Attorney-Approved Operating Agreement Document for the State of Florida

The Florida Operating Agreement form serves as a foundational document for limited liability companies (LLCs) operating within the state. This agreement outlines the management structure, operational procedures, and financial arrangements of the LLC. It typically includes essential provisions such as the roles and responsibilities of members, guidelines for decision-making, and procedures for adding or removing members. Additionally, the form addresses how profits and losses will be distributed among members, ensuring clarity in financial matters. Importantly, it also provides mechanisms for resolving disputes, which can help prevent conflicts and maintain harmony among members. By establishing these critical aspects, the Operating Agreement not only protects the interests of individual members but also enhances the overall functionality and sustainability of the business entity.

Consider More Operating Agreement Templates for Different States

How to File Operating Agreement Llc - This agreement is important for securing investment and funding.

Having the right documentation is essential when it comes to the sale of a vessel, and the Bill of Sale for a Boat is vital for ensuring a smooth transaction in Washington. This form not only protects the interests of both the buyer and seller but also provides a clear record of the boat ownership transfer, making it a key component for anyone looking to navigate the waters of boat sales effectively.

Operating Agreement Llc California Template - An Operating Agreement outlines the management structure of a business entity.

Dos and Don'ts

When filling out the Florida Operating Agreement form, it is essential to be mindful of certain practices. Here are six things you should and shouldn't do:

- Do read the entire form carefully before beginning to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do consult with a legal professional if you have any questions.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this could lead to rejection.

- Don't use unclear or ambiguous language; clarity is key.

Florida Operating Agreement Sample

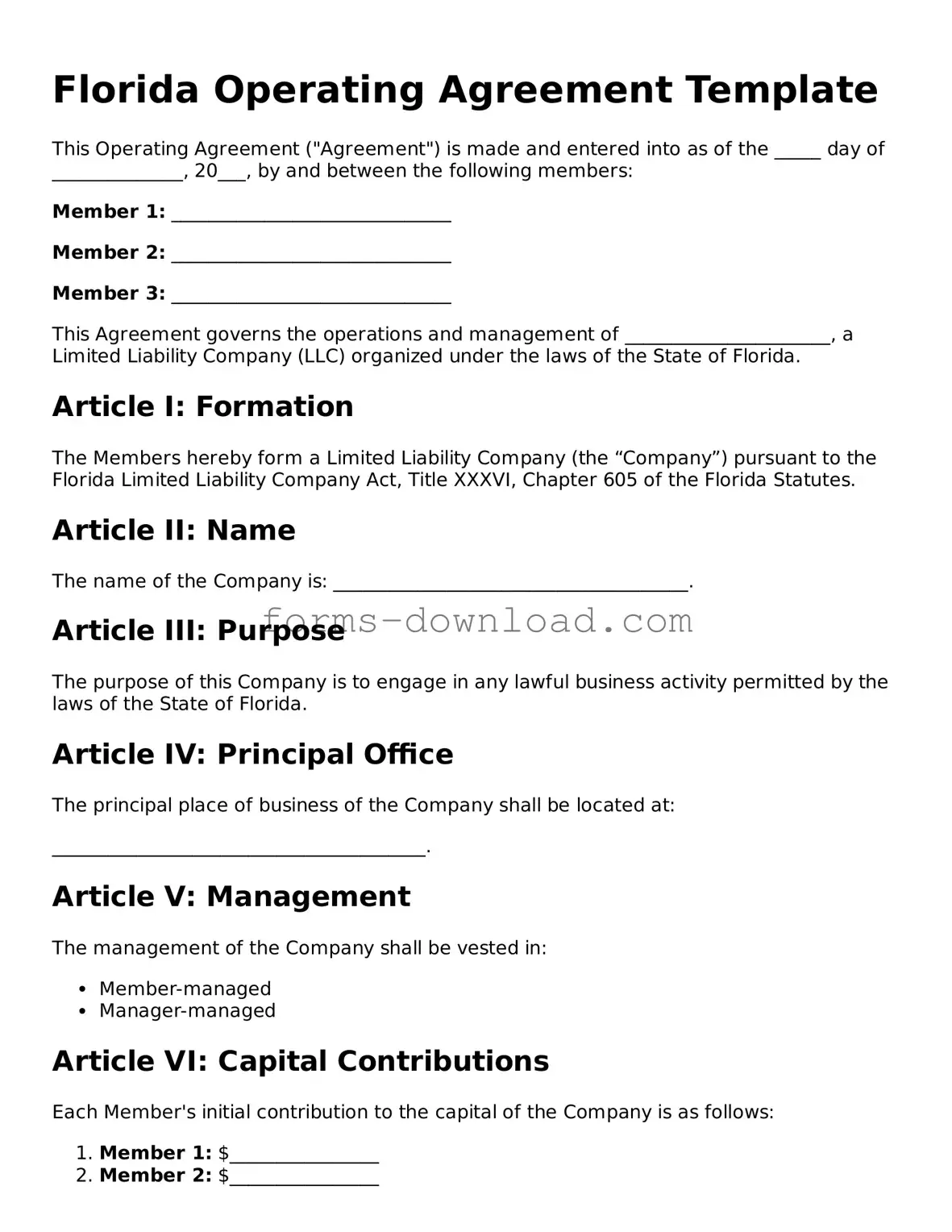

Florida Operating Agreement Template

This Operating Agreement ("Agreement") is made and entered into as of the _____ day of ______________, 20___, by and between the following members:

