Blank Payroll Check Form

The Payroll Check form is a vital document that serves as a record of payment for employees, ensuring they receive their due compensation for work performed. This form typically includes essential information such as the employee's name, identification number, and the period for which the payment is being issued. Additionally, it outlines the gross pay, deductions, and net pay, providing a transparent breakdown of how the final amount was determined. Employers must ensure that the form is filled out accurately to comply with federal and state regulations, which govern payroll practices. Furthermore, the Payroll Check form often contains details regarding tax withholdings and benefits contributions, which can significantly impact an employee's take-home pay. Understanding the components of this form is crucial not only for employers who wish to maintain compliance but also for employees who need to verify that they are being compensated fairly and correctly. By paying attention to the intricacies of the Payroll Check form, both parties can foster a more transparent and trusting workplace environment.

More PDF Forms

Employer's Quarterly Federal Tax Return - Employers must reconcile their payroll records with the filed 941 to avoid discrepancies.

The Trailer Bill of Sale form is a legal document that transfers ownership of a trailer from one individual to another. This form ensures that all pertinent details of the transaction are documented, providing both parties with a record of the sale. To facilitate this process, you may want to use the Trailer Bill of Sale form, which can be essential for a smooth transfer process and for protecting your rights as a buyer or seller.

Trader Joe - Knowledgeable in food safety practices and committed to high standards.

Dos and Don'ts

When filling out the Payroll Check form, it’s important to be careful and accurate. Here’s a list of things you should and shouldn’t do:

- Do double-check all employee information for accuracy.

- Don't leave any required fields blank.

- Do use clear and legible handwriting or type the information.

- Don't forget to include the correct pay period dates.

- Do calculate the total amount carefully.

- Don't use white-out or any correction fluid on the form.

- Do sign the form where required.

- Don't submit the form without reviewing it first.

- Do keep a copy of the completed form for your records.

- Don't ignore any instructions provided with the form.

Following these guidelines will help ensure a smooth payroll process.

