Blank Netspend Dispute Form

The Netspend Dispute Notification Form serves as a crucial tool for cardholders who need to address unauthorized credit or debit transactions. This form allows individuals to formally initiate a dispute process, ensuring that their concerns are documented and reviewed by Netspend in a timely manner. To start the process, it is essential to complete the form and submit it within 60 days of the disputed transaction. Once received, Netspend commits to making a decision regarding the disputed funds within 10 business days. The form requires cardholders to provide detailed information about each disputed transaction, including the amount, date, time, and merchant involved. Additionally, it prompts users to indicate whether they have contacted the merchant and whether a refund is expected. In cases where a card has been lost or stolen, the form includes specific instructions for reporting this to Netspend, which can help limit liability for unauthorized transactions. Cardholders are encouraged to attach supporting documentation, such as police reports or receipts, to bolster their claims. This proactive approach not only aids in the resolution of disputes but also helps protect the cardholder's financial interests.

More PDF Forms

Business Credit Application Template - Use the form to request specific credit amounts based on your needs.

The process of buying or selling a boat in Arkansas can be simplified by using the Arkansas Boat Bill of Sale, which serves as a crucial documentation of the transaction. By ensuring that all details, including the buyer and seller's information, boat specifications, and sale price, are accurately recorded, both parties can avoid misunderstandings. For more information about creating this essential document, you can refer to the Vessel Bill of Sale.

Driver License Online - The DL 44 form is used to apply for a California driver license or identification card.

Dos and Don'ts

When filling out the Netspend Dispute form, it is crucial to follow certain guidelines to ensure a smooth process. Below is a list of recommended actions and common pitfalls to avoid.

- Do: Complete the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do: Provide accurate and detailed information for each transaction you are disputing.

- Do: Include supporting documentation, such as receipts or police reports, to strengthen your case.

- Do: Indicate if your card was lost or stolen and request to block activity on your card.

- Don't: Leave any sections of the form blank; incomplete forms can delay the process.

- Don't: Submit the form without reviewing it for accuracy and completeness.

- Don't: Forget to sign and date the form before submission.

- Don't: Assume that contacting the merchant is unnecessary; always check if they can provide a refund.

By adhering to these guidelines, individuals can enhance the likelihood of a favorable outcome regarding their dispute.

