Fillable Gift Deed Form

A Gift Deed form is an essential legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. This form is not merely a piece of paper; it serves as a formal record of the donor's intent to give and the recipient's acceptance of the gift. Key elements of the Gift Deed include the identification of both the donor and the recipient, a clear description of the property being gifted, and any conditions attached to the gift. Additionally, the form often requires the signatures of witnesses to validate the transaction. Understanding the implications of this document is crucial, as it can affect tax liabilities and ownership rights. Timeliness in executing a Gift Deed is also important, as delays may complicate the transfer process. With proper completion, a Gift Deed ensures that the donor's wishes are honored and that the recipient receives the intended benefit without legal disputes arising in the future.

Gift DeedTemplates for Particular US States

More Gift Deed Forms:

Life Estate Deed Sample - The deed can facilitate a smoother transition of property management upon the owner’s death.

When engaging in a boat transaction, it is important to utilize the correct documentation to ensure everything is in order. The California Boat Bill of Sale form is essential as it acts as proof of the sale and transfer of ownership. For those looking to understand and complete this form accurately, you can find valuable resources and guidance by visiting the Bill of Sale for a Boat page.

New Jersey Quitclaim Deed Form - When using this form, legal advice can be beneficial for clarity.

Dos and Don'ts

When filling out a Gift Deed form, it's important to approach the process with care. Here are some key things to keep in mind:

- Do ensure that all names and addresses are spelled correctly.

- Do clearly describe the property being gifted.

- Do include the date of the gift.

- Do have the form signed by both the giver and the recipient.

- Don't leave any sections blank; fill in all required information.

- Don't use vague language when describing the property.

- Don't forget to check local laws regarding gift taxes.

- Don't rush through the form; take your time to review everything carefully.

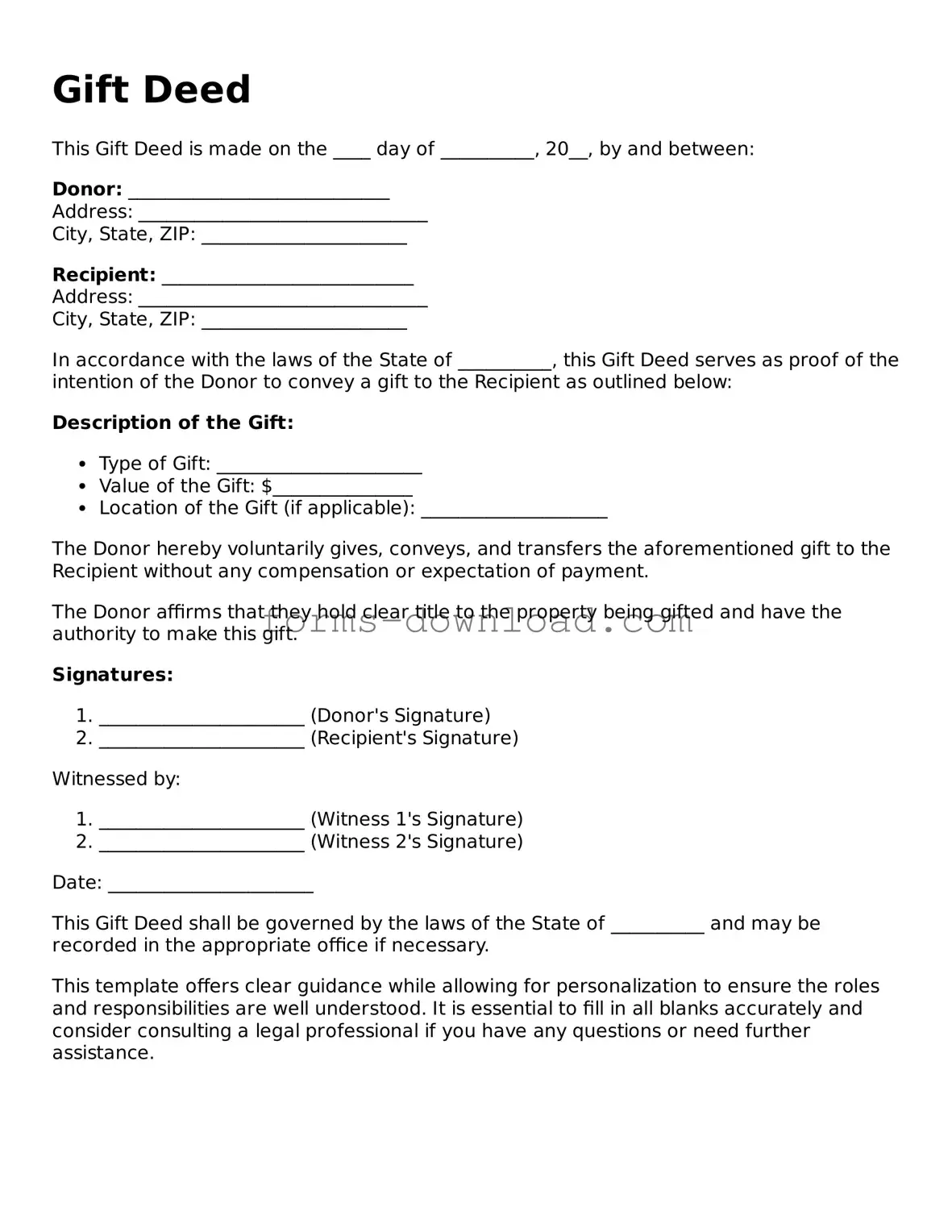

Gift Deed Sample

Gift Deed

This Gift Deed is made on the ____ day of __________, 20__, by and between:

