Attorney-Approved Transfer-on-Death Deed Document for the State of New Jersey

The New Jersey Transfer-on-Death Deed (TODD) is an important legal tool that allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the often lengthy probate process. This form provides a streamlined method for individuals to ensure that their property passes directly to their heirs without the need for court intervention. It is essential for property owners to understand the requirements and implications of utilizing a TODD, as it involves specific legal criteria that must be met for the deed to be valid. The form must be executed during the owner’s lifetime and recorded with the county clerk to be effective. Importantly, the transfer does not take effect until the owner's death, allowing them to retain full control over the property during their lifetime. Additionally, the TODD can be revoked or modified at any time before the owner's death, offering flexibility to adapt to changing circumstances. Understanding these key aspects can help property owners make informed decisions regarding their estate planning strategies in New Jersey.

Consider More Transfer-on-Death Deed Templates for Different States

Lady Bird Deed Virginia - Considered a user-friendly tool for people of all ages planning for their future.

To ensure a smooth transaction when buying or selling a boat, it's important to complete the necessary documentation, such as the Bill of Sale for a Boat, which formalizes the transfer of ownership and protects both parties involved.

Transfer on Death Deed Washington State Form - A properly executed Transfer-on-Death Deed can protect the owner's property plans from unwanted external claims.

Transfer on Death Deed Form Florida - This form helps avoid probate by directly transferring ownership to heirs when the owner dies.

Transfer on Death Deed Tennessee Form - A legal document that allows property transfer upon the owner's death.

Dos and Don'ts

When filling out the New Jersey Transfer-on-Death Deed form, it's important to be mindful of certain practices to ensure the process goes smoothly. Here are five things you should and shouldn't do:

- Do ensure that you understand the implications of a Transfer-on-Death Deed. It allows you to transfer property upon your death without going through probate.

- Do provide accurate information regarding the property. Double-check the legal description and address to avoid any errors.

- Do sign the deed in the presence of a notary public. This step is crucial for the validity of the document.

- Do file the deed with the county clerk's office where the property is located. This ensures that the deed is officially recorded.

- Do keep a copy of the filed deed for your records. This can be important for future reference.

- Don't forget to check if there are any specific requirements for your county. Each county may have different rules regarding the form.

- Don't use vague language when describing the property. Clarity is essential to prevent disputes later.

- Don't neglect to consider tax implications. Consult a tax advisor if you're unsure about how this deed may affect your estate.

- Don't assume that the deed is irrevocable once filed. Understand the process for revoking it if necessary.

- Don't overlook the importance of informing your beneficiaries about the deed. Transparency can help avoid confusion in the future.

