Blank Membership Ledger Form

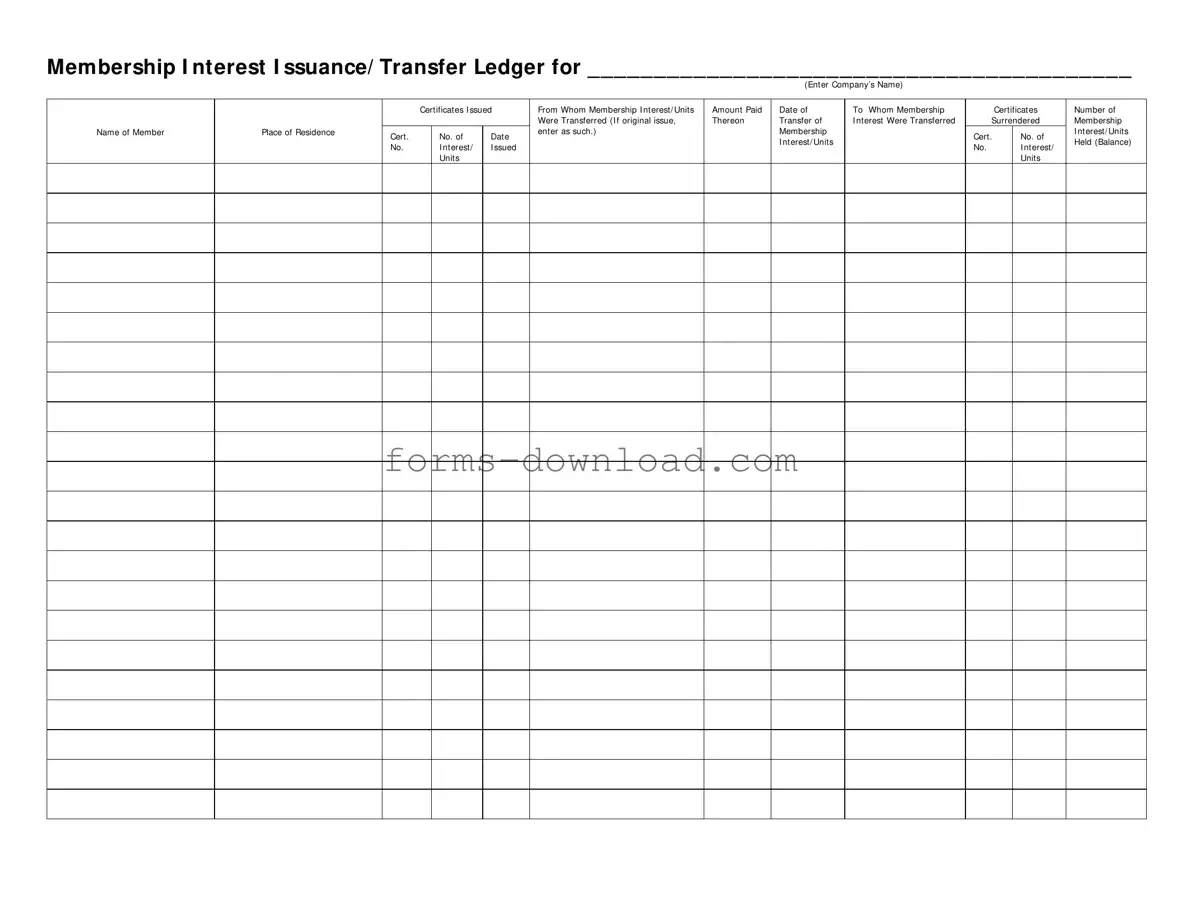

The Membership Ledger form serves as an essential tool for tracking ownership and transfers of membership interests within a company. This document captures critical information, including the company's name and details about the certificates issued. It provides a clear record of who holds membership interests, the amount paid for those interests, and the dates on which transfers occur. The form also allows for the documentation of original issuances and subsequent transfers, ensuring transparency in ownership changes. Additionally, it includes sections for noting the surrender of certificates, which is vital for maintaining accurate records of membership units held. By organizing this information systematically, the Membership Ledger form helps companies manage their membership interests effectively and comply with relevant regulations.

