Blank Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form serves as a vital tool for both independent contractors and the businesses that engage their services. This form provides a detailed breakdown of payments made to contractors, ensuring transparency and clarity in financial transactions. Key components typically include the contractor’s name and address, the pay period, and the total amount earned during that period. Additionally, it may outline deductions, if applicable, such as taxes or other withholdings, although independent contractors usually handle their own tax responsibilities. The form often features a summary of hours worked, rates applied, and any bonuses or commissions earned, providing a comprehensive view of the contractor's earnings. By utilizing this pay stub, both parties can maintain accurate records for accounting purposes, making it easier to track payments and resolve any potential disputes. Overall, the Independent Contractor Pay Stub form is an essential document that promotes accountability and professionalism in the independent contracting landscape.

More PDF Forms

How to File a Mechanics Lien - Enforces a claim against a property for unpaid labor or materials.

The Texas Boat Bill of Sale form is a crucial document that officially records the sale and transfer of ownership of a boat in Texas. This form serves as proof of the transaction between the buyer and seller, ensuring that all necessary details are documented for legal purposes. To ensure a smooth transfer, it is essential to fill out this form accurately; for further assistance, you can refer to the Bill of Sale for a Boat.

What Is an I9 - It helps ensure that employment histories presented are correct.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it's essential to get it right. Here’s a straightforward list of what you should and shouldn’t do:

- Do ensure all personal information is accurate, including your name and address.

- Do include the correct payment period to avoid confusion.

- Do itemize your services clearly to provide transparency.

- Do double-check the payment amount before submitting.

- Don’t leave any fields blank; fill in every required section.

- Don’t use vague descriptions for your services; be specific.

Following these guidelines will help ensure that your pay stub is clear and professional. Accuracy and clarity are key when presenting your work and payment details.

