Fillable Loan Agreement Form

When individuals or businesses seek financial assistance, a Loan Agreement form becomes a crucial document in the lending process. This form outlines the specific terms and conditions under which the loan is granted, ensuring that both the lender and borrower have a clear understanding of their obligations. Key aspects typically covered in the agreement include the loan amount, interest rate, repayment schedule, and any collateral that may be required. Additionally, the form addresses potential penalties for late payments and outlines the rights and responsibilities of each party involved. By providing a structured framework, the Loan Agreement form helps to protect the interests of both the lender and borrower, fostering a transparent and trustworthy financial relationship.

Loan AgreementTemplates for Particular US States

Loan Agreement Subtypes

Popular Forms:

When Do You Get a P45 - It's advisable to store the P45 securely, as copies are not available once it is submitted.

Vehicle Sale Agreement - This document helps provide a structured approach to negotiate terms that benefit both parties.

When engaging in the sale or purchase of a boat in California, it is crucial to utilize the appropriate documentation to prevent any misunderstandings during the transaction. The California Boat Bill of Sale form acts as this essential document, ensuring that both parties are protected and that the transfer of ownership is clear. To streamline this process, one can refer to the Vessel Bill of Sale, which provides further guidance on completing the form accurately and adhering to state requirements.

Make Your Own Gift Certificate - Give the gift of adventure with a fun-filled gift certificate.

Dos and Don'ts

When filling out a Loan Agreement form, it's essential to be meticulous and informed. Here’s a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do read the entire agreement carefully before signing.

- Do provide accurate personal and financial information.

- Do ask questions if any part of the agreement is unclear.

- Do keep a copy of the signed agreement for your records.

- Do understand the terms of repayment and interest rates.

- Don't rush through the form without reviewing it.

- Don't omit any required information or documents.

- Don't sign the agreement if you feel pressured.

- Don't ignore the fine print; it often contains important details.

By following these guidelines, you can avoid potential pitfalls and ensure that your Loan Agreement is filled out correctly and comprehensively.

