Attorney-Approved Loan Agreement Document for the State of Florida

In the realm of financial transactions, the Florida Loan Agreement form plays a crucial role in establishing clear terms between borrowers and lenders. This form serves as a legally binding document that outlines the specifics of the loan, including the principal amount, interest rate, repayment schedule, and any collateral involved. It is essential for both parties to understand their rights and obligations under this agreement. Additionally, the form typically includes provisions related to default, which detail the consequences should the borrower fail to meet repayment terms. By addressing these key components, the Florida Loan Agreement not only facilitates a smoother lending process but also helps to prevent misunderstandings that could lead to disputes. Moreover, it often contains clauses that govern the resolution of conflicts, ensuring that both parties have a clear path to follow in case of disagreements. Understanding the intricacies of this form is vital for anyone involved in borrowing or lending in Florida, as it lays the foundation for a successful financial relationship.

Consider More Loan Agreement Templates for Different States

Promissory Note Template California - A detailed agreement can enhance trust between parties involved.

To navigate the complexities of estate planning, utilizing an effective guide for your Arizona Last Will and Testament form can be invaluable. By ensuring that this critical document reflects your wishes, you can achieve peace of mind for yourself and your loved ones. For more information, refer to this helpful resource on Last Will and Testament documentation.

Dos and Don'ts

When filling out a Florida Loan Agreement form, it's essential to approach the process with care. Here’s a helpful list of things to do and avoid to ensure that your agreement is completed correctly.

- Do: Read the entire agreement carefully before filling it out.

- Do: Provide accurate information regarding your personal and financial details.

- Do: Ensure that all parties involved sign the document.

- Do: Keep a copy of the completed agreement for your records.

- Don't: Rush through the form; take your time to avoid mistakes.

- Don't: Leave any sections blank; fill out all required fields.

- Don't: Use unclear or vague language; be specific in your descriptions.

- Don't: Ignore the terms and conditions; understand your obligations before signing.

