Fillable Power of Attorney Form

When it comes to managing personal affairs, the Power of Attorney (POA) form emerges as a vital tool, granting someone the authority to act on your behalf in various matters. This legal document can be tailored to fit specific needs, whether it’s for financial decisions, healthcare choices, or real estate transactions. A durable Power of Attorney remains effective even if you become incapacitated, ensuring your wishes are honored when you cannot voice them. Alternatively, a limited Power of Attorney can be set up for a specific purpose, such as selling a property or handling a business deal, and it automatically expires once the task is completed. It’s essential to choose a trusted individual, often referred to as the agent or attorney-in-fact, who will uphold your interests. Understanding the implications of this form is crucial, as it involves significant responsibilities and can impact your life in profound ways. By taking the time to explore the nuances of the Power of Attorney, you empower yourself to make informed decisions about your future and the management of your affairs.

Power of AttorneyTemplates for Particular US States

Power of Attorney Subtypes

Popular Forms:

Affidavit of Affixture Form - Local title companies may request this affidavit during the closing process of a sale.

For those looking to navigate the intricacies of property transactions, a reliable resource is the Alabama bill of sale form guide, which provides a thorough understanding of the documentation required for a successful transfer. You can find more information by visiting the following link: Alabama bill of sale form guide.

U.S. Corporation Income Tax Return - C Corporations that are part of a consolidated group may need to file a separate consolidated Form 1120.

Child Travel Consent Form - It outlines important information about the child, including health conditions and emergency contacts.

Dos and Don'ts

When filling out a Power of Attorney form, it’s crucial to follow specific guidelines to ensure the document is valid and effective. Here are five things you should and shouldn’t do:

- Do: Clearly identify the principal and the agent. Make sure their names and addresses are accurate.

- Do: Specify the powers granted to the agent. Be explicit about what decisions they can make on your behalf.

- Do: Sign the document in the presence of a notary public, if required by your state.

- Do: Keep copies of the signed document for your records and provide copies to your agent.

- Do: Review the form periodically to ensure it still meets your needs.

- Don’t: Leave any sections blank. Incomplete forms can lead to confusion or invalidation.

- Don’t: Use vague language. Ambiguities can lead to disputes and misinterpretations.

- Don’t: Forget to date the document. An undated form may raise questions about its validity.

- Don’t: Assume all states have the same requirements. Verify your state’s specific rules.

- Don’t: Rush the process. Take your time to ensure everything is filled out correctly.

