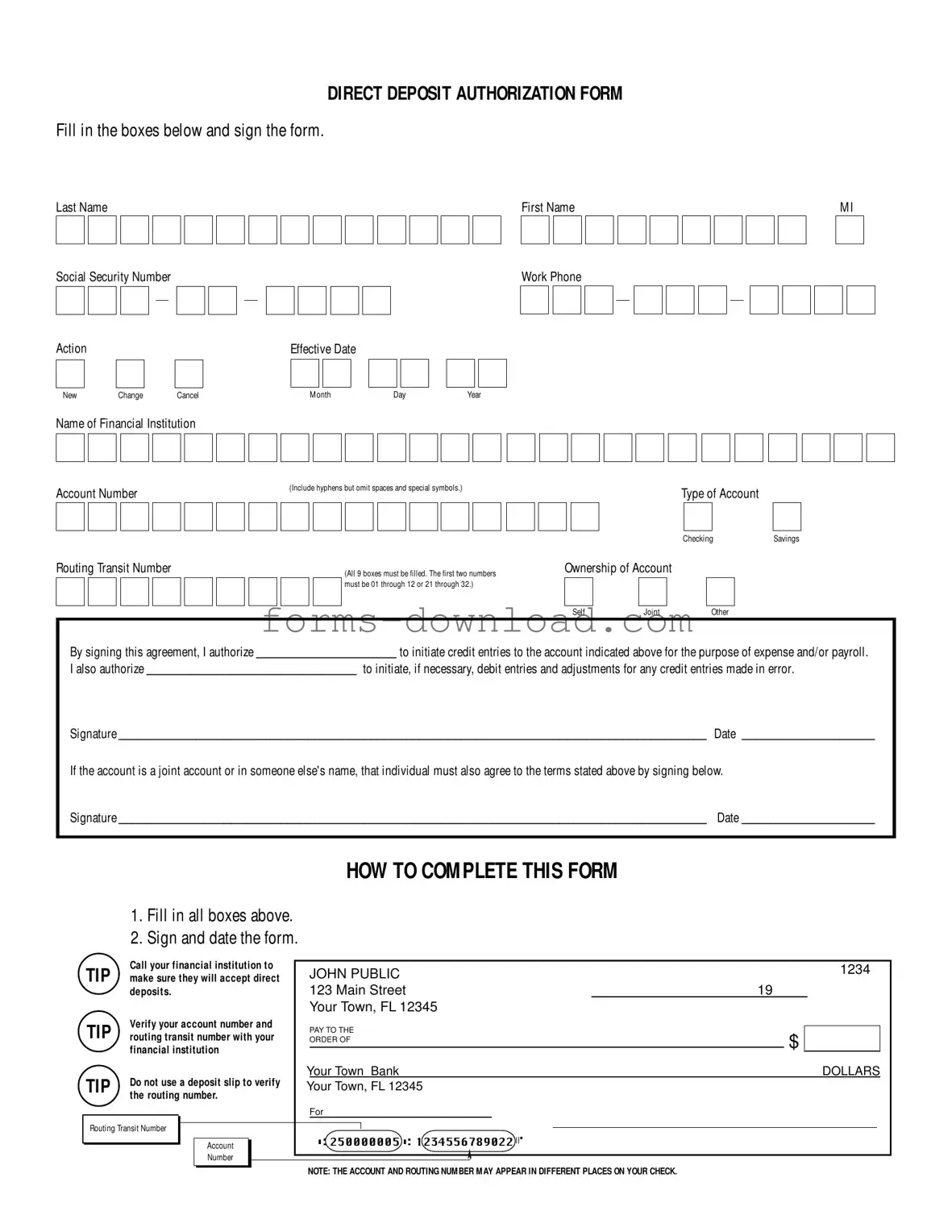

Blank Generic Direct Deposit Form

The Generic Direct Deposit form is a crucial document for individuals looking to streamline their payment processes. It facilitates the automatic transfer of funds into a designated bank account, ensuring timely access to payroll or other payments. The form requires essential personal information, including the individual's name, Social Security number, and contact details. Additionally, it prompts users to specify the type of account—either savings or checking—along with the account number and routing transit number. Accuracy is vital, as the routing number must consist of nine digits, with specific restrictions on the first two numbers. The form also includes sections for authorization, where individuals grant permission for their employer or another entity to initiate credit entries and, if necessary, debit entries to correct any errors. For joint accounts, an additional signature is required, emphasizing the importance of consent from all account holders. Completing the form involves filling out all fields, signing, and dating the document, making it essential to verify account details with the financial institution beforehand. This ensures that the direct deposit setup proceeds smoothly, eliminating potential delays in receiving funds.

