Attorney-Approved Promissory Note Document for the State of New Jersey

The New Jersey Promissory Note form serves as a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form typically includes key components such as the principal amount, interest rate, payment schedule, and maturity date, ensuring that both parties have a clear understanding of their obligations. Additionally, it may specify any late fees or penalties for missed payments, providing further clarity on the consequences of non-compliance. By detailing the rights and responsibilities of each party, the form helps to protect the interests of both the borrower and the lender. Furthermore, it is essential to note that the New Jersey Promissory Note can be customized to suit specific lending situations, making it a versatile tool in personal and business finance. Understanding this form is vital for anyone involved in lending or borrowing money in New Jersey, as it helps to formalize the agreement and serves as a reference point in case of disputes.

Consider More Promissory Note Templates for Different States

Tennessee Promissory Note - An unsigned promissory note is not legally enforceable.

When it comes to safeguarding sensitive information, understanding the significance of a well-drafted Non-disclosure Agreement template is crucial for effective business operations and relationship management. You can find a complete overview and resources by visiting the comprehensive Non-disclosure Agreement template guide.

Promissory Note Washington State - This form facilitates personal loans, business loans, real estate transactions, and more.

Promissory Note Virginia - In the event of non-payment, this document can be used in legal proceedings to recover the debt.

Dos and Don'ts

When filling out the New Jersey Promissory Note form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do provide clear and accurate information for all parties involved.

- Do specify the loan amount and interest rate clearly.

- Do include a repayment schedule to avoid confusion later.

- Do sign and date the document in the appropriate sections.

- Don't leave any blank spaces; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

Following these guidelines will help ensure that the Promissory Note is valid and enforceable.

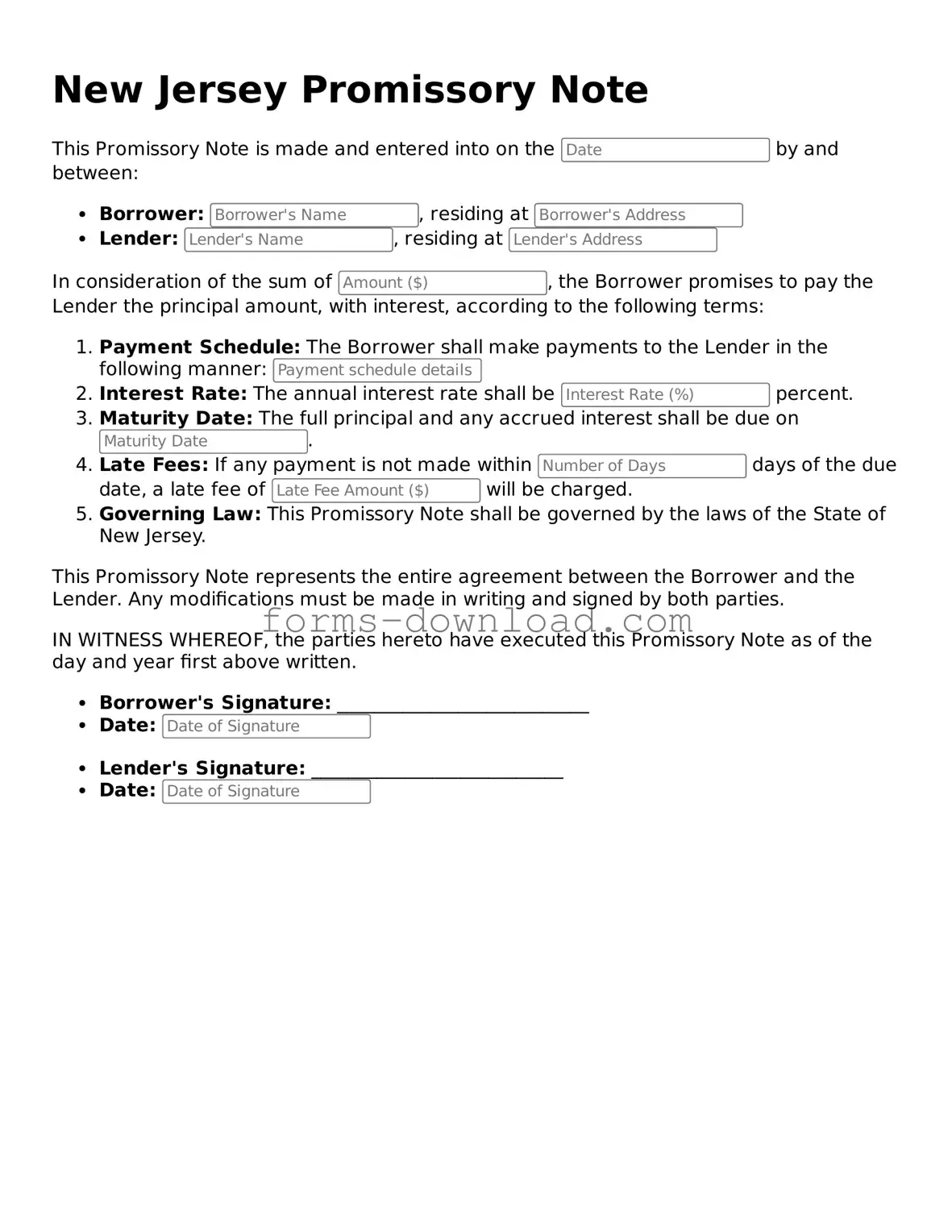

New Jersey Promissory Note Sample

New Jersey Promissory Note

This Promissory Note is made and entered into on the by and between:

- Borrower: , residing at

- Lender: , residing at

In consideration of the sum of , the Borrower promises to pay the Lender the principal amount, with interest, according to the following terms:

- Payment Schedule: The Borrower shall make payments to the Lender in the following manner:

- Interest Rate: The annual interest rate shall be percent.

- Maturity Date: The full principal and any accrued interest shall be due on .

- Late Fees: If any payment is not made within days of the due date, a late fee of will be charged.

- Governing Law: This Promissory Note shall be governed by the laws of the State of New Jersey.

This Promissory Note represents the entire agreement between the Borrower and the Lender. Any modifications must be made in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the day and year first above written.

- Borrower's Signature: ___________________________

- Date:

- Lender's Signature: ___________________________

- Date:

Listed Questions and Answers

-

What is a New Jersey Promissory Note?

A New Jersey Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a certain time. It outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments.

-

Who can use a Promissory Note in New Jersey?

Anyone can use a Promissory Note in New Jersey. This includes individuals, businesses, and organizations. Whether you are lending money to a friend or financing a business deal, a Promissory Note can help ensure that the terms are clear and legally binding.

-

What information should be included in a Promissory Note?

A complete Promissory Note should include:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate

- The repayment schedule

- Any late fees or penalties

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed. It is advisable to have the Note notarized to further strengthen its validity.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It’s important to document any modifications in writing and have both parties sign the revised terms to avoid any confusion later.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may pursue collection efforts, which can include legal action. It’s essential to review the terms of the Promissory Note to understand the specific consequences of default.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The New Jersey Uniform Commercial Code (UCC) governs promissory notes in New Jersey. |

| Parties Involved | The note involves two primary parties: the maker (the borrower) and the payee (the lender). |

| Consideration | A valid promissory note requires consideration, which is something of value exchanged between the parties. |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, depending on the agreement. |

| Payment Terms | Payment terms must be clearly stated, including the due date and any installment schedules. |

| Default Clause | Many promissory notes include a default clause outlining the consequences if the borrower fails to pay. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include all essential terms. |