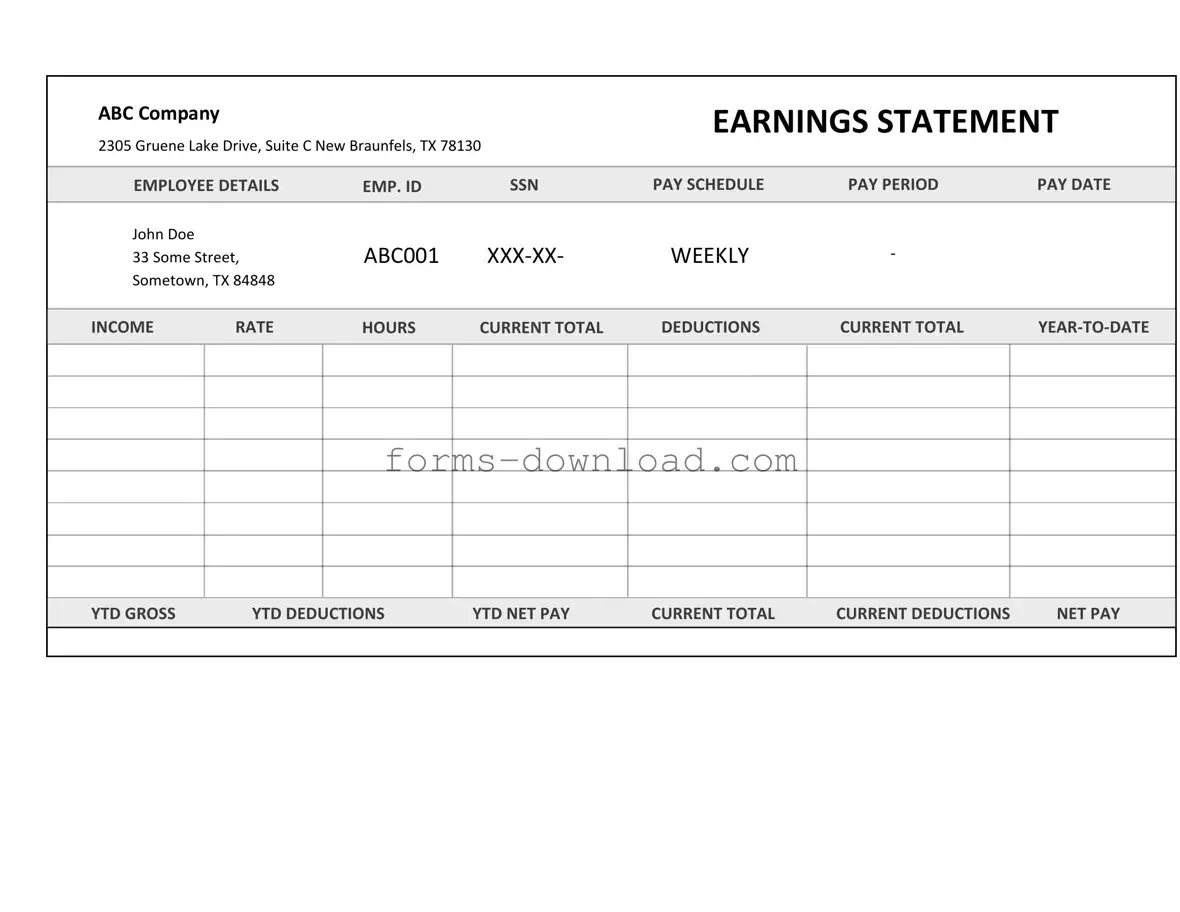

Independent Contractor Pay Stub Sample

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Listed Questions and Answers

-

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. It provides a detailed breakdown of the contractor's income, including any applicable taxes and other deductions. This document serves as a record for both the contractor and the client regarding payments made for services rendered.

-

Who needs an Independent Contractor Pay Stub?

Independent contractors who receive payment for their services should use a pay stub. This includes freelancers, consultants, and other self-employed individuals. Clients who hire independent contractors may also benefit from providing a pay stub, as it helps maintain clear financial records and ensures transparency in the payment process.

-

What information is included on the pay stub?

An Independent Contractor Pay Stub typically includes the following information:

- Name and contact information of the contractor

- Name and contact information of the client or company

- Pay period dates

- Total earnings for the period

- Any deductions, such as taxes or fees

- Net pay after deductions

-

How is the pay stub beneficial for independent contractors?

The pay stub serves several purposes for independent contractors. It provides a clear record of income, which is essential for tax filing and financial planning. Additionally, it can help contractors track their earnings over time and manage their budgets more effectively. Having a formal pay stub can also enhance professionalism and credibility when dealing with clients.

-

Can independent contractors create their own pay stubs?

Yes, independent contractors can create their own pay stubs. There are various templates and software available that simplify the process. It is important to ensure that the pay stub includes all necessary information and complies with any applicable laws or regulations. This self-created document can be customized to meet specific needs and preferences.

-

Are there legal requirements for providing a pay stub?

While there are no federal laws specifically requiring independent contractors to provide pay stubs, some states may have regulations that apply. It is advisable to check local laws to ensure compliance. Providing a pay stub can also foster trust and clarity in the contractor-client relationship.

-

How should independent contractors store their pay stubs?

Independent contractors should store their pay stubs in a safe and organized manner. Digital storage options, such as cloud services or dedicated financial software, can help keep records accessible and secure. Physical copies should be kept in a dedicated file or binder. Maintaining these records is crucial for tax purposes and financial management.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | The Independent Contractor Pay Stub form is a document that outlines the payment details for independent contractors, including hours worked, pay rate, and total earnings. |

| Purpose | This form serves to provide transparency between the contractor and the hiring entity, ensuring both parties have a clear understanding of the payment structure. |

| State-Specific Requirements | Some states may have specific requirements regarding the information that must be included on the pay stub. For example, California law requires that pay stubs include the contractor's name, address, and the last four digits of their Social Security number. |

| Tax Implications | Independent contractors are responsible for their own taxes. The pay stub should reflect gross earnings, which will help contractors accurately report income to the IRS. |

| Record Keeping | Both the contractor and the hiring entity should keep copies of the pay stubs for their records. This is essential for tax purposes and any potential disputes regarding payment. |

| Electronic vs. Paper | Pay stubs can be provided in either electronic or paper format. However, electronic versions must comply with state laws regarding electronic records and signatures. |