Netspend Dispute Sample

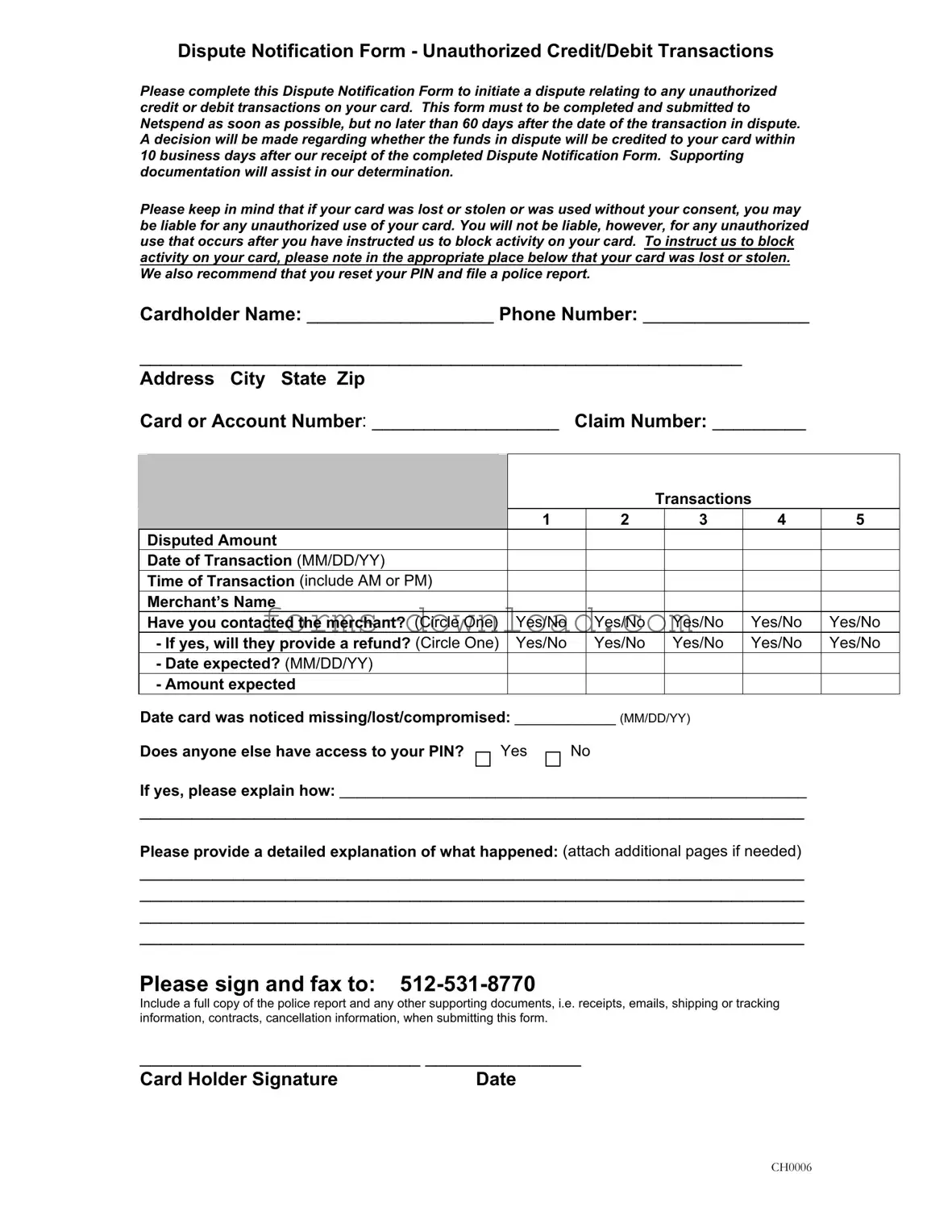

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Listed Questions and Answers

-

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is designed to help you report unauthorized credit or debit transactions on your card. By completing this form, you initiate a formal dispute process, allowing Netspend to investigate the transactions in question and determine whether you are entitled to a refund.

-

How soon do I need to submit the form after noticing an unauthorized transaction?

You must submit the Dispute Notification Form as soon as possible, but no later than 60 days from the date of the transaction you are disputing. Timeliness is crucial in ensuring your dispute is processed effectively.

-

What happens after I submit my dispute?

Once Netspend receives your completed form, they will review the information provided. A decision regarding the disputed funds will be made within 10 business days. If the investigation confirms your claim, the funds may be credited back to your card.

-

What documentation do I need to provide with the form?

It’s important to include supporting documentation to strengthen your case. This may include a police report if your card was lost or stolen, receipts, emails, or any other relevant information that can help clarify the situation. The more evidence you provide, the easier it will be for Netspend to assess your dispute.

-

Am I liable for unauthorized transactions?

If your card was lost or stolen, you may be liable for unauthorized transactions that occurred before you reported the loss. However, you won’t be held responsible for transactions that took place after you instructed Netspend to block your card. It’s always best to act quickly to minimize potential liability.

-

What should I do if my card is lost or stolen?

If you believe your card is lost or stolen, you should indicate this on the form. Additionally, it’s advisable to reset your PIN and file a police report. Taking these steps helps protect your account and aids in the dispute process.

-

Can I dispute multiple transactions on one form?

Yes, you can dispute up to five transactions on a single Dispute Notification Form. Make sure to provide all necessary details for each transaction, including the disputed amount, date, time, and merchant’s name. This will streamline the process for you and for Netspend.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used to dispute unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | The form must be submitted within 60 days from the date of the disputed transaction. |

| Response Time | Netspend will respond within 10 business days after receiving the completed form. |

| Liability for Unauthorized Use | Cardholders may be liable for unauthorized transactions if they do not report a lost or stolen card promptly. |

| Blocking Card Activity | Cardholders can block activity on their card by indicating it was lost or stolen on the form. |

| Supporting Documentation | Including supporting documents, such as a police report, can help in the dispute resolution process. |

| Number of Transactions | Up to five transactions can be disputed on a single form submission. |

| State-Specific Laws | The governing laws may vary by state, including regulations related to unauthorized transactions under the Electronic Fund Transfer Act. |