More PDF Forms

Texas Temporary Tag - Be aware of the expiration date on your temporary tag to avoid fines.

The Missouri Boat Bill of Sale form is a crucial document that facilitates the transfer of ownership for boats and watercraft in the state of Missouri. This form serves as a legal record, ensuring both the buyer and seller have a clear understanding of the transaction details. To streamline your boat sale process, consider filling out the form by clicking the button below or visiting the Bill of Sale for a Boat for more information.

Free Facial Consent Form Template - This form helps establish trust between you and the practitioner.

Advance Salary Application Form - Request financial support to keep your projects on track.

Dos and Don'ts

When filling out the Membership Ledger form, attention to detail is crucial. The following list outlines key actions to take and avoid to ensure accuracy and compliance.

- Do enter the company's name clearly at the top of the form.

- Do provide complete information for each certificate issued, including the certificate number and the amount paid.

- Do ensure that the dates are filled in correctly, using the format specified in the form.

- Do double-check the names of members and their places of residence for accuracy.

- Don't leave any sections blank; every field must be completed to avoid processing delays.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to sign and date the form where required.

- Don't submit the form without reviewing it for typos or errors.

Membership Ledger Sample

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

Listed Questions and Answers

-

What is the purpose of the Membership Ledger form?

The Membership Ledger form serves as a comprehensive record for tracking the issuance and transfer of membership interests or units within a company. It helps ensure transparency and accuracy in documenting who holds membership interests, the amounts paid, and any transfers that occur.

-

How should I fill out the company name on the form?

In the designated space for the company name, enter the full legal name of the company as it appears in official documents. This ensures that the ledger accurately reflects the entity involved in the membership interests.

-

What information is required when issuing certificates?

When issuing certificates, you must provide details such as the name of the member receiving the interest, the amount paid for the membership interest or units, the date of issuance, and the certificate number. This information helps maintain an accurate record of ownership.

-

What should I do if a membership interest is transferred?

In the event of a transfer, you must fill out the section indicating the name of the member to whom the interest is transferred, along with the date of transfer and the certificate number. This ensures that the ledger reflects the current holder of the membership interest.

-

Can I document the surrender of certificates on this form?

Yes, the form includes a section for documenting the surrender of certificates. You should enter the certificate number and the corresponding membership interest or units being surrendered. This helps maintain clarity regarding the status of the interests.

-

How do I calculate the balance of membership interests held?

The balance of membership interests held can be calculated by subtracting any surrendered or transferred interests from the total issued interests. This balance should be clearly documented in the designated area of the form.

-

Is it necessary to keep the Membership Ledger form updated?

Absolutely. Keeping the Membership Ledger form updated is crucial for accurate record-keeping and compliance with legal requirements. Regular updates help avoid disputes regarding ownership and ensure that all transactions are properly documented.

-

Who is responsible for maintaining the Membership Ledger?

The responsibility for maintaining the Membership Ledger typically falls to the company’s secretary or an appointed officer. This individual ensures that all entries are accurate and that the ledger is kept up to date.

-

What happens if there are discrepancies in the Membership Ledger?

If discrepancies arise, it is important to investigate and resolve them promptly. This may involve reviewing transaction records, contacting members for clarification, and making necessary corrections to the ledger. Maintaining accurate records is vital to prevent legal issues.

Form Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The Membership Ledger form tracks the issuance and transfer of membership interests or units within a company. |

| Company Name | Users must enter the name of the company at the top of the form, ensuring clarity about which entity the ledger pertains to. |

| Transfer Details | The form requires information about the parties involved in the transfer, including the original member and the new recipient. |

| Certification Numbers | Each membership interest or unit has a unique certificate number, which must be recorded for tracking purposes. |

| Amount Paid | The form includes a section to specify the amount paid for the membership interest or units, ensuring financial transparency. |

| Governing Laws | State-specific laws govern the use of the Membership Ledger. For instance, in Delaware, the relevant statutes are found in Title 6, Chapter 18. |

| Balance Tracking | The ledger must reflect the number of membership interests or units held after each transaction, maintaining accurate records of ownership. |

| Transfer Dates | Each transfer must include the date of the transaction, which is critical for maintaining an accurate timeline of ownership changes. |