Loan Agreement Sample

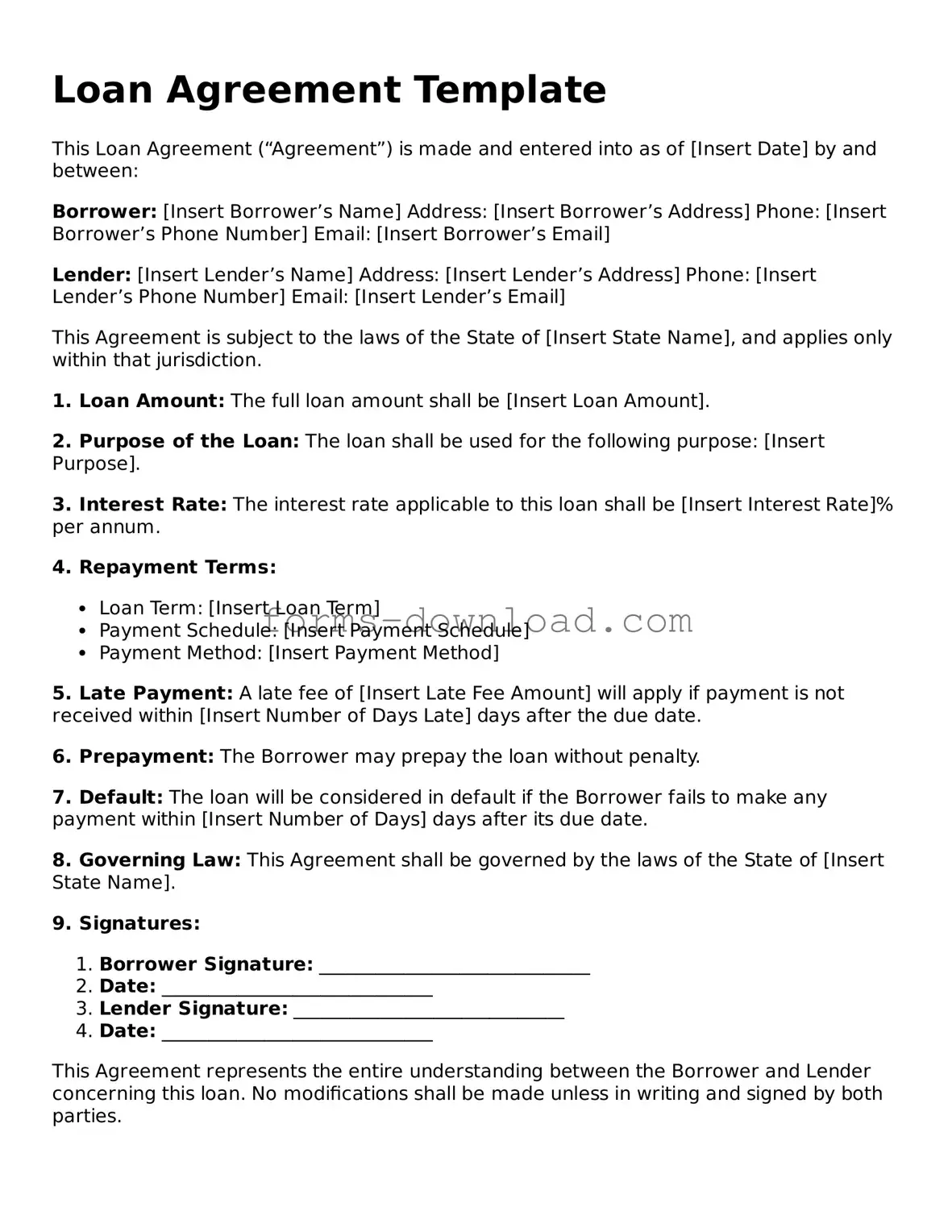

Loan Agreement Template

This Loan Agreement (“Agreement”) is made and entered into as of [Insert Date] by and between:

Borrower: [Insert Borrower’s Name] Address: [Insert Borrower’s Address] Phone: [Insert Borrower’s Phone Number] Email: [Insert Borrower’s Email]

Lender: [Insert Lender’s Name] Address: [Insert Lender’s Address] Phone: [Insert Lender’s Phone Number] Email: [Insert Lender’s Email]

This Agreement is subject to the laws of the State of [Insert State Name], and applies only within that jurisdiction.

1. Loan Amount: The full loan amount shall be [Insert Loan Amount].

2. Purpose of the Loan: The loan shall be used for the following purpose: [Insert Purpose].

3. Interest Rate: The interest rate applicable to this loan shall be [Insert Interest Rate]% per annum.

4. Repayment Terms:

- Loan Term: [Insert Loan Term]

- Payment Schedule: [Insert Payment Schedule]

- Payment Method: [Insert Payment Method]

5. Late Payment: A late fee of [Insert Late Fee Amount] will apply if payment is not received within [Insert Number of Days Late] days after the due date.

6. Prepayment: The Borrower may prepay the loan without penalty.

7. Default: The loan will be considered in default if the Borrower fails to make any payment within [Insert Number of Days] days after its due date.

8. Governing Law: This Agreement shall be governed by the laws of the State of [Insert State Name].

9. Signatures:

- Borrower Signature: _____________________________

- Date: _____________________________

- Lender Signature: _____________________________

- Date: _____________________________

This Agreement represents the entire understanding between the Borrower and Lender concerning this loan. No modifications shall be made unless in writing and signed by both parties.

Listed Questions and Answers

-

What is a Loan Agreement?

A Loan Agreement is a legal document that outlines the terms and conditions under which one party (the lender) provides a certain amount of money to another party (the borrower). This document serves to protect the interests of both parties by clearly detailing the repayment schedule, interest rates, and any collateral involved.

-

What are the key components of a Loan Agreement?

Typically, a Loan Agreement includes the following key components:

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: The schedule for repaying the loan, including the duration and frequency of payments.

- Default Clauses: Conditions under which the borrower may be considered in default and the lender's rights in such situations.

- Signatures: The agreement must be signed by both parties to be legally binding.

-

Why is it important to have a written Loan Agreement?

A written Loan Agreement is crucial for several reasons. It provides clarity and transparency, helping to prevent misunderstandings between the lender and borrower. Additionally, in the event of a dispute, a written agreement serves as a legal record that can be referred to in court. It protects both parties by ensuring that their rights and obligations are clearly defined.

-

Can Loan Agreements be modified after they are signed?

Yes, Loan Agreements can be modified, but any changes must be agreed upon by both parties. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This ensures that all parties are aware of the new terms and helps maintain the legal integrity of the agreement.

-

What should I do if I cannot repay my loan?

If you find yourself unable to repay your loan, it is important to communicate with your lender as soon as possible. Many lenders are willing to work with borrowers facing financial difficulties. You may be able to negotiate a revised repayment plan or seek other options such as deferment or loan consolidation. Ignoring the situation can lead to more severe consequences, including damage to your credit score and potential legal action.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legally binding contract between a lender and a borrower outlining the terms of a loan. |

| Governing Law | The governing law for Loan Agreements varies by state; for example, California follows the California Civil Code. |

| Key Components | Essential elements include loan amount, interest rate, repayment schedule, and default conditions. |

| Types of Loans | Loan Agreements can pertain to personal loans, business loans, mortgages, and student loans. |

| Enforceability | For a Loan Agreement to be enforceable, it must be signed by both parties and include all necessary terms. |