More PDF Forms

Petty Cash Receipt Template - Supports good customer relations by providing a formal record of payment.

Cg 2010 07/04 - It includes liability for bodily injury, property damage, or advertising injury.

In addition to the essential functions of the Indiana Boat Bill of Sale form, utilizing resources such as the Vessel Bill of Sale can provide clarity and additional guidance throughout the sales process, helping to ensure that both the seller and buyer are fully informed and adequately protected during the transaction.

Pregnancy Verification Letter Planned Parenthood - Assurance of confidentiality assures a safe space for honest communication.

Dos and Don'ts

When filling out the Generic Direct Deposit form, there are several important dos and don’ts to keep in mind. Following these guidelines can help ensure that your direct deposit is processed smoothly and without errors.

- Do fill in all the required boxes accurately, including your name, Social Security number, and account details.

- Do sign and date the form to validate your authorization for direct deposit.

- Do contact your financial institution to confirm they accept direct deposits and to verify your account and routing numbers.

- Do double-check that the routing transit number is correct; all nine boxes must be filled in.

- Do ensure that if the account is joint or in someone else’s name, that person also signs the form.

- Don’t use a deposit slip to verify your routing number, as this can lead to inaccuracies.

- Don’t leave any boxes blank, as this may delay the processing of your direct deposit.

- Don’t forget to check that the first two numbers of your routing number fall within the specified ranges (01-12 or 21-32).

- Don’t submit the form without ensuring that all information is correct and complete.

- Don’t assume your financial institution will automatically accept the information provided without verification.

Generic Direct Deposit Sample

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Listed Questions and Answers

-

What is a Generic Direct Deposit form?

The Generic Direct Deposit form is a document that allows you to authorize your employer or another organization to deposit your pay or other funds directly into your bank account. This process is convenient and helps ensure timely payments.

-

How do I fill out the Generic Direct Deposit form?

To complete the form, fill in all the required fields, including your name, Social Security number, and account details. Make sure to specify whether you are opening a new account, changing an existing one, or canceling your direct deposit. Finally, sign and date the form.

-

What information do I need to provide?

You will need to provide your last name, first name, middle initial, Social Security number, work phone number, name of your financial institution, account number, routing transit number, and the type of account (checking or savings).

-

What is a routing transit number?

The routing transit number is a nine-digit code that identifies your bank or credit union. It is essential for processing direct deposits and other electronic transactions. Make sure to verify this number with your financial institution to avoid errors.

-

What if my account is a joint account?

If the account you are using for direct deposit is a joint account or in someone else's name, that individual must also sign the form. This ensures that all account holders agree to the terms of the direct deposit authorization.

-

Can I use a deposit slip to verify my account information?

No, it is not advisable to use a deposit slip for verifying your routing transit number. Instead, contact your financial institution directly to confirm your account number and routing number.

-

How long does it take for direct deposit to start?

The time it takes for direct deposit to begin can vary. Typically, it may take one or two pay cycles for your employer to process the authorization. It's best to check with your employer for specific timelines.

-

What should I do if I change banks?

If you change banks, you will need to complete a new Generic Direct Deposit form with your new bank information. Make sure to submit it to your employer before your next payday to ensure there are no interruptions in your payments.

-

What happens if there is an error in my deposit?

If there is an error in your direct deposit, the form allows your financial institution to initiate debit entries to correct any mistakes. It’s important to monitor your account regularly to catch any discrepancies early.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize a financial institution to deposit funds directly into their bank account. |

| Required Information | Users must provide their name, Social Security Number, account number, routing transit number, and type of account (checking or savings). |

| Signature Requirement | Both the account holder and, if applicable, any joint account holder must sign the form to authorize direct deposits. |

| Effective Date | The form allows users to specify an effective date for the direct deposit, whether it is a new setup, change, or cancellation. |

| Governing Law | In Florida, the governing law for direct deposits is outlined in the Florida Statutes, specifically under Title XXXII, Chapter 655. |

| Verification Tips | It is advisable to verify the account and routing numbers with the financial institution before submission to avoid errors. |