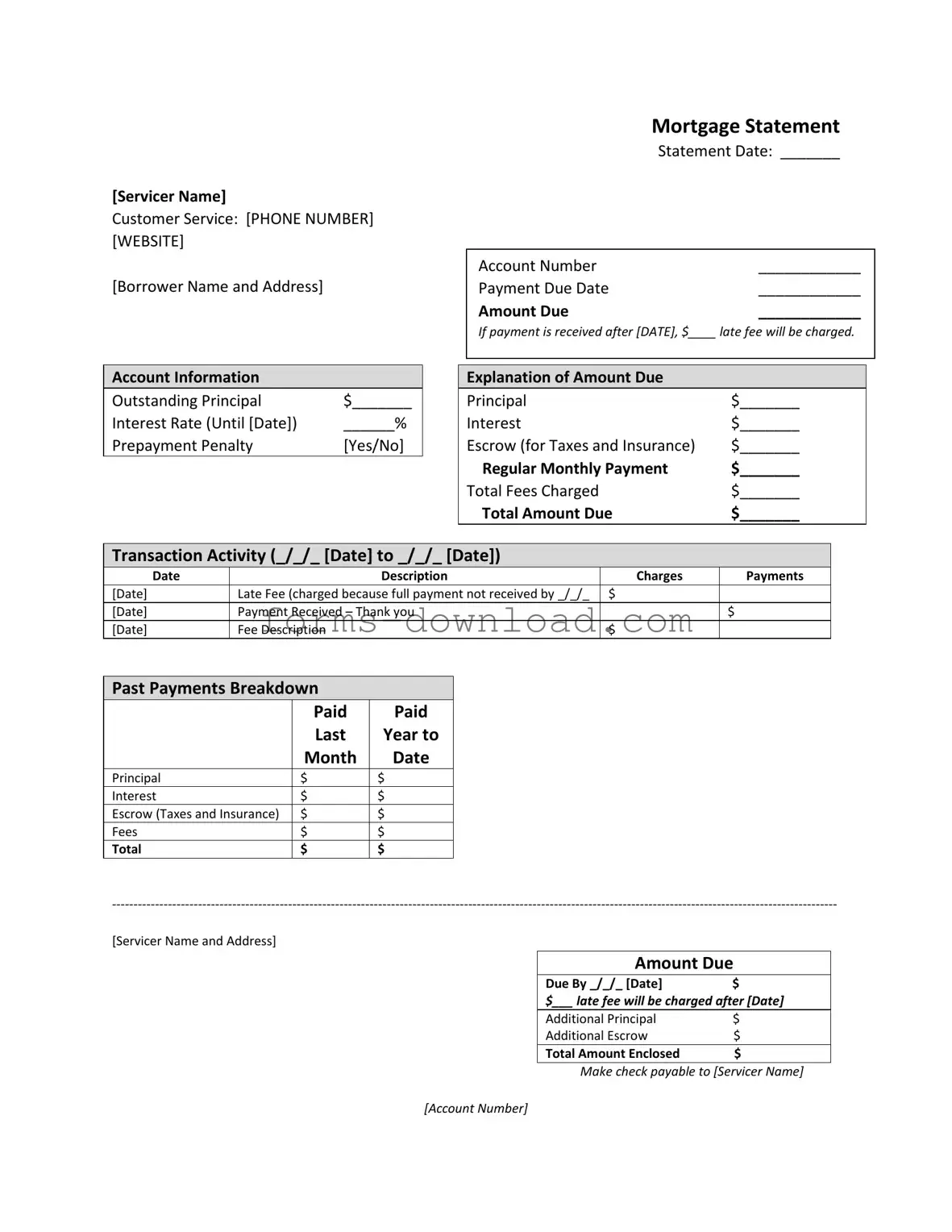

Blank Mortgage Statement Form

The Mortgage Statement form is a crucial document for homeowners, providing essential information about their mortgage account. It includes the servicer's contact details, ensuring borrowers know where to reach for assistance. The statement clearly outlines the account number, payment due date, and the total amount due, which encompasses principal, interest, and escrow for taxes and insurance. Homeowners will also find details about any late fees that may apply if payments are not received on time. Additionally, the form breaks down transaction activity, showing recent charges and payments, which helps borrowers track their financial history. Important messages regarding partial payments and delinquency notices are included to inform borrowers of their standing and the potential consequences of late payments. If homeowners are facing financial difficulties, the statement provides guidance on seeking mortgage counseling or assistance, emphasizing the servicer's commitment to supporting borrowers through challenging times.

