Blank Intent To Lien Florida Form

The Intent to Lien Florida form serves as a critical communication tool for contractors and suppliers who have not received payment for services or materials provided on a property. This form is intended to notify property owners of the impending filing of a lien, which could lead to serious financial consequences if not addressed. The notice must be sent at least 45 days before the actual lien is recorded, as stipulated by Florida law. It includes essential details such as the date of the notice, the property owner's legal name and mailing address, and a description of the property in question. Additionally, it specifies the amount owed for the work performed and outlines the potential repercussions of failing to respond within 30 days, which may include foreclosure proceedings and additional costs. The sender is encouraged to reach out promptly to resolve the payment issue and avoid further legal action. The form also includes a certificate of service, confirming that the notice has been properly delivered to the relevant parties. This proactive approach not only protects the rights of the service provider but also serves to inform the property owner of their obligations and the potential risks associated with non-payment.

More PDF Forms

Gf Applications - Searching for a fun partner for quiet evenings at home.

Employee Status Change Form Template Word - Record changes in employment status, such as transfers between departments.

Understanding the importance of a thorough Arizona Last Will and Testament document is crucial for ensuring your wishes are fulfilled after you are gone. Having a well-prepared plan can help prevent potential disputes and provide clear directions for your loved ones. For guidance on creating this vital legal document, visit the comprehensive resource on Last Will and Testament preparation.

Where to Find 1040 Form - The 1040 form allows for the reporting of wages, dividends, interest, and other income types.

Dos and Don'ts

When filling out the Intent To Lien Florida form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do during this process.

- Do ensure all fields are completed accurately, including dates and names.

- Do provide a clear and detailed property description to avoid confusion.

- Do send the notice at least 45 days before filing a Claim of Lien.

- Do keep a copy of the notice for your records after sending it.

- Don't leave any sections blank, as this may invalidate the notice.

- Don't use vague language; be specific about the amount owed and the services provided.

- Don't forget to include your contact information for follow-up.

- Don't ignore the timeline; failing to adhere to the required notice periods can affect your rights.