Payroll Check Sample

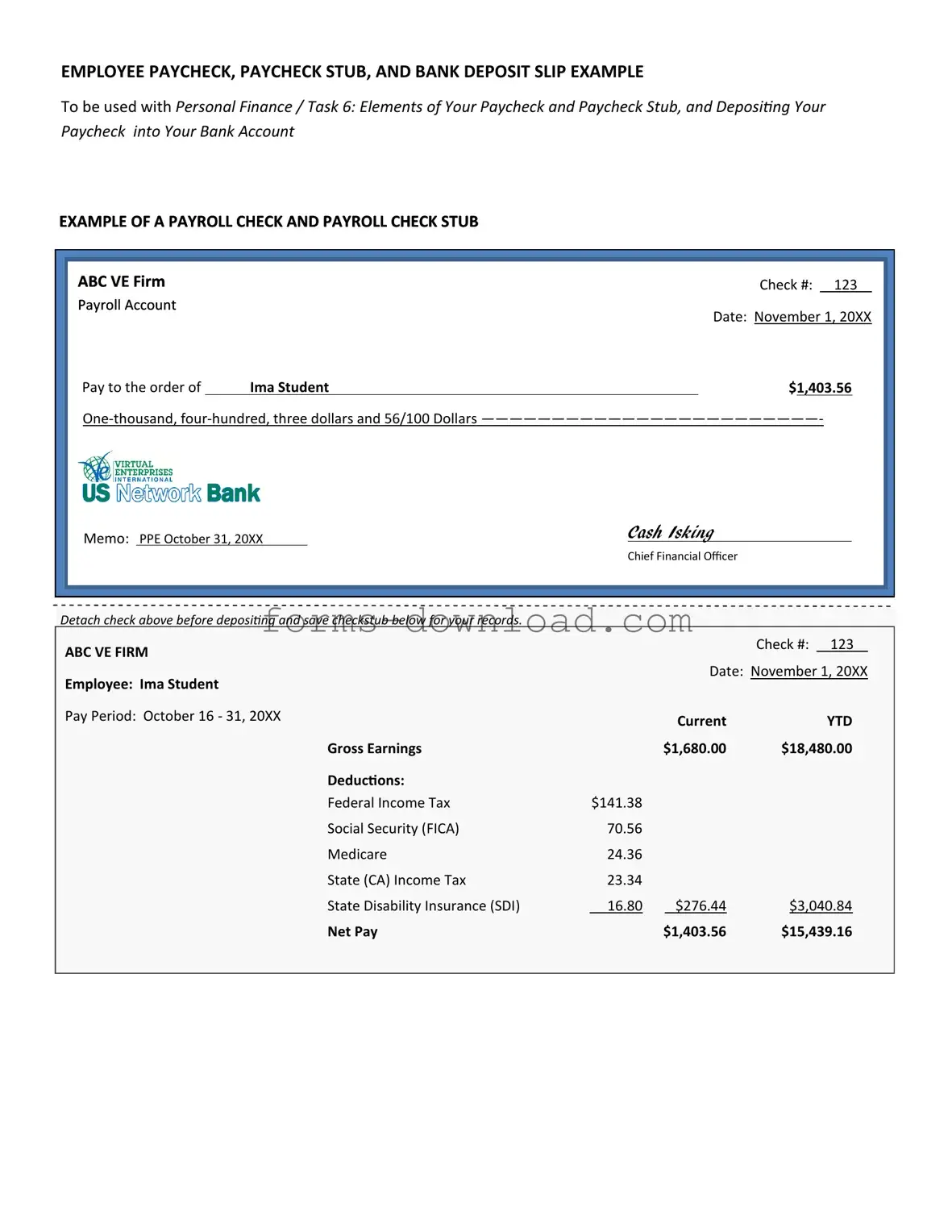

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

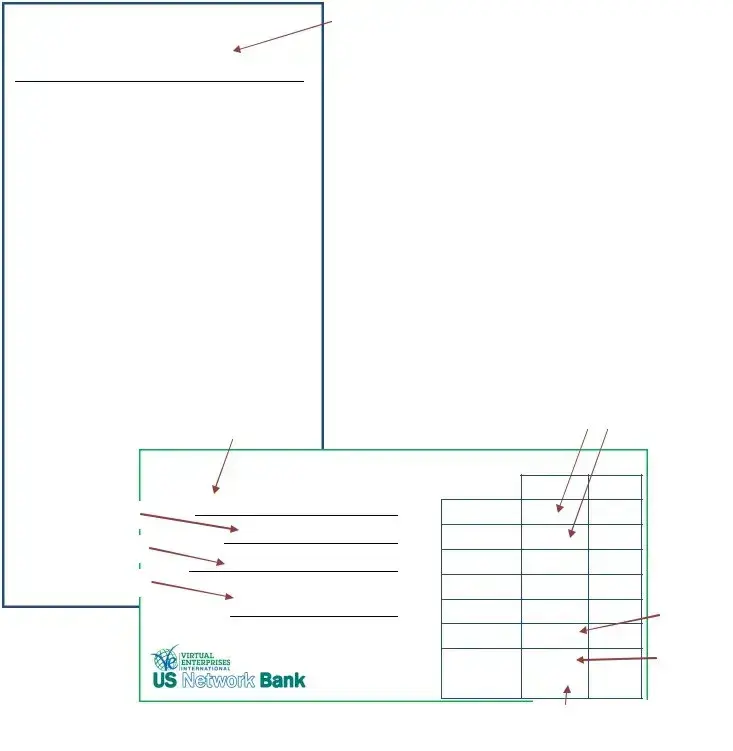

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Listed Questions and Answers

-

What is a Payroll Check form?

A Payroll Check form is a document used by employers to issue payments to employees for their work. It details the amount earned, deductions, and net pay. This form ensures that employees receive their wages accurately and on time.

-

Who needs to use a Payroll Check form?

Any business that pays employees needs to use a Payroll Check form. This includes small businesses, large corporations, and non-profits. It is essential for maintaining accurate records of employee compensation.

-

What information is required on a Payroll Check form?

The Payroll Check form typically requires the following information:

- Employee name

- Employee identification number

- Pay period dates

- Gross pay

- Deductions (taxes, benefits, etc.)

- Net pay

- Employer information

-

How often should Payroll Check forms be issued?

Payroll Check forms should be issued according to the company's payroll schedule. This could be weekly, bi-weekly, or monthly. Consistency in issuing checks helps employees manage their finances effectively.

-

Can Payroll Check forms be issued electronically?

Yes, Payroll Check forms can be issued electronically. Many companies use direct deposit, where funds are transferred directly to an employee's bank account. However, a physical or digital check may still be provided for record-keeping purposes.

-

What should I do if I notice an error on my Payroll Check form?

If you find an error, notify your employer or the payroll department immediately. They can correct the mistake and issue a new check if necessary. Prompt action helps avoid issues with your pay.

-

Are there any legal requirements for Payroll Check forms?

Yes, there are legal requirements that vary by state. Employers must comply with federal and state labor laws regarding minimum wage, overtime pay, and record-keeping. It is crucial to stay informed about these regulations to avoid penalties.

-

How long should Payroll Check forms be kept for record-keeping?

Employers should keep Payroll Check forms for at least three years. This period aligns with the IRS guidelines for tax records. Keeping accurate records protects both the employer and the employee in case of audits or disputes.

-

Can Payroll Check forms be customized?

Yes, Payroll Check forms can be customized to meet a company's needs. Employers may choose to add their logo, adjust the layout, or include additional information relevant to their business.

-

What should I do if I lose my Payroll Check?

If you lose your Payroll Check, report it to your employer or payroll department as soon as possible. They can stop payment on the lost check and issue a replacement. This helps prevent unauthorized access to your wages.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is used to issue payments to employees for their work, detailing the amount earned and deductions taken. |

| Components | The form typically includes the employee's name, pay period, gross pay, deductions, and net pay. |

| State-Specific Requirements | Some states have specific requirements for payroll checks, including the necessity to itemize deductions, as mandated by state labor laws. |

| Governing Laws | In California, for example, the California Labor Code Section 226 outlines the requirements for pay stubs, which include detailed information about deductions. |

| Frequency of Use | Payroll checks are typically issued on a regular basis, such as weekly, bi-weekly, or monthly, depending on company policy. |

| Importance of Accuracy | Accurate payroll checks are crucial for compliance with tax laws and for maintaining employee trust and satisfaction. |