Fillable Owner Financing Contract Form

When considering alternative financing options for purchasing a home, the Owner Financing Contract form emerges as a practical solution for both buyers and sellers. This form outlines the terms under which the seller finances the buyer's purchase directly, bypassing traditional lenders. Key components of the contract include the purchase price, down payment, interest rate, repayment schedule, and any penalties for late payments. Additionally, it details the responsibilities of both parties, such as property maintenance and insurance requirements. The contract also stipulates the consequences of default, ensuring that both the buyer and seller understand their rights and obligations. By clearly laying out these terms, the Owner Financing Contract provides a structured approach to real estate transactions that can benefit those who may face challenges in securing conventional financing.

More Owner Financing Contract Forms:

Purchase Agreement Addendum - Documentation via this addendum is important for legal protection of all parties.

To further enhance your understanding of the Real Estate Purchase Agreement process, you can access useful templates and resources, such as the Minnesota PDF Forms, which provide a clear structure to help you navigate the complexities of property transactions effectively.

How to Fire a Realtor Example Letter - This essential document helps prevent any unwanted obligations stemming from the agreement.

Dos and Don'ts

When filling out an Owner Financing Contract form, it is crucial to approach the task with care and attention. Here are some essential do's and don'ts to keep in mind:

- Do read the entire contract thoroughly before filling it out.

- Do ensure all parties involved understand the terms being agreed upon.

- Do provide accurate and complete information in all sections of the form.

- Do consult with a real estate professional or attorney if you have questions.

- Do keep a copy of the completed contract for your records.

- Don't rush through the form; taking your time can prevent mistakes.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't ignore any legal requirements or regulations that apply to your situation.

- Don't sign the contract until you are fully comfortable with its terms.

Owner Financing Contract Sample

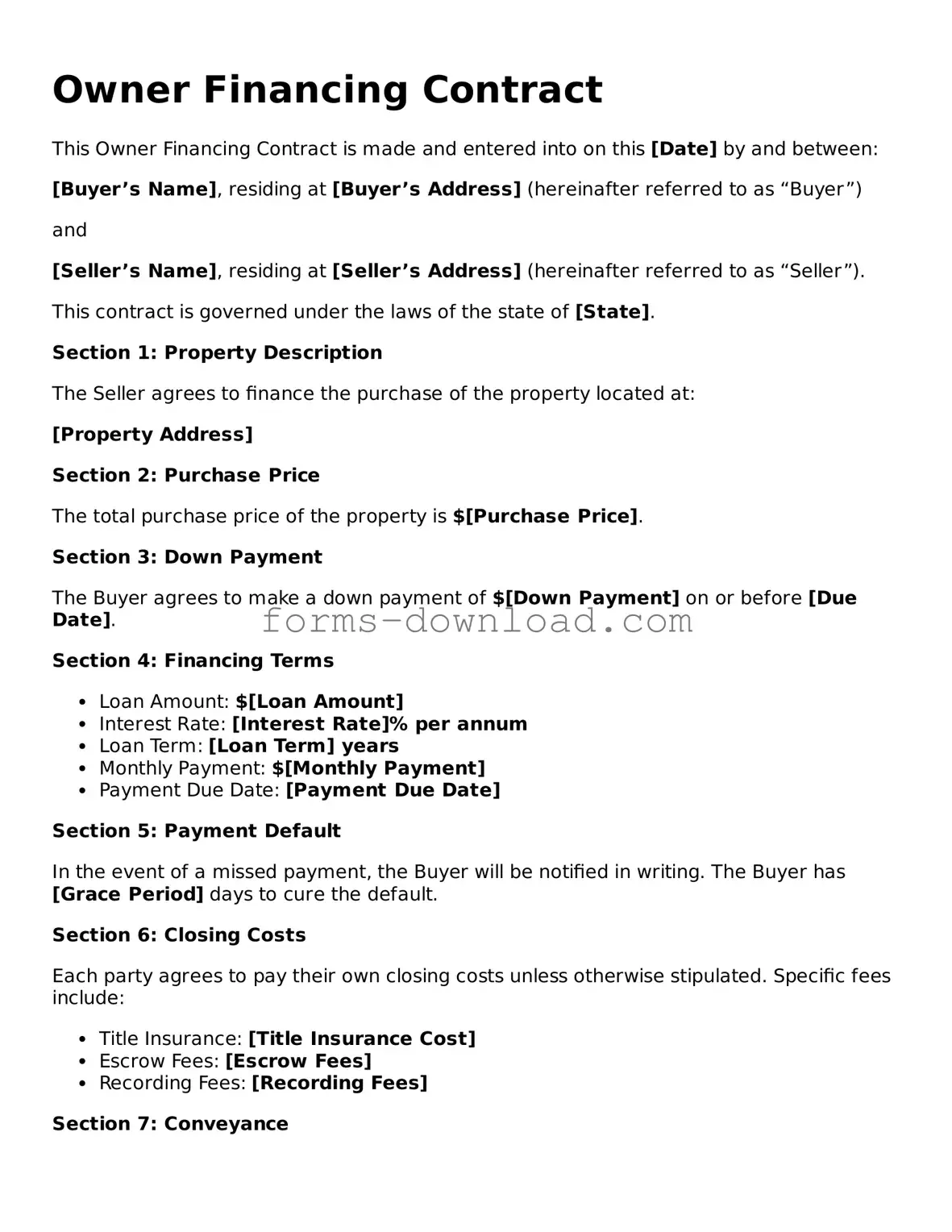

Owner Financing Contract

This Owner Financing Contract is made and entered into on this [Date] by and between:

[Buyer’s Name], residing at [Buyer’s Address] (hereinafter referred to as “Buyer”)

and

[Seller’s Name], residing at [Seller’s Address] (hereinafter referred to as “Seller”).