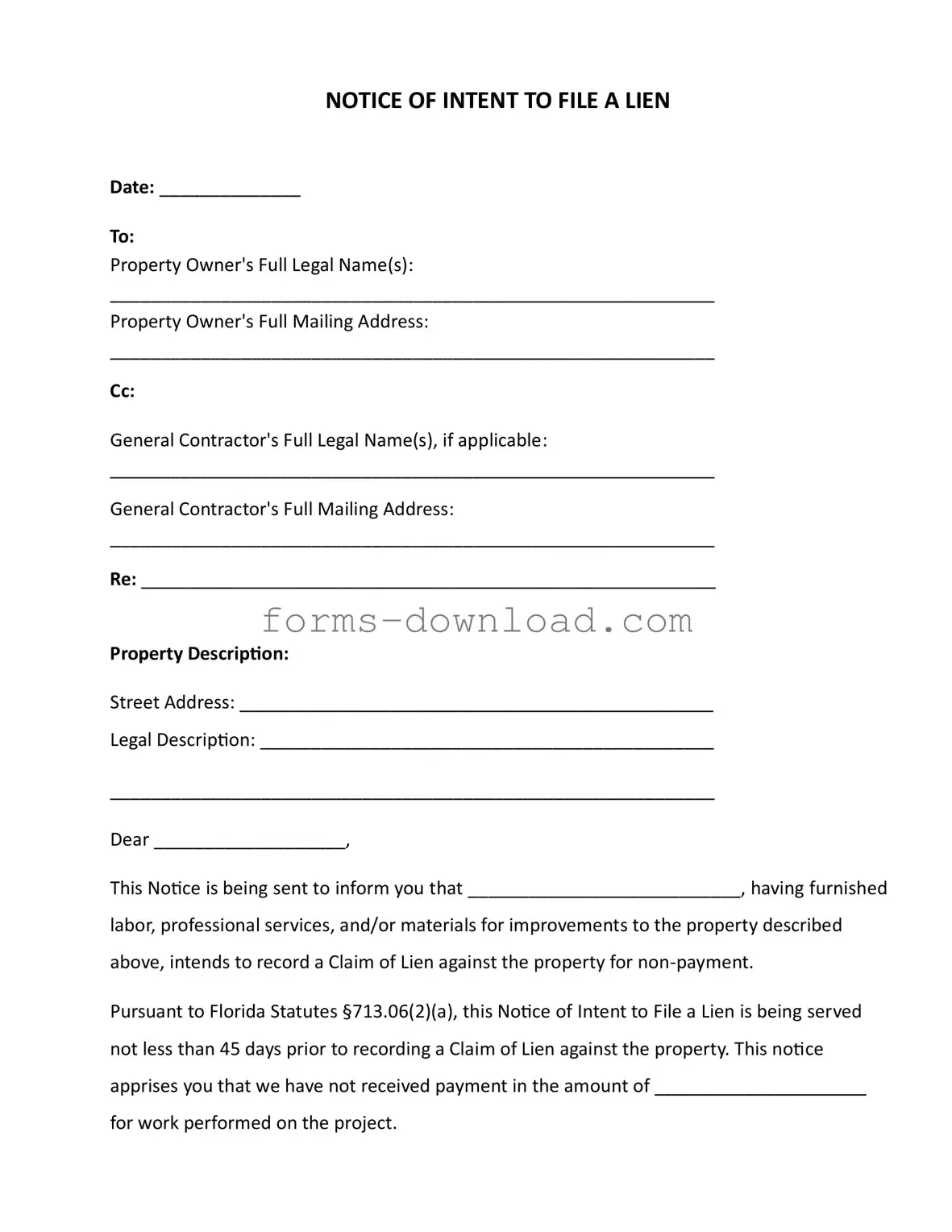

Intent To Lien Florida Sample

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Listed Questions and Answers

-

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal document used to notify property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice serves as a warning and is required by Florida law to be sent at least 45 days before a lien is recorded.

-

Who needs to file an Intent to Lien?

Any contractor, subcontractor, or supplier who has not received payment for work done or materials supplied may file an Intent to Lien. This includes individuals or businesses that have provided labor, professional services, or materials for improvements to a property.

-

What information is required on the form?

The form requires specific details including:

- The date of the notice

- The full legal names and mailing addresses of the property owner and general contractor, if applicable

- A description of the property, including its street address and legal description

- The amount owed for the work performed

-

What happens if payment is not made after the notice is sent?

If the property owner does not make payment or provide a satisfactory response within 30 days of receiving the notice, the contractor or supplier may proceed to record a lien against the property. This could lead to foreclosure proceedings, where the property may be sold to satisfy the debt.

-

How can property owners respond to the Intent to Lien?

Property owners should contact the sender of the notice as soon as possible to discuss payment options or any disputes regarding the amount owed. Prompt communication may help resolve the issue and avoid further legal action.

-

Is there a way to contest a lien after it has been filed?

Yes, property owners can contest a lien by filing a lawsuit in court. It is advisable to seek legal counsel to understand the specific grounds for contesting the lien and the process involved. Timely action is crucial, as there are deadlines for challenging a lien.

-

What are the potential consequences of a lien being filed?

If a lien is filed against a property, it can affect the owner’s ability to sell or refinance the property. Additionally, the owner may be responsible for legal fees, court costs, and other expenses associated with the lien. In severe cases, the property could be subject to foreclosure.

-

Can the Intent to Lien be withdrawn?

Yes, the party who filed the Intent to Lien can withdraw it if the payment issue is resolved before the lien is officially recorded. This may require filing a formal document with the appropriate authorities to ensure that the lien does not affect the property.

Form Overview

| Fact Name | Fact Description |

|---|---|

| Date Requirement | The form requires the date of the notice to be filled in at the top. |

| Property Owner Information | It must include the full legal name and mailing address of the property owner. |

| General Contractor Details | If applicable, the name and address of the general contractor must be included. |

| Property Description | The form requires a detailed description of the property, including street address and legal description. |

| Intent to Lien | The notice informs the property owner of the intent to file a lien for non-payment. |

| Statutory Reference | This notice is governed by Florida Statutes §713.06(2)(a) and §713.06(2)(b). |

| Payment Deadline | The property owner has 30 days to respond or make payment before a lien is recorded. |

| Consequences of Non-Payment | If unpaid, the property may face foreclosure proceedings and additional costs. |

| No Waivers | The notice states that no waivers or releases of lien have been received. |

| Certificate of Service | A section for certifying that the notice was properly served to the property owner. |