Attorney-Approved Real Estate Purchase Agreement Document for the State of New Jersey

When navigating the world of real estate in New Jersey, understanding the Real Estate Purchase Agreement form is essential for both buyers and sellers. This document serves as a binding contract that outlines the terms and conditions of the property transaction. It includes crucial elements such as the purchase price, financing details, and the closing date, ensuring that all parties are on the same page. Additionally, the agreement addresses contingencies, such as inspections and appraisals, which can protect buyers from unforeseen issues. The form also specifies the responsibilities of each party, covering aspects like earnest money deposits and property disclosures. By clearly defining these key components, the New Jersey Real Estate Purchase Agreement helps facilitate a smooth transaction process, fostering transparency and trust between buyers and sellers.

Consider More Real Estate Purchase Agreement Templates for Different States

Tn Purchase and Sale Agreement - A Real Estate Purchase Agreement outlines the terms under which a property will be bought or sold.

If you are looking for a reliable way to document your educational intentions, the "crucial Homeschool Letter of Intent" can be a vital resource. This form not only signifies your commitment to homeschooling but also ensures adherence to necessary regulations. For those interested in obtaining the form, follow the link to access the template: Homeschool Letter of Intent template.

Virginia Real Estate Contract - It often requires disclosures about the property’s condition from the seller.

Dos and Don'ts

When filling out the New Jersey Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure clarity and compliance. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Read the entire form carefully before filling it out.

- Provide accurate information about the property and parties involved.

- Sign and date the agreement in the appropriate sections.

- Consult with a real estate professional if you have questions.

- Keep a copy of the completed agreement for your records.

Things You Shouldn't Do:

- Do not leave any sections blank; fill in all required fields.

- Do not use abbreviations or unclear terms that may cause confusion.

- Do not rush through the process; take your time to ensure accuracy.

- Do not sign the agreement without fully understanding its contents.

- Do not ignore deadlines for submitting the agreement.

