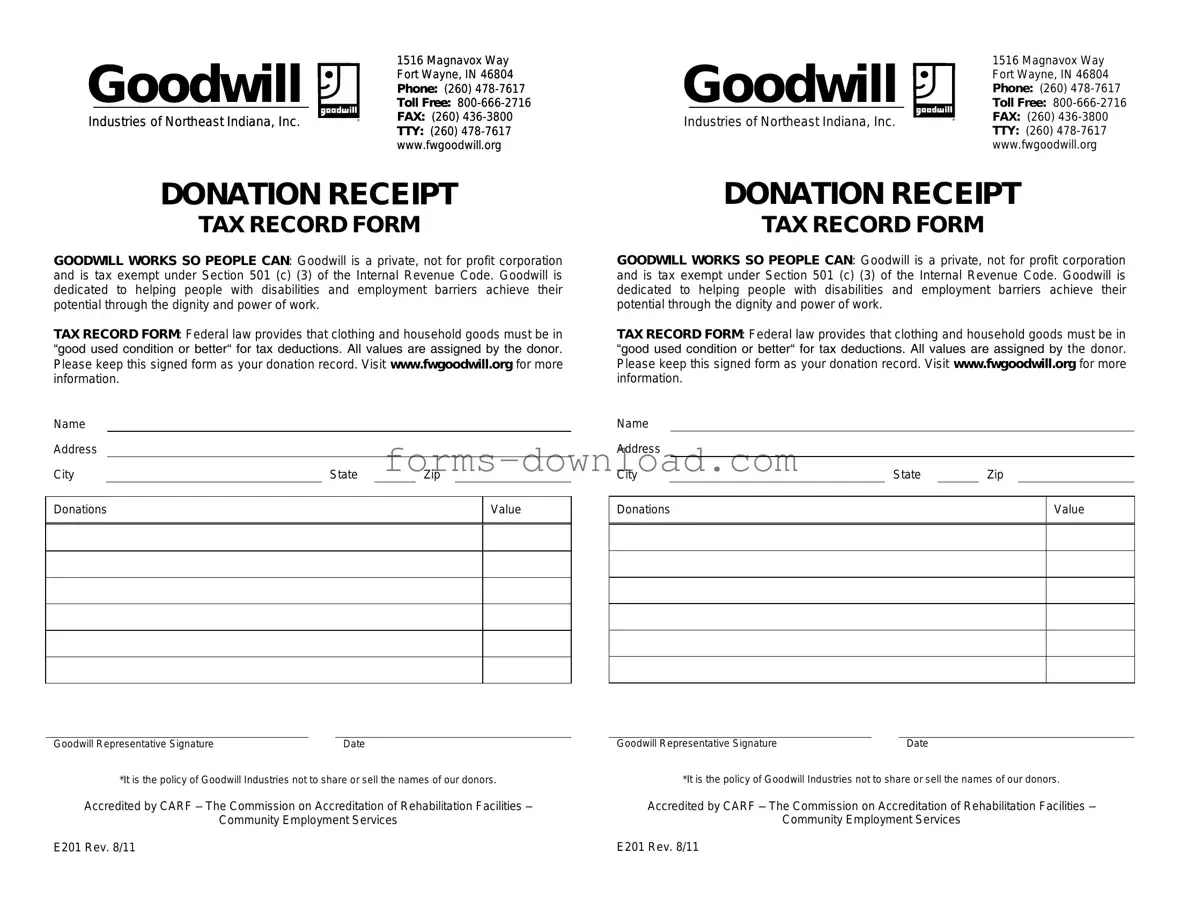

Blank Goodwill donation receipt Form

When you donate items to Goodwill, you not only support a worthy cause but also have the opportunity to claim a tax deduction for your generosity. Central to this process is the Goodwill donation receipt form, which serves as a vital document for both donors and the organization. This form typically includes essential details such as the date of the donation, a description of the items donated, and the estimated value of those items. Donors must ensure that they accurately complete the form, as it provides the necessary proof for tax purposes. Moreover, the receipt often contains information about Goodwill's mission and how your contributions help individuals in the community. Understanding the importance of this form can make a significant difference in your charitable giving experience, allowing you to maximize the benefits while supporting a cause that empowers others.

More PDF Forms

Us Service Animals Esa Letter - The document can be presented to employers regarding the need for an emotional support animal at work.

For additional guidance on completing your transaction, you can refer to the comprehensive template available at https://vehiclebillofsaleform.com/trailer-bill-of-sale-template/georgia-trailer-bill-of-sale-template, which can help ensure that all necessary details are captured for a successful sale.

Employee Application - This form may include sections on skills relevant to the position you are applying for.

Western Union Receipt - Western Union provides options for direct bank transfers to your loved ones' accounts.

Dos and Don'ts

When filling out a Goodwill donation receipt form, it’s important to ensure accuracy and clarity. Here are some key things to do and avoid:

- Do provide your name and contact information clearly.

- Do list all items being donated, including their condition.

- Do estimate the fair market value of each item.

- Do keep a copy of the receipt for your records.

- Don’t leave any sections of the form blank.

- Don’t overstate the value of donated items.

- Don’t forget to sign and date the receipt.

Following these guidelines will help ensure that your donation process goes smoothly and that you have the necessary documentation for tax purposes.

Goodwill donation receipt Sample

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Listed Questions and Answers

-

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors when they make a charitable contribution to Goodwill Industries. This form serves as proof of the donation for tax purposes and outlines the items donated.

-

How do I obtain a Goodwill donation receipt?

After making a donation at a Goodwill location, you will receive a donation receipt from the staff. If you drop off items, you can request a receipt at the time of donation. Ensure you keep this receipt for your records.

-

What information is included on the receipt?

The receipt typically includes the following information:

- The name and address of Goodwill Industries.

- The date of the donation.

- A description of the items donated.

- The estimated value of the items (if applicable).

- A statement indicating that no goods or services were provided in exchange for the donation.

-

Do I need to list the items I donated?

While the receipt will provide a general description of the items, it is advisable for donors to keep a personal record of the specific items donated. This can help in accurately reporting the donation on your tax return.

-

Can I deduct my donations on my taxes?

Yes, donations made to Goodwill are typically tax-deductible. However, it is essential to consult with a tax professional to understand the specific rules and limits that apply to your situation.

-

What if I lose my donation receipt?

If you lose your receipt, it may be challenging to prove your donation for tax purposes. Goodwill may not be able to provide a duplicate receipt, so it is crucial to keep your receipt in a safe place.

-

Is there a limit to how much I can donate?

There is no limit to how much you can donate to Goodwill. However, the IRS does have rules regarding the deductibility of charitable contributions, which may vary based on your income and the total amount of your donations.

-

What should I do if my items are valuable?

If you are donating items that have a significant value, consider getting an appraisal. This can provide a more accurate estimate of the item's worth, which can be useful when filing your taxes.

-

Can I donate items that are not in good condition?

Goodwill accepts items that are gently used and in good working condition. Donating items that are damaged or unsellable may not be accepted, as Goodwill aims to provide quality goods to those in need.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose of Receipt | The Goodwill donation receipt serves as proof of your charitable contribution, which can be used for tax deductions. |

| IRS Guidelines | The IRS requires that donations over $250 be documented with a receipt to claim a tax deduction. |

| Itemization | Donors should list the items donated, along with their estimated fair market value, on the receipt. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California requires a written acknowledgment for donations over $250. |

| Goodwill's Policy | Goodwill provides receipts for all donations, regardless of the amount, to support transparency and accountability. |

| Record Keeping | Donors should keep a copy of the receipt with their tax records for at least three years after filing their tax returns. |