Attorney-Approved Lady Bird Deed Document for the State of Florida

The Florida Lady Bird Deed, also known as an enhanced life estate deed, is a powerful estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This unique form provides the ability to maintain control over the property, enabling the original owner to live in and manage the property without interference from the beneficiaries. One of the key advantages of the Lady Bird Deed is that it bypasses the often lengthy and costly probate process, ensuring a smoother transition of property upon the owner's passing. Additionally, it offers flexibility, as the owner can change beneficiaries or revoke the deed entirely if their circumstances change. This form is particularly beneficial for those looking to protect their assets from potential creditors or Medicaid claims, making it an attractive option for many Florida residents. Understanding the nuances of this deed is essential for anyone considering estate planning in the Sunshine State, as it combines the benefits of a life estate with the ease of transfer upon death.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, there are important guidelines to follow. Here are some dos and don'ts to keep in mind:

- Do ensure that you have the correct legal description of the property.

- Do clearly state the names of all individuals involved in the deed.

- Don't leave any sections of the form blank; incomplete forms may lead to issues.

- Don't forget to have the deed notarized to ensure its validity.

Florida Lady Bird Deed Sample

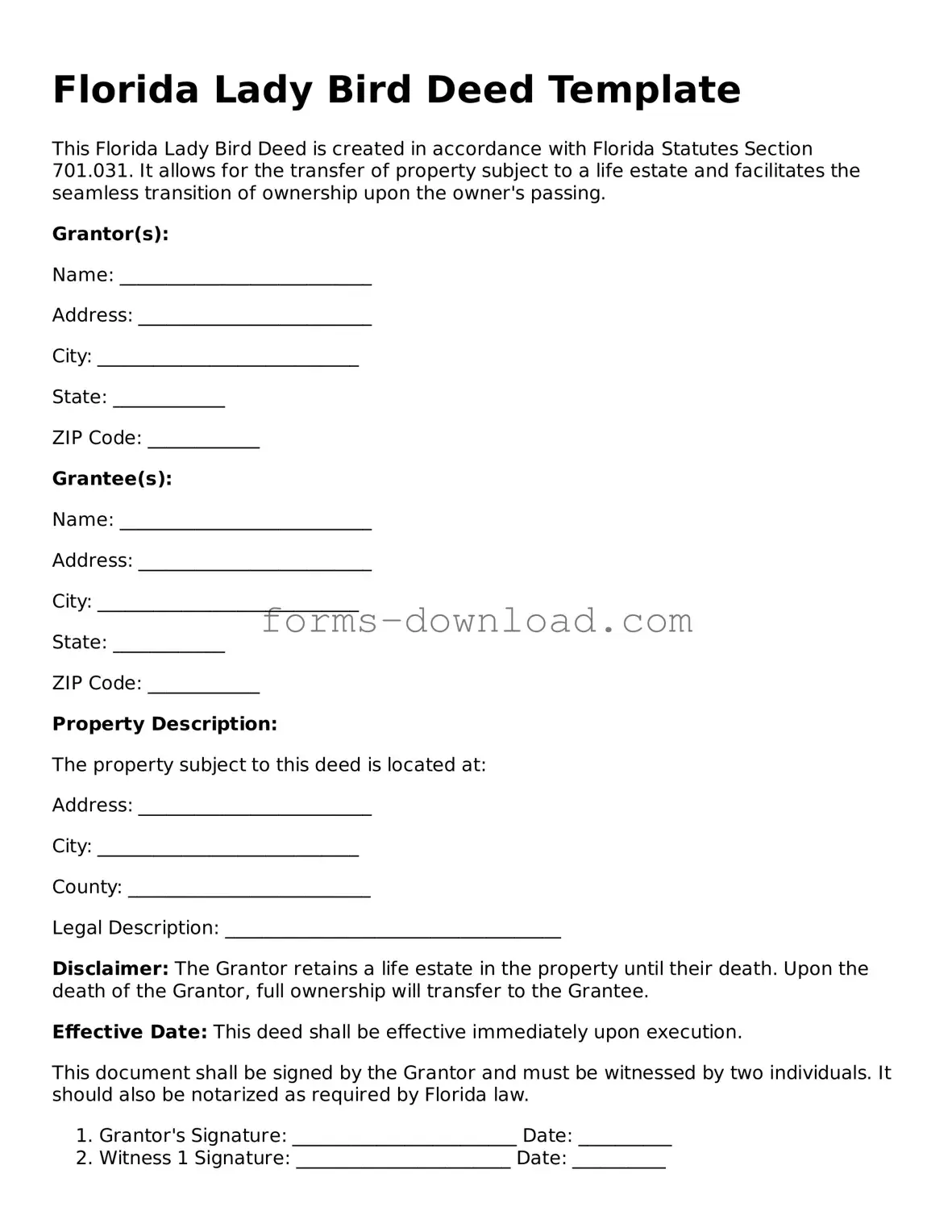

Florida Lady Bird Deed Template

This Florida Lady Bird Deed is created in accordance with Florida Statutes Section 701.031. It allows for the transfer of property subject to a life estate and facilitates the seamless transition of ownership upon the owner's passing.

Grantor(s):

Name: ___________________________

Address: _________________________

City: ____________________________

State: ____________

ZIP Code: ____________

Grantee(s):

Name: ___________________________

Address: _________________________

City: ____________________________

State: ____________

ZIP Code: ____________

Property Description:

The property subject to this deed is located at:

Address: _________________________

City: ____________________________

County: __________________________

Legal Description: ____________________________________

Disclaimer: The Grantor retains a life estate in the property until their death. Upon the death of the Grantor, full ownership will transfer to the Grantee.

Effective Date: This deed shall be effective immediately upon execution.

This document shall be signed by the Grantor and must be witnessed by two individuals. It should also be notarized as required by Florida law.

- Grantor's Signature: ________________________ Date: __________

- Witness 1 Signature: _______________________ Date: __________

- Witness 2 Signature: _______________________ Date: __________

- Notary Public Signature: ____________________ Date: __________

After execution, the deed must be recorded in the public records of the appropriate county to ensure its legal effectiveness.

Listed Questions and Answers

-

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed helps avoid probate and can offer tax benefits.

