mentally incapacitated, ensuring continuous management of their affairs. |

| Agent's Authority | The agent can perform a wide range of financial tasks, including managing bank accounts, paying bills, and handling real estate transactions. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. |

| Witness and Notary Requirements | The form must be signed by the principal in the presence of two witnesses and a notary public to be valid. |