Fillable Investment Letter of Intent Form

When considering a new investment opportunity, clarity and intent are crucial. The Investment Letter of Intent (LOI) serves as a key document that outlines the preliminary understanding between parties before formal agreements are drafted. This form typically includes essential details such as the names of the involved parties, the nature of the investment, and the proposed terms. It may also cover the amount of capital being invested, the expected timeline for the investment, and any conditions that must be met before proceeding. By laying out these fundamental aspects, the LOI helps to ensure that all parties are on the same page, reducing the risk of misunderstandings down the line. Furthermore, while the LOI is generally non-binding, it can set the stage for negotiations and foster a sense of trust among investors and entrepreneurs alike. Understanding its components and purpose is vital for anyone looking to navigate the investment landscape effectively.

More Investment Letter of Intent Forms:

Letter of Intent for Business - It can help identify any initial concerns the buyer might have.

Sue Letter of Intent to Take Legal Action Template - The form can help streamline the dispute resolution process overall.

Letter of Hire - A Letter of Intent to Hire outlines the mutual interest in employment between an employer and a prospective employee.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it's essential to approach the task with care and attention to detail. Here are some important dos and don'ts to consider:

- Do read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do provide complete and honest information. Transparency is key in investment matters.

- Do double-check your contact information. Ensure that all details are current and correct.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't rush through the form. Taking your time can prevent mistakes and omissions.

- Don't leave any required fields blank. Incomplete forms may be rejected or delayed.

- Don't hesitate to ask for help if you have questions. Seeking clarification can prevent misunderstandings.

By following these guidelines, you can ensure a smoother process when submitting your Investment Letter of Intent form. Taking the time to do it right can make a significant difference in your investment journey.