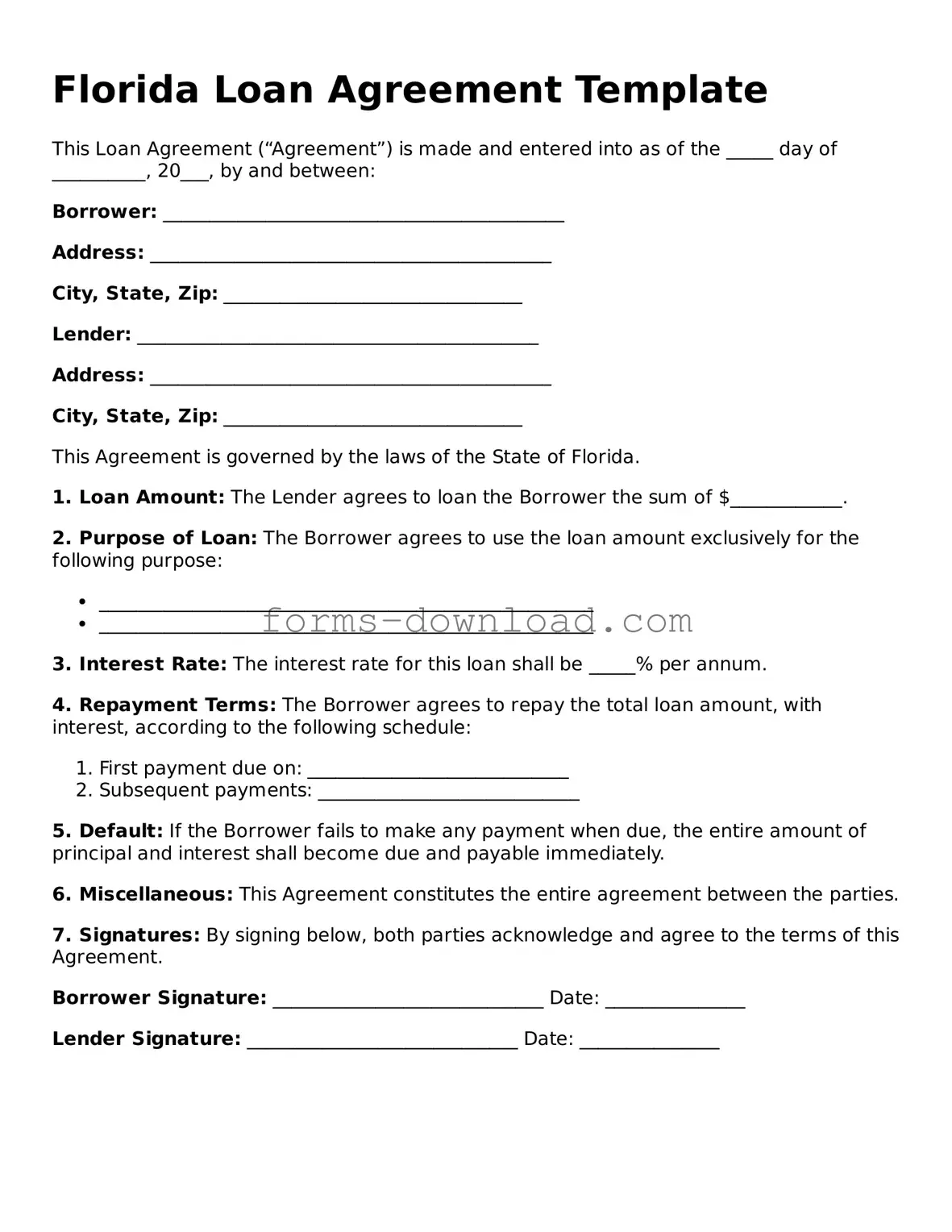

Florida Loan Agreement Sample

Florida Loan Agreement Template

This Loan Agreement (“Agreement”) is made and entered into as of the _____ day of __________, 20___, by and between:

Borrower: ___________________________________________

Address: ___________________________________________

City, State, Zip: ________________________________

Lender: ___________________________________________

Address: ___________________________________________

City, State, Zip: ________________________________

This Agreement is governed by the laws of the State of Florida.

1. Loan Amount: The Lender agrees to loan the Borrower the sum of $____________.

2. Purpose of Loan: The Borrower agrees to use the loan amount exclusively for the following purpose:

- _____________________________________________________

- _____________________________________________________

3. Interest Rate: The interest rate for this loan shall be _____% per annum.

4. Repayment Terms: The Borrower agrees to repay the total loan amount, with interest, according to the following schedule:

- First payment due on: ____________________________

- Subsequent payments: ____________________________

5. Default: If the Borrower fails to make any payment when due, the entire amount of principal and interest shall become due and payable immediately.

6. Miscellaneous: This Agreement constitutes the entire agreement between the parties.

7. Signatures: By signing below, both parties acknowledge and agree to the terms of this Agreement.

Borrower Signature: _____________________________ Date: _______________

Lender Signature: _____________________________ Date: _______________

Listed Questions and Answers

-

What is a Florida Loan Agreement?

A Florida Loan Agreement is a legal document that outlines the terms and conditions under which one party lends money to another in the state of Florida. This agreement details the amount borrowed, interest rates, repayment schedules, and any collateral involved. It serves to protect both the lender and the borrower by clearly defining their rights and responsibilities.

-

Who can use a Florida Loan Agreement?

Any individual or business in Florida can use a Loan Agreement. This includes personal loans between friends or family, business loans, and even loans for real estate transactions. However, it’s important that all parties involved understand the terms and agree to them.

-

What should be included in a Florida Loan Agreement?

A comprehensive Loan Agreement should include:

- The names and addresses of the lender and borrower.

- The principal amount of the loan.

- The interest rate and how it is calculated.

- The repayment schedule, including due dates.

- Any collateral securing the loan.

- Consequences of default or late payments.

- Governing law and dispute resolution procedures.

-

Is it necessary to have a Loan Agreement in writing?

While verbal agreements can be legally binding, having a Loan Agreement in writing is highly recommended. A written document provides clear evidence of the terms agreed upon and helps prevent misunderstandings or disputes in the future.

-

Can I modify a Florida Loan Agreement?

Yes, a Loan Agreement can be modified if both parties agree to the changes. It’s best to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the loan?

If the borrower fails to repay the loan as agreed, the lender may have several options, including pursuing legal action to recover the owed amount. The specific consequences for default should be outlined in the Loan Agreement, so both parties understand the potential outcomes.

-

Are there any specific laws governing Loan Agreements in Florida?

Yes, Florida has specific laws that govern lending practices, including interest rates and usury laws. It’s important for both lenders and borrowers to be aware of these regulations to ensure that the Loan Agreement complies with state laws.

-

Do I need a lawyer to draft a Loan Agreement?

While it’s not mandatory to hire a lawyer, consulting with one can be beneficial, especially for larger loans or complex agreements. A legal expert can help ensure that the agreement is properly drafted and compliant with Florida law, providing peace of mind for both parties.

-

Can a Loan Agreement be enforced in court?

Yes, a properly executed Loan Agreement can be enforced in a Florida court. If disputes arise, having a written agreement makes it easier for either party to present their case and seek resolution.

-

What should I do if I have more questions about Loan Agreements?

If you have additional questions or need specific legal advice regarding a Loan Agreement, consider reaching out to a qualified attorney. They can provide guidance tailored to your situation and help you navigate the complexities of loan agreements.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida, specifically under Florida Statutes Chapter 687. |

| Loan Amount | The form specifies the total amount of money being loaned, which must be clearly stated to avoid confusion. |

| Interest Rate | The interest rate applicable to the loan is defined in the agreement, which can be fixed or variable. |

| Repayment Terms | Details regarding how and when the borrower will repay the loan are included, ensuring both parties understand their obligations. |

| Default Conditions | The form outlines what constitutes a default, including the consequences for the borrower if they fail to meet their obligations. |

| Signatures | Both the lender and borrower must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

| Amendments | The form may include provisions for amendments, allowing for changes to be made with mutual consent of both parties. |