Attorney-Approved Transfer-on-Death Deed Document for the State of Florida

The Florida Transfer-on-Death Deed (TODD) form serves as a valuable tool for property owners looking to streamline the transfer of their real estate assets upon death. By utilizing this form, individuals can designate one or more beneficiaries to receive their property without the need for probate, simplifying the process for loved ones during a difficult time. This deed allows property owners to retain full control over their property while they are alive, ensuring that they can sell, mortgage, or otherwise manage their real estate as they see fit. Importantly, the TODD does not take effect until the owner's death, meaning that the property remains part of the owner's estate until that time. This unique feature provides peace of mind, as property owners can change their beneficiaries or revoke the deed entirely if their circumstances or intentions change. Understanding the nuances of the Florida Transfer-on-Death Deed is essential for anyone considering its use, as it involves specific requirements for execution, including the necessity of notarization and witnesses. By navigating these elements carefully, property owners can create a clear and efficient plan for the future transfer of their real estate, ultimately easing the burden on their heirs.

Consider More Transfer-on-Death Deed Templates for Different States

Problems With Transfer on Death Deeds - The contents of the deed should be kept secure to avoid any challenges in the future.

Lady Bird Deed Virginia - Beneficiaries receive an easy transition of ownership, often without any additional taxes.

The Texas Motorcycle Bill of Sale is a legal document that records the sale of a motorcycle between a buyer and a seller. This form serves as proof of ownership transfer and outlines essential details about the transaction. To simplify this process, you can utilize the Bill Of Sale for a Motorcycle, which ensures that all necessary information is included and helps prevent any misunderstandings.

How to File a Transfer on Death Deed - This deed is specific to real property and does not apply to personal or financial assets.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do: Ensure that all property details are accurate and complete.

- Do: Include the full legal names of all parties involved.

- Do: Sign the deed in the presence of a notary public.

- Do: Record the deed with the county clerk’s office promptly.

- Don't: Leave out any required information, as this can invalidate the deed.

- Don't: Use informal or abbreviated names for the parties.

- Don't: Forget to have witnesses present if required.

- Don't: Delay in recording the deed, as timing can affect its validity.