Donor: ____________________________

Address: _______________________________

City, State, ZIP: ______________________

Recipient: ___________________________

Address: _______________________________

City, State, ZIP: ______________________

In accordance with the laws of the State of __________, this Gift Deed serves as proof of the intention of the Donor to convey a gift to the Recipient as outlined below:

Description of the Gift:

- Type of Gift: ______________________

- Value of the Gift: $_______________

- Location of the Gift (if applicable): ____________________

The Donor hereby voluntarily gives, conveys, and transfers the aforementioned gift to the Recipient without any compensation or expectation of payment.

The Donor affirms that they hold clear title to the property being gifted and have the authority to make this gift.

Signatures:

- ______________________ (Donor's Signature)

- ______________________ (Recipient's Signature)

Witnessed by:

- ______________________ (Witness 1's Signature)

- ______________________ (Witness 2's Signature)

Date: ______________________

This Gift Deed shall be governed by the laws of the State of __________ and may be recorded in the appropriate office if necessary.

Listed Questions and Answers

-

What is a Gift Deed?

A Gift Deed is a legal document that allows a person (the donor) to voluntarily transfer ownership of property or assets to another person (the recipient) without any exchange of money or consideration. This document formalizes the gift and outlines the details of the transfer.

-

What types of property can be transferred using a Gift Deed?

Various types of property can be transferred through a Gift Deed, including real estate, vehicles, bank accounts, and personal belongings. However, it is essential to ensure that the property is legally transferable and that there are no liens or other claims against it.

-

Do I need a lawyer to create a Gift Deed?

While it is not legally required to have a lawyer draft a Gift Deed, it is highly recommended. A legal professional can ensure that the document meets all legal requirements and protects the interests of both the donor and the recipient.

-

What information should be included in a Gift Deed?

A Gift Deed should include the following information:

- The names and addresses of the donor and recipient

- A detailed description of the property being gifted

- The date of the gift

- A statement indicating that the gift is made voluntarily and without consideration

- Signatures of the donor and, if required, witnesses

-

Is a Gift Deed revocable?

Generally, a Gift Deed is irrevocable once it has been executed and delivered. However, the donor may retain certain rights or conditions that could allow them to revoke the gift under specific circumstances. It is crucial to clarify these terms in the deed.

-

Do I need to register a Gift Deed?

In many jurisdictions, it is advisable to register a Gift Deed, especially for real estate transfers. Registration provides legal recognition of the gift and helps prevent future disputes regarding ownership. Check local laws for specific requirements.

-

Are there any tax implications for a Gift Deed?

Yes, there may be tax implications for both the donor and the recipient. The donor may be subject to gift tax if the value of the gift exceeds the annual exclusion limit set by the IRS. The recipient may also face tax consequences if they sell the property later. Consulting a tax professional is wise.

-

Can a minor receive a gift through a Gift Deed?

A minor can receive a gift through a Gift Deed, but the transfer may require a custodian or guardian to manage the property until the minor reaches the age of majority. This ensures that the minor's interests are protected.

-

What happens if the donor passes away after executing a Gift Deed?

If the donor passes away after executing a Gift Deed, the property generally remains with the recipient, assuming the deed was valid and irrevocable. However, estate laws may affect the situation, especially if the donor had other estate planning documents in place.

-

How can disputes regarding a Gift Deed be resolved?

Disputes regarding a Gift Deed can be resolved through negotiation, mediation, or, if necessary, litigation. It is advisable to seek legal counsel to navigate the complexities of property law and ensure a fair resolution.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Consideration | Unlike other forms of property transfer, a Gift Deed does not require monetary consideration. |

| Voluntary Action | The transfer of property through a Gift Deed must be a voluntary act by the donor. |

| Revocation | Generally, a Gift Deed cannot be revoked once executed, unless specific conditions allow it. |

| State-Specific Forms | Each state may have its own specific requirements and forms for Gift Deeds. For example, in California, the governing law is found in the California Civil Code. |

| Witness Requirements | Many states require the Gift Deed to be witnessed or notarized to be valid. |

| Tax Implications | Gift Deeds may have tax implications for both the donor and the recipient, particularly concerning gift tax regulations. |

| Property Types | A Gift Deed can be used for various types of property, including real estate, personal property, and financial assets. |

| Legal Capacity | Both the donor and the recipient must have the legal capacity to enter into a Gift Deed. |

| Recordation | To provide public notice of the transfer, it is advisable to record the Gift Deed with the appropriate local government office. |