Blank Louisiana act of donation Form

The Louisiana Act of Donation form serves as a vital legal document that enables individuals to transfer ownership of property or assets to another party without the expectation of payment. This form is particularly significant in Louisiana, where the civil law system influences property transactions. The act outlines the specifics of the donation, including the identities of the donor and the donee, a clear description of the property being donated, and any conditions or stipulations that may apply to the transfer. Additionally, it requires the signatures of both parties, ensuring that the act is executed with mutual consent. Notably, the form may also necessitate notarization to enhance its legal standing and provide additional protection for both the donor and the recipient. Understanding the nuances of this form is essential for anyone considering a donation, as it encapsulates the intentions and agreements between the parties involved while adhering to Louisiana's legal requirements.

More PDF Forms

Marrage Papers - This form must be signed by both parties getting married.

Cair Login - Ensure any health issues are discussed with your healthcare provider.

When transferring ownership of a boat in Indiana, using the Indiana Boat Bill of Sale form is essential, as it serves as proof of the transaction and protects both parties involved. This form ensures that all relevant details about the vessel are documented accurately, making the process smoother. For more information or to access the necessary documentation, refer to the Bill of Sale for a Boat.

Affidavit of Support - The I-864 is a key component in the immigration process.

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information for all required fields.

- Do sign and date the form where indicated.

- Do consult with a legal professional if you have any questions or concerns.

- Don't leave any required fields blank.

- Don't use white-out or any correction fluid on the form.

- Don't submit the form without reviewing it for errors.

- Don't forget to keep a copy of the completed form for your records.