-

How does a Lady Bird Deed work?

When a property owner executes a Lady Bird Deed, they maintain full control over the property. They can sell, mortgage, or change the beneficiaries at any time without needing the consent of the beneficiaries. Upon the owner's death, the property automatically transfers to the designated beneficiaries, bypassing the probate process.

-

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed:

- Avoids probate, which can be a lengthy and costly process.

- Allows the property owner to retain control over the property during their lifetime.

- Potentially reduces estate taxes.

- Provides flexibility to change beneficiaries as needed.

-

Are there any drawbacks to a Lady Bird Deed?

While there are many benefits, there are also some drawbacks to consider. For instance, if the property owner requires Medicaid assistance, the property may still be counted as an asset, which could affect eligibility. Additionally, if the property appreciates significantly, capital gains taxes may apply to the beneficiaries upon transfer.

-

Who can create a Lady Bird Deed?

Any individual who owns property in Florida can create a Lady Bird Deed. This includes homeowners, co-owners, and even those who hold property in a trust. However, it is advisable to consult with an attorney or a qualified professional to ensure that the deed is executed correctly and meets all legal requirements.

-

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, the property owner must draft the deed, including specific language that indicates the retention of a life estate and the transfer of the property upon death. The deed must then be signed, notarized, and recorded with the county clerk's office where the property is located. It is highly recommended to seek legal assistance to ensure compliance with all local laws and regulations.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | The Florida Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Retained Control | Property owners can continue to live in and use the property, even after the deed is executed. |

| Automatic Transfer | Upon the death of the property owner, the property automatically transfers to the designated beneficiaries without going through probate. |

| Tax Benefits | This deed can help avoid capital gains taxes for beneficiaries since the property receives a step-up in basis at the owner's death. |

| Governing Law | The Florida Lady Bird Deed is governed by Florida Statutes, specifically under Chapter 732, which addresses wills and intestacy. |

| Beneficiary Designation | Property owners can name multiple beneficiaries and specify how the property is divided among them. |

| Revocability | The deed can be revoked or modified at any time during the property owner's lifetime. |

| Eligibility | Any individual who owns real property in Florida can create a Lady Bird Deed, provided they are of sound mind. |

| Legal Assistance | While individuals can create a Lady Bird Deed without an attorney, legal guidance is often recommended to ensure compliance with state laws. |

| Common Uses | This deed is commonly used for estate planning, particularly for avoiding probate and facilitating the transfer of family homes. |