Attorney-Approved Promissory Note Document for the State of Florida

In Florida, a Promissory Note serves as a crucial financial document that outlines the agreement between a borrower and a lender regarding a loan. This form details important aspects such as the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, it specifies the consequences of default, which can include late fees or legal action. The document is typically signed by both parties to indicate their consent and understanding of the terms. In Florida, it is important to ensure that the Promissory Note complies with state laws to be enforceable in court. Furthermore, the note can be secured or unsecured, depending on whether collateral is involved. Understanding these elements is vital for both lenders and borrowers, as it provides clarity and protection for both parties involved in the transaction.

Consider More Promissory Note Templates for Different States

Promissory Note Washington State - A promissory note typically includes details such as the loan amount, interest rate, and repayment schedule.

When dealing with financial transactions or loan applications, having access to a Sample Tax Return Transcript form can greatly assist in providing a clear overview of your federal tax return details, including income, deductions, and credits claimed, which are crucial for verifying your tax information.

Arizona Promissory Note - This document can strengthen trust between private lenders and borrowers.

Dos and Don'ts

When filling out the Florida Promissory Note form, it’s important to be careful and thorough. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and lender.

- Do clearly state the loan amount and interest rate.

- Do specify the repayment terms, including due dates.

- Do sign and date the document in the appropriate places.

- Don't leave any sections blank; fill out every required field.

- Don't use unclear language or abbreviations that may confuse.

- Don't forget to keep a copy for your records.

- Don't rush through the process; take your time to ensure accuracy.

By following these guidelines, you can help ensure that your Promissory Note is completed correctly and effectively. Good luck!

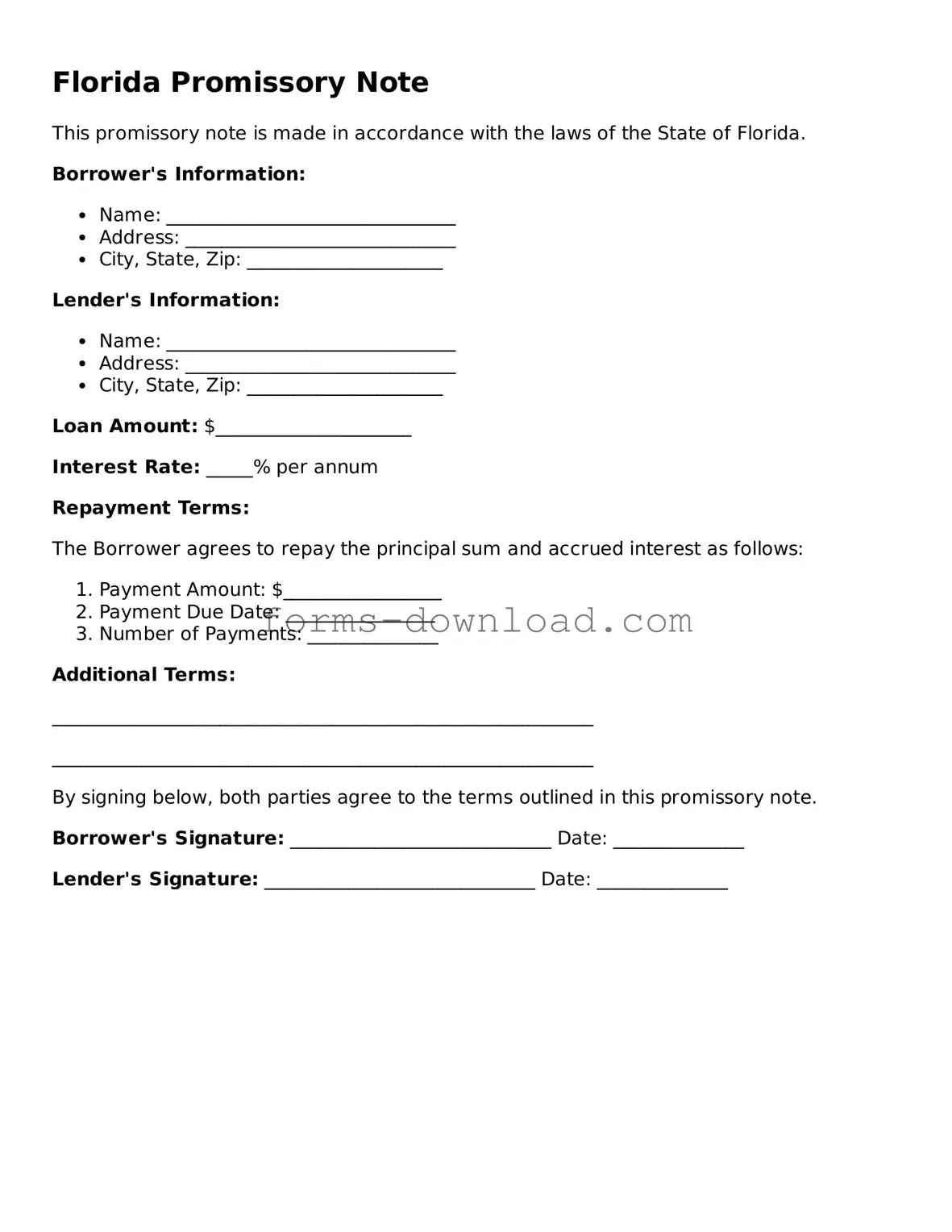

Florida Promissory Note Sample

Florida Promissory Note

This promissory note is made in accordance with the laws of the State of Florida.

Borrower's Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

Lender's Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

Loan Amount: $_____________________

Interest Rate: _____% per annum

Repayment Terms:

The Borrower agrees to repay the principal sum and accrued interest as follows:

- Payment Amount: $_________________

- Payment Due Date: ________________

- Number of Payments: ______________

Additional Terms:

__________________________________________________________

__________________________________________________________

By signing below, both parties agree to the terms outlined in this promissory note.

Borrower's Signature: ____________________________ Date: ______________

Lender's Signature: _____________________________ Date: ______________

Listed Questions and Answers

-

What is a Florida Promissory Note?

A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. This document outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

-

Who typically uses a Promissory Note?

Individuals and businesses often use Promissory Notes for various transactions. Lenders, such as banks or private individuals, may require a Promissory Note when extending credit. Borrowers use it to formalize their commitment to repay the borrowed funds.

-

What are the essential components of a Florida Promissory Note?

- The names and addresses of the borrower and lender.

- The principal amount borrowed.

- The interest rate and how it is calculated.

- The repayment schedule, including due dates.

- Any fees or penalties for late payments.

- Signatures of both parties.

-

Is a Florida Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It serves as evidence of the debt and outlines the obligations of both the borrower and lender. However, it is important that the note complies with Florida law to be enforceable in court.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised note to avoid future disputes.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may involve filing a lawsuit or pursuing other collection methods. The terms of the Promissory Note will dictate the lender's options in case of default.

-

Where can I find a Florida Promissory Note template?

Templates for Florida Promissory Notes are available through various online legal resources, law offices, and document preparation services. It is crucial to ensure that any template used complies with Florida state laws and meets the specific needs of the transaction.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Florida promissory note is a written promise to pay a specified amount of money to a designated party at a future date. |

| Governing Laws | The Florida Uniform Commercial Code (UCC) governs promissory notes in Florida, specifically under Chapter 673. |

| Requirements | To be valid, the note must include the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| Enforceability | A properly executed promissory note can be enforced in court if the borrower fails to repay the loan as agreed. |