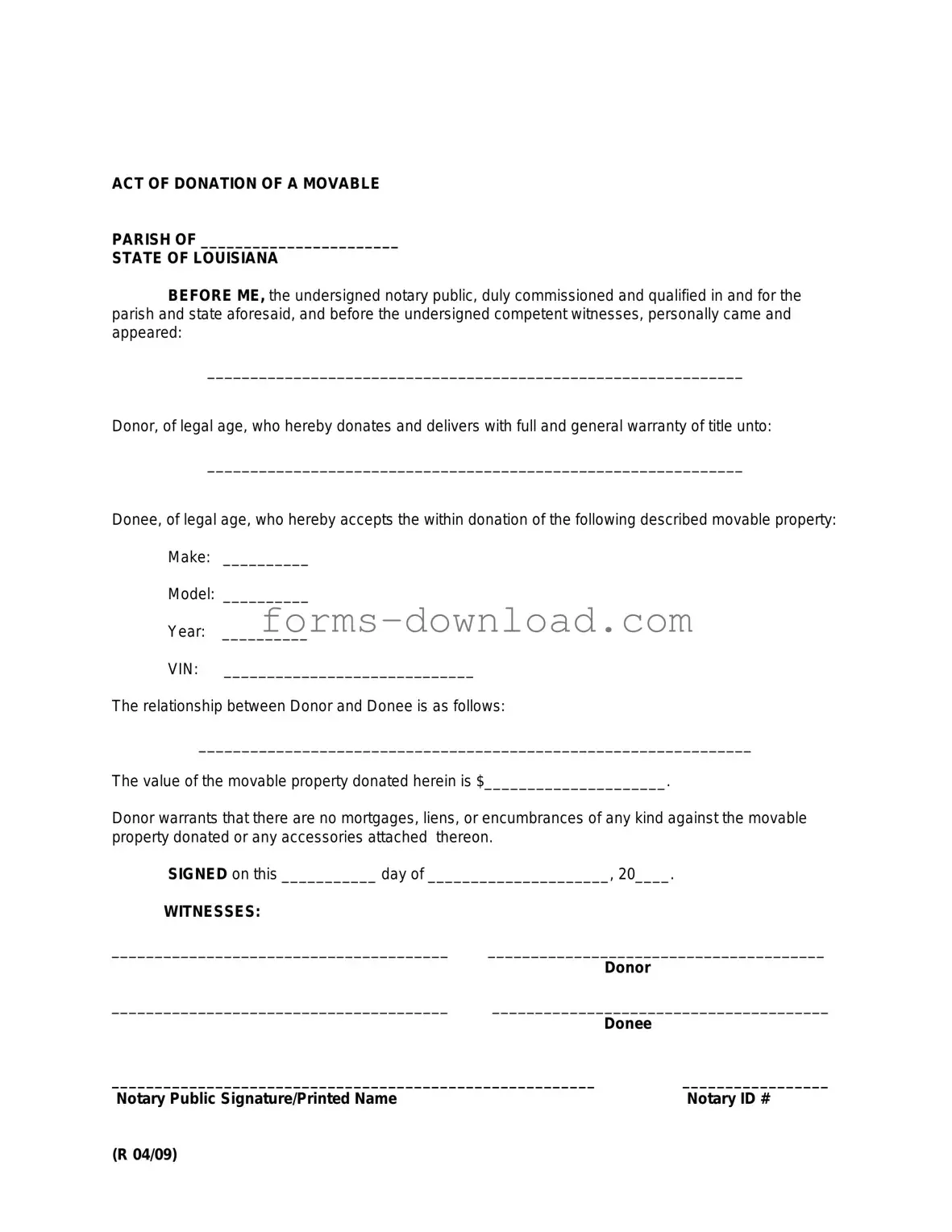

Louisiana act of donation Sample

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Listed Questions and Answers

-

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one individual to another without any exchange of money. This form is commonly used in cases where a person wishes to donate property, such as real estate, to a family member or friend.

-

Who can use the Act of Donation Form?

Any individual who owns property in Louisiana and wishes to donate it can use the Act of Donation Form. Both the donor (the person giving the property) and the donee (the person receiving the property) must be competent adults, meaning they are of legal age and mentally capable of understanding the transaction.

-

What types of property can be donated using this form?

The Act of Donation Form can be used to donate various types of property, including real estate, personal property, and financial assets. However, specific requirements may apply depending on the type of property being donated.

-

Is the Act of Donation Form legally binding?

Yes, once properly executed, the Act of Donation Form is legally binding. This means that the donor cannot later change their mind and reclaim the property without the consent of the donee. It is essential to ensure that the form is completed correctly to avoid any disputes in the future.

-

Are there any tax implications associated with donating property?

Yes, there may be tax implications for both the donor and the donee. The donor may be subject to gift tax if the value of the donated property exceeds a certain threshold. The donee may also have tax responsibilities when they sell the property in the future. Consulting with a tax professional is advisable to understand these implications fully.

-

Do I need a lawyer to complete the Act of Donation Form?

While it is not legally required to have a lawyer to complete the Act of Donation Form, seeking legal advice can be beneficial. A lawyer can help ensure that the form is filled out correctly and that all necessary legal requirements are met, thereby reducing the risk of future disputes.

-

What should I do after completing the Act of Donation Form?

After completing the Act of Donation Form, it should be signed by both the donor and the donee in the presence of a notary public. Once notarized, it is advisable to record the document with the appropriate parish clerk's office to provide public notice of the property transfer.

-

Can the Act of Donation be revoked?

Generally, once the Act of Donation is executed and the property is transferred, it cannot be revoked unilaterally by the donor. However, if the donation was made under certain conditions or if the donor can prove incapacity at the time of signing, there may be grounds for revocation. Legal counsel should be sought in such cases.

-

Where can I obtain the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form can typically be obtained from legal stationery stores, online legal document providers, or through local government offices, such as the parish clerk's office. It is essential to ensure that the form used is the most current version and complies with Louisiana law.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | The Louisiana act of donation form is a legal document used to transfer ownership of property from one person to another without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 to 1471. |

| Types of Donations | It can be used for both inter vivos (during life) and mortis causa (after death) donations. |

| Requirements | The act must be in writing and signed by the donor and the donee. |

| Witnesses | For certain donations, the presence of witnesses may be required to validate the document. |

| Notarization | While notarization is not always mandatory, it is highly recommended for clarity and legality. |

| Property Types | Real estate, personal property, and movable property can be donated using this form. |

| Tax Implications | Donations may have tax consequences for both the donor and the donee, including potential gift taxes. |

| Revocation | A donor can revoke the donation under certain conditions, such as if the donee fails to fulfill obligations. |

| Filing | While the act of donation does not require filing with the state, recording it with the local parish can provide public notice. |