Fillable Lady Bird Deed Form

The Lady Bird Deed, often regarded as a powerful estate planning tool, allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form is especially beneficial for those looking to avoid probate, as it enables a seamless transfer of property upon the owner's passing. With the ability to change beneficiaries at any time, the Lady Bird Deed offers flexibility that many traditional deeds do not. It also provides protection against creditors, ensuring that the property remains secure from claims after the owner's death. Understanding the intricacies of this deed can empower individuals to make informed decisions about their property and legacy, ultimately simplifying the transfer process for loved ones. As you explore the Lady Bird Deed, consider its advantages, potential limitations, and how it fits into your overall estate planning strategy.

Lady Bird DeedTemplates for Particular US States

More Lady Bird Deed Forms:

Correction Deed Form California - This form helps clarify property ownership records.

Does California Have a Transfer on Death Deed - Choosing the right beneficiaries in your deed can ensure that your property goes to those you love most.

The Missouri Boat Bill of Sale form is not only essential for establishing ownership but also provides both parties with the peace of mind that all details are legally documented. To ensure a smooth transaction, it’s advisable to complete the necessary paperwork, including the Bill of Sale for a Boat, which will help clarify the specifics of the sale and protect your interests.

Gift Deed Form - The Gift Deed can serve as a legacy, passing down property through generations.

Dos and Don'ts

When filling out the Lady Bird Deed form, it is essential to approach the process with care. This deed allows property owners to transfer their property upon death while retaining certain rights during their lifetime. Here are some important dos and don’ts to consider.

- Do ensure that you have the correct legal description of the property.

- Do clearly identify all parties involved, including the grantor and grantee.

- Do review state-specific laws regarding Lady Bird Deeds, as they can vary.

- Do consider consulting a legal professional for guidance.

- Don't rush through the form; take your time to avoid errors.

- Don't forget to sign the document in the presence of a notary.

- Don't overlook the need to record the deed with the appropriate county office.

Taking these steps can help ensure that the Lady Bird Deed is completed accurately and effectively. Proper attention to detail can prevent future complications.