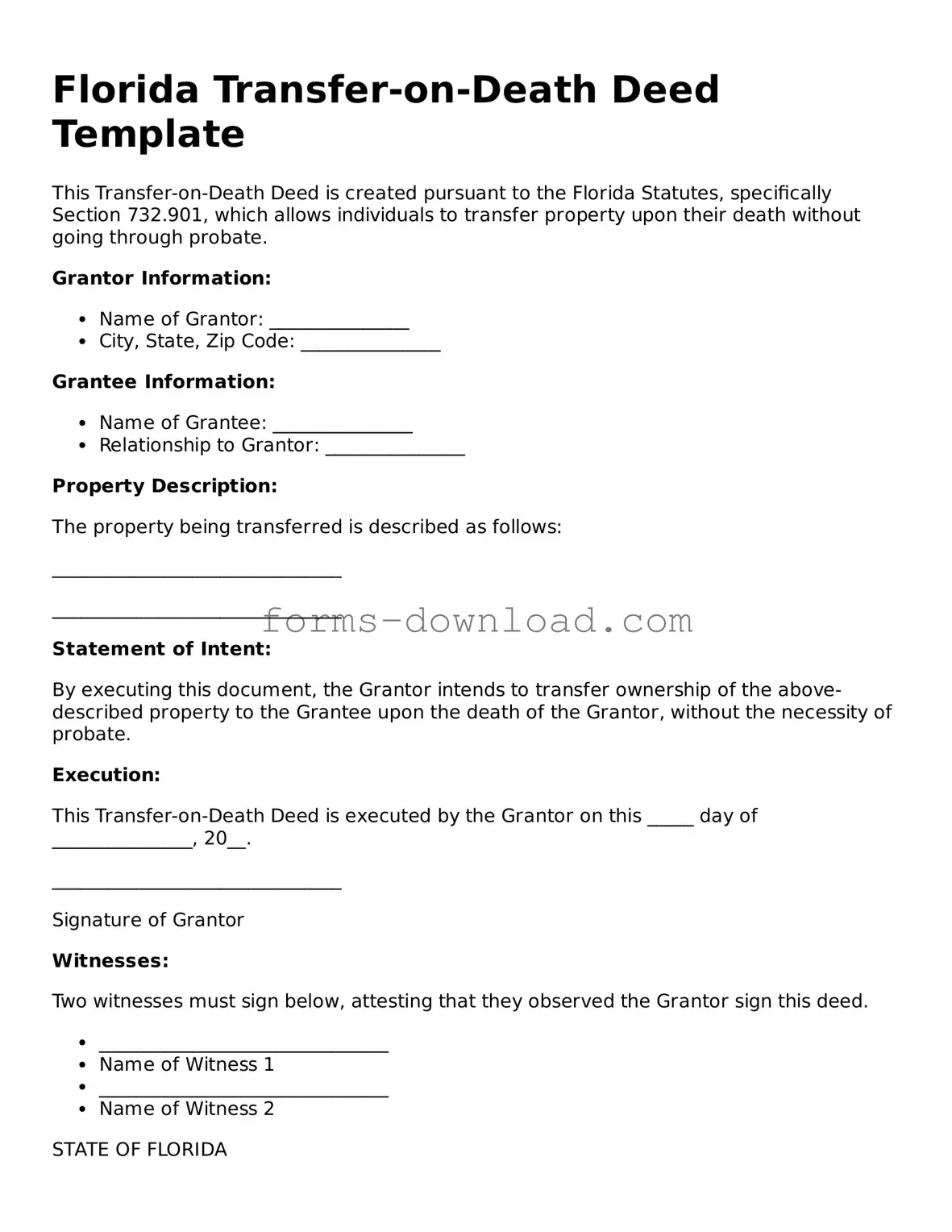

Florida Transfer-on-Death Deed Sample

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created pursuant to the Florida Statutes, specifically Section 732.901, which allows individuals to transfer property upon their death without going through probate.

Grantor Information:

- Name of Grantor: _______________

- City, State, Zip Code: _______________

Grantee Information:

- Name of Grantee: _______________

- Relationship to Grantor: _______________

Property Description:

The property being transferred is described as follows:

_______________________________

_______________________________

Statement of Intent:

By executing this document, the Grantor intends to transfer ownership of the above-described property to the Grantee upon the death of the Grantor, without the necessity of probate.

Execution:

This Transfer-on-Death Deed is executed by the Grantor on this _____ day of _______________, 20__.

_______________________________

Signature of Grantor

Witnesses:

Two witnesses must sign below, attesting that they observed the Grantor sign this deed.

- _______________________________

- Name of Witness 1

- _______________________________

- Name of Witness 2

STATE OF FLORIDA

COUNTY OF _______________

Before me, a Notary Public, personally appeared the Grantor named herein, who is known to me or has provided satisfactory proof of identity, and who executing the deed voluntarily and for the purposes stated herein.

_______________________________

Notary Public Signature

My Commission Expires: _______________

This template provides a clear and simple framework for creating a Transfer-on-Death Deed specific to Florida while making it easy to fill in the necessary information.Listed Questions and Answers

-

What is a Florida Transfer-on-Death Deed?

A Florida Transfer-on-Death Deed allows a property owner to designate a beneficiary who will automatically receive the property upon the owner's death. This deed is effective immediately but does not transfer ownership until the owner passes away. It simplifies the transfer process and helps avoid probate.

-

How do I create a Transfer-on-Death Deed in Florida?

To create a Transfer-on-Death Deed, you need to fill out the appropriate form, which includes details about the property and the designated beneficiary. After completing the form, it must be signed in the presence of a notary public. Finally, you must record the deed with the county clerk's office where the property is located to ensure it is legally recognized.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that clearly states the changes or explicitly revokes the previous deed. It is essential to record the new or revoking deed with the county clerk's office to ensure that your intentions are legally documented.

-

What are the benefits of using a Transfer-on-Death Deed?

The primary benefits include avoiding probate, maintaining control of the property during your lifetime, and allowing for a straightforward transfer to your chosen beneficiary. This deed can also provide peace of mind, knowing that your property will go directly to the intended person without the complications that often arise during the probate process.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, Chapter 732.4015. |

| Eligibility | Any individual who owns real estate in Florida can create a TOD deed, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Property owners can name one or more beneficiaries on the deed, allowing for flexible estate planning. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner before their death, ensuring control over the property. |

| No Immediate Transfer | The transfer of property does not occur until the owner’s death, allowing them to retain full ownership during their lifetime. |

| Property Types | Only certain types of real estate can be transferred via a TOD deed, including residential and commercial properties. |

| Filing Requirements | The deed must be signed and notarized, and it must be recorded with the county clerk’s office to be effective. |

| Tax Implications | There are generally no tax consequences upon the transfer of property through a TOD deed until the beneficiary sells the property. |

| Limitations | Some limitations apply, such as the inability to transfer property that is part of a trust or subject to a mortgage that prohibits transfer. |