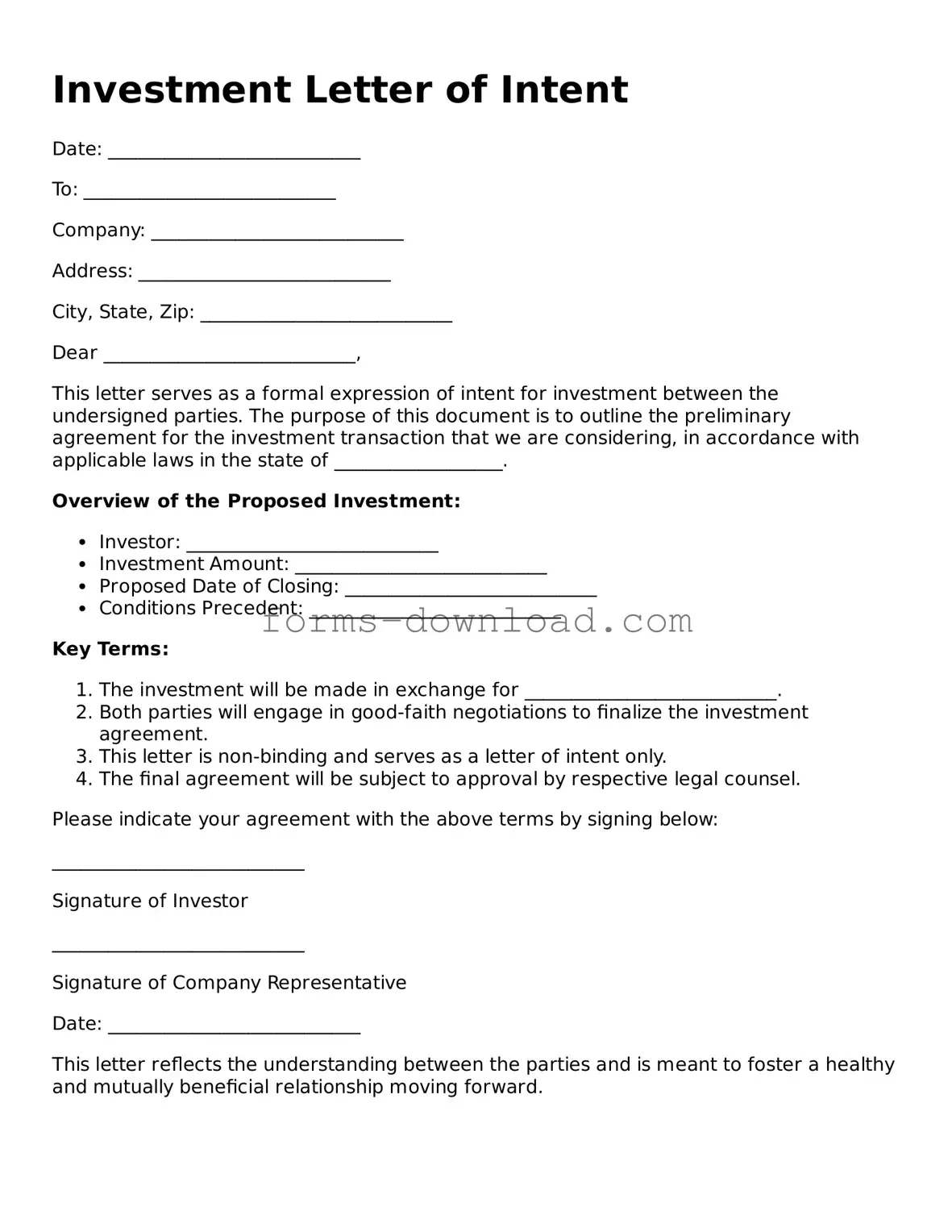

Investment Letter of Intent Sample

Investment Letter of Intent

Date: ___________________________

To: ___________________________

Company: ___________________________

Address: ___________________________

City, State, Zip: ___________________________

Dear ___________________________,

This letter serves as a formal expression of intent for investment between the undersigned parties. The purpose of this document is to outline the preliminary agreement for the investment transaction that we are considering, in accordance with applicable laws in the state of __________________.

Overview of the Proposed Investment:

- Investor: ___________________________

- Investment Amount: ___________________________

- Proposed Date of Closing: ___________________________

- Conditions Precedent: ___________________________

Key Terms:

- The investment will be made in exchange for ___________________________.

- Both parties will engage in good-faith negotiations to finalize the investment agreement.

- This letter is non-binding and serves as a letter of intent only.

- The final agreement will be subject to approval by respective legal counsel.

Please indicate your agreement with the above terms by signing below:

___________________________

Signature of Investor

___________________________

Signature of Company Representative

Date: ___________________________

This letter reflects the understanding between the parties and is meant to foster a healthy and mutually beneficial relationship moving forward.

Listed Questions and Answers

-

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties who intend to engage in a financial investment. It serves as a formal expression of interest and sets the stage for further negotiations and agreements.

-

Why is an Investment Letter of Intent important?

The LOI is crucial because it helps clarify the intentions of both parties before entering into a legally binding agreement. It can outline key terms, such as investment amounts, timelines, and expectations, which can prevent misunderstandings later on.

-

What information is typically included in an Investment Letter of Intent?

Common elements of an LOI include:

- Names and contact information of the parties involved

- Description of the investment opportunity

- Proposed investment amount

- Timeline for the investment

- Any conditions or contingencies that must be met

- Confidentiality agreements, if applicable

-

Is an Investment Letter of Intent legally binding?

The LOI is generally not considered a legally binding contract. However, certain provisions, such as confidentiality clauses, may be enforceable. It is essential to specify which parts of the LOI are binding and which are not to avoid confusion.

-

How should one draft an Investment Letter of Intent?

When drafting an LOI, clarity is key. Start with a clear introduction, followed by the main terms of the investment. Use straightforward language and avoid ambiguity. It may also be beneficial to consult with legal professionals to ensure that all necessary elements are included.

-

Can an Investment Letter of Intent be modified?

Yes, an LOI can be modified if both parties agree to the changes. It is best to document any modifications in writing to maintain a clear record of the agreement.

-

What should one do after signing an Investment Letter of Intent?

After signing the LOI, the next steps typically involve due diligence and negotiations to finalize the investment agreement. Both parties should work collaboratively to address any outstanding issues and move towards a formal contract.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent serves as a preliminary agreement outlining the intent of parties to enter into a formal investment contract. |

| Non-Binding | This document is typically non-binding, meaning it expresses an intention rather than a legal obligation. |

| Key Elements | Common elements include the investment amount, proposed terms, and conditions, as well as timelines for closing. |

| Confidentiality | Many Investment Letters of Intent include confidentiality clauses to protect sensitive information shared between parties. |

| State-Specific Forms | Some states may have specific requirements or forms for investment letters, influenced by local laws. |

| Governing Law | Investment Letters of Intent are often governed by the laws of the state where the investment is made, which can vary by jurisdiction. |

| Negotiation Tool | This document can serve as a negotiation tool, helping parties outline their expectations and facilitate discussions. |

| Next Steps | Following the signing of the letter, parties usually proceed to draft a more detailed and binding investment agreement. |