Member 1: ______________________________

Member 2: ______________________________

Member 3: ______________________________

This Agreement governs the operations and management of ______________________, a Limited Liability Company (LLC) organized under the laws of the State of Florida.

Article I: Formation

The Members hereby form a Limited Liability Company (the “Company”) pursuant to the Florida Limited Liability Company Act, Title XXXVI, Chapter 605 of the Florida Statutes.

Article II: Name

The name of the Company is: ______________________________________.

Article III: Purpose

The purpose of this Company is to engage in any lawful business activity permitted by the laws of the State of Florida.

Article IV: Principal Office

The principal place of business of the Company shall be located at:

________________________________________.

Article V: Management

The management of the Company shall be vested in:

- Member-managed

- Manager-managed

Article VI: Capital Contributions

Each Member's initial contribution to the capital of the Company is as follows:

- Member 1: $________________

- Member 2: $________________

- Member 3: $________________

Article VII: Profits and Losses

Profits and losses of the Company shall be allocated to the Members in proportion to their respective percentage interests as follows:

Member 1: _____ %

Member 2: _____ %

Member 3: _____ %

Article VIII: Distributions

Distributions shall be made to the Members at the times and in the amounts determined by the Members.

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

IN WITNESS WHEREOF

the parties hereto have executed this Operating Agreement as of the date first above written.

Member 1 Signature: ____________________________ Date: ________

Member 2 Signature: ____________________________ Date: ________

Member 3 Signature: ____________________________ Date: ________

Listed Questions and Answers

-

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in Florida. It serves as a blueprint for how the company will function, detailing the roles of members, management structure, and financial arrangements.

-

Why do I need an Operating Agreement for my LLC?

While Florida law does not require an Operating Agreement, having one is highly recommended. It helps clarify the rights and responsibilities of members, reduces the risk of disputes, and provides a clear framework for decision-making. This document can also protect your personal assets by reinforcing the LLC's status as a separate entity.

-

What should be included in the Operating Agreement?

An Operating Agreement typically includes:

- The name and purpose of the LLC

- The names and addresses of the members

- The management structure (member-managed or manager-managed)

- Voting rights and procedures

- Profit and loss distribution

- Procedures for adding or removing members

- Dispute resolution methods

-

Can I create an Operating Agreement on my own?

Yes, you can draft your own Operating Agreement. However, it’s important to ensure that it complies with Florida laws and accurately reflects your business intentions. Many people choose to consult with a legal professional to ensure all necessary elements are included and correctly structured.

-

How does an Operating Agreement affect taxes?

The Operating Agreement itself does not directly affect how your LLC is taxed. However, it can outline how profits and losses are distributed among members, which can impact each member's individual tax situation. It's wise to consult a tax professional to understand the implications fully.

-

Do I need to file the Operating Agreement with the state?

No, you do not need to file your Operating Agreement with the state of Florida. This document is kept internally among the members of the LLC. However, it is crucial to have it readily available for reference, especially in case of disputes or when making significant business decisions.

-

How often should I update my Operating Agreement?

You should review and update your Operating Agreement whenever there are significant changes in your business, such as adding new members, changing the management structure, or altering profit distribution. Regular updates ensure that the document remains relevant and accurately reflects your business operations.

-

What happens if I don’t have an Operating Agreement?

If your LLC does not have an Operating Agreement, Florida law will default to the state's rules regarding LLCs. This can lead to unexpected outcomes in terms of management, profit distribution, and member rights. Without a customized agreement, members may face challenges in resolving disputes or making decisions.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Florida Operating Agreement outlines the management structure and operational procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by Florida Statutes, specifically Chapter 605, which pertains to LLCs. |

| Members' Rights | It defines the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Flexibility | Florida law allows significant flexibility in structuring the agreement, enabling members to tailor it to their specific needs. |

| Written Requirement | While not mandatory, having a written Operating Agreement is highly recommended to prevent disputes and clarify expectations. |

| Amendments | The agreement can be amended as needed, provided that all members agree to the changes in writing. |

| Duration | The Operating Agreement can specify the duration of the LLC, whether it is perpetual or for a defined term. |