Attorney-Approved Golf Cart Bill of Sale Document for the State of Florida

When buying or selling a golf cart in Florida, having a proper bill of sale is essential for both parties involved in the transaction. This document serves as a formal record of the sale and outlines key details such as the names and addresses of the buyer and seller, the date of the transaction, and a description of the golf cart being sold, including its make, model, and Vehicle Identification Number (VIN). Additionally, the bill of sale may include the purchase price and any terms of the sale, such as whether the cart is being sold "as-is" or with warranties. By using a Golf Cart Bill of Sale form, both the buyer and seller can protect their interests and ensure a smooth transfer of ownership. This form not only helps in maintaining transparency but also serves as proof of ownership should any disputes arise in the future. Understanding the importance of this document can help facilitate a hassle-free transaction and ensure compliance with Florida regulations.

Dos and Don'ts

When filling out the Florida Golf Cart Bill of Sale form, there are several important dos and don'ts to keep in mind. Following these guidelines will help ensure that your transaction goes smoothly and is legally binding.

- Do provide accurate information about the golf cart, including the make, model, year, and Vehicle Identification Number (VIN).

- Do include the names and addresses of both the buyer and the seller to avoid any confusion later.

- Do clearly state the sale price and any terms of the sale, such as payment methods or conditions.

- Do sign and date the form to make it official. Both parties should sign to acknowledge the transaction.

- Don't leave any sections blank. Fill out every part of the form to prevent misunderstandings.

- Don't forget to keep a copy of the completed bill of sale for your records. This is important for both the buyer and seller.

