Blank Gift Letter Form

When navigating the complexities of home buying, understanding the Gift Letter form is essential for prospective homeowners, especially first-time buyers. This document serves as a formal declaration that funds received from family or friends are indeed a gift and not a loan. By clarifying the nature of the financial assistance, the Gift Letter helps lenders assess the borrower's financial situation accurately. Typically, the form includes important details such as the donor's information, the recipient's information, the amount gifted, and a statement confirming that the funds do not require repayment. Additionally, it often requires the donor's signature, ensuring that all parties are in agreement about the terms of the gift. By utilizing this form, buyers can streamline the mortgage process, making it easier to secure financing while demonstrating transparency and integrity in their financial dealings.

More PDF Forms

How to Make a Bill of Lading - Given its straightforwardness, training staff in using the Straight Bill of Lading becomes a manageable task for companies.

For those interested in securing a reliable sales agreement, the comprehensive Motorcycle Bill of Sale document serves as a critical tool that facilitates the transfer of ownership while outlining the necessary details of the transaction.

Youth Baseball Player Evaluation Form - Evaluate a player's adaptability in various fielding positions.

Rst Form Army - Officers involved in the process must be well-trained on the form's requirements.

Dos and Don'ts

When filling out a Gift Letter form, it is important to follow certain guidelines to ensure clarity and compliance. Here are five things to keep in mind:

- Do clearly state the relationship between the giver and the recipient. This establishes the context of the gift.

- Don't leave any sections blank. Incomplete forms can lead to delays or complications.

- Do specify the amount of the gift. This provides transparency and helps avoid misunderstandings.

- Don't use vague language. Be precise about the nature of the gift to avoid any confusion.

- Do sign and date the form. A signature indicates that the information is accurate and complete.

Gift Letter Sample

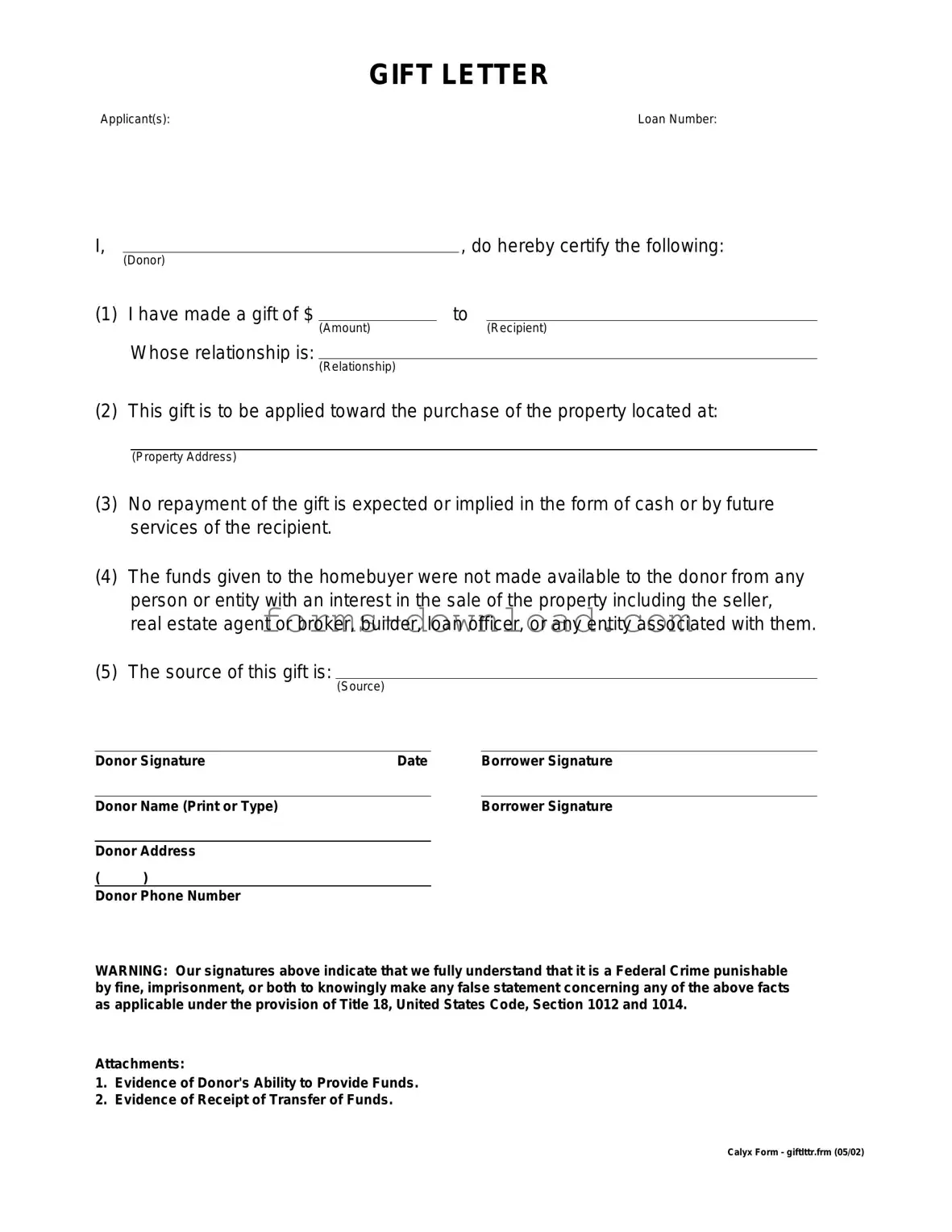

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Listed Questions and Answers

-

What is a Gift Letter?

A Gift Letter is a written document that confirms a financial gift, typically used in the context of real estate transactions. When someone receives money as a gift, especially for a home purchase, the lender may require a Gift Letter to ensure that the funds are not a loan that needs to be repaid. This letter serves as proof that the money is a gift and not a debt obligation.

-

Who needs to provide a Gift Letter?

Generally, the person giving the gift, often a family member or close friend, needs to provide the Gift Letter. This document should detail the relationship between the giver and the recipient, the amount of the gift, and a statement confirming that the funds do not need to be repaid. The lender may request this letter as part of the mortgage application process.

-

What information should be included in a Gift Letter?

A well-structured Gift Letter should include the following information:

- The date of the letter.

- The names and addresses of both the giver and the recipient.

- The relationship between the two parties.

- The amount of the gift.

- A clear statement indicating that the funds are a gift and do not need to be repaid.

- The giver’s signature.

Including all this information helps the lender verify the legitimacy of the gift.

-

Do I need to notarize the Gift Letter?

In most cases, notarization is not required for a Gift Letter. However, some lenders may have specific requirements, so it is always best to check with the lender beforehand. Notarizing the letter can add an extra layer of authenticity, but it is not a standard practice.

-

Can I use a Gift Letter for any type of loan?

Gift Letters are primarily used in mortgage applications, particularly for first-time homebuyers. They may also be applicable for certain types of loans, like FHA or VA loans, where gift funds can help cover down payments or closing costs. However, it’s essential to consult with the lender to confirm if a Gift Letter is acceptable for the specific loan type you are applying for.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose of Gift Letter | A Gift Letter is used to document a financial gift, typically for a home purchase, ensuring that the funds are not a loan that needs to be repaid. |

| Who Needs It? | Homebuyers receiving a monetary gift from family members or friends often need this letter to satisfy lender requirements. |

| State-Specific Requirements | Different states may have specific requirements for gift letters. For example, in California, the letter should state that the gift is non-repayable. |

| Key Components | A proper Gift Letter typically includes the donor's name, relationship to the recipient, amount of the gift, and a statement confirming that it is a gift and not a loan. |