More PDF Forms

Pregnancy Verification Letter Planned Parenthood - Your personal story is respected and valued in the healthcare process.

Acord 130 - The form encompasses information sensitive to physical and financial risks related to workers' compensation.

For anyone looking to facilitate a motorcycle transaction, the valuable resource on this efficient Motorcycle Bill of Sale process provides insight into the necessary steps and documentation required.

Schedule of Availability Template - Your availability form is crucial for team planning.

Dos and Don'ts

When filling out the Mortgage Statement form, it is essential to follow specific guidelines to ensure accuracy and completeness. Here is a list of things to do and avoid:

- Do enter your full name and address accurately at the top of the form.

- Do double-check the account number for correctness.

- Do provide the payment due date and the amount due clearly.

- Do review the outstanding principal and interest rate before submission.

- Don't leave any sections blank that require your input.

- Don't ignore the late fee policy; ensure you understand the implications of late payments.

- Don't forget to sign and date the form before sending it.

Mortgage Statement Sample

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Listed Questions and Answers

-

What is a Mortgage Statement?

A mortgage statement is a document that provides a detailed summary of your mortgage account. It outlines important information such as the amount due, payment history, interest rate, and any outstanding principal. This statement helps borrowers keep track of their mortgage obligations and payment schedules.

-

What information can I find on my Mortgage Statement?

Your mortgage statement includes several key pieces of information:

- Account Number

- Payment Due Date

- Outstanding Principal

- Interest Rate

- Escrow details for taxes and insurance

- Total amount due, including any fees

- Transaction activity, including payments and charges

This comprehensive overview allows you to monitor your mortgage effectively.

-

What happens if I miss a payment?

If you miss a payment, your mortgage statement will indicate the amount that is past due. A late fee may be charged if the payment is not received by the specified date. It is crucial to address missed payments promptly to avoid further financial repercussions, including potential foreclosure.

-

What is a partial payment and how is it handled?

Partial payments are amounts that are less than your total monthly mortgage payment. These payments do not apply directly to your mortgage balance; instead, they are held in a suspense account. To have these funds applied to your mortgage, you must pay the remaining balance of the partial payment.

-

What should I do if I am experiencing financial difficulty?

If you find yourself struggling to make mortgage payments, it is essential to seek assistance. Your mortgage statement often includes resources for mortgage counseling or assistance programs. Taking proactive steps can help you avoid serious consequences, such as foreclosure.

-

How can I make my mortgage payment?

You can make your mortgage payment by sending a check payable to your servicer, as indicated on your statement. Ensure that you include your account number to avoid any processing delays. Additionally, many servicers offer online payment options through their websites, making it convenient to manage your payments.

-

What is an escrow account?

An escrow account is a separate account used to hold funds for property taxes and insurance premiums. Your mortgage statement will detail the amount allocated to escrow each month. This ensures that these essential payments are made on time, protecting both you and the lender.

-

How do I interpret the transaction activity section?

The transaction activity section of your mortgage statement provides a history of payments and charges over a specified period. It lists the date of each transaction, a description, and the amounts charged or paid. This section helps you understand your payment history and any fees incurred, allowing for better financial planning.

Form Overview

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Account Details | Key account information such as account number, payment due date, and the total amount due is prominently displayed. |

| Late Fees | If payment is received after the specified date, a late fee will be charged. This amount is clearly indicated on the statement. |

| Outstanding Principal | The statement provides the outstanding principal balance, interest rate, and any applicable prepayment penalties. |

| Transaction Activity | A detailed record of recent transactions is included, showing charges, payments, and any late fees incurred over a specified period. |

| Delinquency Notice | A notice alerts borrowers if they are late on payments, emphasizing the risk of fees and potential foreclosure. |

| Financial Assistance Information | The statement may provide resources for borrowers experiencing financial difficulty, including mortgage counseling options. |