Lady Bird Deed Sample

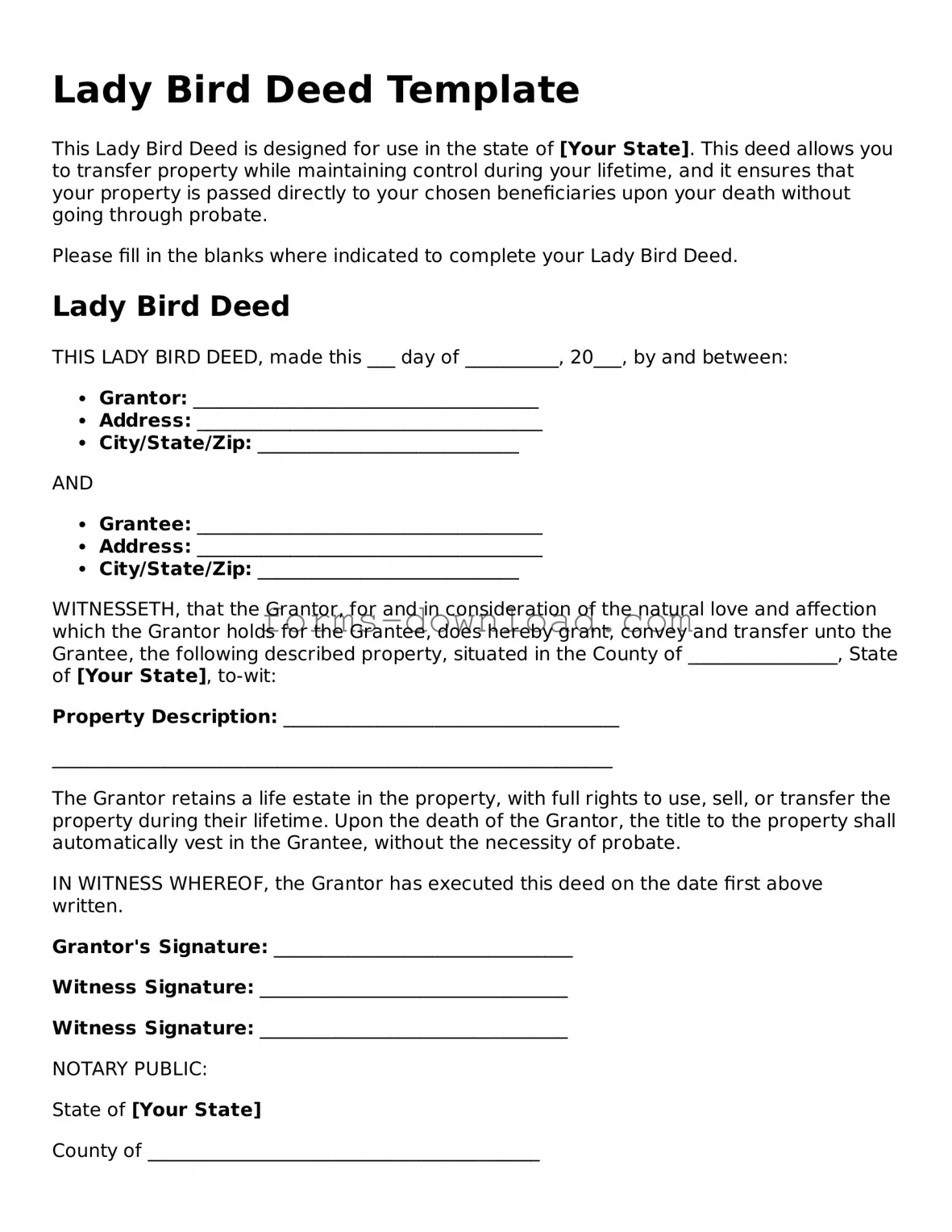

Lady Bird Deed Template

This Lady Bird Deed is designed for use in the state of [Your State]. This deed allows you to transfer property while maintaining control during your lifetime, and it ensures that your property is passed directly to your chosen beneficiaries upon your death without going through probate.

Please fill in the blanks where indicated to complete your Lady Bird Deed.

Lady Bird Deed

THIS LADY BIRD DEED, made this ___ day of __________, 20___, by and between:

- Grantor: _____________________________________

- Address: _____________________________________

- City/State/Zip: ____________________________

AND

- Grantee: _____________________________________

- Address: _____________________________________

- City/State/Zip: ____________________________

WITNESSETH, that the Grantor, for and in consideration of the natural love and affection which the Grantor holds for the Grantee, does hereby grant, convey and transfer unto the Grantee, the following described property, situated in the County of ________________, State of [Your State], to-wit:

Property Description: ____________________________________

____________________________________________________________

The Grantor retains a life estate in the property, with full rights to use, sell, or transfer the property during their lifetime. Upon the death of the Grantor, the title to the property shall automatically vest in the Grantee, without the necessity of probate.

IN WITNESS WHEREOF, the Grantor has executed this deed on the date first above written.

Grantor's Signature: ________________________________

Witness Signature: _________________________________

Witness Signature: _________________________________

NOTARY PUBLIC:

State of [Your State]

County of __________________________________________

Subscribed, sworn to, and acknowledged before me this ___ day of __________, 20___.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________

Listed Questions and Answers

-

What is a Lady Bird Deed?

A Lady Bird Deed is a type of property deed that allows a property owner to transfer their property to a beneficiary while retaining certain rights during their lifetime. This includes the right to live in the property, sell it, or change the beneficiary. It is often used to avoid probate and simplify the transfer of property upon the owner's death.

-

What are the benefits of using a Lady Bird Deed?

One of the primary benefits of a Lady Bird Deed is that it allows property owners to maintain control over their property while ensuring a smooth transition to their heirs. Additionally, it helps to avoid probate, which can be a lengthy and costly process. This deed can also protect the property from Medicaid claims in certain situations.

-

Who can be named as a beneficiary in a Lady Bird Deed?

Any individual or entity can be named as a beneficiary in a Lady Bird Deed. Common choices include family members, friends, or trusts. It is essential to choose someone who will manage the property responsibly after the owner's passing.

-

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner's lifetime. The owner simply needs to execute a new deed to replace the existing one. This flexibility allows property owners to adjust their estate plans as their circumstances change.

-

Is a Lady Bird Deed valid in all states?

No, a Lady Bird Deed is not recognized in all states. It is primarily used in certain states, such as Florida and Texas. If you live in a state that does not recognize this type of deed, you may want to explore other estate planning options.

-

What is the process for creating a Lady Bird Deed?

To create a Lady Bird Deed, the property owner must complete the deed form, including details about the property, the owner, and the beneficiary. The deed must then be signed, notarized, and recorded with the appropriate county office. It is advisable to consult with a legal professional to ensure all requirements are met.

-

Are there any tax implications associated with a Lady Bird Deed?

Generally, a Lady Bird Deed does not trigger immediate tax consequences. The property retains its tax basis, which means that the beneficiary may benefit from a step-up in basis upon the owner's death. However, it is important to consult with a tax advisor to understand the specific implications based on individual circumstances.

-

Can a Lady Bird Deed be used for all types of property?

A Lady Bird Deed can be used for various types of real estate, including residential homes, vacation properties, and commercial real estate. However, it is essential to verify that the property is eligible for this type of transfer and to understand any limitations that may apply.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by state law. In Texas, for example, it falls under Texas Property Code § 5.201. |

| Benefits | It helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Revocability | The property owner can revoke or change the deed at any time before their death. |

| Tax Implications | Transfers made via a Lady Bird Deed generally do not trigger gift taxes, as the property remains under the owner's control. |

| Eligibility | Only individuals, not entities, can use a Lady Bird Deed to transfer property. |