This contract is governed under the laws of the state of [State].

Section 1: Property Description

The Seller agrees to finance the purchase of the property located at:

[Property Address]

Section 2: Purchase Price

The total purchase price of the property is $[Purchase Price].

Section 3: Down Payment

The Buyer agrees to make a down payment of $[Down Payment] on or before [Due Date].

Section 4: Financing Terms

- Loan Amount: $[Loan Amount]

- Interest Rate: [Interest Rate]% per annum

- Loan Term: [Loan Term] years

- Monthly Payment: $[Monthly Payment]

- Payment Due Date: [Payment Due Date]

Section 5: Payment Default

In the event of a missed payment, the Buyer will be notified in writing. The Buyer has [Grace Period] days to cure the default.

Section 6: Closing Costs

Each party agrees to pay their own closing costs unless otherwise stipulated. Specific fees include:

- Title Insurance: [Title Insurance Cost]

- Escrow Fees: [Escrow Fees]

- Recording Fees: [Recording Fees]

Section 7: Conveyance

The Seller agrees to convey clear title to the property to the Buyer upon the fulfillment of all terms of this contract.

Section 8: Signatures

By signing this Owner Financing Contract, both parties agree to the terms herein.

______________________________

Buyer’s Signature

Date: ________________

______________________________

Seller’s Signature

Date: ________________

Witnessed by:

______________________________

Witness Name

Date: ________________

Listed Questions and Answers

-

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller provides financing to the buyer to purchase the property. Instead of the buyer obtaining a mortgage from a bank or other financial institution, the seller allows the buyer to make payments directly to them over time.

-

What are the benefits of using an Owner Financing Contract?

There are several benefits to this type of financing. For sellers, it can attract more buyers, especially those who may not qualify for traditional loans. It can also provide a steady stream of income through monthly payments. For buyers, it offers an alternative route to homeownership, often with more flexible terms and potentially lower closing costs.

-

What terms are typically included in an Owner Financing Contract?

The contract generally includes the purchase price, down payment amount, interest rate, payment schedule, and length of the loan. It may also outline provisions for property taxes, insurance responsibilities, and what happens in case of default.

-

Is a down payment required?

Yes, most Owner Financing Contracts require a down payment. The amount can vary based on the agreement between the seller and the buyer. Typically, a larger down payment can lead to better financing terms.

-

How is the interest rate determined?

The interest rate in an Owner Financing Contract is usually negotiated between the seller and the buyer. It may be based on current market rates, the buyer's creditworthiness, and the seller's willingness to take on risk.

-

What happens if the buyer defaults on the payments?

If the buyer fails to make payments, the seller typically has the right to initiate foreclosure proceedings, similar to a bank. The specific terms regarding default should be clearly outlined in the contract to protect both parties.

-

Can the Owner Financing Contract be transferred to another party?

This depends on the terms of the contract. Some contracts may allow for transfer or assignment, while others may require the seller's approval. It’s important to discuss this possibility with the seller before finalizing the agreement.

-

Is it necessary to involve a lawyer when creating an Owner Financing Contract?

While it is not legally required, it is highly recommended to involve a lawyer. A legal professional can ensure that the contract complies with local laws and protects the interests of both parties. This can help prevent misunderstandings or disputes in the future.

-

How does an Owner Financing Contract affect property taxes?

In most cases, the buyer is responsible for property taxes once the contract is signed. However, the specifics should be clearly defined in the contract. Sellers may want to ensure that the buyer understands their tax obligations to avoid any surprises.

-

Can an Owner Financing Contract be used for any type of property?

Yes, an Owner Financing Contract can be utilized for various types of properties, including residential homes, commercial properties, and land. However, the terms and conditions may vary based on the type of property and its market value.

PDF Characteristics

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer, allowing them to purchase property without a traditional mortgage. |

| Parties Involved | The contract typically involves two parties: the seller (owner) and the buyer (borrower). |

| Payment Structure | The contract outlines the payment terms, including down payment, interest rate, and repayment schedule. |

| Legal Considerations | Each state has specific laws governing owner financing. For example, in California, the California Civil Code applies. |

| Default Clauses | The contract includes clauses that outline what happens if the buyer defaults on payments. |

| Title Transfer | Title to the property may not transfer to the buyer until the contract is fully paid off, depending on the terms agreed upon. |

| Benefits | Owner financing can benefit buyers who may not qualify for traditional loans and sellers who want to attract more buyers. |