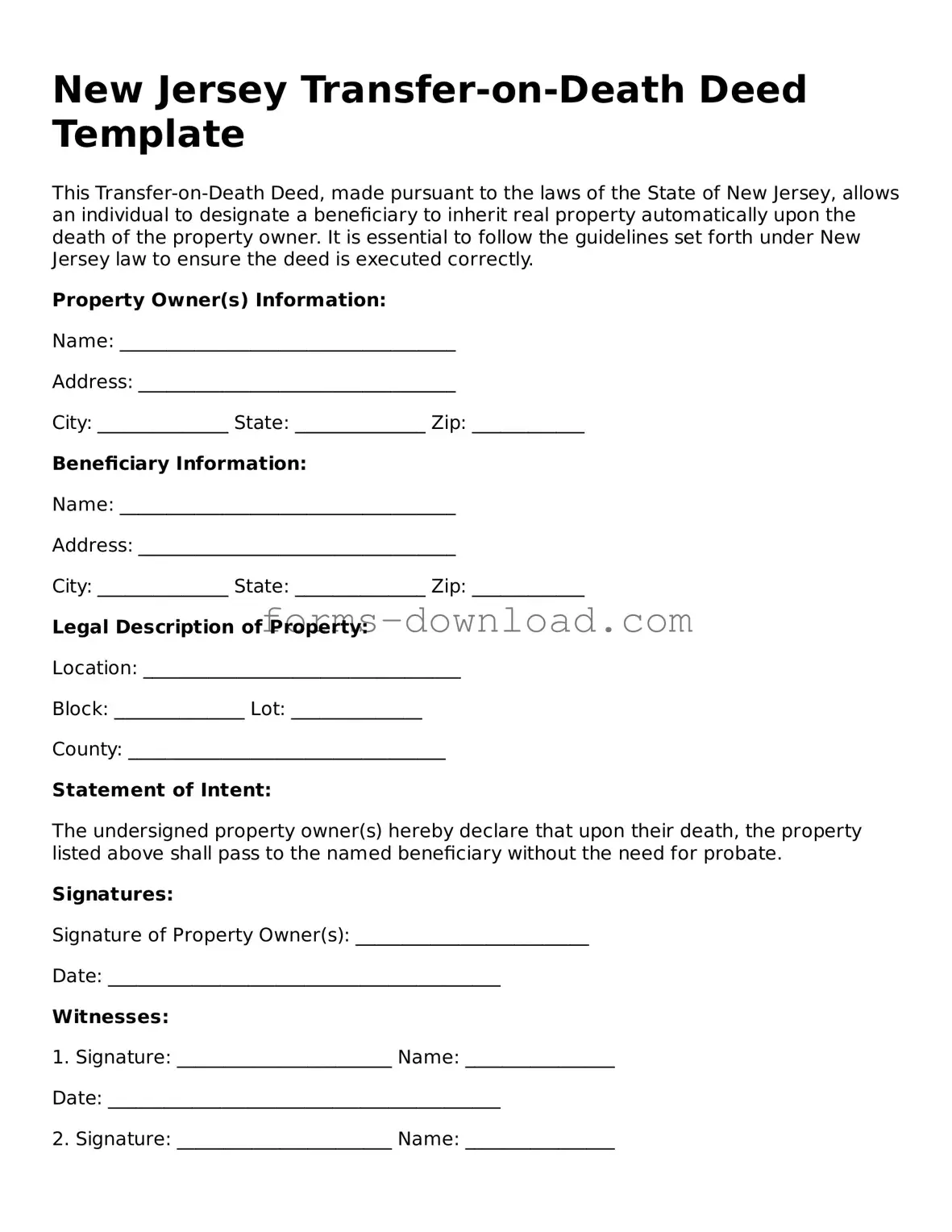

New Jersey Transfer-on-Death Deed Sample

New Jersey Transfer-on-Death Deed Template

This Transfer-on-Death Deed, made pursuant to the laws of the State of New Jersey, allows an individual to designate a beneficiary to inherit real property automatically upon the death of the property owner. It is essential to follow the guidelines set forth under New Jersey law to ensure the deed is executed correctly.

Property Owner(s) Information:

Name: ____________________________________

Address: __________________________________

City: ______________ State: ______________ Zip: ____________

Beneficiary Information:

Name: ____________________________________

Address: __________________________________

City: ______________ State: ______________ Zip: ____________

Legal Description of Property:

Location: __________________________________

Block: ______________ Lot: ______________

County: __________________________________

Statement of Intent:

The undersigned property owner(s) hereby declare that upon their death, the property listed above shall pass to the named beneficiary without the need for probate.

Signatures:

Signature of Property Owner(s): _________________________

Date: __________________________________________

Witnesses:

1. Signature: _______________________ Name: ________________

Date: __________________________________________

2. Signature: _______________________ Name: ________________

Date: __________________________________________

This Transfer-on-Death Deed must be filed with the county clerk in the county where the property is located to be effective. Ensure all required information is filled out correctly.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed in New Jersey?

A Transfer-on-Death Deed (TOD Deed) allows property owners in New Jersey to transfer their real estate to a designated beneficiary upon their death. This method avoids probate, making the transfer process simpler and more efficient for the heirs.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in New Jersey can utilize a Transfer-on-Death Deed. However, it is essential that the property owner is of sound mind and capable of making decisions regarding their property.

-

How do I complete a Transfer-on-Death Deed?

To complete a TOD Deed, you will need to fill out a specific form that includes details about the property, the owner's information, and the designated beneficiary. It is crucial to ensure that the form is signed and notarized properly to make it legally binding.

-

Do I need to notify the beneficiary?

While it is not legally required to notify the beneficiary, it is often a good practice to inform them of the deed. This can help avoid confusion or disputes later on, ensuring that everyone is aware of the arrangement.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time before your death. To do this, you will need to complete a new TOD Deed or a revocation form and ensure it is properly executed and recorded with the county clerk's office.

-

What happens if I sell the property before I die?

If you sell the property before your death, the Transfer-on-Death Deed becomes void. The new owner will not be affected by the deed, and the transfer will not occur since the property is no longer owned by you.

-

Is there a fee for filing a Transfer-on-Death Deed?

Yes, there is typically a fee associated with recording a Transfer-on-Death Deed. The amount may vary by county, so it is advisable to check with your local county clerk’s office for the exact fee.

-

Will a Transfer-on-Death Deed affect my taxes?

A Transfer-on-Death Deed does not directly impact your property taxes during your lifetime. However, the beneficiary may face different tax implications once the property is transferred to them. Consulting a tax professional can provide clarity on potential tax consequences.

-

Can I use a Transfer-on-Death Deed for all types of property?

In New Jersey, a Transfer-on-Death Deed can only be used for real estate. It does not apply to personal property or financial accounts. For those assets, other estate planning tools may be more appropriate.

-

What should I do if I have more questions?

If you have additional questions regarding the Transfer-on-Death Deed or need assistance, consider reaching out to an estate planning attorney. They can provide personalized guidance based on your specific situation.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in New Jersey is governed by the New Jersey Statutes, specifically N.J.S.A. 46:3B-1 et seq. |

| Eligibility | Any individual who owns real estate in New Jersey can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can name one or more beneficiaries in the deed. They can also specify alternate beneficiaries. |

| Revocation | The deed can be revoked at any time before the owner's death. A new deed must be recorded to replace the old one. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded in the county where the property is located to be effective. |

| Tax Implications | There are no immediate tax implications for the beneficiaries until they sell the property after the owner's death. |

| Limitations | This deed cannot be used for all types of property. It is specifically for real estate and does not apply to personal property. |

| Legal Advice | It is advisable to consult with a legal professional when creating a Transfer-on-Death Deed to ensure it meets all requirements. |