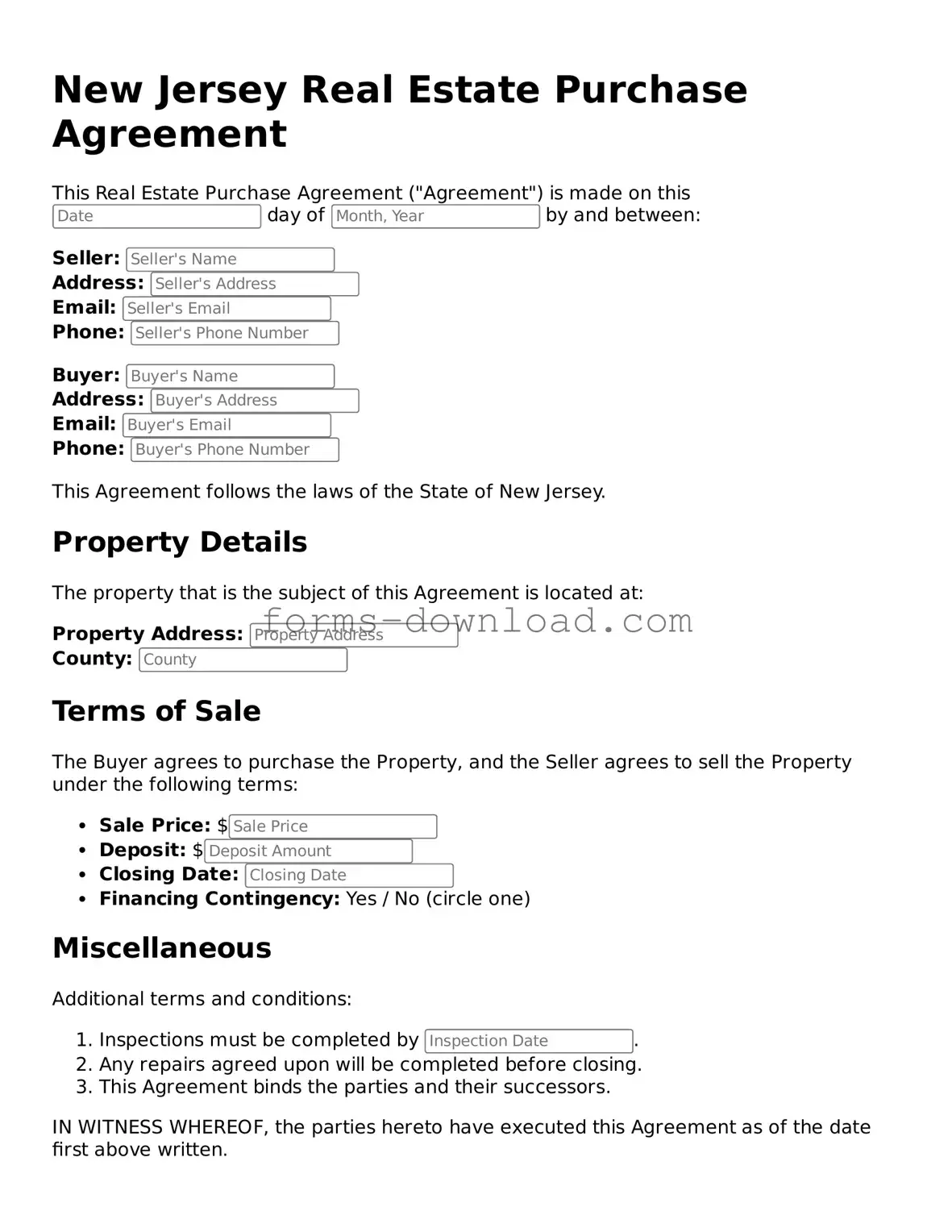

New Jersey Real Estate Purchase Agreement Sample

New Jersey Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made on this day of by and between:

Seller:

Address:

Email:

Phone:

Buyer:

Address:

Email:

Phone:

This Agreement follows the laws of the State of New Jersey.

Property Details

The property that is the subject of this Agreement is located at:

Property Address:

County:

Terms of Sale

The Buyer agrees to purchase the Property, and the Seller agrees to sell the Property under the following terms:

- Sale Price: $

- Deposit: $

- Closing Date:

- Financing Contingency: Yes / No (circle one)

Miscellaneous

Additional terms and conditions:

- Inspections must be completed by .

- Any repairs agreed upon will be completed before closing.

- This Agreement binds the parties and their successors.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

Seller's Signature: ________________________ Date:

Buyer's Signature: ________________________ Date:

Listed Questions and Answers

-

What is a New Jersey Real Estate Purchase Agreement?

The New Jersey Real Estate Purchase Agreement is a legal document that outlines the terms and conditions for the sale of real estate in New Jersey. It serves as a binding contract between the buyer and seller, detailing important aspects such as the purchase price, contingencies, and closing dates.

-

What key elements should be included in the agreement?

Essential components of the agreement include:

- Names and addresses of the buyer and seller

- Description of the property being sold

- Purchase price and payment terms

- Contingencies, such as inspections or financing

- Closing date and possession details

-

Are there any contingencies I should consider?

Yes, contingencies are crucial as they protect the buyer's interests. Common contingencies include:

- Home inspection contingency

- Financing contingency

- Appraisal contingency

These clauses allow the buyer to back out of the agreement without penalty if certain conditions are not met.

-

How is the purchase price determined?

The purchase price is typically negotiated between the buyer and seller. Factors influencing this decision may include the property’s market value, condition, and comparable sales in the area. It’s advisable to conduct thorough research or consult a real estate agent for guidance.

-

What happens if either party breaches the agreement?

If either party fails to uphold their obligations under the agreement, it may be considered a breach of contract. The non-breaching party may have the right to seek remedies, which can include financial compensation or specific performance, compelling the breaching party to fulfill their contractual duties.

-

Can I make changes to the agreement after it is signed?

Yes, changes can be made to the agreement, but they must be documented in writing and signed by both parties. Verbal agreements or informal changes are not legally binding. It’s important to ensure that all modifications are clear to avoid any misunderstandings later on.

-

Is it necessary to have a lawyer review the agreement?

While it is not legally required, having a lawyer review the Real Estate Purchase Agreement is highly recommended. A legal professional can help identify potential issues, ensure that your rights are protected, and provide valuable advice throughout the transaction process.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The New Jersey Real Estate Purchase Agreement is governed by the laws of the State of New Jersey. |

| Purpose | This form outlines the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement identifies the buyer(s) and seller(s) involved in the transaction. |

| Property Description | A detailed description of the property being sold is included in the agreement. |

| Purchase Price | The total purchase price for the property is specified in the agreement. |

| Earnest Money | The agreement typically requires an earnest money deposit to show the buyer's commitment. |

| Contingencies | Common contingencies may include financing, inspections, and appraisals, which must be met for the sale to proceed. |

| Closing Date | The expected closing date, when the transaction will be finalized, is stated in the agreement. |

| Disclosures | The seller is required to provide certain disclosures regarding the property's condition and any known issues. |