Power of Attorney Sample

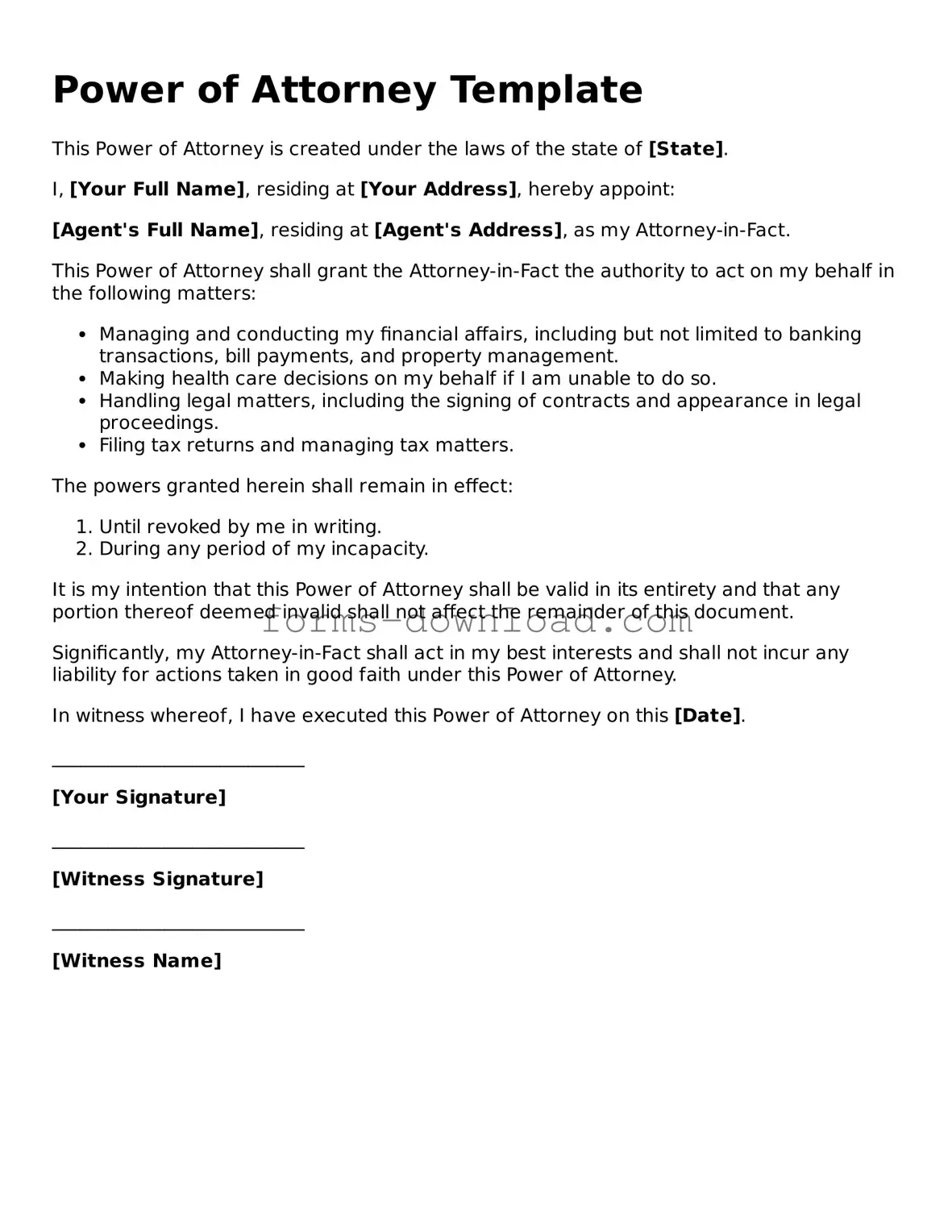

Power of Attorney Template

This Power of Attorney is created under the laws of the state of [State].

I, [Your Full Name], residing at [Your Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address], as my Attorney-in-Fact.

This Power of Attorney shall grant the Attorney-in-Fact the authority to act on my behalf in the following matters:

- Managing and conducting my financial affairs, including but not limited to banking transactions, bill payments, and property management.

- Making health care decisions on my behalf if I am unable to do so.

- Handling legal matters, including the signing of contracts and appearance in legal proceedings.

- Filing tax returns and managing tax matters.

The powers granted herein shall remain in effect:

- Until revoked by me in writing.

- During any period of my incapacity.

It is my intention that this Power of Attorney shall be valid in its entirety and that any portion thereof deemed invalid shall not affect the remainder of this document.

Significantly, my Attorney-in-Fact shall act in my best interests and shall not incur any liability for actions taken in good faith under this Power of Attorney.

In witness whereof, I have executed this Power of Attorney on this [Date].

___________________________

[Your Signature]

___________________________

[Witness Signature]

___________________________

[Witness Name]

Listed Questions and Answers

-

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person, known as the "principal," to appoint another person, known as the "agent" or "attorney-in-fact," to act on their behalf. This arrangement can cover a wide range of decisions, including financial matters, healthcare choices, or legal affairs. The principal retains the ability to revoke or modify the POA at any time, as long as they are mentally competent.

-

What are the different types of Power of Attorney?

There are several types of Power of Attorney, each serving different purposes:

- General Power of Attorney: This grants broad powers to the agent to manage the principal's affairs, including financial transactions and legal matters.

- Durable Power of Attorney: This remains effective even if the principal becomes incapacitated. It is often used for long-term planning.

- Medical Power of Attorney: This specifically allows the agent to make healthcare decisions on behalf of the principal if they are unable to do so.

- Limited Power of Attorney: This grants the agent authority to act only in specific situations or for a limited period of time.

-

How do I create a Power of Attorney?

Creating a Power of Attorney typically involves several steps. First, you should determine the type of POA that best suits your needs. Next, you will need to fill out the appropriate form, which can often be found online or obtained from a legal professional. After completing the form, it must be signed by the principal and, in many cases, witnessed or notarized to ensure its validity. It is advisable to keep copies of the document in a safe place and provide a copy to the agent.

-

Can I revoke a Power of Attorney?

Yes, a principal can revoke a Power of Attorney at any time, as long as they are mentally competent. To do this, the principal should create a written revocation document and notify the agent and any relevant institutions or individuals. It is also wise to destroy any copies of the original POA to prevent confusion.

-

What happens if the agent can no longer serve?

If the agent is unable or unwilling to fulfill their duties, the principal can appoint a new agent through a new Power of Attorney document. If the POA is durable and the principal becomes incapacitated, the authority may pass to a successor agent, if one was named in the original document. If no successor is named, a court may need to appoint a guardian to manage the principal's affairs.

-

Are there any risks associated with granting Power of Attorney?

Yes, there are potential risks involved in granting Power of Attorney. The principal must choose a trustworthy and reliable agent, as the agent will have significant control over financial and personal matters. Misuse of this power can lead to financial loss or other complications. It is crucial to have open communication with the agent and consider legal advice when drafting the document to ensure that the principal's interests are protected.

PDF Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types of POA | There are several types, including General, Limited, and Durable Power of Attorney, each serving different purposes. |

| Governing Laws | POA laws vary by state. For example, in California, the governing law is the California Probate Code. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated, unlike a standard POA. |

| Revocation | The principal can revoke a Power of Attorney at any time, as long as they are mentally competent to do so. |

| Execution Requirements | Most states require the POA to be signed by the principal and may also require witnesses or notarization. |

| Importance of Choosing Wisely | Selecting a trusted agent is crucial, as they will have significant control over the principal's affairs. |