Florida Golf Cart Bill of Sale Sample

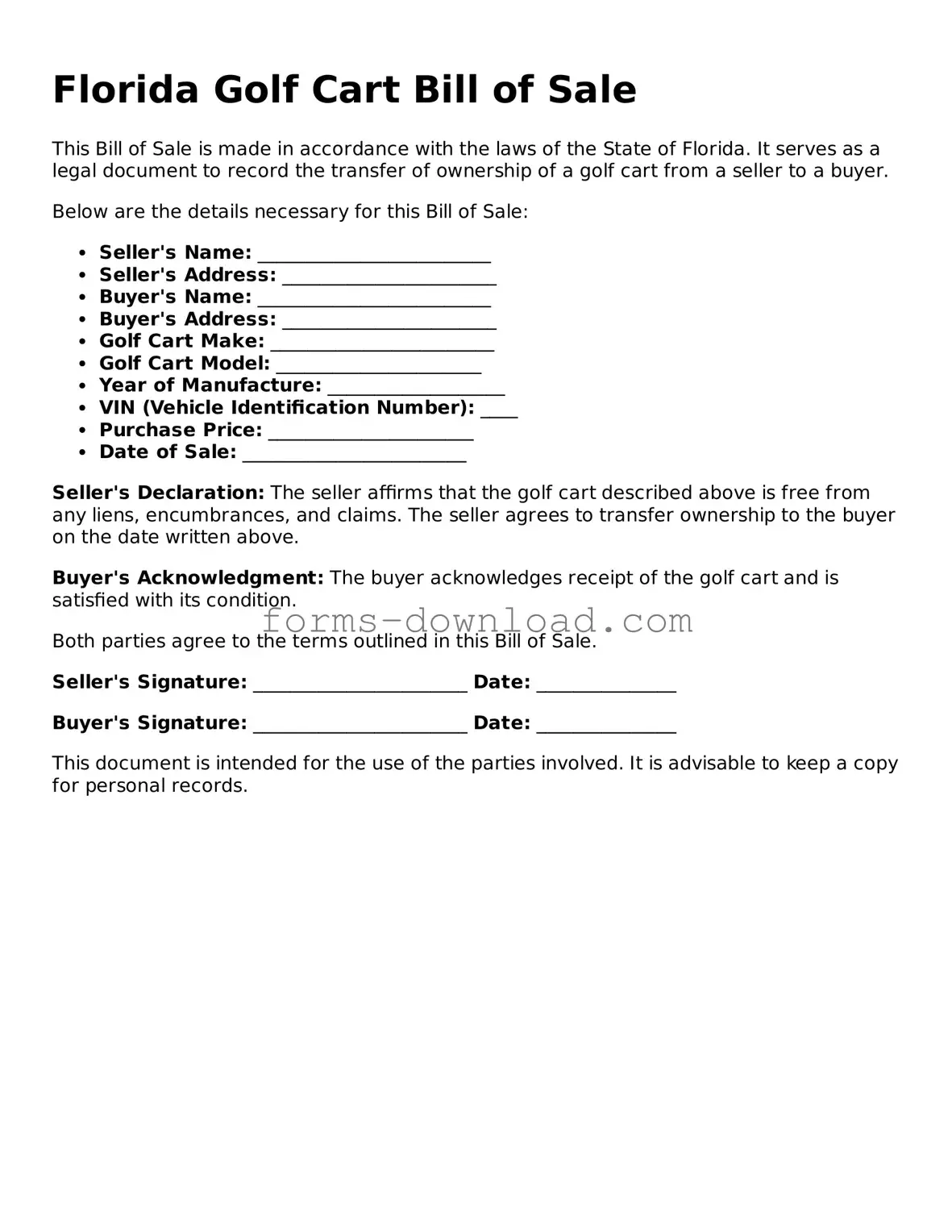

Florida Golf Cart Bill of Sale

This Bill of Sale is made in accordance with the laws of the State of Florida. It serves as a legal document to record the transfer of ownership of a golf cart from a seller to a buyer.

Below are the details necessary for this Bill of Sale:

- Seller's Name: _________________________

- Seller's Address: _______________________

- Buyer's Name: _________________________

- Buyer's Address: _______________________

- Golf Cart Make: ________________________

- Golf Cart Model: ______________________

- Year of Manufacture: ___________________

- VIN (Vehicle Identification Number): ____

- Purchase Price: ______________________

- Date of Sale: ________________________

Seller's Declaration: The seller affirms that the golf cart described above is free from any liens, encumbrances, and claims. The seller agrees to transfer ownership to the buyer on the date written above.

Buyer's Acknowledgment: The buyer acknowledges receipt of the golf cart and is satisfied with its condition.

Both parties agree to the terms outlined in this Bill of Sale.

Seller's Signature: _______________________ Date: _______________

Buyer's Signature: _______________________ Date: _______________

This document is intended for the use of the parties involved. It is advisable to keep a copy for personal records.

Listed Questions and Answers

-

What is a Florida Golf Cart Bill of Sale?

A Florida Golf Cart Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a golf cart. This form outlines essential details about the transaction, including the buyer's and seller's information, the golf cart's description, and the sale price. It is crucial for both parties to have a record of the sale for legal and tax purposes.

-

Is a Bill of Sale required for golf carts in Florida?

While Florida law does not mandate a Bill of Sale for golf carts, it is highly recommended. Having this document can protect both the buyer and seller by providing a clear record of the transaction. It can also help in registering the golf cart and proving ownership if any disputes arise later.

-

What information should be included in the Bill of Sale?

A comprehensive Bill of Sale should include:

- The full names and addresses of both the buyer and seller.

- The date of the sale.

- A detailed description of the golf cart, including make, model, year, and Vehicle Identification Number (VIN).

- The sale price.

- Any warranties or disclaimers.

- Signatures of both parties.

-

Do I need to have the Bill of Sale notarized?

Notarization is not a requirement for a Florida Golf Cart Bill of Sale, but it can add an extra layer of security to the transaction. Having the document notarized can help verify the identities of both parties and confirm that they willingly entered into the agreement.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. As long as it includes all the necessary information, it is valid. However, using a template or a standard form can simplify the process and ensure that you don't miss any important details.

-

What if the golf cart has a lien on it?

If the golf cart has a lien, it is essential to resolve this before completing the sale. The seller should ensure that any outstanding debts are paid off and that the lien is released. Failing to do so could lead to complications for the buyer, who may inherit the debt.

-

How does a Bill of Sale affect registration?

A Bill of Sale is often required when registering a golf cart with the Florida Department of Highway Safety and Motor Vehicles. It serves as proof of ownership and helps facilitate the registration process. The buyer will need to present the Bill of Sale along with other documents to complete the registration.

-

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, it may be challenging to prove ownership. However, if you have other documentation, such as a registration certificate or receipts related to the purchase, these can help establish your claim. If necessary, you can create a new Bill of Sale with the original parties' consent, detailing the circumstances of the loss.

-

Are there any tax implications when selling a golf cart?

Yes, there may be tax implications when selling a golf cart in Florida. The seller might be required to report the sale on their income tax return, especially if a profit was made. Additionally, the buyer may be responsible for paying sales tax when registering the golf cart. It's advisable to consult with a tax professional to understand the specific obligations.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Florida Golf Cart Bill of Sale form serves as a legal document to transfer ownership of a golf cart from one party to another. |

| Governing Law | This form is governed by Florida Statutes, specifically Chapter 319, which outlines the requirements for vehicle ownership transfers. |

| Information Required | Essential details include the seller's and buyer's names, addresses, the golf cart's make, model, year, and Vehicle Identification Number (VIN). |

| Signatures | Both the seller and buyer must sign the document to validate the transfer of ownership. |

| Notarization | While notarization is not mandatory, it is recommended to enhance the document's credibility and prevent disputes. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed Bill of Sale for their records, as it may be needed for future reference. |

| Usage | This form can be used for both new and used golf carts, ensuring a smooth transaction process for both parties involved. |